Economics is the study of how people make choices in the face of scarcity.

It’s a fascinating and complex field that can help you understand the world around you and make better decisions in your personal and professional life.

By learning economics, you can gain valuable insights into how markets work, how governments shape economic policies, and how individual choices affect the broader economy.

Finding the right economics course on Coursera can be a daunting task, with so many options available.

You’re looking for a program that’s comprehensive, engaging, and taught by experts, but also fits your learning style and goals.

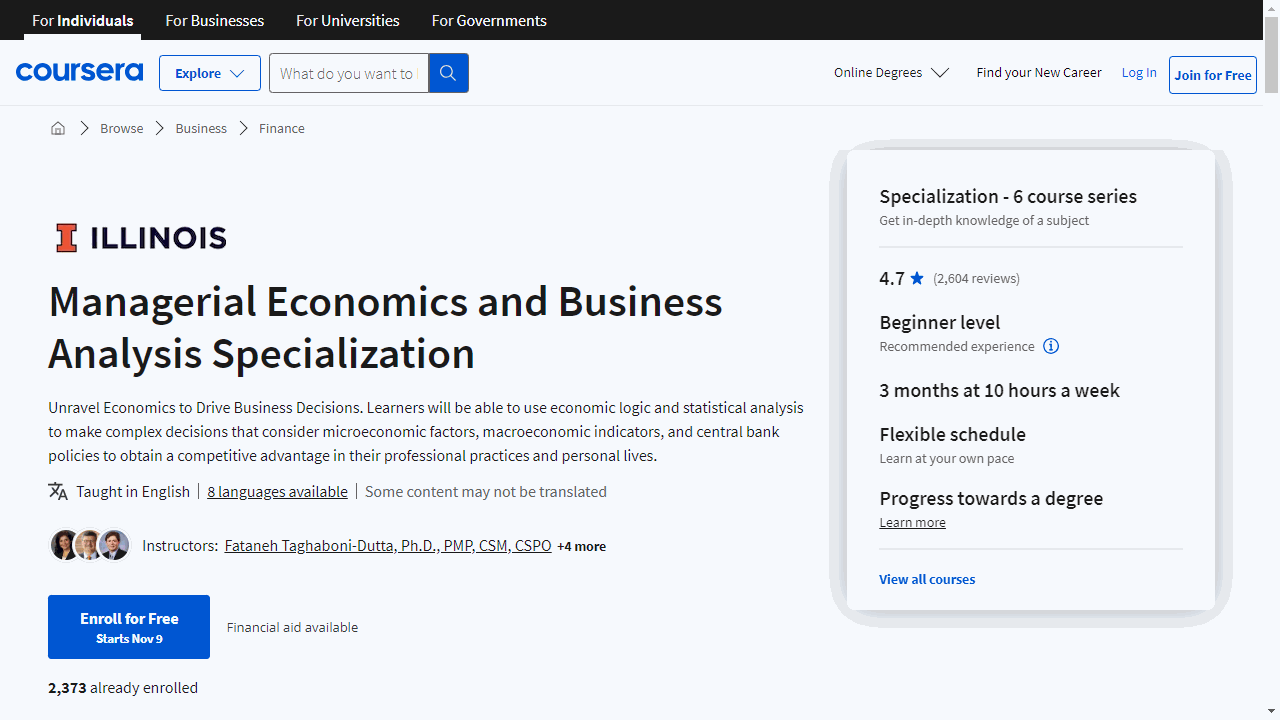

For the best economics course overall on Coursera, we recommend the Managerial Economics and Business Analysis Specialization by the University of Illinois.

This specialization offers a deep dive into the core principles of managerial economics, covering topics such as consumer and producer behavior, market structures, and cost analysis.

It also equips you with practical skills in data analysis using Excel, making it an ideal choice for anyone interested in applying economic principles to real-world business scenarios.

While this is our top pick, there are many other excellent economics courses available on Coursera.

Keep reading for our full list of recommendations, including courses on microeconomics, macroeconomics, game theory, and more.

We’ve got options for beginners, intermediate learners, and experts, so you can find the perfect course to help you master the world of economics.

Managerial Economics and Business Analysis Specialization

This specialization, offered by the esteemed Gies College of Business, equips you with the analytical tools necessary for astute business decision-making.

The course “Firm Level Economics: Consumer and Producer Behavior” delves into the intricacies of market dynamics.

You’ll gain a clear understanding of how prices influence consumer and producer choices, and how these interactions determine market equilibrium.

The concepts of demand elasticity and cost theory are broken down, providing you with a solid foundation to analyze business constraints and pricing strategies.

Moving on, “Firm Level Economics: Markets and Allocations” expands on market structures and the role of government intervention.

You’ll learn to model the effects of external shocks on markets and assess the efficiency of different economic systems.

This course also addresses market failures and the optimal government responses, enhancing your ability to navigate complex market conditions.

Data is the lifeblood of modern business, and “Exploring and Producing Data for Business Decision Making” teaches you to harness it effectively.

You’ll become proficient in summarizing and interpreting data, understanding the importance of sampling, and applying statistical concepts using Excel.

These skills are crucial for making informed business decisions in an uncertain world.

“Inferential and Predictive Statistics for Business” further develops your statistical acumen.

It focuses on hypothesis testing, comparing population metrics, and employing linear regression for forecasting.

The course emphasizes practical application, particularly through Excel, ensuring that you can apply these statistical methods directly to real-world business scenarios.

For those with an interest in finance, “Banking and Financial Institutions” offers a deep dive into the sector’s inner workings.

You’ll explore the structure of financial institutions, the services they offer, and the evolving landscape of financial regulation.

This course provides a conceptual framework to understand how financial innovations and regulations impact the economy.

Lastly, “Central Banks and Monetary Policy” demystifies the role of central banks in shaping economic policy.

You’ll grasp the relationships between interest rates, inflation, and unemployment, and learn to interpret how central bank decisions affect financial markets and the broader economy.

Each course in this specialization builds upon the last, culminating in a well-rounded understanding of managerial economics and business analysis.

The skills you acquire are not only theoretical but also practical, with a strong emphasis on real-world application, particularly through the use of Excel for data analysis.

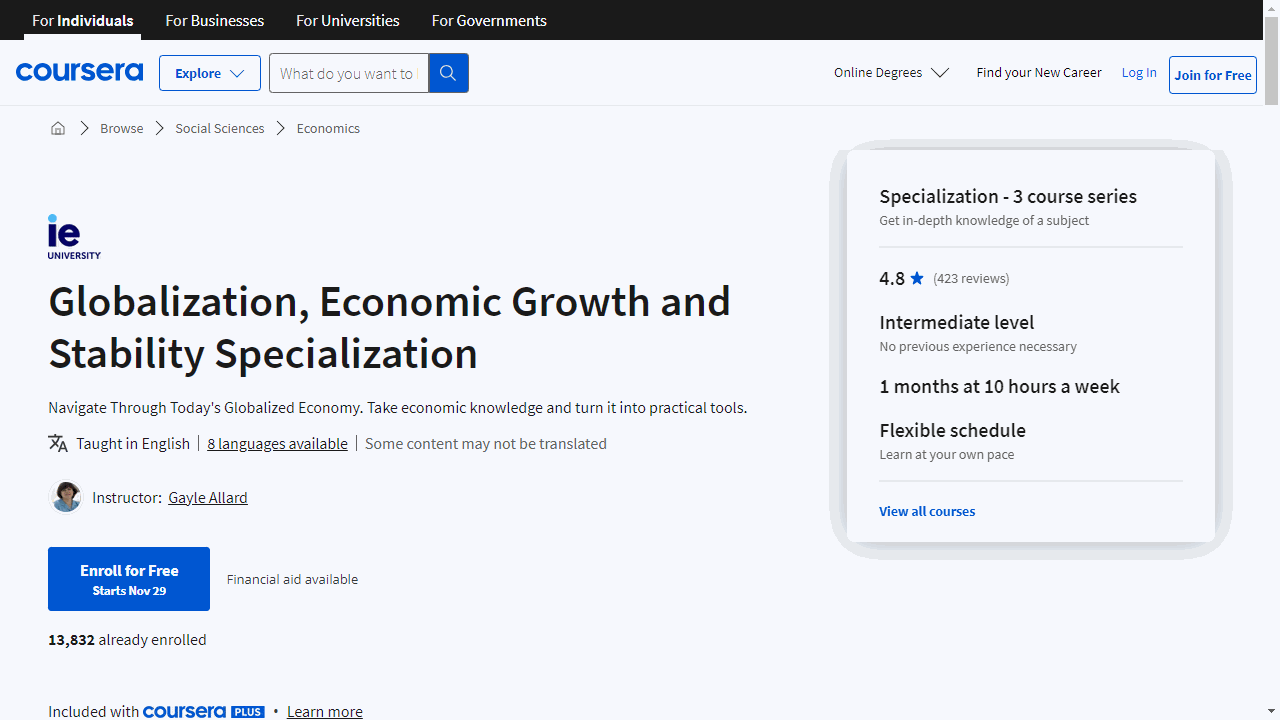

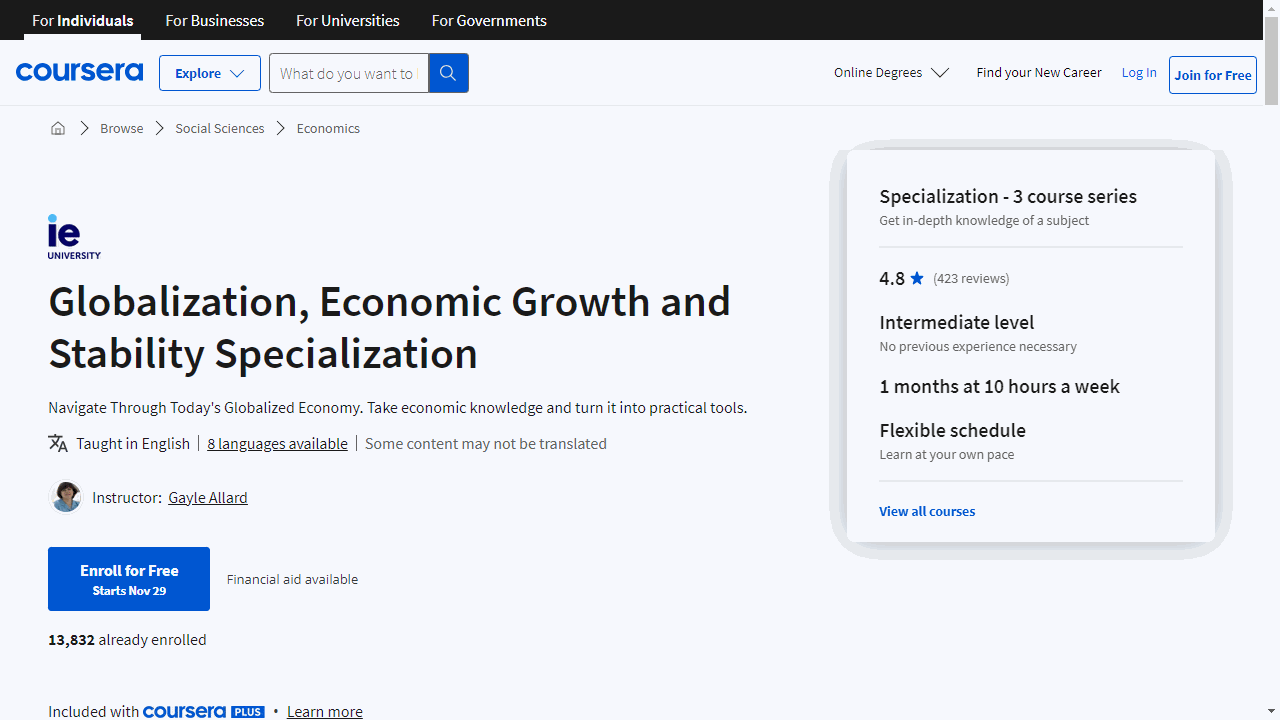

Globalization, Economic Growth and Stability Specialization

This specialization is a deep dive into the intricacies of economic policy, global trade, and market analysis, tailored to give you a comprehensive understanding of today’s economic landscape.

The first course, “Understanding Economic Policymaking,” equips you with the essentials of fiscal and monetary policy, debt, and deficits.

It’s a practical approach to deciphering the actions governments take to navigate economic challenges.

You’ll also engage in a simulation that puts you at the helm of a country’s economy, providing a dynamic learning experience.

Moving on, “Trade, Immigration and Exchange Rates in a Globalized World” tackles the complexities of international economics.

You’ll explore the mechanics of exchange rates and their profound impact on global trade.

The course demystifies the balance of payments and delves into the contentious issue of immigration, offering a balanced view of its effects on host countries.

The final course, “Business Opportunities and Risks in a Globalized Economy,” is a strategic guide for anyone interested in global markets.

Through analysis of real-world data from major economies, you’ll learn to identify potential investment opportunities and risks.

This course translates macroeconomic theory into actionable insights, focusing on the economic narratives of the United States, Japan, Europe, China, and India.

Each course is rich with practical skills, from understanding macroeconomic indicators to analyzing trade effects and currency valuation.

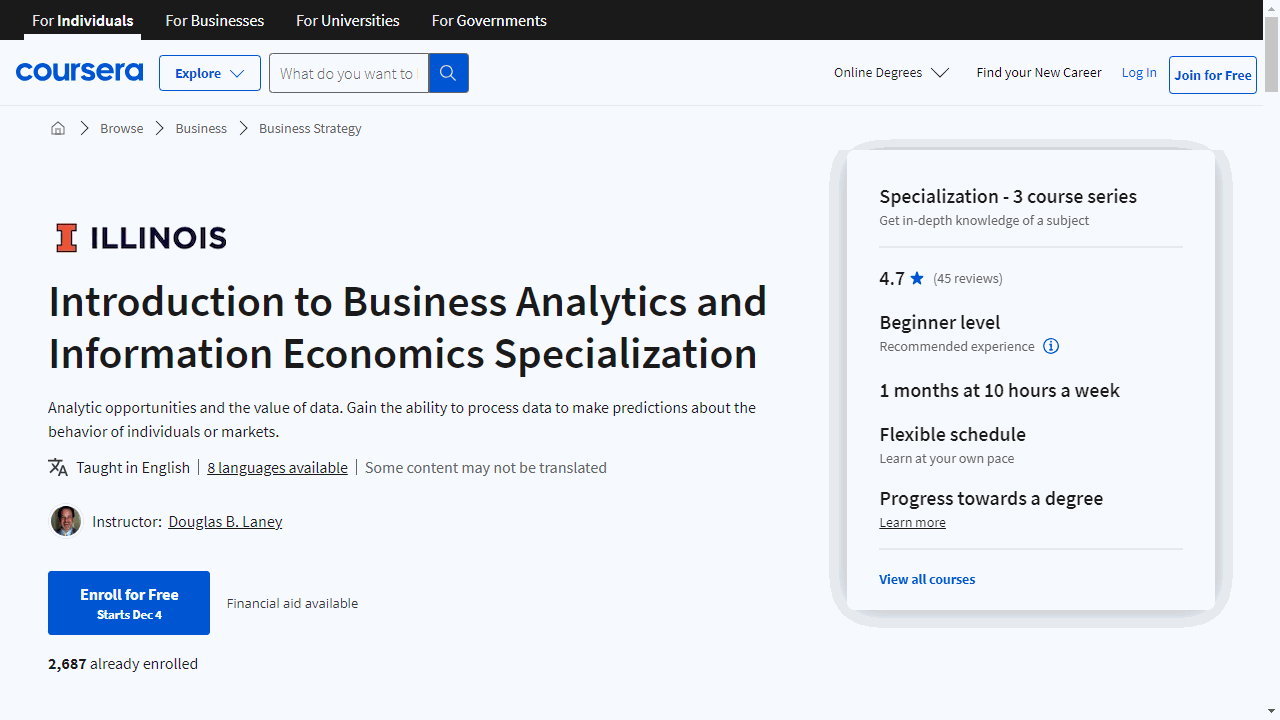

Introduction to Business Analytics and Information Economics Specialization

This specialization is a deep dive into the intersection of data, economics, and business strategy, equipping you with the tools to make data-driven decisions.

The “Business Analytics Executive Overview” course is your gateway to understanding analytics.

It’s not just about crunching numbers; it’s about interpreting data to make informed predictions and decisions.

You’ll explore a variety of real-world analytics problems and solutions, get acquainted with the latest technologies, and discuss future trends.

Moving on to “Infonomics I: Business Information Economics and Data Monetization,” this course challenges you to rethink the role of information in business.

You’ll learn to treat information as an economic asset, exploring its accounting, legal, and economic aspects.

The course guides you through innovative ways to monetize information, enhancing its value within your organization.

“Infonomics II: Business Information Management and Measurement” builds on these concepts, focusing on the management and valuation of information as an asset.

You’ll delve into asset management principles tailored to information, confront issues of ownership and control, and examine emerging organizational roles centered around information.

Throughout these courses, you’ll develop skills in accounting, big data, data analysis, and innovation.

You’ll emerge with a comprehensive understanding of how to manage and capitalize on information assets, positioning you to lead in the data-driven business landscape.

Econometrics for Economists and Finance Practitioners Specialization

Starting with “The Classical Linear Regression Model,” you’ll grasp the essentials of econometrics, learning to apply the OLS estimator and progressing from simple to multiple regression analyses.

The course simplifies complex concepts, making it accessible if you have a basic understanding of algebra and graphing.

Practical application is a key focus, with R software training to analyze real data, such as estimating the Capital Asset Pricing Model.

Building on that foundation, “Hypotheses Testing in Econometrics” introduces you to the statistical backbone of econometrics.

You’ll delve into hypothesis testing, understanding the rationale behind the OLS approach and mastering diagnostic tests.

This course assumes familiarity with basic statistics and the content from the preceding course, ensuring a seamless learning progression.

“Topics in Applied Econometrics” expands your toolkit, addressing specific challenges in econometric modeling.

You’ll navigate through parameter identification, panel data intricacies, and the nuances of qualitative variables.

The course culminates in applying these concepts to build an Early Warning system for banking crises, using World Bank data.

Lastly, “The Econometrics of Time Series Data” hones in on the unique aspects of time series analysis.

You’ll explore stationary and non-stationary processes, cointegration, and volatility forecasting, applying these techniques to real-world economic indicators like GDP growth.

This course is the capstone of the specialization, synthesizing all prior learning.

Each course is rich with practical skills, from data management to model estimation and validation, all through the lens of R software.

You’ll emerge with the ability to interpret models and leverage them for strategic decision-making.

A Story of Economics: A Principles Tale Specialization

This specialization, based on a Rice University course, is a comprehensive journey through the essentials of economics, tailored to equip you with practical knowledge and analytical skills.

It kicks off with “Principles of Economics: Introduction - Getting to Know You,” where you’ll delve into the core principles of micro and macroeconomics.

You’ll learn to navigate supply and demand, understand market dynamics, and evaluate the impact of government policies.

By the end of this course, you’ll be adept at interpreting economic indicators and making informed decisions.

Next, “Principles of Economics: Microeconomics - Down to Business” hones in on the mechanics of business economics.

It covers production costs, market structures, and consumer choices.

This course demystifies complex concepts with a touch of real-world application, ensuring you grasp the intricacies of economic competition and strategy.

Finally, “Principles of Economics: Macroeconomics - The Big Picture” broadens your perspective to national and international economics.

It addresses the indicators of economic health, the role of government in the economy, and the factors driving economic growth.

This course empowers you to analyze economic policies and their implications on a global scale.

Each course is enriched with engaging lectures, interactive quizzes, and practical problem sets.

For those looking to deepen their understanding, a companion book is available, providing an additional resource to complement your learning.

Microeconomics Principles

The Microeconomics Principles, by the University of Illinois at Urbana-Champaign, is a classic course that offers a deep dive into the economic forces shaping our daily lives.

From the get-go, this course is interactive.

You’ll engage with peers through discussions and social media, making learning dynamic and social.

It’s not just about theory; it’s about connecting with others and applying concepts to real-world scenarios.

The curriculum kicks off with foundational concepts like “Opportunity Costs” and the “Invisible Hand Principle,” revealing the trade-offs and unseen market forces that influence economic decisions.

You’ll quickly move beyond the basics to explore how markets operate, delving into the forces of demand and supply, and the resulting market equilibriums.

As you progress, the course demystifies complex ideas like “Consumer Surplus” and “Producer Surplus,” illustrating the hidden value in transactions.

Taxation’s impact on prices is also broken down, showing its real-world implications on everyday items.

A key part of the syllabus is “Elasticity,” a concept that explains consumer reactions to price changes.

This knowledge is crucial for understanding market dynamics and business strategies.

Speaking of strategies, you’ll examine various market structures, including those where companies wield significant pricing power.

In the final modules, the course tackles public economics, discussing “Public Goods,” “Externalities,” and the challenges they present, such as the “Tragedy of the Commons.”

Through interactive games and case studies, you’ll explore potential solutions to these complex issues.

By the end of this course, you’ll have a comprehensive understanding of microeconomic principles and the analytical tools to examine economic phenomena critically.

This isn’t just an academic exercise; it’s practical knowledge that empowers you to make informed decisions in both personal finance and business contexts.

Managerial Economics: Buyer and Seller Behavior

If you’re keen on analyzing market behavior and applying economic principles to real-world scenarios, this course offers a deep dive into the essentials of economics, equipping you with the tools to make informed managerial decisions.

From the get-go, the instructor sets the stage with a clear overview, ensuring you’re well-prepared for the journey ahead.

Module 1 introduces you to the Prisoner’s Dilemma through an interactive video, offering a real-world glimpse into market dynamics.

You’ll explore the Adamantium industry, a fictional yet effective context for understanding cost structures and market forces.

The module wraps up with a case study on consumer and producer surplus, cementing your knowledge through practical application.

In Module 2, the focus shifts to supply curves and the mechanics of profit.

You’ll learn how firms determine supply and pricing, and you’ll gain hands-on experience using Excel to chart market supply curves—a valuable skill for any aspiring economist.

The Adamantium case study continues, illustrating the tangible impact of economic profit on business strategies.

Module 3 delves into the long-term perspective, examining the long-run supply curve and its implications for firms and markets.

Real-world examples from the real estate and oil industries bring these concepts to life, helping you interpret market price paths and understand market equilibrium.

Each module concludes with a summative assessment, challenging you to apply your knowledge.

The course culminates in a comprehensive assessment, solidifying your understanding of managerial economics.

Business Economics and Game Theory for Decision Making

Starting with elasticity, the course breaks down how price changes influence demand and profitability.

You’ll work through real-world scenarios and linear demand curves to understand the concepts deeply.

Quizzes reinforce your learning, ensuring you can apply these principles effectively.

The course then navigates the complexities of economic efficiency and government intervention.

You’ll examine case studies that illustrate the unintended consequences of policies like price ceilings and delve into the nuances of externalities.

This module is crucial for understanding the broader economic environment in which businesses operate.

Market power is another critical focus.

Through detailed examples, including a case study on H&M, you’ll learn how companies establish prices and maintain competitive advantages.

The course also covers the ethical boundaries of business strategies, touching on collusion and antitrust policies.

In the final modules, game theory takes center stage.

You’ll explore strategic decision-making in various market conditions, from auctions to oligopolistic competition.

The course demystifies complex concepts like adverse selection, preparing you to anticipate and counteract potential challenges in the marketplace.

By the end of the course, after a comprehensive assessment, you’ll have a robust understanding of business economics and game theory.

Economics of Money and Banking

This course, by Columbia University, goes beyond the textbook, offering a deep dive into the roles and functions of banks, shadow banks, and central banks, setting the stage for a comprehensive understanding of the financial hierarchy.

Real-world relevance is a cornerstone of this curriculum.

You’ll engage with current events through Financial Times articles, connecting economic theories to the pulse of global finance.

Topics like the Eurocrisis and quantitative easing aren’t just discussed; they’re dissected and related to today’s economic climate.

The course is meticulously structured, guiding you from the fundamentals of the national banking system to the intricacies of the Federal Reserve’s operations.

As you progress, the material builds on itself, ensuring a robust grasp of each concept before moving on to more complex topics.

Payment systems, a critical yet often overlooked component of finance, are thoroughly examined.

You’ll gain insight into the mechanics of Fed Funds, the repo market, and the Eurodollar market, illuminating the pathways through which money travels across borders.

The international dimension is a key feature, broadening your perspective with discussions on the gold standard, currency internationalization, and the evolving landscape of global finance.

The course also confronts the challenges of financial stability, drawing on the wisdom of economic thinkers like Hyman Minsky and John Hicks.

As the financial world evolves, so does the course content, delving into the transition from traditional banking to the burgeoning realm of shadow banking.

This is essential for understanding the current and future state of financial markets.

Supporting materials, including downloadable lecture notes, ensure that you can review and solidify your understanding at your own pace.

Politics and Economics of International Energy

Starting with a solid introduction, you’ll examine global energy consumption and learn to interpret energy scenarios, leveraging insights from the World Energy Outlook.

Interviews with industry experts like Tim Gould from the IEA and Professor Manfred Hafner provide real-world perspectives that enrich your learning experience.

The course tackles the critical issue of energy transition, linking it to environmental challenges, energy security, and poverty.

You’ll engage with case studies from BP and Shell and dissect the COP21 Paris Agreement, gaining a practical understanding of energy policies.

You’ll participate in interactive group events, discussing market-based and administrative approaches to energy policy, including ETS and carbon taxes.

Insights from professionals like Barbara Mariani and Samantha Mcculloch bring these concepts to life.

As you progress, you’ll explore the complexities of international initiatives such as the Kyoto Protocol and the Paris Agreement, understanding their role in global climate efforts.

The course also addresses the impact of coal and the interplay between multilateralism and domestic politics.

Renewable energy is covered extensively, with a focus on hydro, wind, solar, and battery storage.

You’ll examine the challenges of integrating these intermittent energy sources into existing systems, informed by IRENA’s innovation landscape.

Energy efficiency is another key topic, with a look at its application in buildings and transportation, including the rise of electric vehicles.

The traditional energy sector is also featured, with comprehensive content on oil and natural gas, from their geological origins to the geopolitical forces that influence their markets.

Nuclear energy is scrutinized post-Fukushima, with expert input from Professor Bertrand Barré, offering a balanced view of its role and future.

In the concluding weeks, the course addresses energy security, exploring how supply disruptions and cross-border electricity security affect the global landscape.

You’ll also confront energy poverty and the complexities of energy pricing.

By the end of this course, you’ll have a nuanced understanding of the political and economic factors shaping the international energy sector, equipped to engage in informed discussions and make strategic decisions.

Country Level Economics: Macroeconomic Variables and Markets

This course is a thorough, yet accessible journey through the economic indicators that shape national policies and influence global markets.

Dive into the world of macroeconomic indicators, starting with the essentials like unemployment rates and GDP.

You’ll not only grasp their definitions but also master the intricacies of their measurement.

This foundational knowledge is crucial for anyone interested in the economic health of nations.

The course then guides you through the components of GDP, revealing the roles of government and international trade.

The balance of payments section further clarifies how countries interact economically on a global stage.

In Module 3, the focus shifts to the foreign exchange market.

You’ll unravel the significance of exchange rates and their impact on a country’s competitive edge.

The exploration of spot and forward markets equips you with a forward-looking perspective on currency values.

Money’s role in the economy is demystified in the final module, where you’ll learn about money supply and demand, and the equilibrium in money markets.

The connection between money, inflation, and interest rates is made clear, providing a comprehensive view of monetary policy.

Peer review assignments throughout the course enhance your learning experience, allowing for practical application and a deeper understanding of the material.

Country Level Economics: Policies, Institutions, and Macroeconomic Performance

This course from Gies College of Business offers a comprehensive look at the economic forces shaping nations, diving into consumption, investment, and trade.

You’ll start by understanding the factors influencing spending and investment decisions, essential for grasping the broader economic picture.

The course then guides you through the equilibrium of national income and the role of interest rates, providing a solid foundation in economic equilibrium concepts.

As you progress, you’ll tackle the impact of fiscal and monetary policies on short-term economic performance.

You’ll learn how governments respond to economic fluctuations and the effects of price level changes, equipping you with the knowledge to analyze policy decisions critically.

The long-term perspective isn’t neglected either.

You’ll explore what drives long-term economic growth, including resources, technology, and institutions.

The course also contrasts short-term and long-term economic outcomes, offering insights into stabilization policies in response to demand and supply shocks.

In the final module, you’ll delve into the formulation of sound monetary and fiscal policies and the influence of political processes on economic decision-making.

You’ll examine how countries can commit to effective economic strategies, rounding out your understanding of macroeconomic policy-making.

Interactive discussions, peer reviews, and targeted readings enhance the learning experience, ensuring you can apply concepts to real-world scenarios, such as analyzing the US economy.

Firm Level Economics: Consumer and Producer Behavior

This course, offered by Gies College of Business, starts with the fundamentals of scarcity and opportunity costs, setting the stage for a deeper understanding of economic principles.

You’ll delve into the mechanics of demand and supply curves, learning to distinguish between movements along the curves and shifts that can alter market equilibrium.

This knowledge is vital for grasping how prices fluctuate and affect consumer behavior.

Real-world applications are a strong focus, with lessons on government market interventions, such as price controls and excise taxes.

You’ll gain insight into the rationale behind these policies and their impact on everyday prices, like those at the gas pump.

Elasticity is another key concept covered, revealing how demand can vary with price changes.

This section will clarify why certain goods see a surge in demand even as their prices increase.

On the production side, the course breaks down firm behavior, types of firms, and the law of diminishing marginal returns.

Understanding these concepts is crucial for analyzing business strategies and production costs.

Cost curves are thoroughly examined, teaching you to derive and interpret short-run cost curves and understand their implications for business decisions, including profit maximization and shutdown conditions.

Interactive elements like discussion forums and a peer review assignment enrich the learning experience, allowing you to engage with peers and apply your newfound knowledge.

Agriculture, Economics and Nature

This course offers a comprehensive look at the intersection of agriculture and economics, and its impact on the environment.

You’ll start with an engaging introduction to the course, followed by a historical overview of agricultural production and pricing.

Understanding these foundations is crucial for grasping the complexities of the global food system.

The course then delves into supply and demand dynamics of agricultural products, providing clarity on price fluctuations and their broader implications.

The 2007 food price crisis and its significance for global food security are examined in detail, offering valuable insights into the challenges of feeding a growing population.

Resource management is a key theme, with dedicated videos on the use of land, water, nutrients, and pesticides.

These sessions are enriched by expert interviews, including insights from Kadambot Siddique of the University of Western Australia, adding real-world perspectives to your learning.

Environmental concerns are addressed through discussions on pollution, resource depletion, and climate change.

The course doesn’t just highlight problems but also explores practical solutions and adaptive strategies for the agricultural sector.

Fertilizers, crop yields, and profit maximization are tackled with hands-on tools like spreadsheet tutorials, equipping you with practical skills for economic analysis.

The course also emphasizes the importance of resource conservation, featuring case studies and interviews with farmers and agricultural professionals.

In the final modules, you’ll explore the role of government policies in supporting agricultural production and environmental protection.

The course concludes with a wrap-up that reinforces key concepts and ensures you’ve got a solid grasp of the material.

Throughout the course, optional and recommended readings and viewings supplement the core content, allowing you to dive deeper into topics like wheat price betting and the economics of conservation agriculture.

Economic Growth and Distributive Justice Part I - The Role of the State

You’ll start by examining the objectives of policymakers, using Bhutan’s unique focus on happiness as a case study.

This sets the stage for exploring the roles of the experiencing and remembering selves in shaping public satisfaction.

The course then guides you through the mechanics of how the state can achieve its goals.

You’ll engage with concepts like public goods provision, the implications of externalities, and the pressing issue of climate change through interactive elements like the Ultimatum Game.

As you progress to week two, the course demystifies economic growth, highlighting the pivotal role of innovation and the sometimes surprising relationship between efficiency and equality.

You’ll also learn to navigate the trade-offs between these two goals using the Leaky Bucket Parable to understand social welfare functions.

Week three introduces you to the landscape of distributive justice theories, from libertarianism to egalitarianism, and their policy implications.

Real-life examples bring these theories to life, particularly in the context of taxation and its impact on social welfare.

In the final week, you’ll apply your knowledge to public finance analysis, exploring tax rules that maximize social welfare and addressing complex issues like income inequality and poverty measurement.

By the end of this course, you’ll have a comprehensive understanding of the state’s role in economic growth and distributive justice, equipped with a wealth of recommended readings to continue your exploration of economics.

Economic Growth and Distributive Justice Part II - Maximize Social Wellbeing

This natural progression of the course above begins by demystifying the concept of social efficiency, breaking down consumer and producer surplus in a way that’s easy to grasp.

You’ll quickly learn why taxes are more than a pocketbook issue, as the course sheds light on their broader economic impact, including compliance costs and the influence on market prices.

The syllabus takes you through the complexities of tax incidence, revealing the often-unexpected effects of taxes and subsidies on different groups.

It challenges the assumption that laws can dictate who bears the tax burden, instead showing how market forces play a crucial role.

Income redistribution is another key topic, with the course exploring various strategies governments use to level the playing field.

From progressive tax rates to deductions and grants, you’ll examine the tools at policymakers’ disposal.

Real-world insights from experts like Professor Dan Shaviro enrich the learning experience, providing a practical perspective on theoretical concepts.

As you progress, the course delves into the design of optimal tax and welfare systems, discussing flat taxes, grants, and the rationale behind different marginal tax rates.

It also engages with contemporary debates, such as those sparked by Thomas Piketty’s “Capital in the 21st Century,” encouraging you to critically assess the relationship between inequality and democracy.

The Korean Economic Development

“The Korean Economic Development” course offers a thorough exploration of South Korea’s remarkable economic transformation.

It begins with a foundational understanding of the country’s post-war challenges and progresses through the decades, detailing the strategic policies that spurred growth.

You’ll gain insights into the 1950s Import Substitution Policy and the pivotal role of foreign aid, understanding how these elements laid the groundwork for future prosperity.

The course doesn’t just tell you what happened; it shows you through supplementary videos that bring historical policies to life, such as the Saemaul Undong movement and the 1960s development plans.

As you move into the 1970s, you’ll examine the Heavy and Chemical Industrialization drive, learning how South Korea positioned itself as an industrial leader.

The course also addresses the economic repercussions of the oil shocks, providing a realistic view of the challenges faced and the strategies employed to overcome them.

The narrative continues into the 1980s and ’90s, where you’ll dissect the Asian Financial Crisis and its implications for South Korea.

This section is particularly insightful, offering a deep dive into crisis management and economic resilience.

Moreover, the course celebrates South Korea’s innovation in key industries like automotive, semiconductors, and IT, showcasing how these sectors contributed to the nation’s economic boom.

The peer review component further enriches the learning experience, allowing for meaningful exchanges with peers.

Narrative Economics

Guided by Professor Robert Shiller (Yale University), an Nobel prize winner in the field, this course goes beyond traditional economic analysis to explore how narratives influence economic behavior.

The journey begins with foundational concepts like the SIR Model and epidemic curves, illustrating how ideas spread.

You’ll get practical with tools like Ngram, tracking the ebb and flow of economic narratives through history.

The course’s core is built around seven thought-provoking propositions.

These explore the dynamics of economic narratives, their scale and speed, and their resilience, even in the face of contradictory evidence.

You’ll understand the role of repetition and emotional attachment in the life cycle of economic stories.

Real-world applications come to life as you examine “perennial narratives,” recurring themes like automation fears and financial booms and busts.

These case studies demonstrate the persistent influence of certain stories on economic behavior.

In the final modules, “consilience” encourages you to synthesize knowledge across disciplines, fostering a holistic understanding of how narratives shape the economic landscape.

You’ll be encouraged to develop your own narrative, applying your newfound insights.

“Narrative Economics” offers a fresh lens through which to view economic phenomena, equipping you with the analytical skills to decipher the stories that drive markets and policy.

Introduction to Economic Theories

You’ll begin by understanding the scientific nature of economics, tackling utility maximization to see how choices are made in the marketplace.

The course doesn’t just teach you theory; it arms you with practical tools, such as calculating price elasticity of demand and deriving demand functions, essential for grasping how prices affect consumer behavior and business decisions.

Diversity of thought is a key feature here.

You’ll compare and contrast various economic schools of thought, from neoclassical to Post Keynesian, giving you a broad perspective on economic reasoning.

This isn’t just academic; it’s about applying these theories to real-world issues like labor hiring, market organization, and firm growth.

Beyond the numbers, the course addresses the human side of economics.

You’ll explore the economic implications of community organization, gender roles, and even environmental sustainability.

It tackles tough questions on unemployment, income equality, and the intricacies of economic growth.

International trade and policy aren’t neglected either.

You’ll delve into the mechanics of global trade, understanding concepts like demand-led growth and comparative advantage.

The course also confronts social challenges, examining the economics of wellbeing, poverty, and the strategies for achieving green growth in the face of climate change.

Earth Economics

This course goes beyond traditional economic theories, focusing on the interconnectedness of the planet’s financial health.

The introductory module sets the tone, challenging you to think globally with exercises that explore Earth’s economic balance and the financial repercussions of the COVID-19 crisis.

It’s a practical approach that ties learning to current events.

You’ll delve into the Gross Planet Product (GPP), a concept that expands your understanding of economic activity beyond national borders.

The course also demystifies the business cycle, secular stagnation, and unemployment fluctuations, linking macroeconomic principles to the planetary scale through engaging exercises.

A key feature of the syllabus is its interactive model-building.

You won’t just learn about the Earth Economy; you’ll actively construct and analyze models, applying theories to scenarios like world tourism and population dynamics.

The curriculum tackles complex topics such as government spending, taxation, deficits, debts, and the role of the IMF with clarity.

You’ll also explore the intricacies of money, including the impact of cryptocurrencies and banking practices on the global economy.

Advanced concepts like Walras’ Law, elasticity, and the IS and LM curves are presented in a digestible format, ensuring you grasp these critical economic tools.

The course consistently connects theory to practice, with a particular focus on the economic implications of the COVID-19 crisis.

Wrapping up, “Earth Economics” addresses global public goods, competition policy, and strategies for managing the Earth Economy.

It’s an engaging, thought-provoking journey through the economics of our planet, offering practical insights and a deep understanding of global economic dynamics.

The Art and Science of Economic Policy

The course kicks off by addressing a fundamental question: Why do we need a government?

You’ll examine historical policy failures to understand the government’s role and its limitations.

Discussions on real-world issues, such as online data security and voting rights, make the content relevant and thought-provoking.

As you progress, the course shifts focus to the scientific aspects of economic policy.

You’ll explore key concepts like incentives, pricing, and competition, and how they influence resource allocation.

Practical examples, including healthcare capacity and the impact of minimum support prices, illustrate these principles in action.

The art of policymaking is also a major focus.

Here, you’ll learn the importance of patience, managing complexity, and the value of transparency in policy implementation.

The course encourages you to consider international experiences and emphasizes that the government’s role is to enable progress, not to control it.

Finally, you’ll dive into the implementation process, discovering how to build state capacity and the significance of knowledge institutions.

The course provides a comprehensive look at the policy pipeline, from capacity building to managing political economies.

Throughout the course, you’ll engage with a variety of topics, including infrastructure financing, workfare programs, and the challenges of corruption.

By the end, you’ll have a well-rounded understanding of both the theoretical and practical aspects of economic policy.

Doing Economics: Measuring Climate Change

This course is about applying real-world data to see the impact of climate change on economies and lifestyles.

It’s an ideal course if you are looking to blend economic theory with data analysis skills in the context of climate change.

You’ll begin by examining the effects of climate change on your own country, making the learning experience relevant and immediate.

With Excel, you’ll learn to chart global temperatures over centuries, turning abstract numbers into clear, visual stories.

The course then guides you through the relationship between extreme weather events and climate change, teaching you to analyze temperature distributions and summary measures.

These skills are crucial for understanding adaptation and mitigation strategies in the face of climate variability.

As you progress, you’ll delve into the science of carbon emissions, learning to discern correlation from causation—a fundamental skill in economics.

You’ll practice making scatterplots and calculating correlation coefficients in Excel, equipping you with the tools to interpret complex datasets.

In the latter weeks, the course tackles broader issues like economic growth, environmental degradation, and the valuation of the environment.

You’ll engage with green growth accounting and evaluate environmental policies, gaining a comprehensive view of the economic challenges posed by climate change.

Supporting materials, including readings and instructional videos, complement the hands-on Excel exercises, ensuring a rich learning experience.

Economics: Society, Markets, and Inequality

This course isn’t just about learning economic theory; it’s about understanding the human stories behind the data.

You’ll start by tackling the big questions: Why does inequality exist?

How do scarcity and surplus affect our well-being?

The course goes beyond textbook definitions, encouraging you to think critically about capitalism and its global impact.

Discussions are integral to this course, providing a platform for you to engage with peers from the get-go.

Each lesson is accompanied by thought-provoking questions, fostering a collaborative learning environment.

The curriculum delves into the nuances of economic systems, examining the positives of competition and entrepreneurship through the lens of renowned thinkers like Adam Smith.

It also addresses the challenges—financial crises, job insecurity, and the undervaluation of certain types of work—offering a balanced perspective on the economy’s multifaceted nature.

Labor market dynamics are dissected, revealing the realities of bargaining power, corporate influence, and the role of institutions like the Federal Reserve.

The course also demystifies globalization, exploring its origins, stakeholders, and the intricate global value chains that define modern commerce.

As the course concludes, it shifts focus to the future, prompting you to consider how to foster a more equitable society.

The readings provided throughout the course enrich your understanding, equipping you with a solid foundation to participate in informed discussions.

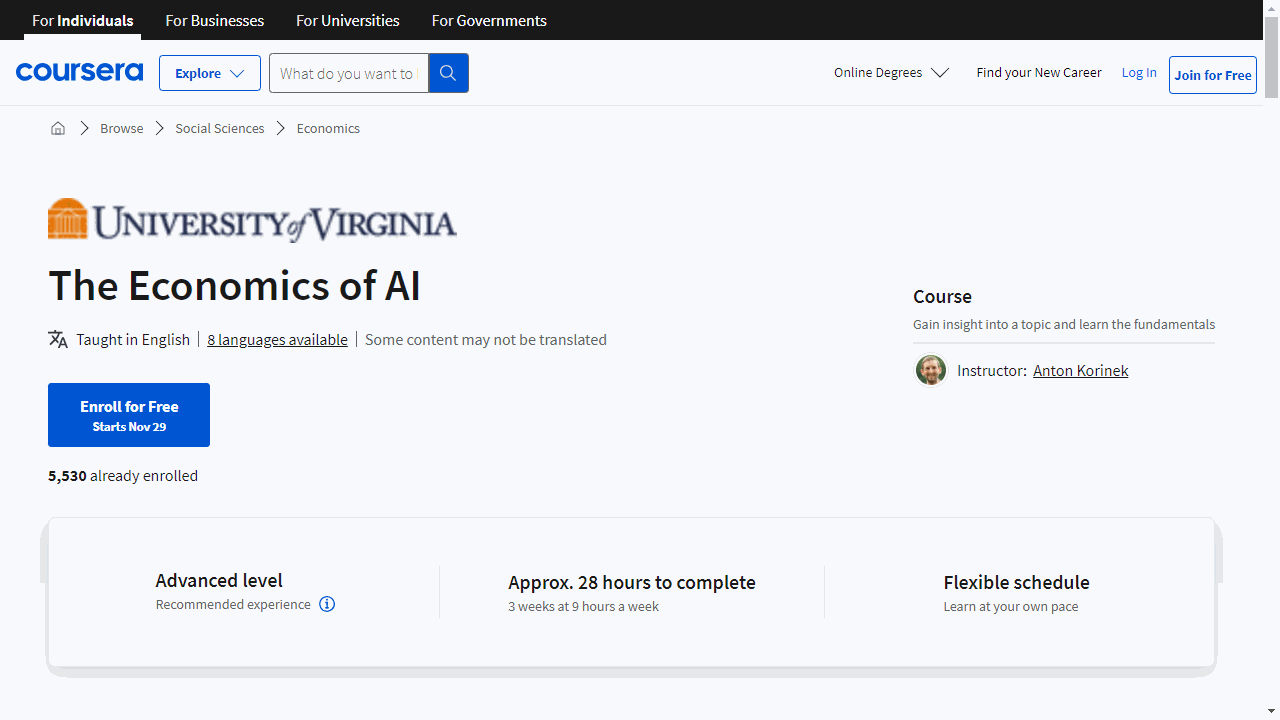

The Economics of AI

This course is a practical guide to understanding AI’s impact on the economic landscape.

You’ll begin with the basics of intelligence, both human and artificial, setting the stage for deeper economic concepts.

The course then transitions into the practicalities of production, where you’ll learn how technology reshapes manufacturing and the implications for digital innovation on economic policies.

Growth is a key theme, and you’ll explore how AI challenges traditional economic models, potentially leading to unprecedented levels of growth.

The course also addresses the pressing issue of labor market shifts due to AI, discussing the effects on employment and societal inequality.

Policy-making in the AI era is another critical area covered.

You’ll engage with strategies for equitable technological progress, including taxation and income distribution, preparing you to think critically about future economic policies.

Lastly, the course delves into the transformative potential of AI in the economy, considering the role of non-human economic agents and the long-term viability of human labor.

Expert interviews, including one with Nobel laureate Joseph Stiglitz, enrich the learning experience.

Also check our posts on: