Finance is the backbone of every successful business, from managing investments and understanding financial statements to making informed decisions that drive growth.

A strong foundation in finance can empower you to navigate the complex world of money, make informed decisions about your personal finances, and even pursue a fulfilling career in the financial sector.

Finding the right finance course on Coursera can be a daunting task, with so many options available.

You’re looking for a program that’s comprehensive, engaging, and taught by experts, but also fits your learning style and goals.

For the best finance course overall on Coursera, we recommend the “Think like a CFO Specialization”.

This series of courses provides a well-rounded education in accounting, financial management, and corporate finance, equipping you with practical skills to analyze financial data, make sound investment decisions, and understand the strategic financial choices companies face.

While this specialization stands out for its comprehensive approach, we understand that different learners have unique needs.

Keep reading to explore our curated list of other top-rated finance courses on Coursera, covering topics like financial modeling, investment strategies, and the rapidly evolving field of FinTech.

Think like a CFO Specialization

The “Think like a CFO Specialization” on Coursera stands out for its practical approach to financial literacy.

This series of courses is tailored to equip you with the essential skills needed to navigate the complex world of finance with ease and confidence.

The journey begins with “Accounting: Principles of Financial Accounting,” where you’ll delve into the essentials of financial statements. This course isn’t just about learning to record numbers; it’s about interpreting the financial health and story of a business.

By the end, you’ll be able to make sense of balance sheets and income statements, which are crucial for any business-related decision-making.

Then there’s “Finance for Managers,” which takes a closer look at the narrative behind the numbers.

This course teaches you to extract meaningful insights from financial data, enabling you to influence managerial decisions and impact a company’s financial future. It’s about understanding the implications of your choices on the company’s financial standing.

In “Corporate Finance Essentials,” you’ll broaden your perspective to understand the relationship between companies and the capital markets.

This course demystifies the financial concepts and vocabulary you’ll encounter in the financial press, making you well-versed in the language of finance professionals.

Finally, “Corporate Finance Essentials II” builds upon the previous course, diving deeper into topics such as market efficiency, bond valuation, stock valuation, capital structure, and dividend policy. This course provides a comprehensive look at the strategic financial decisions companies face.

Each course is designed to impart specific skills, from financial accounting to corporate finance, ensuring that you’re not just passively absorbing information but actively developing competencies that are applicable in real-world scenarios.

It’s a solid choice for anyone looking to understand finance from the ground up or for professionals aiming to refresh and expand their knowledge.

With this specialization, you’re not just learning finance; you’re preparing to apply it strategically in any business context.

Finance & Quantitative Modeling for Analysts Specialization

The journey begins with “Fundamentals of Quantitative Modeling,” where you’ll learn to interpret and construct quantitative models.

This course isn’t just about crunching numbers; it’s about understanding the stories they tell about a business’s trajectory. You’ll gain insight into the types of models used in the industry and acquire the foundational skills to build your own.

Moving on to “Introduction to Spreadsheets and Models,” you’ll discover the power of spreadsheets as a formidable tool for analysis.

This course equips you with the know-how to navigate Excel or Sheets, enabling you to transform raw data into actionable insights. It’s a hands-on experience that prepares you to construct models that can inform your decision-making process.

For those less familiar with the financial world, “Financial Acumen for Non-Financial Managers” offers a clear view into how financial and non-financial data converge to influence a company’s performance.

You’ll delve into financial statements and learn to use data to predict and strategize for the future. This course is designed to enhance your ability to make informed financial decisions without requiring a background in finance.

Lastly, “Introduction to Corporate Finance” provides a comprehensive overview of finance fundamentals.

You’ll explore concepts such as the time value of money and risk-return tradeoff, applying them to various scenarios from personal finance to corporate investments. This course is about connecting theory with practice, ensuring you can apply concepts like discounted cash flow analysis to real-world situations.

Each course is infused with essential skills like regression analysis and cash flow analysis, ensuring that you’re not just learning theory but also acquiring practical expertise. The specialization is designed to be accessible, avoiding jargon and focusing on clear, applicable knowledge.

FinTech: Finance Industry Transformation and Regulation Specialization

Exploring the world of finance through the lens of technology has never been more accessible. This series of courses is designed to equip you with a comprehensive understanding of the rapidly evolving FinTech landscape.

The specialization kicks off with “FinTech Foundations and Overview,” which serves as a solid introduction to the field.

This course isn’t just about learning the basics; it’s about building the confidence to discuss and analyze FinTech trends critically. With insights from HKUST, a leading institution renowned for its finance programs, you’ll gain a unique perspective on the advancements in Asia, a region at the forefront of FinTech innovation.

Moving on to “FinTech Security and Regulation (RegTech),” you’ll delve into the complexities of keeping financial technology secure and compliant.

This course demystifies the regulatory environment surrounding emerging technologies like cryptocurrencies. You’ll explore the challenges of data protection and risk management, and understand how different countries are navigating the intersection of technology and finance.

In “FinTech Risk Management,” the focus shifts to the strategic side of managing financial risks in the age of disruption.

You’ll learn about the importance of compliance and the strategies for analyzing and mitigating FinTech risks. The course also touches on the increasing role of technology firms in the financial sector, highlighting the need for robust IT compliance and assurance.

Lastly, “FinTech Disruptive Innovation: Implications for Society” broadens the scope to consider the societal impact of FinTech.

This course encourages you to think about how disruptive technologies create opportunities and challenges within the finance industry and beyond. You’ll examine the potential effects on various stakeholders and learn how to position yourself for success in a FinTech-driven future.

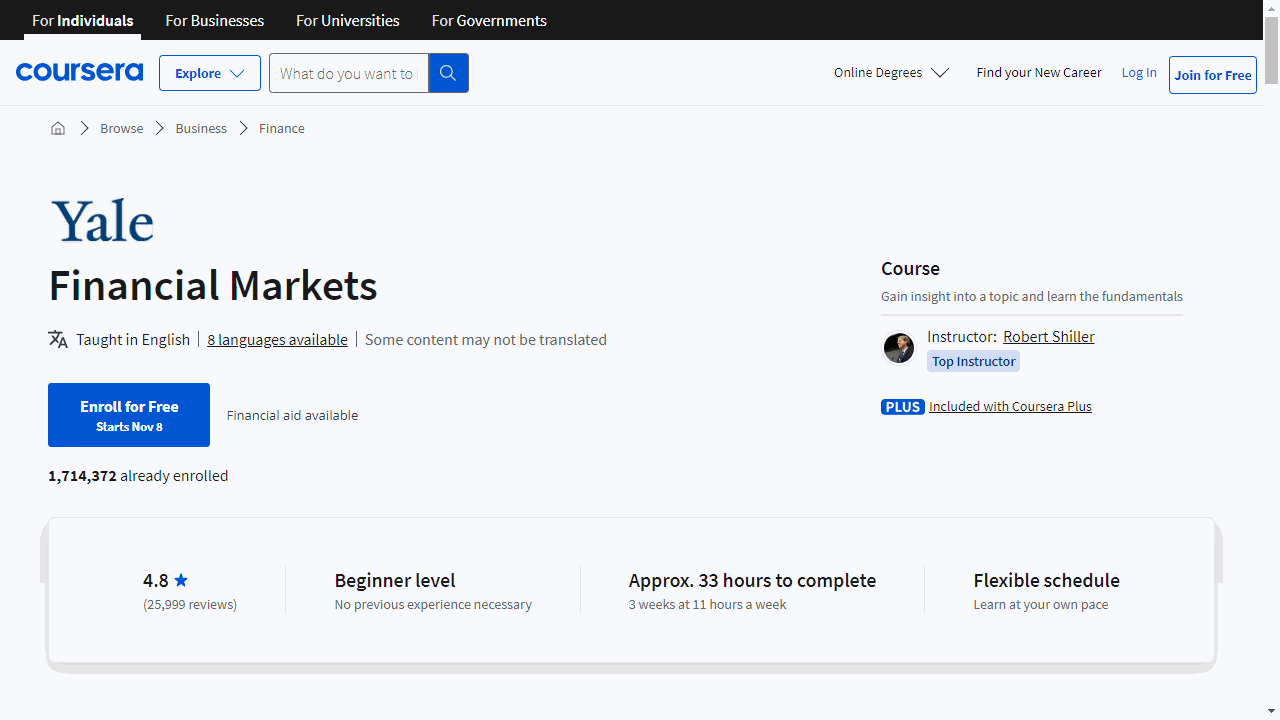

Financial Markets (Yale University)

This course is a classic, taught by Nobel Prize-winning economist Robert Shiller. It will give you a thorough understanding of the financial world, from foundational concepts to advanced strategies.

You’ll start with the basics, learning about the dual nature of financial markets—the potential for both good and evil—and why understanding risk through tools like Value at Risk (VaR) is crucial.

The course then takes you through real-world examples, such as the S&P 500, to illustrate how these concepts play out in actual market scenarios.

Insurance is a key topic, and you’ll explore its fundamentals, its role in the financial system, and the nuances of health insurance and disaster management. The course emphasizes the importance of diversification, teaching you why concentrating all your resources in one place can be a risky move.

Risk management continues with sessions on the Capital Asset Pricing Model (CAPM), beta, and diversification. You’ll also tackle practical skills like short selling and portfolio optimization, which are essential for anyone looking to invest wisely.

The course also covers valuation models like the Gordon Growth Model, helping you understand how to assess a company’s future earnings potential. It doesn’t stop at theory; you’ll see how innovation and invention are integral to financial growth.

You’ll delve into the mechanics of inflation, real estate, and market forecasting, gaining insights into market efficiency and the psychological factors that can influence financial decisions. The course provides a comprehensive look at behavioral finance, shedding light on why people sometimes make irrational financial choices.

On the technical side, you’ll learn about compound interest, bonds, and the structure of corporate finance, including the dynamics of shares, dividends, and capital raising.

The course also covers the complexities of mortgages and the regulatory landscape post-financial crisis, helping you understand the safeguards in place to prevent future economic downturns.

Futures and options are demystified, and you’ll learn about the role of investment banks and the IPO process. The course also touches on the infrastructure of financial markets, including mutual funds, ETFs, and the technology-driven world of high-frequency trading.

Beyond the mechanics of finance, the course examines the broader impact of financial systems on society, discussing government debt, social insurance, and the intersection of finance with social issues like war and population growth.

Finally, the course connects theory to practice, offering interviews with finance professionals to provide real-world context and career insights.

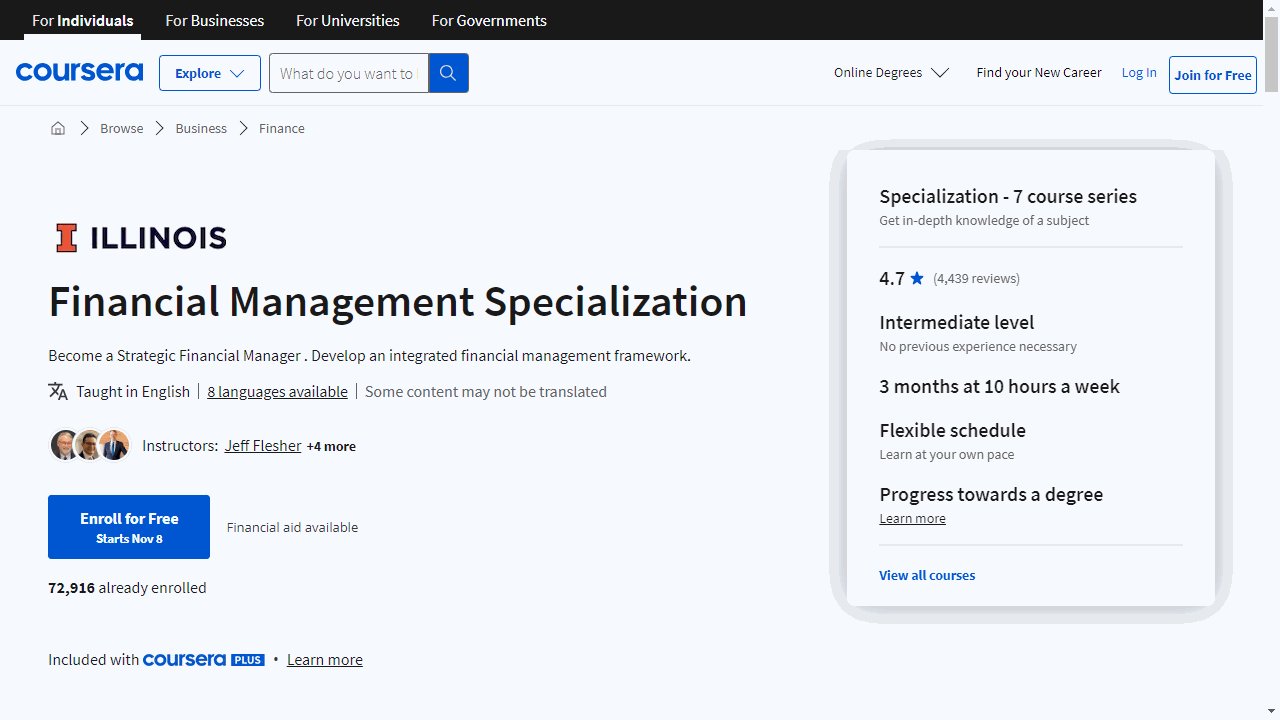

Financial Management Specialization

Navigating the world of finance requires a solid foundation, and the “Financial Management Specialization” on Coursera, backed by the University of Illinois, offers a structured path to acquiring this expertise.

Begin with “Financial Accounting: Foundations,” where you’ll get to grips with the core principles of financial accounting.

This isn’t just about memorizing terms; it’s about understanding the significance of financial statements and how transactions shape the financial narrative of a business.

Building on that foundation, “Financial Accounting: Advanced Topics” delves into the complexities of asset and liability accounting, equity, and the all-important cash flows statement.

This course equips you with the analytical tools to assess a company’s financial health beyond the surface numbers.

For those interested in the dynamics of the stock market, “Investments I: Fundamentals of Performance Evaluation” introduces you to the interplay between risk and return.

You’ll learn to use models like CAPM for investment evaluation, all while honing practical Excel skills that are indispensable in the finance industry.

“Investments II: Lessons and Applications for Investors” continues your investment education, offering insights into the behaviors that drive investor decisions and the performance of mutual funds.

This course provides a deeper understanding of how to navigate and succeed in the investment landscape.

Shifting focus to corporate finance, “Corporate Finance I: Measuring and Promoting Value Creation” teaches you how to use financial information to drive value creation within a company.

From liquidity management to investment evaluation, you’ll learn to make decisions that align with shareholder interests.

“Corporate Finance II: Financing Investments and Managing Risk” addresses the strategic side of finance, including how companies manage debt, equity, and financial risk.

You’ll explore the intricacies of financial instruments and how they can be used to maintain a firm’s financial stability.

The capstone project is where theory meets practice. You’ll synthesize the knowledge from each course to develop a comprehensive financial management plan, showcasing your ability to apply your learning to real-world scenarios.

Each course in this specialization is designed to build upon the last, ensuring a progressive learning experience.

You’ll gain a well-rounded skill set in corporate finance, risk management, and investment strategy.

And as part of the iMBA program, these courses offer a taste of an MBA education at a fraction of the cost.

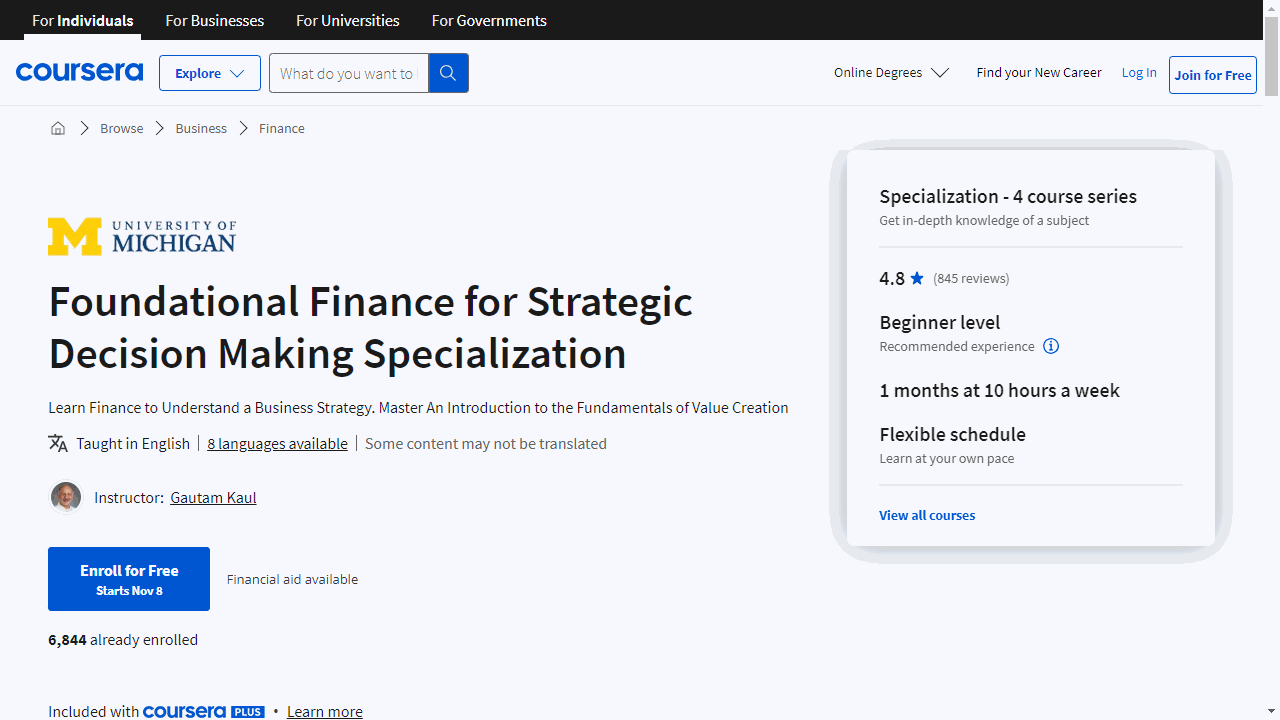

Foundational Finance for Strategic Decision Making Specialization

The journey begins with “Introduction to Time Value of Money (TVM),” where you’ll grasp the fundamental concept that money’s worth changes over time. This course lays the groundwork for understanding investments, savings, and loans, providing you with a toolkit for evaluating financial decisions effectively.

Building on that foundation, “Advanced Concepts in Time Value of Money (TVM)” delves deeper into practical applications.

You’ll tackle scenarios like saving for college and managing loans, translating abstract financial principles into concrete, actionable strategies. This course ensures that the skills you acquire are relevant and directly applicable to real-life financial planning.

Next, “Stocks and Bonds” introduces you to the essentials of investing.

You’ll explore how bonds are structured and priced, alongside the basics of stock valuation. This course demystifies the process of investing, making it accessible and understandable, and sets you up to make informed decisions about personal and corporate investments.

The specialization culminates with “Advanced Understanding of Stocks and Bonds,” where you’ll refine your knowledge of investment valuation and risk assessment. This course encourages a deeper dive into the mechanics of the market, preparing you to approach investing with a more nuanced perspective and a critical eye for company strategies.

Throughout the specialization, you’ll gain practical skills such as financial analysis and model development. The courses are designed to be interactive, with practice assignments that allow you to apply your newfound knowledge in a controlled, risk-free environment.

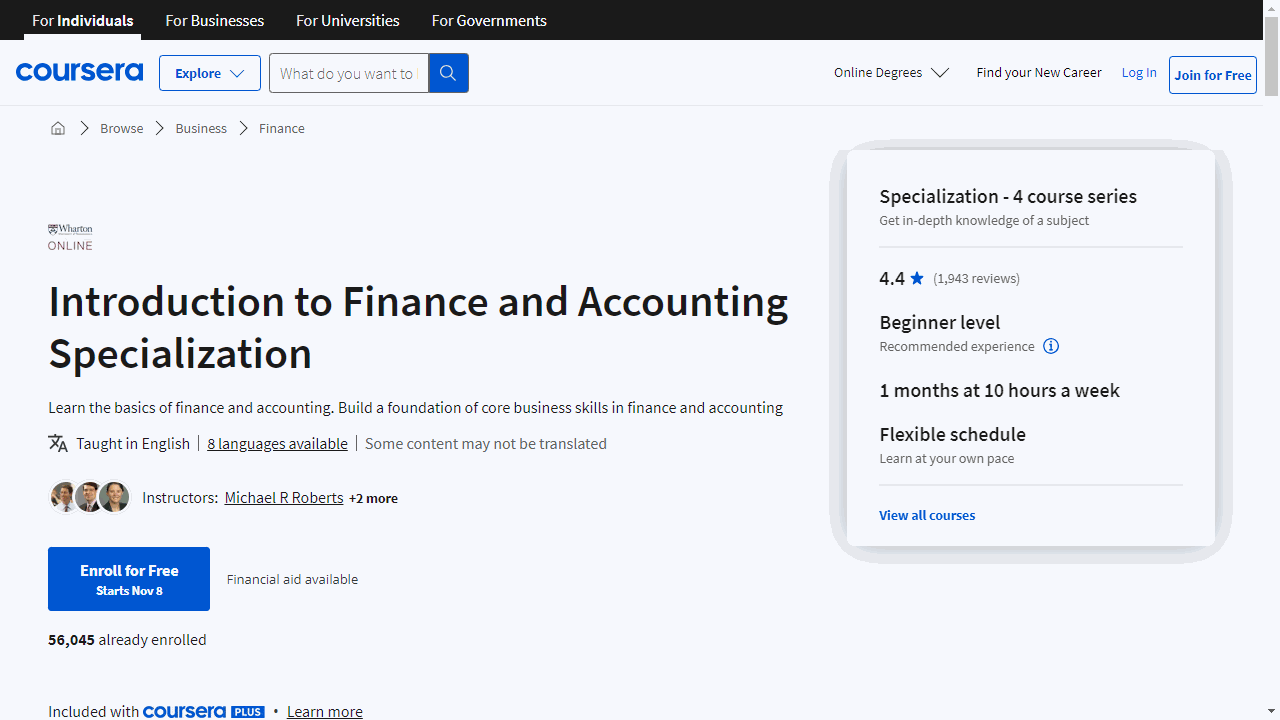

Introduction to Finance and Accounting Specialization

Starting with the “Fundamentals of Finance,” you’ll gain a solid foundation in corporate finance principles.

The course, inspired by the preparatory curriculum for Wharton MBA students, introduces you to key concepts such as Net Present Value (NPV) and the differences between annuities and perpetuities. You’ll also learn to apply these principles to evaluate investments and make strategic decisions for your firm.

Moving on to “Introduction to Corporate Finance,” this course expands on the basics by exploring practical applications.

You’ll delve into the time value of money, understand the risk-return tradeoff, and learn about the cost of capital. These concepts are not just theoretical; they’re essential for personal financial planning, corporate decision-making, and understanding financial markets.

If you are interested in the nuts and bolts of business, “Introduction to Financial Accounting” is invaluable.

It equips you with the skills to analyze financial statements and understand the impact of accounting standards and managerial incentives on financial reporting. By the end of this course, you’ll be adept at reading the three key financial statements and applying this knowledge to real-world scenarios.

The follow-up, “More Introduction to Financial Accounting,” builds on the previous course’s foundation.

It’s designed for those who have already grasped the basics and are ready to dive deeper into financial statement analysis. This course will enhance your ability to make informed decisions using the financial information provided by companies.

Each course in this specialization focuses on developing practical skills such as Discounted Cash Flow (DCF) analysis, decision-making in corporate finance, and a thorough understanding of accounting principles.

These skills are not just academic; they’re directly applicable to real-world situations, whether you’re managing personal investments or making corporate financial decisions.

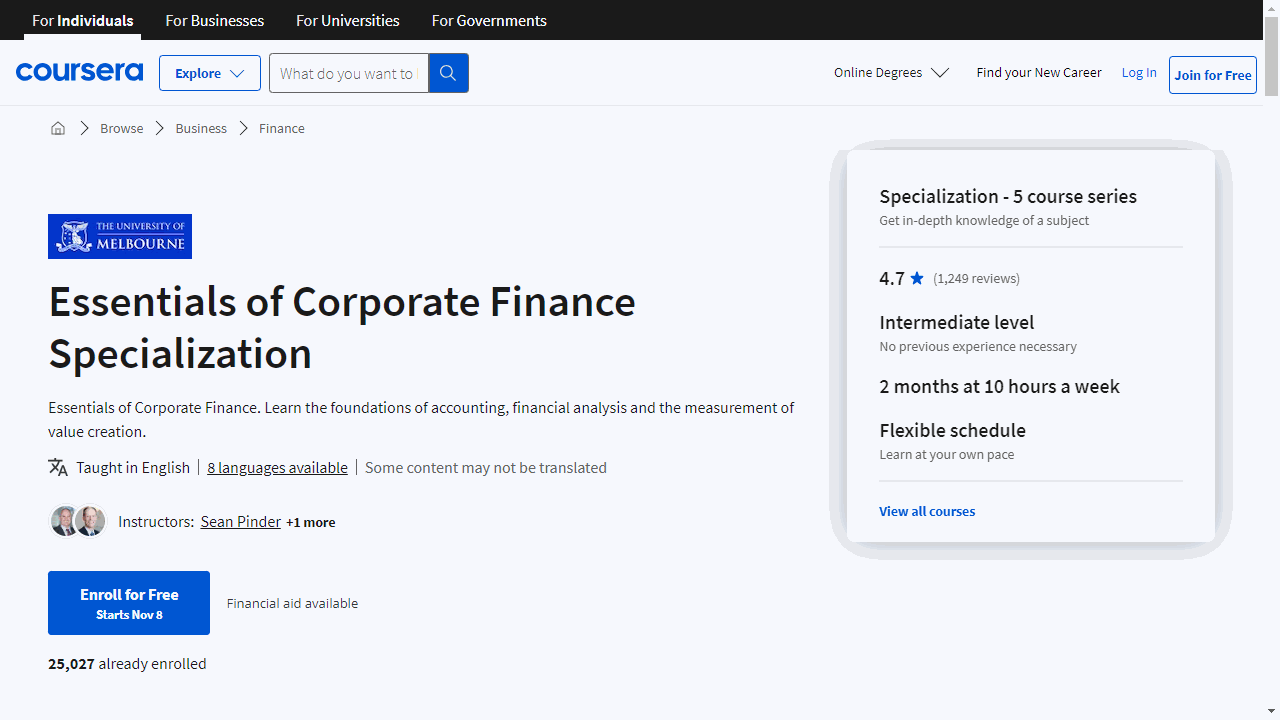

Essentials of Corporate Finance Specialization

This series of courses, crafted by the University of Melbourne in collaboration with BNY Mellon, offers a comprehensive dive into the core aspects of corporate finance.

The journey begins with “The Language and Tools of Financial Analysis.”

Here, you’ll build a strong base in accounting principles and financial analysis. Understanding the connection between these areas is crucial for assessing a company’s value creation. It’s a practical first step that equips you with the essential vocabulary and analytical skills needed in finance.

Then, “The Role of Global Capital Markets” expands your perspective to the international arena.

You’ll explore how global markets interact, creating and managing value for corporations and stakeholders. This course provides a clear view of the financial ecosystem and your potential role within it.

In “Corporate Financial Decision-Making for Value Creation,” the focus shifts to strategy.

You’ll delve into the critical financial decisions that corporations face and the methodologies used to maximize asset value. This course is about understanding the impact of each financial choice and how it contributes to the overall success of a firm.

“Alternative Approaches to Valuation and Investment” offers a deep dive into asset and investment valuation.

You’ll learn about various valuation techniques and their practical applications. Skills such as ratio analysis and understanding financial ratios are just a few of the takeaways that will enhance your financial acumen.

In the “Essentials of Corporate Finance Capstone,” you’ll apply everything you’ve learned by taking on the role of a financial analyst. This project simulates real-world financial analysis and strategic investment decision-making, providing a robust conclusion to the specialization.

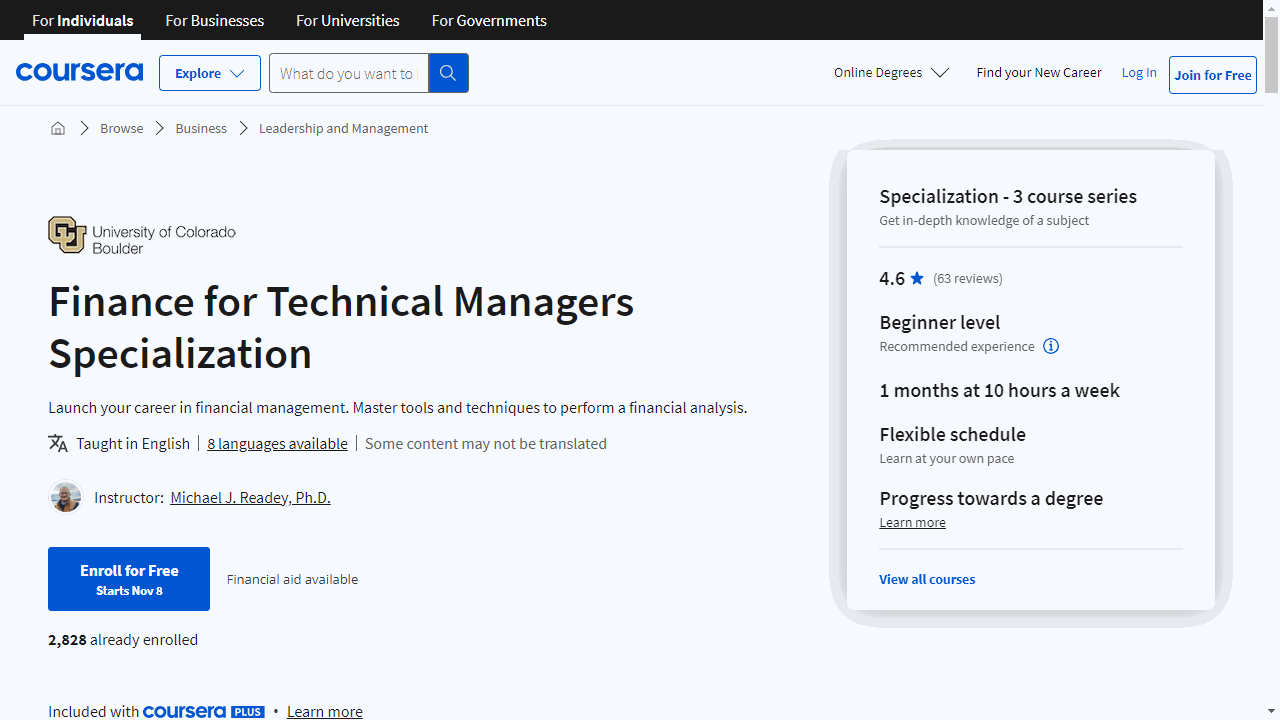

Finance for Technical Managers Specialization

This series of courses is designed to demystify finance for those who are more comfortable with equations than earnings reports.

The first course, “Product Cost and Investment Cash Flow Analysis,” offers a solid foundation in financial management within an organization.

You’ll apply the concepts using spreadsheets, a familiar tool for many technical professionals. You’ll gain insights into product costing methods and understand the time value of money—a crucial concept for both business and personal finance.

Moving on to “Project Valuation and the Capital Budgeting Process,” you’ll tackle the economic assessment of engineering projects.

This course equips you with the skills to evaluate investments using NPV, IRR, and PBP. You’ll also navigate through the complexities of depreciation, taxes, and inflation, ensuring you can create robust financial models that withstand real-world challenges.

Lastly, “Financial Forecasting and Reporting” broadens your perspective on financial health.

You’ll learn to dissect corporate financial statements and develop budgets that align with engineering goals. The course also introduces you to ESG metrics, preparing you to engage with the increasingly important sustainability aspect of corporate finance.

Each course is a component of CU Boulder’s Master of Engineering in Engineering Management (ME-EM) degree, which is accessible through Coursera. This program is ideal for those in technical fields aiming to transition into management roles without the traditional barriers of further education.

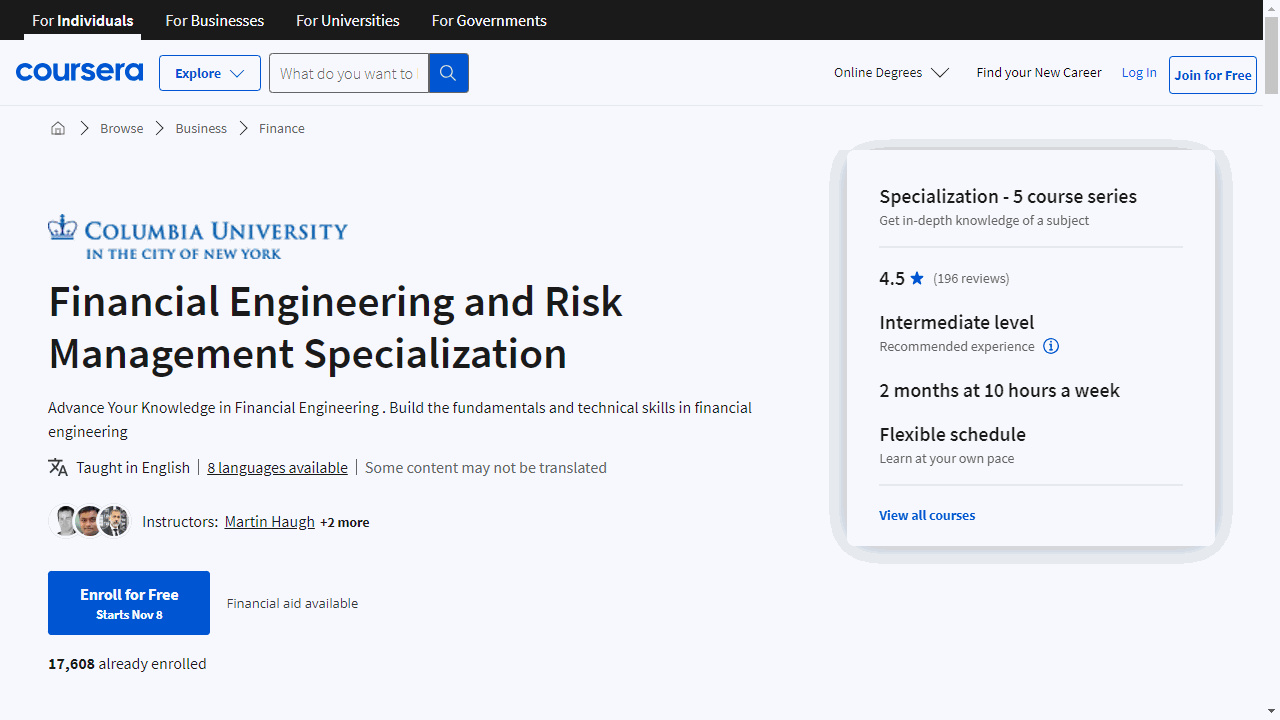

Financial Engineering and Risk Management Specialization

If you are interested in modeling financial derivatives, this specialization is a solid choice.

The specialization begins with the “Introduction to Financial Engineering and Risk Management” course.

This foundational course equips you with the mathematical tools necessary for financial analysis, covering probability, optimization, and the valuation of various financial instruments.

You’ll learn to calculate present value in an arbitrage-free environment and price options using models like Binomial and Black-Scholes. It’s a solid starting point that prepares you for more advanced topics.

Moving on, “Term-Structure and Credit Derivatives” delves into the behavior of interest rates and the mechanics of credit markets.

You’ll explore how to model the evolution of interest rates and gain insights into instruments like credit default swaps and mortgage-backed securities. The course also includes practical exercises, such as using Excel for model calibration, ensuring that you can apply your knowledge to real-world scenarios.

For those interested in asset management, “Optimization Methods in Asset Management” offers a deep dive into portfolio construction and risk assessment.

You’ll learn about the Capital Asset Pricing Model (CAPM) and other techniques to optimize investment portfolios, considering factors like transaction costs and market liquidity. This course emphasizes the application of theory to practice, preparing you to handle the complexities of asset management.

“Advanced Topics in Derivative Pricing” is designed for those ready to tackle more sophisticated financial concepts.

You’ll get to grips with the Black-Scholes model, learn about the Greeks and their role in risk management, and explore the intricacies of volatility in the markets. The course also examines the impact of credit derivatives on the financial system, providing a well-rounded understanding of derivative pricing.

Lastly, “Computational Methods in Pricing and Model Calibration” merges finance with computational techniques.

You’ll be introduced to various options and pricing methods, including the use of Fourier Transforms. The course is hands-on, with Python coding exercises that allow you to practice pricing options and calibrating models, giving you a skill set that’s highly valued in the finance industry.

By the end of the specialization, you’ll have a diverse set of skills, from understanding derivatives and fixed income instruments to mastering computational methods in finance.

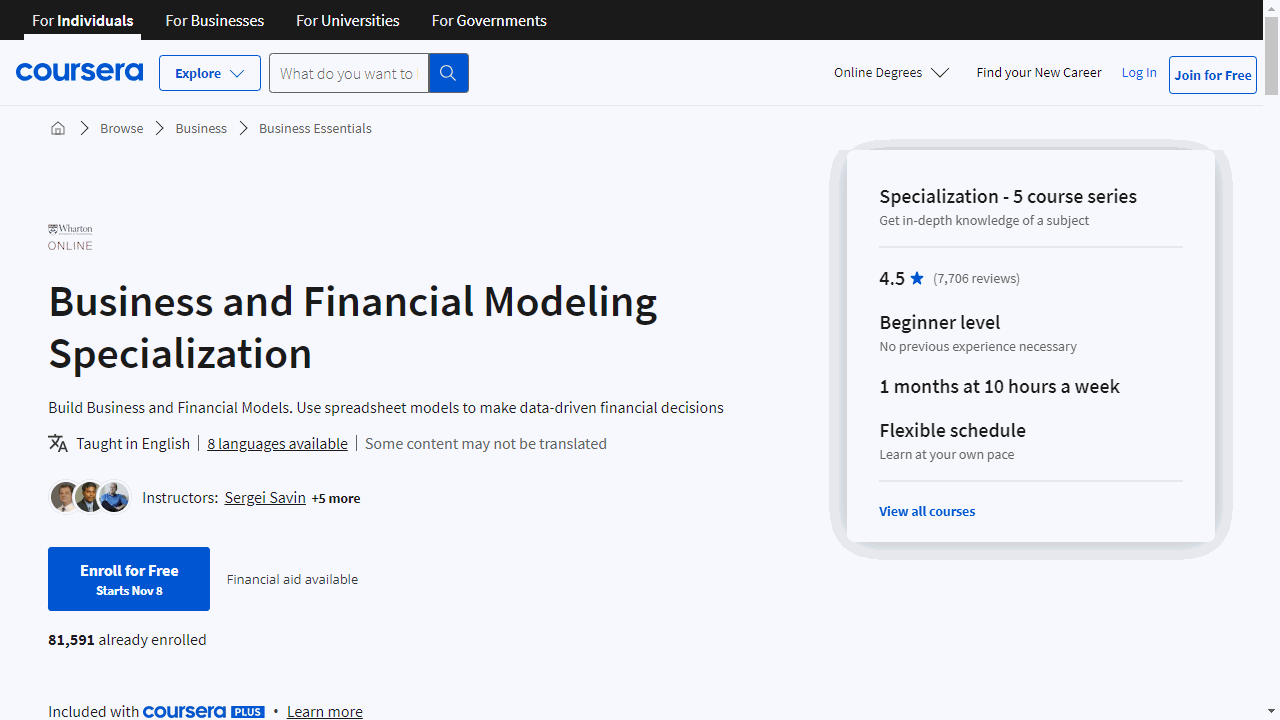

Business and Financial Modeling Specialization

This specialization begins with “Fundamentals of Quantitative Modeling,” where you’ll grasp the essentials of using data to analyze business activities and forecast future trends. This course lays the groundwork for creating models that can be applied to your own business challenges.

Next, “Introduction to Spreadsheets and Models” demystifies the spreadsheet, a ubiquitous tool in financial analysis.

You’ll learn practical spreadsheet functions and formulas that are crucial for organizing and projecting your business’s financial data.

In “Modeling Risk and Realities,” the focus shifts to the unpredictable nature of business. Here, you’ll learn to build models that incorporate elements of risk and uncertainty, equipping you with the foresight to navigate complex decision-making landscapes.

“Decision-Making and Scenarios” further refines your ability to use quantitative models for business decisions.

This course teaches you to structure decision-making processes effectively, enhancing your capability to weigh alternatives and outcomes.

In the “Wharton Business and Financial Modeling Capstone,” you’ll develop a business strategy based on a data model you’ve constructed, using real-world data from Wharton Research Data Services.

This hands-on experience culminates in a professional presentation, showcasing your ability to synthesize data and analysis into actionable business insights.

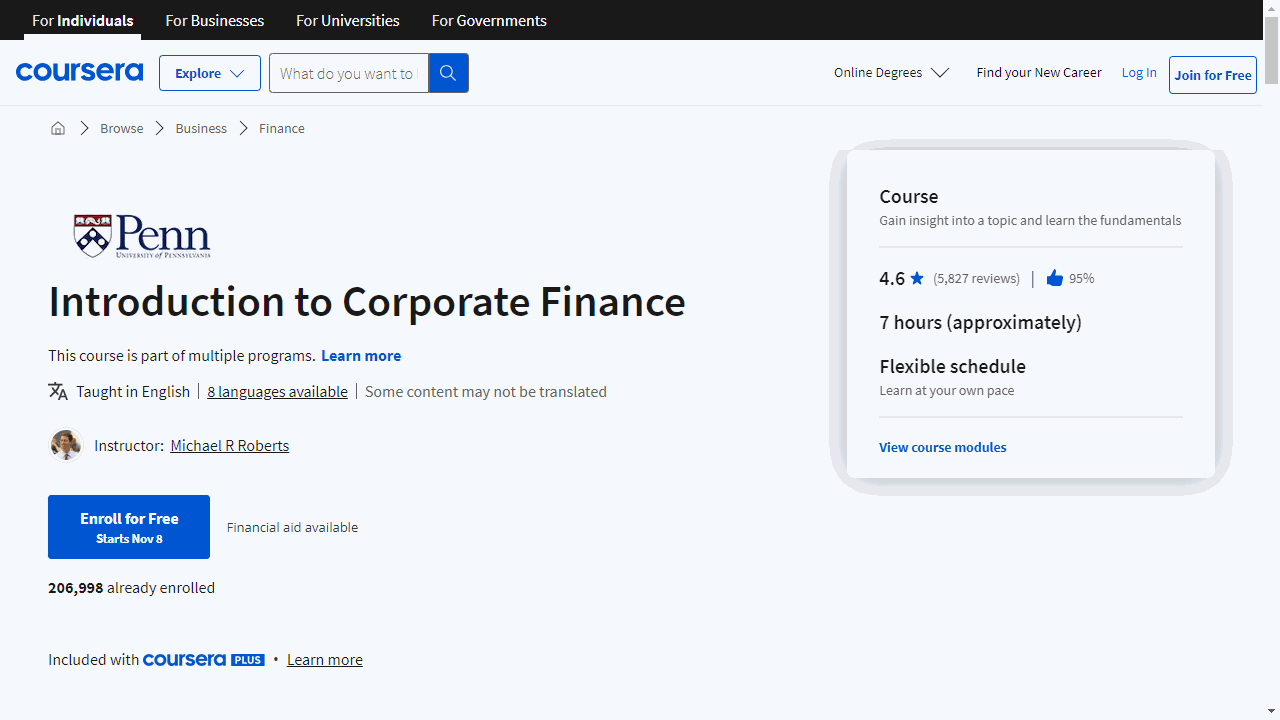

Introduction to Corporate Finance

The course kicks off with a focus on intuition and discounting, which is essentially about understanding the value of money over time. This isn’t just theoretical; it’s a skill you’ll use to make informed financial decisions in real life.

Next, you’ll tackle compounding, a fundamental concept that shows how your investments can grow exponentially. It’s a simple yet powerful idea that can have a big impact on your financial planning.

Shortcuts are always handy, and this course introduces you to some nifty ones that will streamline your calculations. This means you’ll spend less time with your calculator and more time applying what you’ve learned.

Understanding taxes and inflation is crucial because they directly affect your bottom line. You’ll learn how to navigate these financial hurdles, ensuring you’re not caught off guard by their impact on your investments or business operations.

Interest rates are often confusing, but the course demystifies APR and EAR, helping you understand the true cost of borrowing and the real return on your savings.

The term structure section will give you insights into the relationship between interest rates and different time frames, which is key to managing both personal and corporate finances effectively.

At the core of the course is Discounted Cash Flow (DCF), a technique that will become a cornerstone of your decision-making toolkit. You’ll learn how to use DCF to assess the viability of investments, a skill highly valued in the finance industry.

Forecasting free cash flow is about predicting how much money your business will have on hand in the future. You’ll explore the drivers of these forecasts, empowering you to make more accurate financial projections.

Decision-making in finance isn’t always black and white. The course introduces various criteria to evaluate potential investments, giving you a structured approach to making choices.

Sensitivity analysis is your safeguard against uncertainty. By learning how to adjust your forecasts for different scenarios, you’ll be better prepared for whatever the financial world throws your way.

Finally, understanding Return on Investment (ROI) is crucial. This course will show you how to calculate ROI, ensuring you can gauge the effectiveness of your financial decisions.

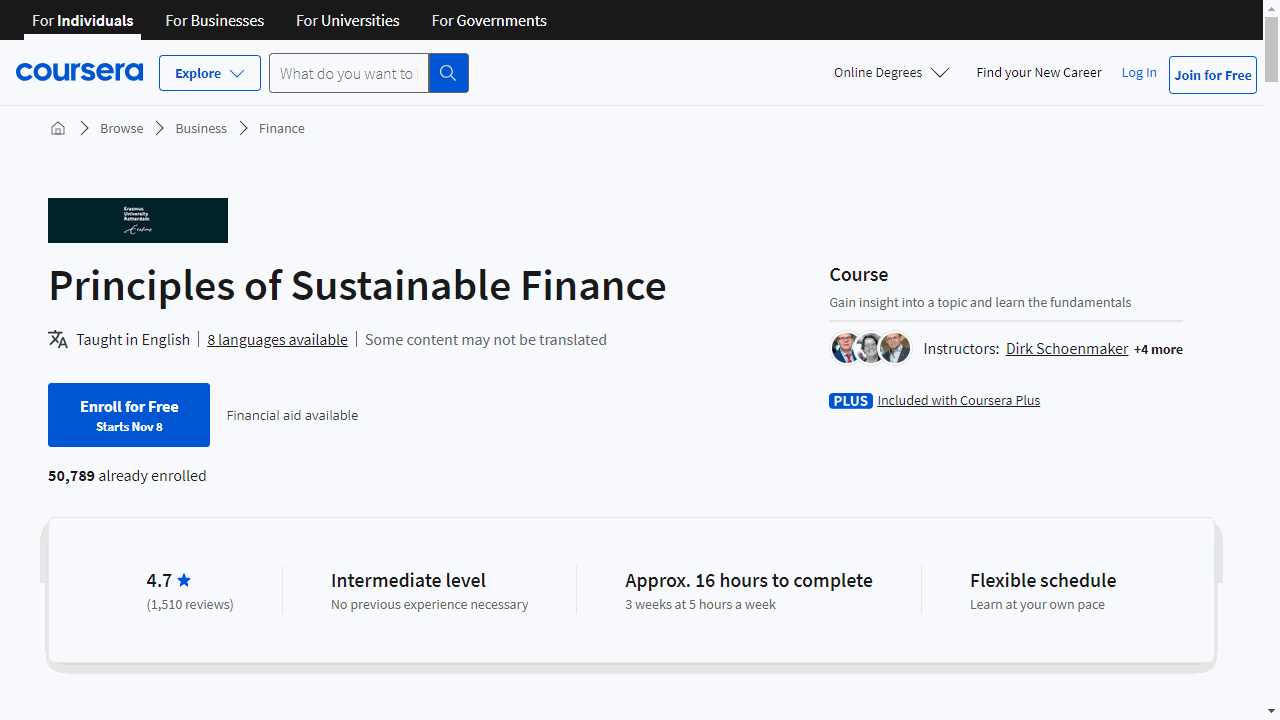

Principles of Sustainable Finance

This course stands out by integrating financial acumen with environmental and social consciousness, equipping you with the knowledge to make a positive impact.

It begins by introducing you to the concept of sustainability within the financial sector. You’ll explore the delicate balance of our planet’s boundaries and the foundational needs of society, setting the stage for understanding the critical role finance plays in sustainability.

As you progress, the UN Sustainable Development Goals come into play, illustrating the global blueprint for prosperity and environmental protection. You’ll see firsthand how sustainable finance is pivotal in achieving these goals, with practical examples like the living wage.

The curriculum then guides you through the stages of sustainable finance, emphasizing why it’s crucial to consider social and environmental factors in financial decision-making. Even if you’re approaching the subject with a hint of skepticism, the course addresses common concerns and demonstrates the value of sustainable practices in finance.

You’ll gain insights into the complexities of government regulation, the concept of true pricing in business, and the importance of integrated value thinking. The course also tackles the ethical responsibilities of companies, weighing the needs of shareholders against the broader interests of stakeholders.

Corporate governance and partnerships are dissected to reveal their significance in sustainable finance. You’ll learn about the sustainability quotient, which connects a company’s sustainability efforts to its overall strategy. Materiality is also a key topic, helping you identify the most pressing issues for businesses and investors.

The course doesn’t shy away from the theoretical underpinnings of finance. You’ll compare the efficient market hypothesis with the adaptive market hypothesis and examine evidence on the performance of sustainable investments.

Real-world applications are plentiful, with case studies like Kraft Heinz and Unilever illustrating how sustainable finance principles are applied in practice. The course also ventures into sustainable banking, discussing both the challenges and opportunities, and covers innovative concepts like circular business lending.

As climate change remains a pressing concern, you’ll delve into catastrophe models and climate stress testing, learning how financial institutions can respond to environmental risks. The course also highlights the particular vulnerabilities of equatorial countries and the financial strategies needed for a sustainable transition.

In the final modules, you’ll reflect on the potential for financial systems to drive positive change and be inspired by stories that showcase the power of individual action.

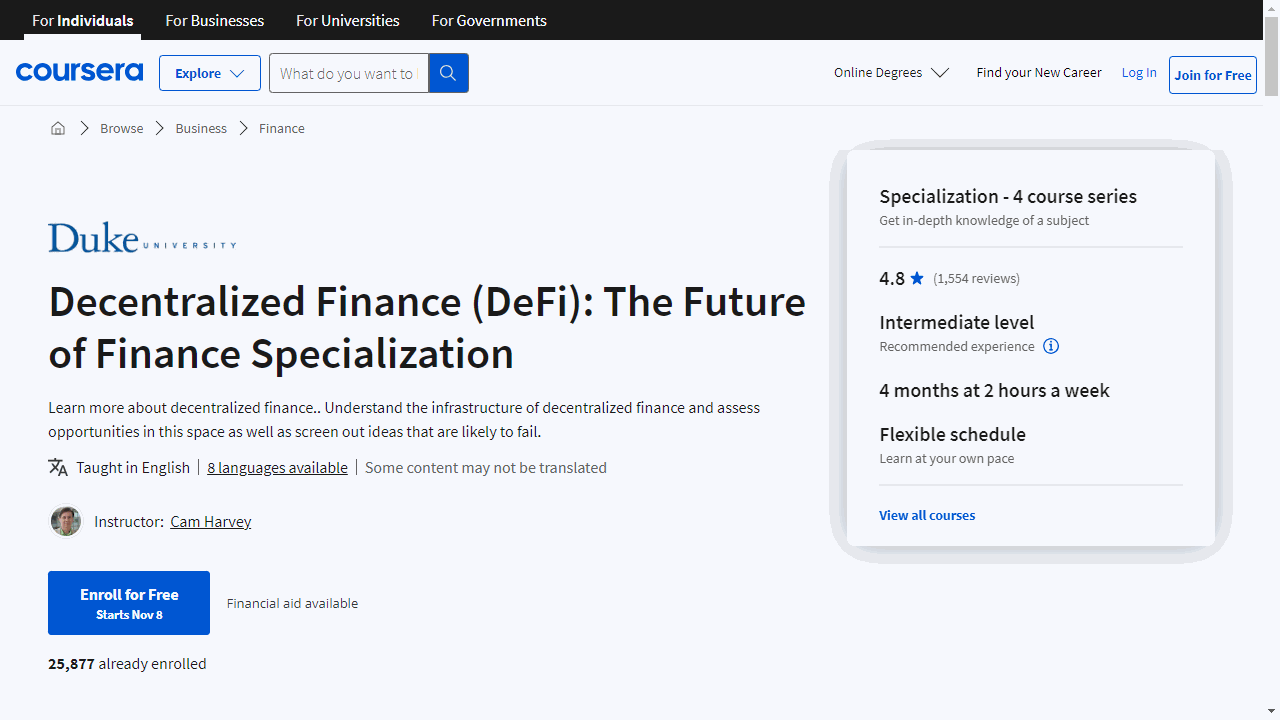

Decentralized Finance (DeFi): The Future of Finance Specialization

Exploring the world of finance can be daunting, but if you’re eager to understand the cutting-edge realm of Decentralized Finance, the “Decentralized Finance (DeFi): The Future of Finance Specialization” on Coursera is a comprehensive starting point.

This series of courses, taught by Professor Campbell R. Harvey of Duke University, offers a deep dive into the rapidly evolving DeFi landscape.

The journey begins with “Decentralized Finance (DeFi) Infrastructure,” where you’ll trace the evolution of finance from bartering to blockchain.

This course doesn’t just recount history; it equips you with a solid understanding of the foundational elements of DeFi, such as smart contracts and cryptocurrencies. You’ll learn about the inefficiencies and limitations of the current financial system and how DeFi addresses these issues.

Moving on to “Decentralized Finance (DeFi) Primitives,” you’ll delve into the mechanics of tokens, including the burgeoning world of NFTs.

The course demystifies the process of token creation and destruction and introduces you to the concept of decentralized exchanges. By contrasting these with centralized counterparts, you’ll gain insight into the benefits and workings of platforms and participants, like Automated Market Makers (AMMs) and liquidity providers.

The third course, “Decentralized Finance (DeFi) Deep Dive,” is where theory meets practice.

Here, you’ll examine leading DeFi protocols, understanding their mechanisms and applications. From credit and lending platforms like Aave and Compound to decentralized exchanges such as Uniswap, this course offers practical examples, including executing arbitrage transactions, to solidify your learning.

Finally, “Decentralized Finance (DeFi) Opportunities and Risks” rounds out the specialization by addressing the potential pitfalls of this nascent technology.

You’ll explore various risks, including smart contract vulnerabilities and regulatory challenges. This course provides a balanced perspective, ensuring you’re well-informed about the complexities of DeFi.

This specialization is more than just a set of courses; it’s an investment in your financial literacy in a domain that’s poised to play a significant role in the future of finance.

Whether you’re a finance professional looking to stay ahead of the curve or a curious learner eager to understand the next wave of financial innovation, these courses offer valuable insights and hands-on knowledge.

Also check our posts on: