Economics is a fascinating field that explores how societies allocate scarce resources to satisfy unlimited wants and needs.

Understanding economic principles can help you make better decisions in your personal life, your career, and even when engaging in discussions about public policy.

From understanding market forces to analyzing government interventions, a strong foundation in economics empowers you to navigate the complexities of the modern world.

Finding a comprehensive and engaging economics course can be a challenge, especially with the abundance of options available online.

You’re looking for a course that not only covers the core concepts but also provides real-world applications and insights from experienced instructors.

Ideally, the course should be accessible to learners of all backgrounds, regardless of their prior knowledge of economics.

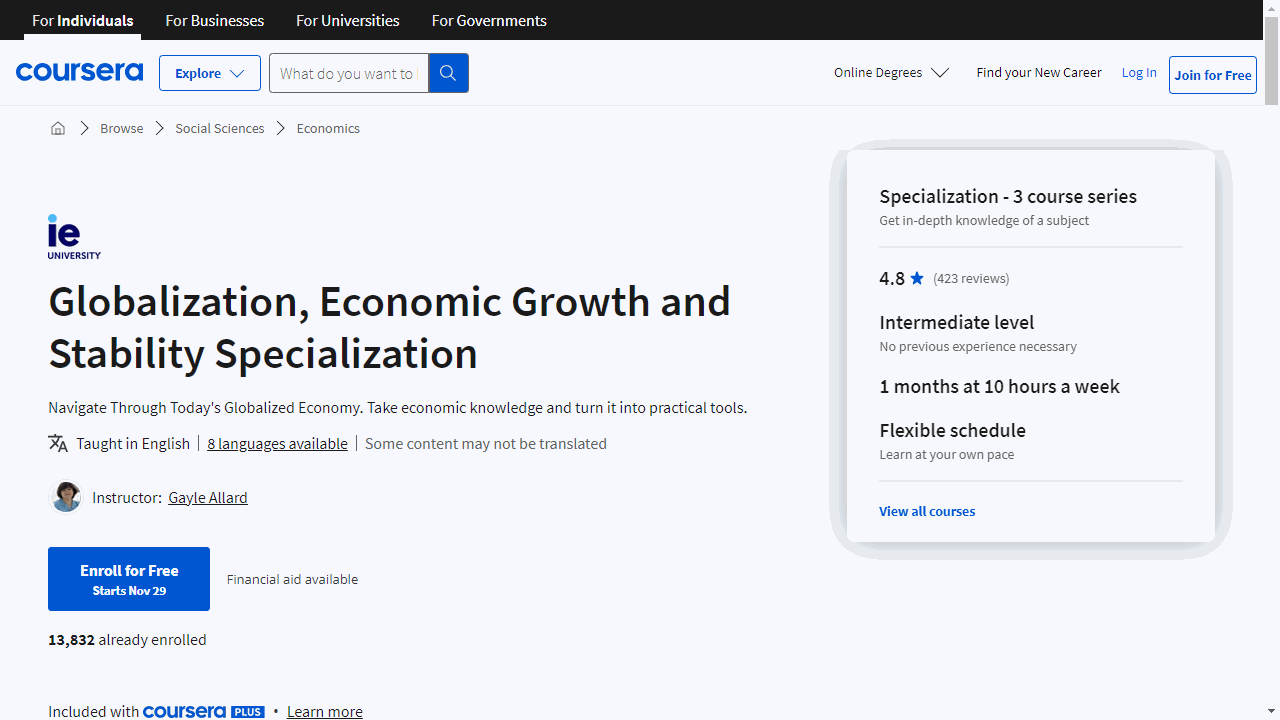

Based on our research, the Globalization, Economic Growth and Stability Specialization offered by IE Business School on Coursera stands out as the best economics course overall.

This specialization dives deep into the forces shaping the global economy, including globalization, economic growth, and stability.

You’ll learn how governments use policies to influence their economies, explore the impact of globalization on different countries, and gain practical skills in analyzing macroeconomic data.

However, this is just one of many excellent economics courses available online.

We’ve compiled a list of top-rated courses covering various aspects of economics, from microeconomics and macroeconomics to econometrics and behavioral economics.

Keep reading to discover the perfect course to expand your knowledge and unlock the power of economic thinking.

Globalization, Economic Growth and Stability Specialization

Provider: Coursera

This Specialization arms you with the skills to understand how governments use policies to influence their economies, going deep on national debt, deficits, and the differences between fiscal and monetary policy, allowing you to predict the effects of these policies on a country.

This knowledge helps you form your own informed opinions on current economic debates like fiscal stimulus versus austerity, quantitative easing, the impact of interest rates, and how to achieve economic growth.

You then explore how globalization impacts economies, learning about exchange rates, the realities of free trade, and the effects of protectionism on a country’s economy.

You’ll examine the balance of payments, understanding how economic transactions between a country and the rest of the world work.

You even dive into the complexities of immigration, uncovering its effects on host countries and examining current migration trends.

Finally, you’ll learn to analyze macroeconomic, institutional, and international data to understand the opportunities and risks present in the global economy.

You’ll use this data to analyze major economies like the United States, Japan, the European Union, China, and India, learning how to identify potential opportunities and risks for investors and businesses in each region.

Professor Gayle Allard guides you in this exploration, teaching you how to “read the story” of an economy from its data and providing practical insight into international economies, the benefits of trade and migration, and economic development.

Economics: Market Forces of Demand, Supply and Equilibrium

Provider: Udemy

This Udemy course on the market forces of demand, supply, and equilibrium teaches you the core principles of how markets work.

You start with the basics, like different market types and the role of competition in setting prices.

Then, you dive into demand, discovering how quantity demanded and the law of demand work.

You’ll learn to analyze demand curves and shifts, seeing how consumer income, preferences, and related goods’ prices affect buying decisions.

Real-world case studies, like how to reduce obesity or the impact of Chinese tourism, make these concepts stick.

Next, you tackle supply, learning about quantity supplied and the law of supply.

You’ll grasp how production costs, technology, and government regulations impact what producers sell.

For example, you’ll analyze how the pandemic affected flight tickets to China and explore the dynamics of shopping malls in Shanghai.

Finally, you’ll understand market equilibrium—where demand and supply meet.

You’ll learn about surplus and shortage and their impact on prices and quantities.

The course also covers price gouging, its ethics, and legal aspects.

You’ll then apply your knowledge to analyze real-world markets like bike-sharing in China or the US egg market.

You’ll analyze five diverse cases, such as the Indian bamboo crash barriers market or the impact of regenerative agriculture on the coffee market in Puerto Rico.

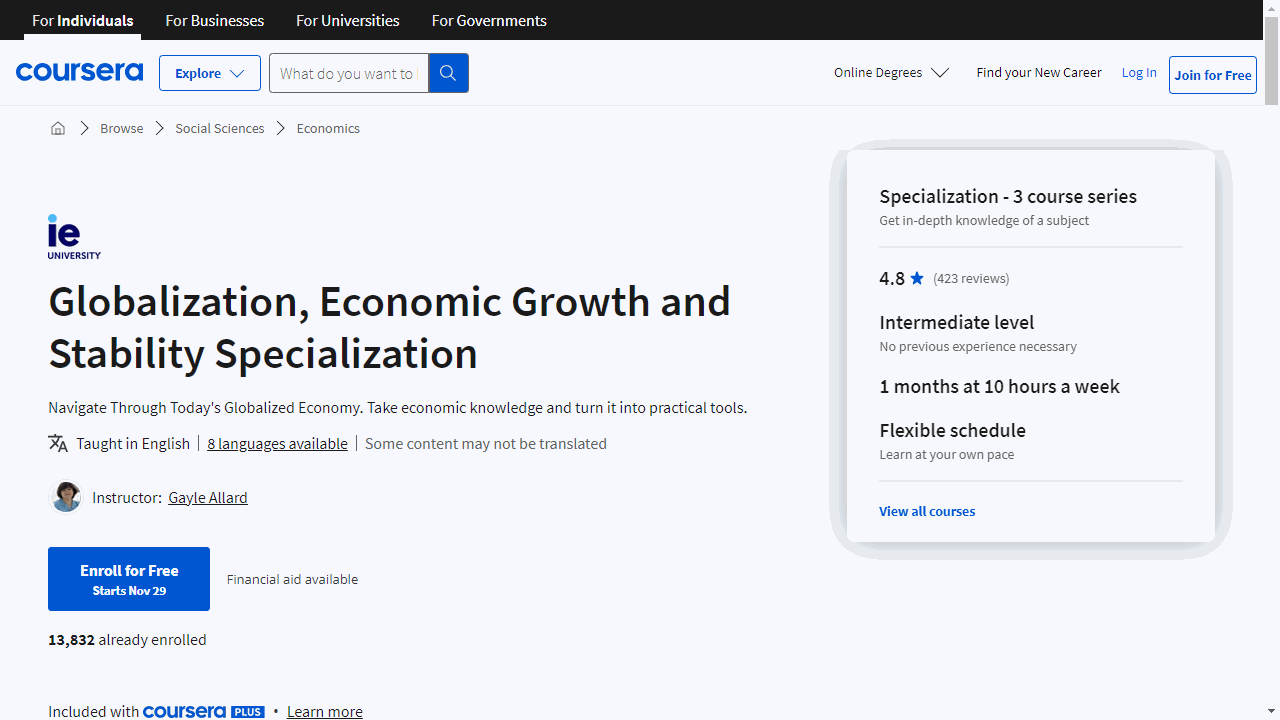

Managerial Economics and Business Analysis Specialization

Provider: Coursera

This specialization on Coursera provides a strong foundation in economics and its role in business.

You will explore fundamental concepts such as supply and demand, how markets function, and consumer behavior.

The courses delve into the various market structures, explaining how they influence resource allocation and how external factors like government regulations can impact market equilibrium.

You will develop a practical skillset in data analysis and statistical modeling alongside the economic theory.

You will master summarizing data, utilizing sampling techniques, and understanding statistical concepts like the normal distribution.

The specialization emphasizes using Microsoft Excel, allowing you to apply your newfound statistical analysis skills.

Furthermore, the courses explore more complex areas like inferential and predictive statistics, equipping you with the tools to evaluate business problems and make sound decisions in uncertain situations.

You will learn to test hypotheses, compare different populations, and utilize linear regression models for predictive purposes, gaining practical experience in applying these statistical tools through Excel exercises.

(Oxford) Master Diploma : Economics (Includes Macro/Micro)

Provider: Udemy

This Udemy economics course takes you beyond the basics.

You start with key economic concepts, including factors of production, opportunity costs, and production possibility curves.

The course then guides you through macroeconomic and microeconomic principles, covering inflation, unemployment, and economic growth.

You’ll also learn how government policies, like monetary and fiscal policies, affect the economy.

This course uses real-world situations to help you learn.

You will analyze current events, like the 2024 UK election, to understand how economic principles work in real life.

You’ll also learn about global economic trends, such as the impact of COVID-19 on different countries.

This course stands out because it focuses on current events.

You will analyze articles from The Times newspaper and learn how economic concepts apply to the real world.

The course also includes specific lectures on the economies of countries like Japan, Russia, and India, giving you deeper insights into their economic conditions and challenges.

By completing this course, you will have a strong understanding of economics and how it applies to real-world situations.

You will learn to analyze news articles, develop your perspectives on economic issues, and understand economic indicators and their importance in the global economy.

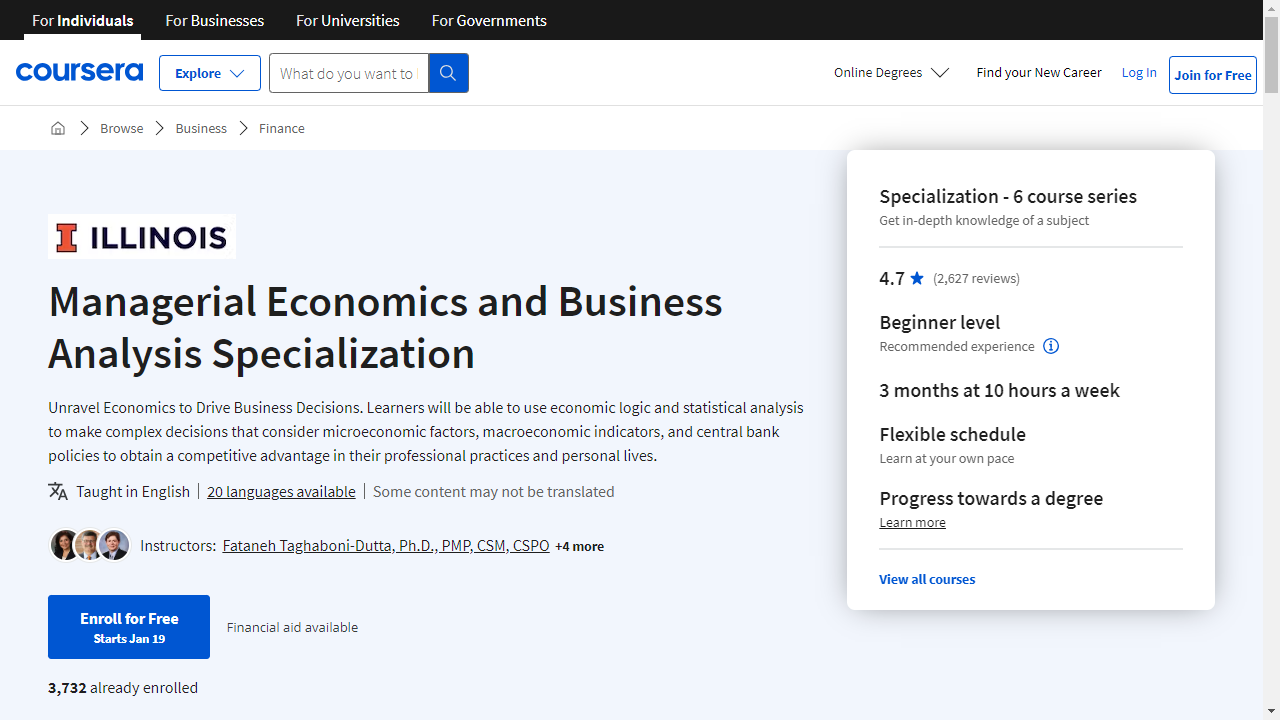

Introduction to Business Analytics and Information Economics Specialization

Provider: Coursera

This specialization teaches you how to use data to improve businesses.

You will learn how to use data analytics to predict what people will do, find and fix problems, and suggest the best solutions.

The first course, “Business Analytics Executive Overview,” introduces you to the world of data analytics.

You’ll see real-life examples of analytics in action and learn about important tools and techniques like data science and business intelligence.

Next, you’ll dive into “Infonomics” and discover how information itself is a valuable asset.

In “Infonomics I,” you’ll learn how to think of information as a resource, just like money or equipment.

You’ll discover its economic value and explore strategies for making the most of it using concepts from microeconomics.

You’ll also learn about different types of business analytics and how they can increase the value of your information.

“Infonomics II” takes this concept a step further, teaching you how to apply traditional asset management principles to the world of information.

You’ll grapple with the difficulties of information ownership and control in the digital age.

You’ll also learn how to determine the value of information and justify investments in data-related projects.

Macroeconomics: A Comprehensive Economics Course

Provider: Udemy

This macroeconomics course begins with foundational concepts like the circular flow of income model, which illustrates the movement of money within an economy.

You will develop a firm grasp of essential economic indicators such as GDP, GNP, and GDP per capita, learning how to differentiate between nominal and real GDP.

The course also delves into the concept of Green GDP, providing a comprehensive understanding of economic measurement.

The course guides you through the intricacies of aggregate demand and aggregate supply, revealing how these forces govern economic fluctuations.

You will discover how fiscal policy, monetary policy, and supply-side policies influence these macroeconomic factors and their effects on prices and output.

By exploring the short-run and long-run aggregate supply curves, you’ll gain insights into economic growth and its societal impact.

You will delve into the concept of macroeconomic equilibrium, where aggregate demand and supply intersect, and explore differing perspectives such as the Neoclassical and Keynesian schools of economic thought.

Through the lens of the labor market diagram, you will analyze various types of unemployment, including cyclical unemployment, and examine the factors that influence employment rates.

The course also equips you with strategies for reducing unemployment, including a discussion of the crowding-out effect.

The course examines inflation and deflation, exploring their causes and effects.

You will learn about demand-pull and cost-push inflation and how these forces can contribute to an inflationary spiral.

The curriculum explores how governments manage inflation through various policies.

You’ll also develop an understanding of economic growth drivers and their effects on poverty and inequality.

You’ll learn about government budgets, expansionary and contractionary fiscal policies, and how central banks leverage monetary policy tools, such as fractional banking and interest rate adjustments, to control the money supply.

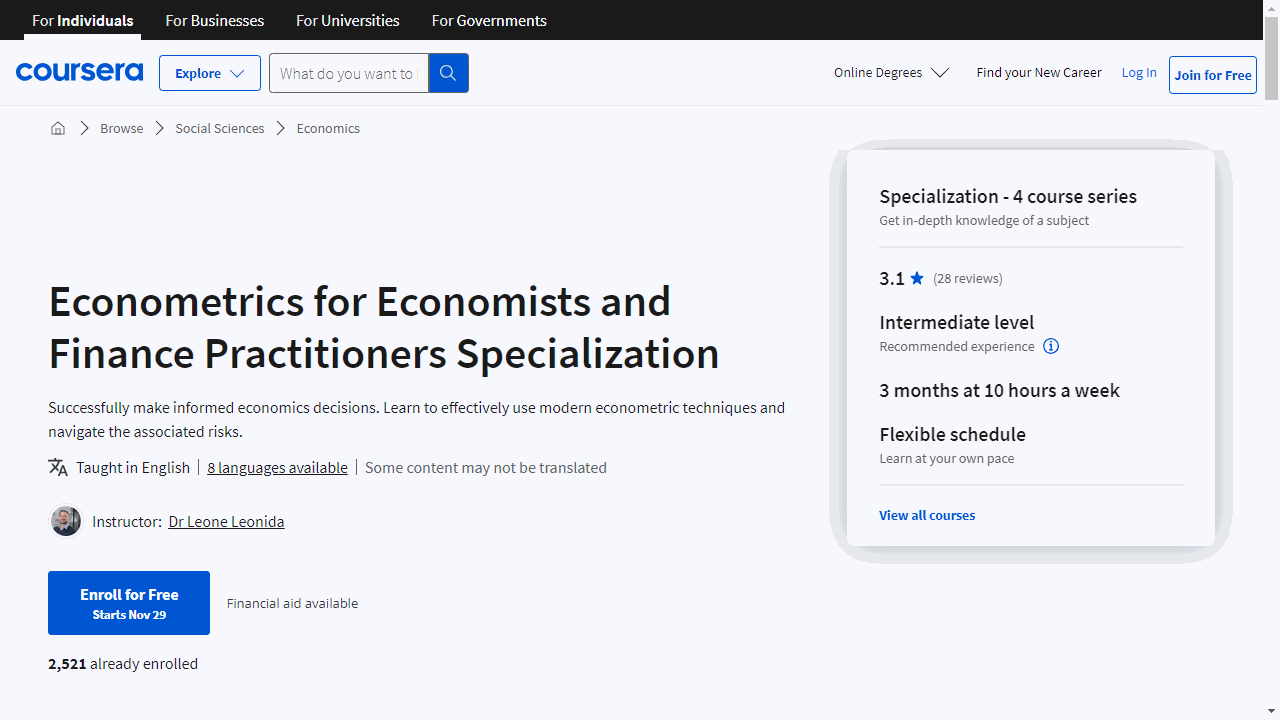

Econometrics for Economists and Finance Practitioners Specialization

Provider: Coursera

This specialization equips you with econometrics, a vital tool for economists and finance professionals.

You’ll start with the Classical Linear Regression Model (CLRM) and the Ordinary Least Squares (OLS) estimator, learning to use OLS for estimating parameters and analyzing goodness-of-fit statistics.

You will even get to practice using real data with the R programming language.

Next, you’ll delve into hypothesis testing, learning to formulate hypotheses and conduct tests using techniques like t-tests and F-tests.

You’ll master diagnostic testing to identify and address potential issues within your models.

The curriculum emphasizes the assumptions of the CLRM and how to ensure your model’s accuracy.

You’ll then explore applied econometrics, tackling challenges like causality and identification.

You’ll learn to work with panel data and utilize probability models to build systems like the Early Warning system for banking crises, using real-world data from institutions such as the World Bank.

Finally, you’ll immerse yourself in the econometrics of time series data, learning to identify patterns and make predictions.

You’ll grapple with concepts like stationarity and non-stationarity and explore models like ARCH and GARCH for volatility forecasting in financial markets.

This specialization culminates in a comprehensive understanding of time series data analysis and its practical applications.

Understanding Macroeconomics for University and Business

Provider: Udemy

This Udemy course equips you with a solid understanding of macroeconomics—the study of the economy as a whole.

You begin by exploring core economic indicators like GDP, inflation, and unemployment.

You quickly learn how these metrics measure economic health and then transition into the concept of macroeconomic equilibrium.

This involves understanding how factors like consumption, investment, and saving interact to determine overall economic activity.

You will also learn about the multiplier effect, which explains how changes in spending ripple through the economy.

The course then introduces government fiscal policy and its influence on the economy.

You uncover how government spending and taxation can either stimulate or curb economic growth.

The course delves into various fiscal policy tools, such as tax cuts and infrastructure spending, and illuminates their impact.

You then shift gears to the world of money and banking, where you’ll discover how banks generate money and how central banks wield monetary policy tools to manage the money supply.

You’ll see how interest rates and other tools influence economic activity.

Finally, you’ll explore the intricate relationship between aggregate output and the overall price level.

You’ll grasp how monetary and fiscal policies can influence both economic activity and inflation.

The course concludes by examining common macroeconomic problems, such as recessions, inflation, and stagflation.

You’ll learn their causes and how governments implement policies to address them.

Also check our posts on: