Accounting is the language of business, providing the framework for recording, analyzing, and interpreting financial transactions.

Understanding accounting principles is crucial for anyone involved in managing finances, whether it’s for personal budgeting, investing, or running a company.

By learning accounting, you gain the ability to interpret financial statements, make informed decisions based on financial data, and effectively communicate financial information to stakeholders.

Finding the right accounting course on Coursera can be overwhelming, with so many options available.

You’re looking for a program that’s comprehensive, engaging, and taught by experts, but also fits your learning style and goals.

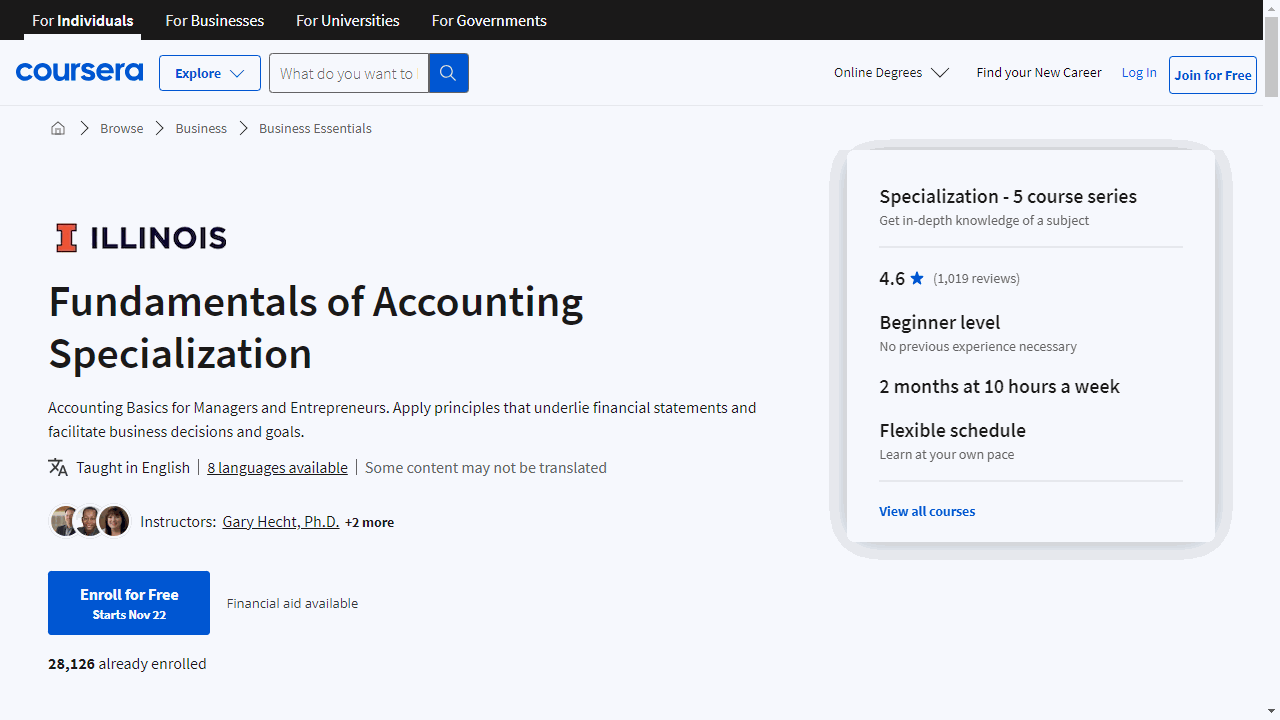

We recommend the Introduction to Finance and Accounting Specialization offered by the University of Pennsylvania’s Wharton School as the best accounting course on Coursera overall.

This specialization provides a robust foundation in both finance and accounting, covering key concepts like financial statements, financial ratios, and corporate finance.

It’s taught by experienced professors from a world-renowned business school, ensuring high-quality instruction and relevant content.

While this specialization is our top pick, we recognize that different learners have unique needs.

Keep reading to discover other top-rated accounting courses on Coursera, tailored to specific areas of accounting, learning levels, and career aspirations.

Introduction to Finance and Accounting Specialization

Starting with the “Fundamentals of Finance,” you’ll gain a solid foundation in corporate finance principles.

The course, inspired by the preparatory curriculum for Wharton MBA students, introduces you to key concepts such as Net Present Value (NPV) and the differences between annuities and perpetuities. You’ll also learn to apply these principles to evaluate investments and make strategic decisions for your firm.

Moving on to “Introduction to Corporate Finance,” this course expands on the basics by exploring practical applications.

You’ll delve into the time value of money, understand the risk-return tradeoff, and learn about the cost of capital. These concepts are not just theoretical; they’re essential for personal financial planning, corporate decision-making, and understanding financial markets.

If you are interested in the nuts and bolts of business, “Introduction to Financial Accounting” is invaluable.

It equips you with the skills to analyze financial statements and understand the impact of accounting standards and managerial incentives on financial reporting. By the end of this course, you’ll be adept at reading the three key financial statements and applying this knowledge to real-world scenarios.

The follow-up, “More Introduction to Financial Accounting,” builds on the previous course’s foundation.

It’s designed for those who have already grasped the basics and are ready to dive deeper into financial statement analysis. This course will enhance your ability to make informed decisions using the financial information provided by companies.

Each course in this specialization focuses on developing practical skills such as Discounted Cash Flow (DCF) analysis, decision-making in corporate finance, and a thorough understanding of accounting principles.

These skills are not just academic; they’re directly applicable to real-world situations, whether you’re managing personal investments or making corporate financial decisions.

You can’t go wrong with a specialization from University of Pennsylvania’s Wharton School, one of the world’s top business schools.

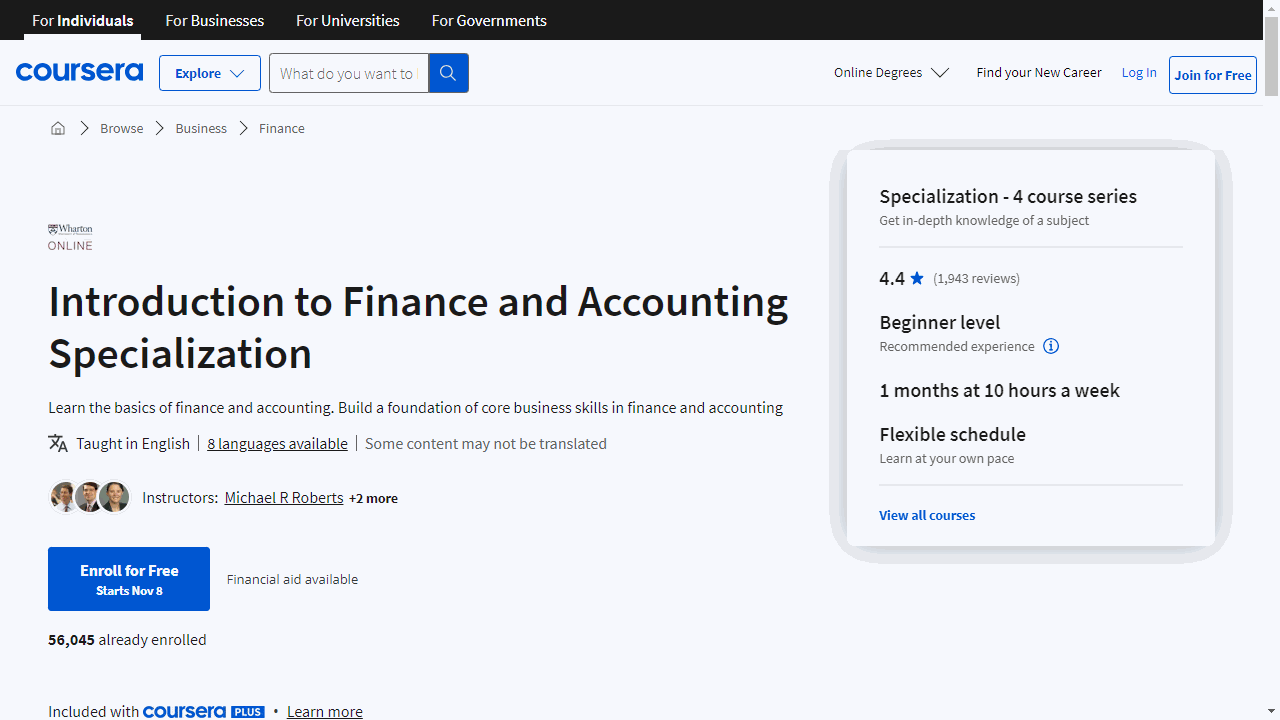

Fundamentals of Accounting Specialization

This series of courses is designed to equip you with a deep understanding of accounting principles and their practical application in the business world.

The journey begins with “Understanding Financial Statements: Company Position,” where you’ll delve into the balance sheet.

This course demystifies financial statements by breaking down the elements that show a company’s financial standing.

Real-world examples bring the concepts to life, making it easier for you to grasp the significance of each line item.

Building on that knowledge, “Understanding Financial Statements: Company Performance” focuses on the income statement.

This course helps you understand how a company’s performance is captured over time, teaching you to identify key components and their implications for the business’s financial health.

Moving into the operational side of things, “Accounting for Business Decision Making: Measurement and Operational Decisions” reveals how accounting information influences daily business choices.

You’ll learn how to create and use cost information for product development, pricing strategies, and profitability analysis, giving you a practical skill set for operational decision-making.

The fourth course, “Accounting for Business Decision Making: Strategy Assessment and Control,” shifts the focus to strategic planning and control.

Here, you’ll explore how accounting informs strategy development and implementation.

The course also covers various control mechanisms, including budgets and performance evaluations, to ensure that business decisions align with organizational goals.

The capstone project is the culmination of your learning experience.

It challenges you to apply the accounting concepts you’ve learned to a simulated business scenario, reinforcing your understanding and preparing you for real-world application.

If you are considering further education, these courses also serve as a stepping stone to the iMBA program offered by the University of Illinois, which is noted for its flexibility and affordability.

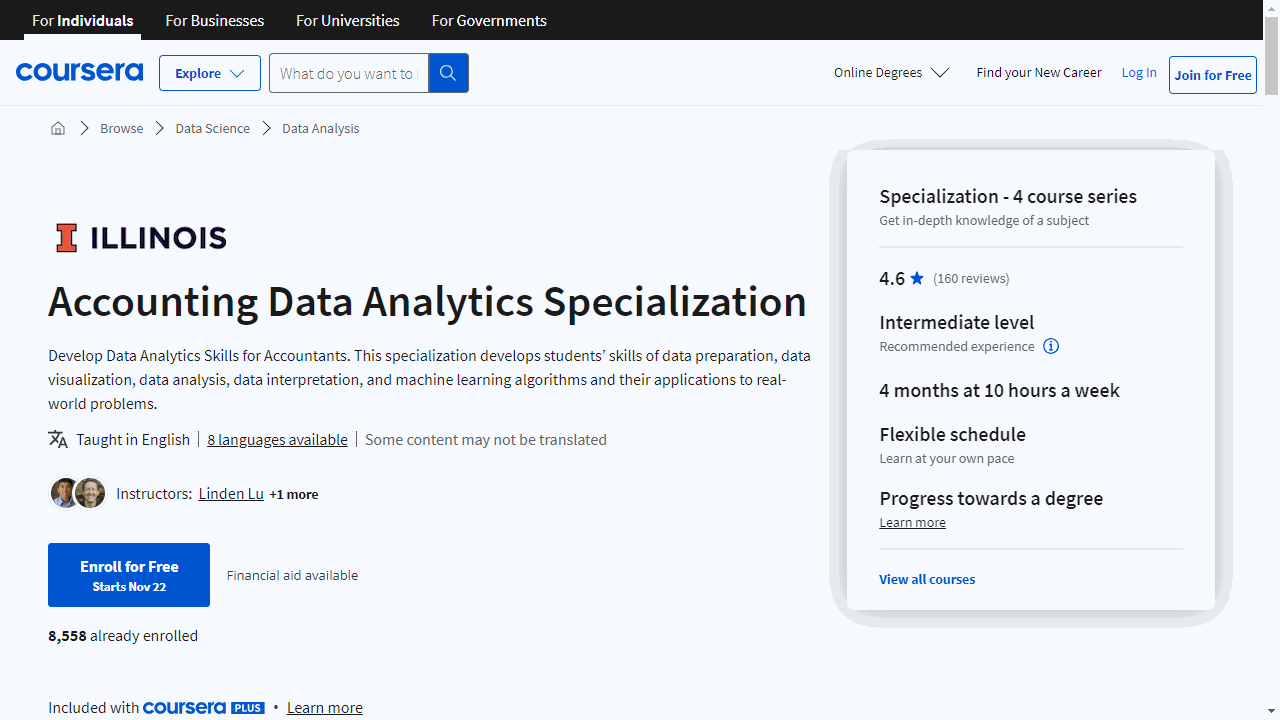

Accounting Data Analytics Specialization

If you are looking to stay relevant in the accounting profession, this Coursera specialization offers a comprehensive, hands-on approach to mastering data analytics.

The journey begins with “Introduction to Accounting Data Analytics and Visualization.”

This course isn’t just about learning to use tools; it’s about developing a mindset that marries accounting with analytics.

You’ll explore how big data analytics can streamline tasks across various accounting domains.

The course emphasizes practical skills, teaching you to use Excel and Tableau for impactful data visualization, and introduces programming with Visual Basic for Applications, setting a foundation for more advanced techniques.

Building on that foundation, “Accounting Data Analytics with Python” shifts your focus to Python, a versatile programming language essential for modern data analysis.

You’ll learn to navigate Jupyter Notebook, a platform that supports code writing and sharing.

The course guides you through data manipulation using Pandas and Numpy, and you’ll gain experience in running regression analyses and interfacing with SQL databases.

This isn’t just theory; you’ll be executing Python code to transform raw data into actionable insights.

Once you’re comfortable with data preparation and analysis, “Machine Learning for Accounting with Python” introduces you to the next frontier: machine learning.

This course is practical, focusing on applying machine learning models to accounting datasets.

You’ll explore various algorithms and learn to evaluate and refine your models for better accuracy.

It’s a hands-on approach to understanding how machine learning can uncover patterns and predictions within financial data.

The culmination of this specialization is the “Data Analytics in Accounting Capstone,” where theory meets practice.

You’ll tackle a real dataset, applying statistical analysis, data visualization, and machine learning to predict loan outcomes.

This capstone project simulates a professional scenario, challenging you to create a portfolio with the potential for higher returns than the benchmark.

Throughout these courses, you’ll acquire a suite of skills—predictive analytics, Python programming, machine learning, and data visualization—that are increasingly valuable in the accounting field.

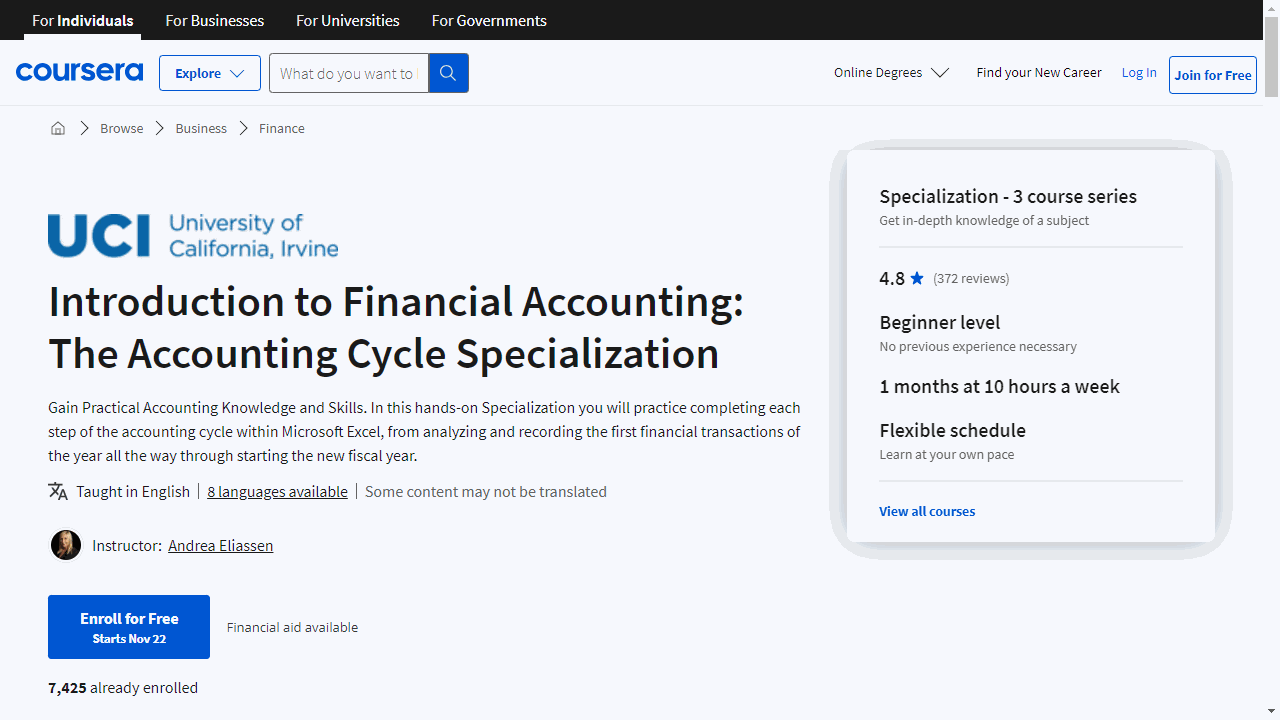

Introduction to Financial Accounting: The Accounting Cycle Specialization

This series of courses is designed to build your accounting skills from the ground up, with a clear and practical approach.

The journey begins with “What is Financial Accounting?”

This course lays the foundation, introducing you to the essentials of the field.

You’ll learn about the accounting equation, a fundamental concept that underpins all financial accounting.

The course also demystifies the four major financial statements, tools that reveal the financial health of a business.

Ethical considerations are addressed too, ensuring you understand the importance of integrity in financial reporting.

By the end, you’ll have a firm grasp of basic accounting principles and be comfortable with terms like ‘debit’ and ‘credit’.

Moving on to “Recording in Journals & Posting in Ledgers,” you’ll start putting theory into practice.

This course focuses on the recording phase of the accounting cycle, teaching you how to document business transactions accurately.

You’ll explore the differences between accrual and cash accounting, two methodologies that can impact financial outcomes.

The interactive activities in this course are designed to simulate real accounting challenges, providing you with valuable hands-on experience.

The final course, “Completing the Accounting Cycle,” ties everything together.

Here, you’ll learn the processes involved in closing out the accounting period.

You’ll become adept at making adjusting and closing entries, and you’ll understand how these entries affect the company’s retained earnings.

The course guides you through the creation of key financial statements and the post-closing trial balance, ensuring you’re ready to tackle the end-of-year accounts with confidence.

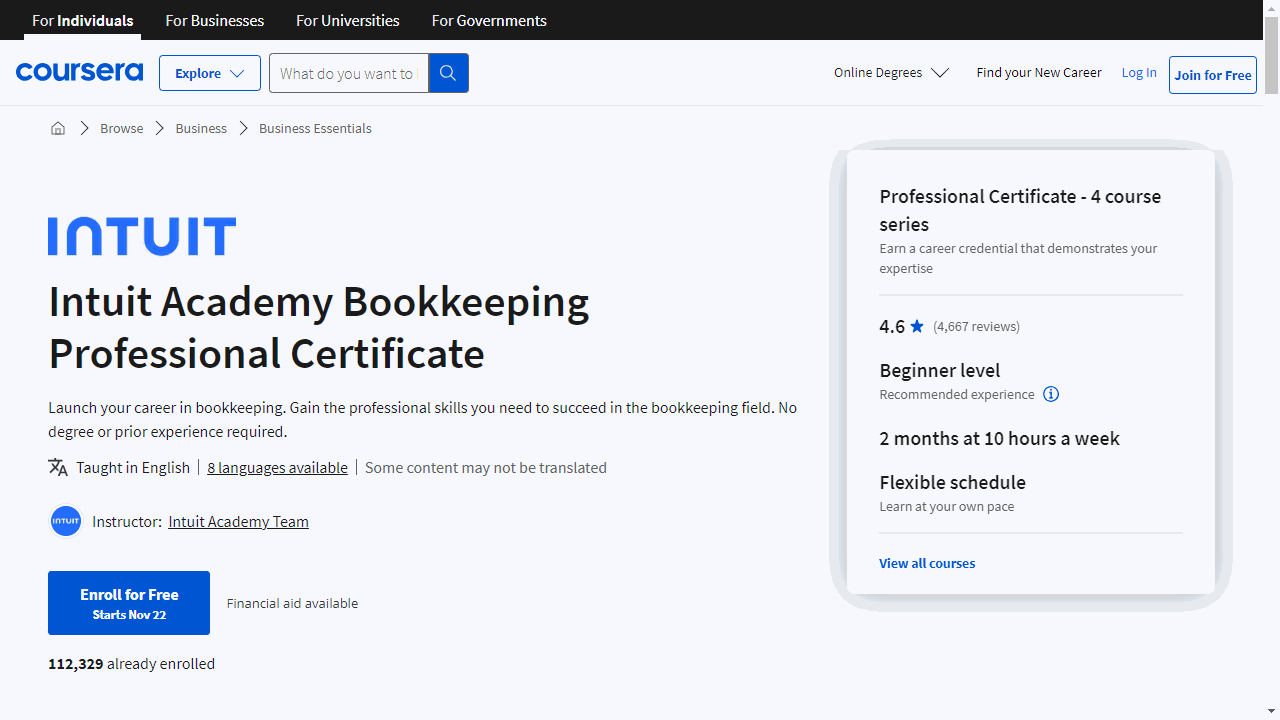

Intuit Academy Bookkeeping Professional Certificate

This series of courses is meticulously crafted to equip you with the essential skills needed for a career in bookkeeping using QuickBooks Online.

The journey begins with “Bookkeeping Basics,” a course that introduces you to the fundamentals without requiring any previous experience.

You’ll learn to navigate the accounting cycle, understand the role of a bookkeeper, and grasp the principles of double-entry bookkeeping.

This course lays the groundwork for your future expertise, emphasizing the importance of accuracy and ethics in financial reporting.

Moving forward, “Assets in Accounting” delves into the specifics of managing a business’s assets.

You’ll gain insights into inventory control, cost of goods sold, and the nuances of Property, Plant, and Equipment (PP&E) accounting.

This course ensures you’re not just memorizing concepts but also applying them to real-world scenarios, preparing you to handle more complex transactions with confidence.

As you progress to “Liabilities and Equity in Accounting,” the focus shifts to the other side of the balance sheet.

Here, you’ll explore various liabilities and understand how they shape a company’s financial landscape.

The course also covers equity, teaching you to accurately reflect changes in ownership.

It’s a critical step in mastering the balance between what a business owns and owes.

The final course, “Financial Statement Analysis,” is where your accumulated knowledge comes to fruition.

You’ll refine your ability to reconcile accounts, identify discrepancies, and employ analytical methods to interpret financial statements.

This course is about empowering you to make informed decisions based on quantitative analysis, a skill that’s invaluable in the business world.

Each course in the certificate builds upon the last, ensuring a seamless learning experience.

You’ll develop a robust set of skills, from creating financial statements to analyzing business health, all while becoming proficient with accounting software.

The curriculum is designed to be practical, providing you with the tools to apply your knowledge immediately.