Quantitative finance is a fascinating field that applies mathematical and statistical methods to understand and solve complex financial problems.

From pricing derivatives to managing risk and developing trading algorithms, quantitative finance plays a critical role in modern financial markets.

By delving into this field, you can gain valuable skills highly sought after by investment banks, hedge funds, and asset management companies.

Whether you aspire to become a quant, a financial analyst, or simply want to deepen your understanding of financial markets, a strong foundation in quantitative finance is essential.

Finding the perfect quantitative finance course on Udemy, however, can feel like navigating a complex financial model itself.

With a plethora of options available, it’s easy to get lost in the sea of courses and struggle to identify the one that best suits your needs and learning style.

You’re looking for a course that not only covers the theoretical foundations but also provides practical applications and hands-on experience with industry-standard tools.

After careful consideration and review, we believe the Financial Derivatives: A Quantitative Finance View course is the best overall choice on Udemy for mastering quantitative finance.

This comprehensive course provides a solid grounding in the core concepts of quantitative finance, with a specific focus on financial derivatives.

It blends theoretical knowledge with practical exercises, allowing you to apply your learning to real-world scenarios.

While Financial Derivatives: A Quantitative Finance View stands out as our top pick, Udemy offers a wealth of other excellent courses catering to various needs and skill levels.

Let’s explore some other noteworthy options that can help you embark on your quantitative finance journey.

Financial Derivatives: A Quantitative Finance View

This course equips you with a robust foundation in quantitative finance, focusing on financial derivatives.

You will start by mastering fundamental concepts like interest rates, the time value of money, and discounted cash flow analysis.

You will then delve into the concept of arbitrage, learning how to identify and capitalize on market inefficiencies to potentially generate risk-free profits.

The course then introduces various derivative instruments like forward contracts, futures contracts, and swaps, teaching you how to price them and utilize them for hedging against potential losses or speculating on future price movements.

The curriculum emphasizes a hands-on approach, allowing you to apply theoretical knowledge to real-world scenarios.

You will work extensively with Python tools, a cornerstone of modern quantitative finance, to build yield curves, analyze bonds, and gain insights from financial data.

This practical experience provides a solid framework for understanding how these complex financial instruments function and interact in the marketplace.

For example, you will learn how to construct a LIBOR curve, a benchmark interest rate used globally in financial markets.

The course also delves into the complexities of stochastic processes, essential for grasping the unpredictable nature of asset prices.

You will explore concepts like Brownian motion, random walks, and the intricacies of volatility clustering and fat-tailed distributions, gaining valuable insights into the challenges of financial modeling and risk management.

You will also master sophisticated concepts like the Black-Scholes formula, a key model used for option pricing, and delve into the practicalities of option Greeks, dynamic hedging strategies, and implied volatility.

Quantitative Finance & Algorithmic Trading in Python

This course equips you with the knowledge and practical skills to analyze financial markets and make informed investment decisions using Python.

You will begin by mastering the fundamentals of financial markets, including the intricacies of stocks, bonds, and currencies.

Building upon this foundation, you will explore the time value of money, a crucial concept for evaluating investment opportunities.

You will delve into the world of quantitative finance, exploring portfolio diversification and risk management through the Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM).

You will learn how to calculate expected returns, assess risks, and construct efficient portfolios.

The course then introduces derivatives, financial instruments used to manage risk and speculate on market movements.

You will become familiar with options, futures, forwards, and swaps, gaining valuable insights into their applications.

You will explore the concept of random market behavior, understanding how unexpected events influence asset prices.

The course covers essential tools like Wiener processes and stochastic calculus to model financial data.

You will learn about the Black-Scholes model, a cornerstone for pricing options, and explore its practical applications.

You will also gain hands-on experience with Monte Carlo simulations, a powerful technique for analyzing financial data and making predictions, and discover how to calculate Value at Risk (VaR) using this method.

Quantitative Finance with Python

This course begins with the fundamentals of financial markets, exploring different analysis methods and the concept of the Time Value of Money.

You delve into core concepts like the Capital Asset Pricing Model (CAPM) and Modern Portfolio Theory (MPT), learning how to value investments and manage risk.

You examine the Efficient Market Hypothesis and the Random Walk Theory to understand how asset prices behave.

You then explore technical analysis, learning to identify support and resistance levels on stock charts and recognize chart patterns.

You gain experience using indicators like the Moving Average and the Relative Strength Index (RSI) to make trading decisions.

You also study the Dow Theory to analyze market trends.

The course teaches you how to apply these concepts in Python, working with OHLC data, plotting candlestick charts, and calculating both Simple Moving Averages (SMA) and Exponential Moving Averages (EMA).

You further explore financial derivatives like Futures and Options, learning how they work and how to price them using models like the Black-Scholes model.

You learn about arbitrage trading, algorithmic trading, the Kelly Criterion, and the Sharpe Ratio.

The course culminates with the application of machine learning in finance.

You utilize algorithms like Linear Regression and LSTM networks to predict stock prices, studying practical examples like predicting Amazon and Apple stock prices.

You gain practical experience building and backtesting trading strategies based on these techniques.

Quantitative Finance with SAS

This course equips you with the ability to use SAS, a powerful tool for analyzing financial data, to confidently tackle real-world financial problems.

You will begin by mastering the installation and navigation of the SAS system.

This foundation will allow you to delve into statistical concepts like the T-Test, which compares different data sets, using practical, real-world examples.

You will then explore correlation, understanding how to interpret SAS output to analyze financial data.

The course then advances to regression modeling, a technique used to predict future trends.

You will learn how to create and interpret various regression models, applying these skills to real-world data sets like the BSE Sensex and Forex markets.

The course doesn’t stop at theory.

You will analyze real-world scenarios, including examples from the Indian auto industry, like the relationship between Maruti stock price and the Sensex, to understand how to analyze economic data and make informed financial decisions.

Algorithmic Trading & Time Series Analysis in Python and R

This course takes you on a journey from the basics to the complexities of algorithmic trading.

You start by setting up your workspace using industry-standard tools like PyCharm and RStudio.

You quickly delve into stock market fundamentals, familiarizing yourself with stocks, commodities, currencies, and concepts like short and long positions.

The course then introduces you to the world of technical indicators.

You’ll learn how to download data from Yahoo Finance, a popular platform for financial data, and use it to calculate indicators like SMA, EMA, and RSI.

You even discover how to use these indicators to build trading strategies and test their effectiveness using a framework called Backtrader.

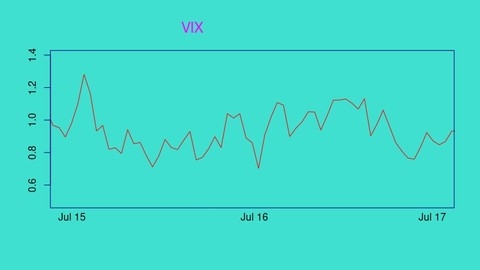

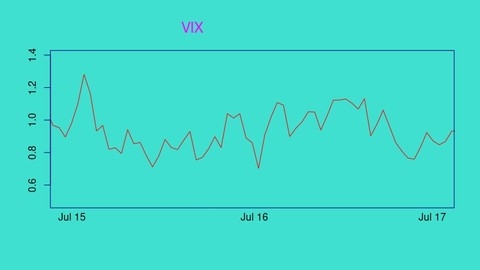

You then shift gears to time series analysis, a critical aspect of quantitative finance.

You explore concepts like stationarity and autocorrelation, and learn how to model financial data using different techniques, including the random walk model and more complex models like AR, MA, ARMA, ARIMA, ARCH, and GARCH.

You then apply these models to real-world trading strategies in both FOREX and the stock market.

The course doesn’t just focus on theoretical knowledge; you get hands-on experience implementing these strategies in Python.

Also check our posts on: