Finance is an essential field that touches every aspect of our lives, from personal budgeting to global markets.

Understanding finance empowers you to make informed decisions about your money, investments, and career.

Whether you’re aiming to manage your personal finances more effectively, pursue a career in finance, or simply want to gain a deeper understanding of the financial world, learning finance is a valuable investment.

Finding the right finance course on Udemy can be a daunting task, with so many options available.

You’re looking for a program that’s comprehensive, engaging, and taught by experts, but also fits your learning style and goals.

It’s easy to feel overwhelmed and unsure where to start.

For the best finance course overall on Udemy, we recommend “Introduction to Finance, Accounting, Modeling and Valuation”.

This course provides a solid foundation in financial concepts, covering essential topics like accounting principles, financial modeling, and valuation techniques.

It’s taught by Chris Haroun, a seasoned finance professional with years of experience working at top firms like Goldman Sachs.

While this course is our top pick, it’s just the beginning.

Udemy offers a wide range of courses catering to various levels of expertise and interests.

Keep reading to explore our comprehensive list of recommendations and find the perfect finance course to ignite your journey.

Introduction to Finance, Accounting, Modeling and Valuation

The course starts by diving into accounting principles, teaching you how to analyze income statements, balance sheets, and cash flow statements.

You’ll learn the importance of these financial statements and how to interpret them through examples and exercises.

This knowledge is essential for building financial models and determining target prices.

Once you have a grasp of accounting, the course moves on to financial modeling.

It teaches best practices and provides a case study on building a model for LinkedIn.

You’ll learn where to find historical data, how to forecast financials, and techniques like discounted cash flow (DCF) analysis.

The valuation section is extensive, covering various methodologies like DCF, price-to-revenue, price-to-earnings, and more.

You’ll understand how to calculate terminal value, weighted average cost of capital (WACC), and blend different valuation approaches to minimize errors.

Additionally, it shows how to verify your target price against the company’s total addressable market.

Towards the end, the course equips you with formulas to assess profitability, debt, inventory, and compare companies using ratios like EV/EBITDA and price-to-book.

There are exercises to practice applying these formulas.

The Complete Financial Analyst Training & Investing Course

The course begins with an introduction to global macroeconomics, exploring key concepts and organizations like the International Monetary Fund (IMF), World Bank, and World Trade Organization (WTO).

You’ll learn how to analyze economic data using Excel and understand the impact of factors such as GDP, inflation, and monetary policy on financial markets.

Next, the course delves into the foundations of finance, including accounting principles, financial statements, and valuation methods.

You’ll learn how to create financial models, forecast revenue, and analyze income statements, balance sheets, and cash flow statements using a step-by-step approach and real-world case studies.

The course then covers various financial analyst roles in detail, including investment banking, equity research, venture capital, hedge funds, mutual funds, and more.

For each role, you’ll gain insights into the job responsibilities, daily tasks, interview tips, promotion strategies, and potential challenges.

You’ll also learn how to come up with investment ideas, pitch them effectively, and manage client relationships.

Additionally, the course covers topics like portfolio management, risk analysis, technical analysis, and compliance.

You’ll learn how to use tools like Yahoo Finance API, create investment templates, and navigate the legal and ethical considerations in the finance industry.

Throughout the course, you’ll have access to numerous Excel exercises, case studies, and quizzes to reinforce your learning.

The instructor provides detailed answers and explanations, ensuring you grasp the concepts thoroughly.

Python for Finance: Investment Fundamentals & Data Analytics

The course starts with an introduction to programming in Python, covering variables, data types, operators, conditional statements, functions, and data structures like lists, tuples, and dictionaries.

It then moves on to more advanced Python tools like object-oriented programming, modules, and packages, including NumPy, Pandas, Matplotlib, and SciPy, which are essential for financial and data analysis applications.

The course delves into the finance part, where you’ll learn how to calculate and compare rates of return for securities and portfolios, measure investment risk, perform portfolio optimization using Markowitz’s efficient frontier, and apply the Capital Asset Pricing Model (CAPM) to calculate expected returns, betas, and Sharpe ratios.

You’ll also explore multivariate regression analysis, a valuable tool for finance practitioners, and learn how to use Monte Carlo simulations for decision-making, forecasting stock prices, and pricing derivative contracts like options using the Black-Scholes-Merton formula.

The course includes practical exercises and coding examples to reinforce the concepts, allowing you to apply the techniques in Python and gain hands-on experience in financial data analysis and modeling.

Additionally, there are appendices covering Pandas fundamentals for data manipulation and an introduction to technical analysis, providing you with a well-rounded skillset in Python for finance and data analytics.

Finance for Non-Finance: Learn Quick and Easy

You’ll start by understanding the importance of financial literacy and what finance actually entails.

The core of the course dives deep into accounting and financial statements.

You’ll learn why every business needs accounting, the different types of financial reports, and the structure of each - the balance sheet, income statement, and cash flow statement.

The lectures use a hypothetical business start-up example to show how real operations get reflected in these statements over time.

There are two practical tasks to reinforce your learning.

Next, you’ll analyze financial statements using key ratios like profit margin, ROE, free cash flow, asset turnover, interest coverage, and debt ratio.

You’ll compare the risks and rewards for lenders vs. equity investors.

Then, you apply this knowledge to analyze the financials of corporate giants Apple, Facebook, and Ford - calculating ratios, assessing financial health, and looking at market valuation metrics.

The course also covers the purpose of budgeting, different budget types, the budgeting process from goal to approval, and budgetary control post-approval.

You’ll understand cost management by distinguishing between direct/overhead costs and fixed/variable costs.

There are three tests spread throughout to evaluate your grasp of accounting, financial analysis, and budgeting concepts.

Excel Crash Course: Master Excel for Financial Analysis

You’ll start by learning the Excel layout, settings, and how to set up worksheets for basic and advanced financial analysis.

This crucial foundation will help you work efficiently right from the start.

The course then dives into basic functions like SUM, AVERAGE, IF statements, and rounding, as well as more advanced ones like VLOOKUP, SUMIF, XIRR, and XNPV.

You’ll master scenarios, data validation, and learn to use tools like data tables and goal seek.

These skills are essential for building robust financial models.

Creating impactful charts and graphs is also covered, including combined column/line charts, waterfall charts (new in Excel 2016), pie charts, and more.

Visualizing your data powerfully is key for communicating insights.

To really turbocharge your productivity, you’ll learn how to record and use macros to automate repetitive tasks in your financial modeling workflows.

Throughout, you’ll get hands-on practice with examples and downloadable files.

MBA ASAP Corporate Finance Fundamentals for Career Success

This comprehensive course covers a wide range of topics, from financial statements and valuation techniques to startup finance and business ethics, equipping you with the knowledge and skills to excel in the world of finance.

The course begins by laying a strong foundation in financial statements, guiding you through the intricacies of the balance sheet, income statement, and cash flow statement.

You’ll learn how to read and analyze these statements, enabling you to make informed decisions about a company’s financial health and performance.

Additionally, the course delves into financial statement analysis, teaching you how to calculate and interpret various ratios, such as liquidity, profitability, and solvency ratios, to assess a company’s financial standing.

One of the course’s standout features is its focus on valuation techniques.

You’ll gain a deep understanding of the time value of money concept and learn how to discount cash flows using techniques like net present value (NPV) and internal rate of return (IRR).

These skills are essential for evaluating investment opportunities and making sound financial decisions.

The course also covers the weighted average cost of capital (WACC), a crucial metric for determining a company’s cost of capital and evaluating potential investments.

You’ll learn how to calculate WACC and use it in conjunction with other valuation techniques to make informed investment decisions.

Moving beyond traditional corporate finance topics, the course explores the exciting world of startups and entrepreneurship.

You’ll gain insights into startup funding rounds, learn how to raise capital effectively, and understand the importance of financial statements for entrepreneurs.

This knowledge can be invaluable if you’re considering starting your own business or working in the startup ecosystem.

Additionally, the course addresses the intersection of corporate finance and business ethics, highlighting the importance of ethical decision-making in the corporate world.

You’ll explore real-world case studies and learn how to navigate ethical dilemmas, ensuring that your financial decisions align with ethical principles.

Throughout the course, you’ll have the opportunity to apply your knowledge through coding exercises and quizzes.

These interactive elements not only reinforce your understanding but also provide hands-on experience in using Python for financial analysis and modeling.

One of the unique aspects of this course is its emphasis on practical application.

The instructor, John Cousins, draws from his extensive experience in finance and business to provide real-world examples and insights.

His engaging teaching style and clear explanations make even the most complex concepts accessible and easy to understand.

The Complete Personal Finance Course: Save,Protect,Make More

The course starts with an introduction on how to take it effectively, including access to live Q&A sessions with the instructor.

Part 1 focuses on saving money through exercises that demonstrate the power of compound interest and creating a personal income statement.

You’ll learn over 100 ways to cut expenses across various categories like taxes, transportation, food, and more.

Changing your perception of saving and teaching your kids good money habits are also covered.

Part 2 is all about protecting your money.

You’ll create a balance sheet to understand your net worth, learn tax strategies, set up an organized filing system, create a budget, choose the right bank, and protect your family with wills, trusts, and insurance products.

The instructor even explains how to access and fix your credit score.

In Part 3, you’ll learn to make your money work for you.

It begins with avoiding high investment fees and using low-cost index funds from firms like Vanguard.

You’ll build an investment portfolio management system to track stocks, bonds, commodities, and real estate investments.

Valuation methods, diversification strategies, and Buffett’s favorite investments are explained.

The bigger picture of interest rates, global economics, and currency movements is also covered.

Throughout the course, you’ll complete over 25 exercises using tools like a mortgage calculator and Excel dashboard.

The Complete Finance Manager Course

You’ll start by exploring the role of a finance manager and learn how to measure and improve financial performance.

The course then dives into the importance of Enterprise Resource Planning (ERP) systems, covering their advantages, implementation challenges, and best practices, including a case study on Hershey’s ERP implementation.

Next, you’ll delve into accounting basics, mastering revenue recognition, cost recognition, and the different types of revenues, costs, assets, and liabilities.

The course also covers advanced accounting topics like trade receivables, inventory management, fixed assets, trade payables, financial liabilities, and leasing liabilities.

You’ll gain insights into various financing sources, including debt and equity financing, and learn about financial statement analysis and ratio analysis, with a practical example analyzing P&G’s financial report.

Working capital management is another key area covered, focusing on techniques like economic order quantity (EOQ) and inventory optimization.

Capital budgeting takes center stage as you explore the theory behind it, calculating present and future cash flows, cost of debt and equity, and WACC.

A comprehensive case study walks you through building a complete DCF model, forecasting cash flows, and performing sensitivity analysis.

The course equips you with essential skills like creating effective presentations, adhering to key principles, and designing slides for company profiles, share prices, and financial overviews.

You’ll also learn company valuation techniques, building a practical DCF model to value a company like Tesla Inc.

As you progress, you’ll gain insights into becoming an effective manager, covering planning, organizing human resources, pre-hire and post-hire activities, employee motivation, and stress management.

The negotiation section teaches you the art of negotiation, including preparation, types of negotiation, and long-term success tactics, with a case study on Disney’s acquisition of Lucasfilm.

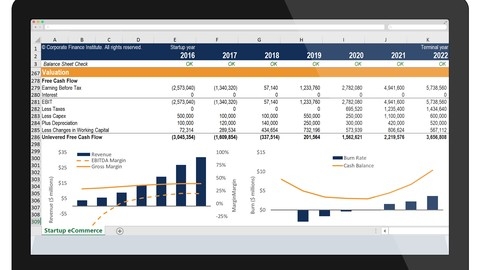

Financial Modeling: Build a Complete DCF Valuation Model

The course starts by explaining the theoretical framework behind company valuation and the importance of valuing firms from an investor’s perspective.

You’ll learn about the key drivers of a company’s value and the technical tools needed for valuation, such as calculating unlevered free cash flows, estimating the cost of debt and equity, forecasting future cash flows, and determining terminal value.

The real strength of this course lies in its hands-on approach.

Through a detailed case study, you’ll learn how to build a complete DCF model in Excel step-by-step.

The case study walks you through forecasting key profit and loss (P&L) and balance sheet items, creating clean output sheets, calculating unlevered free cash flows and net cash flows, and determining the present value of cash flows within the forecast period.

Moreover, you’ll learn how to calculate the continuing value, enterprise value, and equity value of the business being valued.

The course also covers additional analyses like sensitivity analysis, goal seek, and hypothesis testing, providing a well-rounded understanding of financial modeling.

Interestingly, the course extends beyond the core DCF valuation by covering the valuation of Tesla, a real-world example.

You’ll learn how to organize external inputs, forecast deliveries and revenue, estimate costs and expenses, and ultimately perform a DCF valuation for Tesla.

Additionally, the course introduces you to multiples valuation, a complementary approach to DCF.

You’ll explore different types of valuation multiples, their principles, and how to apply them in practice, using a hands-on exercise.

Acorns’ Guide to Personal Finance

The course starts by laying the foundation with an introduction to building wealth.

It then dives into the first step - budgeting better.

You’ll learn what net worth is and how to calculate yours.

The course will guide you in setting realistic financial goals and understanding the 50/20/30 budgeting rule.

This crucial first step gets you on track to manage your money effectively.

Next up is paying down debt faster.

The course compares the snowball and avalanche methods for debt repayment.

You’ll discover three ways to lower your interest rate and tips to quickly improve your credit score.

Mastering debt repayment is key to financial freedom.

Once you have a handle on budgeting and debt, the course moves on to saving more money.

It shares five simple spending hacks and shows you how to cut your biggest expense - housing costs.

You’ll also learn other easy ways to save more each month.

The fourth step focuses on earning more money.

The course reveals that you’re likely underpaid and teaches the right way to ask for a raise or negotiate a better job offer.

It also covers having a successful side hustle to boost your income.

With extra income coming in, you’ll be ready for the final step - investing successfully.

The course explains the power of compounding and covers different investment vehicles like savings accounts, stocks, bonds, and real estate.

You’ll gain a solid understanding of how to make your money work for you.

Throughout each step, there are end-of-section review lectures to reinforce key concepts.

The course wraps up with a conclusion encouraging you to keep growing your financial knowledge.

Learn and Master the Basics of Finance

The journey begins by dispelling any misconceptions you might have about finance.

You’ll then delve into the origins of finance, tracing its evolution from the primitive barter system to the introduction of money and the establishment of modern banking systems.

Along the way, you’ll grasp the core functions of banks, the different types of financial institutions, and the importance of banking regulations.

Moving on, you’ll explore the foundational principles of economics, both microeconomics and macroeconomics.

You’ll study the dynamics of supply and demand, price elasticity, inflation, monetary and fiscal policies implemented by governments, and the cyclical nature of business cycles.

Real-world case studies, such as the 2008 Financial Crisis and the demand-supply dynamics of crude oil, will reinforce these concepts.

A crucial aspect of finance is understanding the time value of money.

You’ll learn how to calculate simple and compound interest, determine the present and future values of cash flows, and make informed economic decisions based on these principles.

As you progress, you’ll transition from personal finance to corporate finance.

You’ll gain insights into financial accounting, analyzing financial statements, and conducting financial analysis to assess a company’s health and strategy.

Additionally, you’ll delve into the study of corporate finance, exploring sources of funds, cost of capital calculations, and the capital budgeting process used by companies to maximize shareholder wealth.

The course culminates with an in-depth exploration of various financial products, including fixed income securities (bonds), equities (stocks), mutual funds, derivatives, and alternative investments.

You’ll learn valuation techniques, risk management strategies, and the rationale behind investing in these instruments.

Throughout the course, quizzes and case studies will reinforce your understanding of the concepts covered, ensuring you master the basics of finance.

Investment Banking and Finance: Private Equity Finance

This comprehensive course provides an in-depth look into the world of private equity, covering everything from the fundamentals to advanced topics.

Right from the start, the course introduces you to the concept of private equity and how it differs from venture capital.

You’ll learn about the advantages and disadvantages of private equity funding, giving you a well-rounded understanding of this investment avenue.

As you progress, the course dives into the intricate details of how private equity funds operate.

You’ll gain insights into setting up a fund, its structure, the roles within a firm, and the key characteristics that distinguish different types of private equity firms.

This knowledge is invaluable for anyone looking to work in or with private equity firms.

One of the standout features of this course is its focus on the practical aspects of private equity deals.

You’ll learn how firms source deals, evaluate potential targets, and structure transactions.

The course provides a step-by-step breakdown of the entire deal process, from origination to closing, ensuring you have a comprehensive grasp of the journey.

Moreover, the course dedicates substantial time to due diligence, a critical aspect of any private equity transaction.

You’ll explore the various areas of due diligence, including commercial, financial, and legal, equipping you with the skills to thoroughly assess potential investments.

Valuation and pricing are also covered in-depth, with the course explaining how to value private companies and the significance of metrics like EBITDA multiples.

Additionally, you’ll delve into the intricacies of LBO (Leveraged Buyout) modeling, a crucial tool in the private equity world.

It also examines the risks and returns associated with private equity investments, management equity in LBOs, and the various exit options available, such as trade sales, mergers and acquisitions, and initial public offerings (IPOs).

Throughout the course, you’ll have access to downloadable resources, including slide decks and spreadsheets, which will aid your learning and provide practical examples.

Also check our posts on: