Learning about financial markets is crucial for anyone interested in investing, trading, or simply understanding how the global economy works.

However, finding a good financial markets course online can be a daunting task.

There are so many options available, and it’s hard to know which ones are worth your time and money.

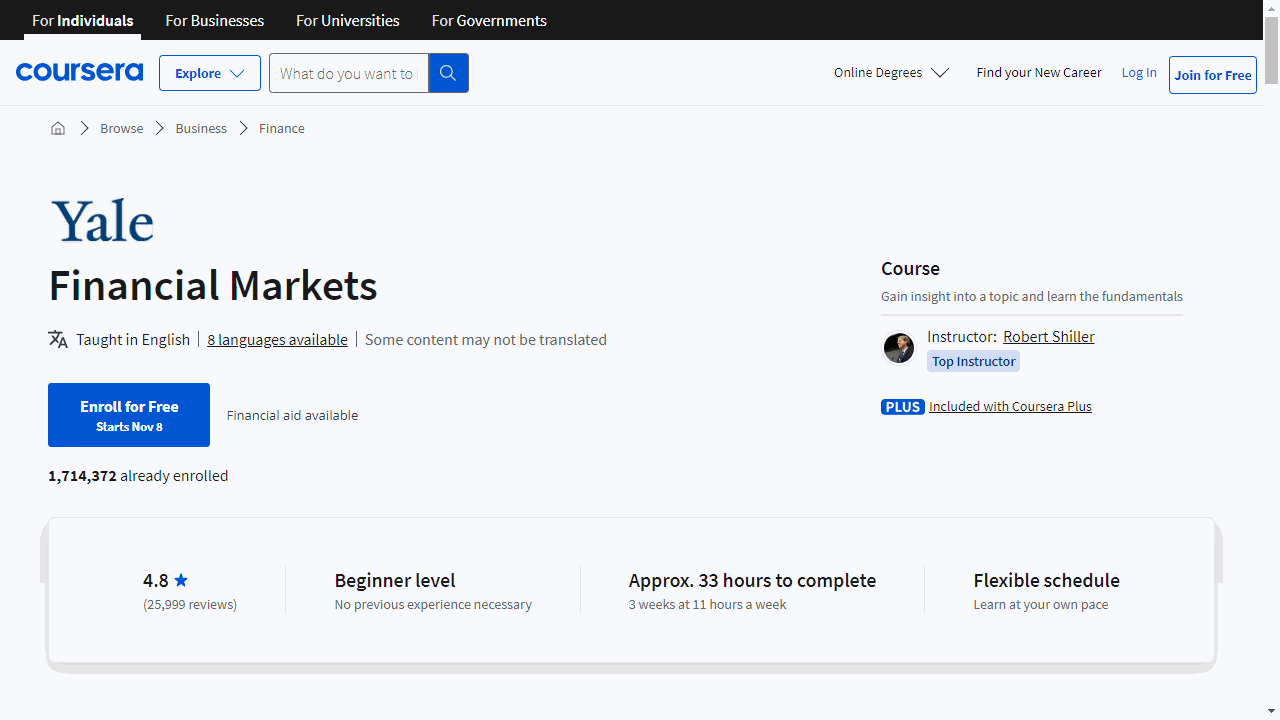

We’ve scoured Coursera to find the best financial markets courses, and our top pick is Financial Markets (Yale University).

This classic course, taught by Nobel Prize-winning economist Robert Shiller, provides a comprehensive overview of the financial world, covering everything from foundational concepts to advanced strategies.

Its engaging format, real-world examples, and expert insights make it a truly exceptional learning experience.

But if you’re looking for something more specific, we’ve got you covered.

We’ve also included courses focusing on fintech startups, trading strategies, corporate valuation, oil & gas markets, and more.

Keep reading to find the perfect financial markets course for your needs and goals.

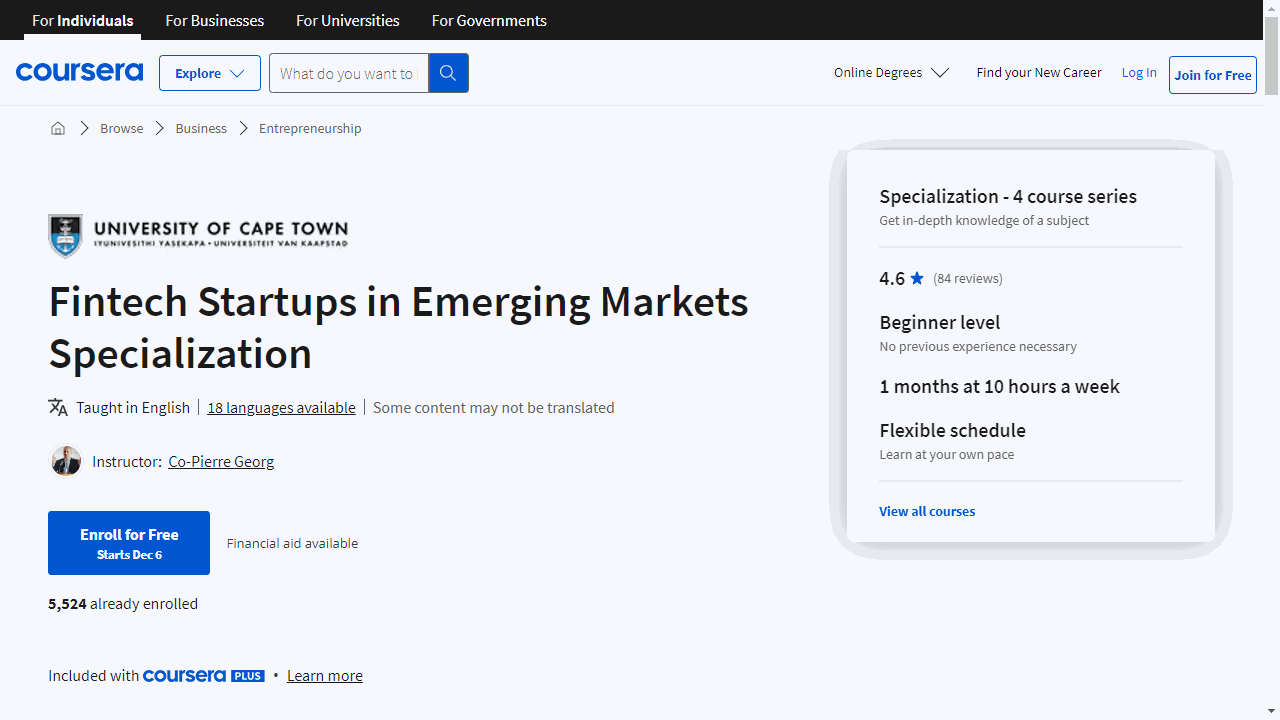

Fintech Startups in Emerging Markets Specialization

This specialization is offered by University of Cape Town.

Start by diving into “Financial Regulation in Emerging Markets and the Rise of Fintech Companies” to grasp how fintech is reshaping finance globally.

You’ll explore the impact of financial regulations post-crisis and how technologies like AI and blockchain are creating opportunities for innovation.

With case studies from China and South Africa, you’ll see firsthand how fintech is thriving in different regulatory and socio-economic landscapes, focusing on peer-to-peer lending and remittances.

In “How Entrepreneurs in Emerging Markets can master the Blockchain Technology,” you’ll unravel the complexities of blockchain and its applications beyond finance.

This course demystifies how blockchain secures data and empowers users to control their personal information, challenging the dominance of tech giants.

You’ll also delve into artificial intelligence, learning about various AI algorithms and assessing when blockchain is an appropriate solution for your business challenges.

“Building Fintech Startups in Emerging Markets” is tailored for aspiring entrepreneurs.

It introduces design thinking and the business model canvas, tools that prioritize user needs in product development.

You’ll gain insights from entrepreneurs who are actively navigating the fintech space, learning that the right time to start is now, with the right idea in hand.

The “Capstone Course: Start Up Your Fintech Future” is the culmination of the specialization, where you apply your learning to develop a business model canvas and pitch for your startup.

You’ll identify market needs, navigate regulatory frameworks, and select suitable technologies to propose a viable business solution.

Crafting a compelling pitch will be your final step in this hands-on project.

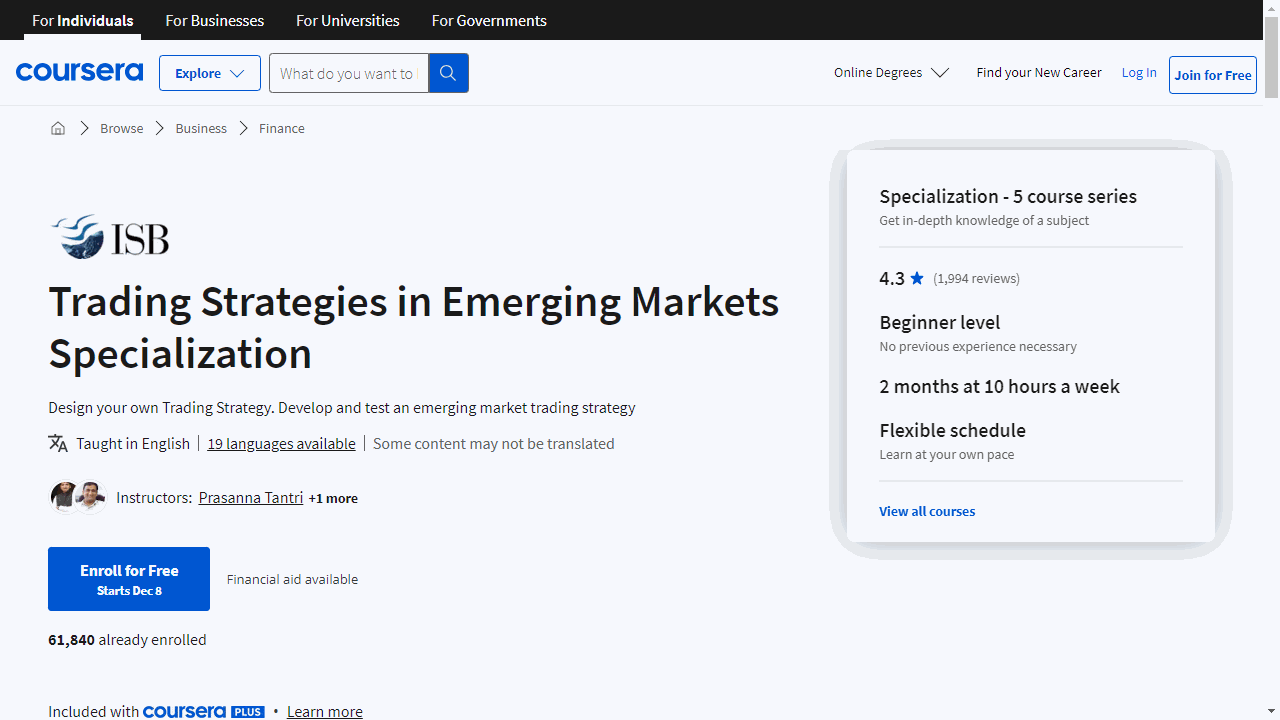

Trading Strategies in Emerging Markets Specialization

This specialization is offered by Indian School of Business.

It offers a deep dive into the mechanics of trading, specifically designed for the dynamic emerging markets.

Kick off with “Trading Basics,” where you’ll get to grips with financial statements and the inner workings of the stock market.

This course empowers you to analyze company performance and craft trading strategies informed by academic research.

You’ll also tackle asset pricing theories to predict stock returns and understand the intricacies of asset markets, including order types, trading costs, and liquidity management.

Move on to “Trading Algorithms,” where you’ll focus on two powerful strategies: the Piotroski F-score and Post-Earnings-Announcement Drift (PEAD).

You’ll learn to navigate academic research and apply these strategies effectively, enhancing your trading acumen.

With “Advanced Trading Algorithms,” you’ll refine your strategy development with robust backtesting, avoiding common pitfalls like look-ahead and survival bias.

This course teaches you to incorporate transaction costs into your algorithms and evaluate strategy performance using measures like the Sharpe ratio, Treynor’s Ratio, and Jensen’s Alpha.

“Creating a Portfolio” brings your learning full circle by showing you how to assemble a portfolio of strategies fit for a hedge fund.

You’ll master risk and return assessment, optimal strategy weighting, and risk minimization techniques.

A bonus is the overview of hedge fund regulations and investor expectations.

The capstone, “Design your own trading strategy – Culminating Project,” is where you shine.

You’ll create and evaluate new trading strategies, integrate them into a portfolio, and draft a plan to start your hedge fund.

This specialization equips you with skills in financial analysis, algorithmic trading, and risk management.

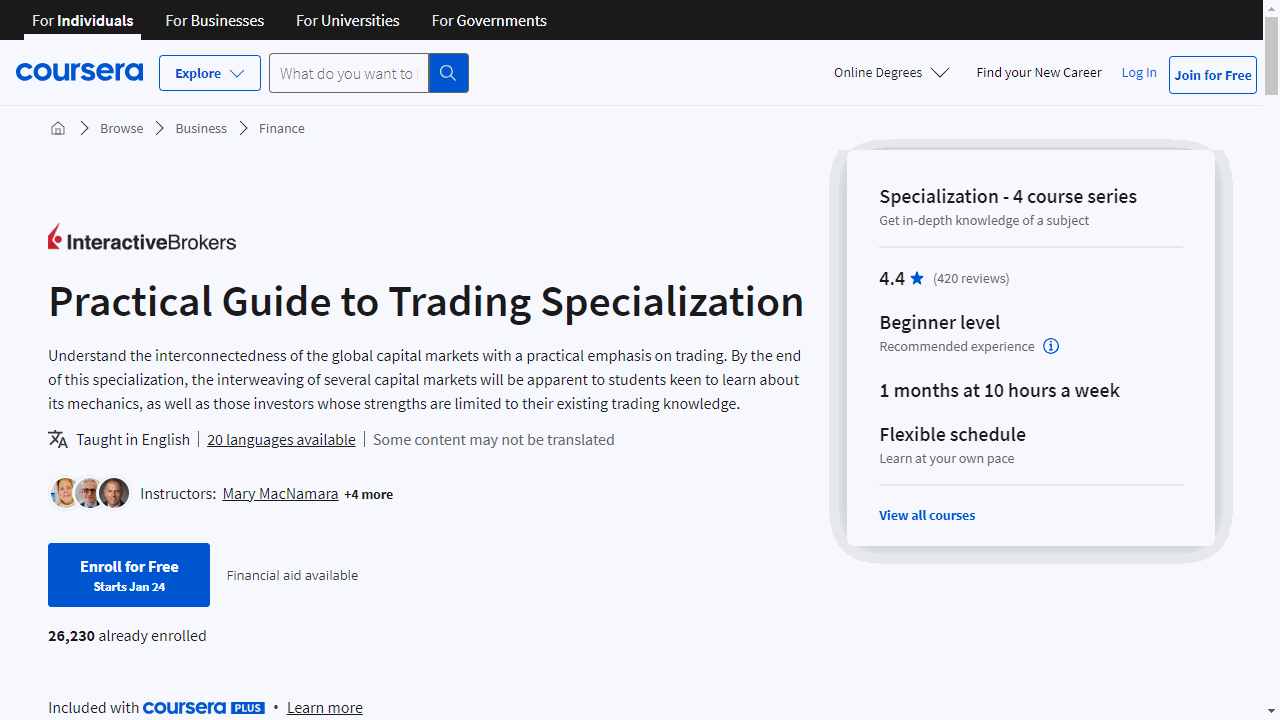

Practical Guide to Trading Specialization

Provider: Interactive Brokers

This is a comprehensive program that covers the essentials of trading across various asset classes.

In “Fundamentals of Equities,” you’ll dive into the stock market, learning to analyze industries, economic sectors, and fundamental values.

You’ll become adept at interpreting balance sheets, cash flows, and income statements.

This course also introduces you to mutual funds and ETFs, providing a broader investment perspective.

“Forex - Trading Around the World” offers a thorough understanding of the foreign exchange market (FOREX).

You’ll explore the roles of its participants, the intricacies of currency pairs, and the use of margin accounts.

Practical skills in executing trades on an online trading platform are a key takeaway, setting you up for real-world currency trading.

For a solid grasp of the fixed income space, “U.S. Bond Investing Basics” is your go-to.

You’ll differentiate between corporate and municipal bonds, understand the mechanics of the bond market, and identify investment risks.

The course equips you with the know-how to navigate an online trading platform for bond transactions.

Lastly, “Derivatives - Options & Futures” demystifies complex financial instruments.

You’ll learn the language of stock options, the mechanics of the futures market, and strategies for trading options.

The course emphasizes practical demonstrations, helping you to comprehend and apply options and futures concepts.

Each course is designed with practical examples, quizzes, and projects, ensuring you not only learn but also apply your knowledge.

For hands-on practice, you can use a demo trading account to simulate trading in a risk-free environment.

By completing this specialization, you’ll acquire the skills to analyze and trade in equities, FOREX, bonds, and derivatives with confidence.

Advanced Valuation and Strategy - M&A, Private Equity, and Venture Capital

This course offered by Erasmus University Rotterdam goes into the essentials of corporate valuation and strategic decision-making, tailored for the dynamic fields of mergers and acquisitions, private equity, and venture capital.

You’ll start by understanding the core of investment decision-making, learning about the origins of value and the importance of flexibility in business.

The course breaks down real options, showing you how these strategic choices are present in everyday business scenarios and can significantly impact your investment approach.

The curriculum guides you through the practicalities of corporate valuation, teaching you to apply the Discounted Cash Flow (DCF) method and calculate free cash flows and terminal value.

You’ll become proficient in using the Weighted Average Cost of Capital (WACC) and multiples for accurate company valuation.

But it’s not all about the numbers.

You’ll learn to link valuation with corporate strategy, exploring how to assess the value of growth options and their influence on acquisition strategies.

The course brings theory to life with a case study on the RJ Reynolds Tobacco Company and Nabisco merger, providing real-world context to the valuation strategies you learn.

Real option theory is another highlight, equipping you with the skills to value R&D projects and understand options related to project timing, expansion, contraction, and abandonment.

These insights are crucial for navigating investment decisions in uncertain markets.

Game theory is also a key component of the course.

You’ll learn to solve various strategic games, including simultaneous and sequential games, and those with asymmetric information.

This knowledge is invaluable for understanding competitive dynamics and making informed strategic investments.

Throughout the course, checklists and practice quizzes reinforce your learning, ensuring you grasp key concepts like Internal Rate of Return (IRR) and Economic Value Added (EVA).

By the end, you’ll have a comprehensive toolkit for making strategic investment decisions, whether you’re aiming for a career in M&A, private equity, or venture capital, or simply looking to manage your investments more effectively.

Financial Markets (Yale University)

This course is a classic, taught by Nobel Prize-winning economist Robert Shiller. It will give you a thorough understanding of the financial world, from foundational concepts to advanced strategies.

You’ll start with the basics, learning about the dual nature of financial markets—the potential for both good and evil—and why understanding risk through tools like Value at Risk (VaR) is crucial.

The course then takes you through real-world examples, such as the S&P 500, to illustrate how these concepts play out in actual market scenarios.

Insurance is a key topic, and you’ll explore its fundamentals, its role in the financial system, and the nuances of health insurance and disaster management. The course emphasizes the importance of diversification, teaching you why concentrating all your resources in one place can be a risky move.

Risk management continues with sessions on the Capital Asset Pricing Model (CAPM), beta, and diversification. You’ll also tackle practical skills like short selling and portfolio optimization, which are essential for anyone looking to invest wisely.

The course also covers valuation models like the Gordon Growth Model, helping you understand how to assess a company’s future earnings potential. It doesn’t stop at theory; you’ll see how innovation and invention are integral to financial growth.

You’ll delve into the mechanics of inflation, real estate, and market forecasting, gaining insights into market efficiency and the psychological factors that can influence financial decisions. The course provides a comprehensive look at behavioral finance, shedding light on why people sometimes make irrational financial choices.

On the technical side, you’ll learn about compound interest, bonds, and the structure of corporate finance, including the dynamics of shares, dividends, and capital raising.

The course also covers the complexities of mortgages and the regulatory landscape post-financial crisis, helping you understand the safeguards in place to prevent future economic downturns.

Futures and options are demystified, and you’ll learn about the role of investment banks and the IPO process. The course also touches on the infrastructure of financial markets, including mutual funds, ETFs, and the technology-driven world of high-frequency trading.

Beyond the mechanics of finance, the course examines the broader impact of financial systems on society, discussing government debt, social insurance, and the intersection of finance with social issues like war and population growth.

Finally, the course connects theory to practice, offering interviews with finance professionals to provide real-world context and career insights.

Oil & Gas Industry Operations and Markets

Provider: Duke University

This course offers a comprehensive look into the oil and gas industry, starting with the basics of hydrocarbons and reservoir rocks.

This foundational knowledge is crucial for grasping the industry’s core.

The course then guides you through exploration techniques, including securing mineral rights and the intricacies of the drilling process.

You’ll learn how to identify potential oil and gas sites and what it takes to transform a prospect into a productive play.

Production isn’t the end of the story.

You’ll delve into the methods of enhancing oil and gas output and the steps involved in processing these raw materials.

The course covers the entire value chain, including midstream operations like transportation and the specifics of liquified natural gas.

On the financial side, you’ll break down the costs associated with well drilling and production, and understand the complexities of cash flow in this sector.

You’ll also learn how to calculate transport, processing, and sales costs, and get familiar with benchmark costs that impact the industry.

The course doesn’t shy away from the economics of oil and gas.

You’ll explore the factors influencing supply and demand, price elasticity, and the impact of seasonal and short-term constraints on prices.

This knowledge is vital for anyone interested in the financial markets of oil and gas.

You’ll also differentiate between resources and reserves, a distinction that’s key to evaluating company profiles and the industry’s potential.

The course even touches on unconventional resources, preparing you for the evolving landscape of the energy sector.

By the end of this course, you’ll have a robust understanding of the operations and markets within the oil and gas industry.

You’ll be equipped with the insights to navigate and succeed in the financial side of this dynamic field.

Understanding Financial Markets

Provider: University of Geneva

You’ll start with the essentials, breaking down finance into six approachable parts.

This foundation is crucial for understanding company valuations on the stock market, and you’ll get the chance to learn from UBS experts who bring the realities of the market to your screen.

The course then guides you through the intricacies of various investment types.

You’ll examine the merits and risks of government and corporate bonds, delve into the dynamics of money markets, and decode the complexities of currencies.

Plus, you’ll tackle the concept of risk-adjusted returns and learn why some valuation methods outshine others.

Diversity in assets is key, and this course doesn’t disappoint.

It covers the spectrum from emerging market stocks and bonds to the significance of gold, and the practicalities of real estate investing.

Hedge funds are demystified, revealing their strategies and origins, and you’ll weigh the pros and cons of alternative versus traditional investments.

Central banks play a huge role in financial markets, and you’ll gain insight into their policies, both conventional and unconventional, with a UBS guest lecturer shedding light on these topics.

Discover how these policies influence equity and bond markets and learn to interpret the interplay between market performance and economic indicators like inflation and growth.

Interest rates’ impact on investment portfolios is another critical area you’ll explore, along with the incentives governments may offer banks.

The course concludes by assessing the real value of central banks’ unconventional policies.

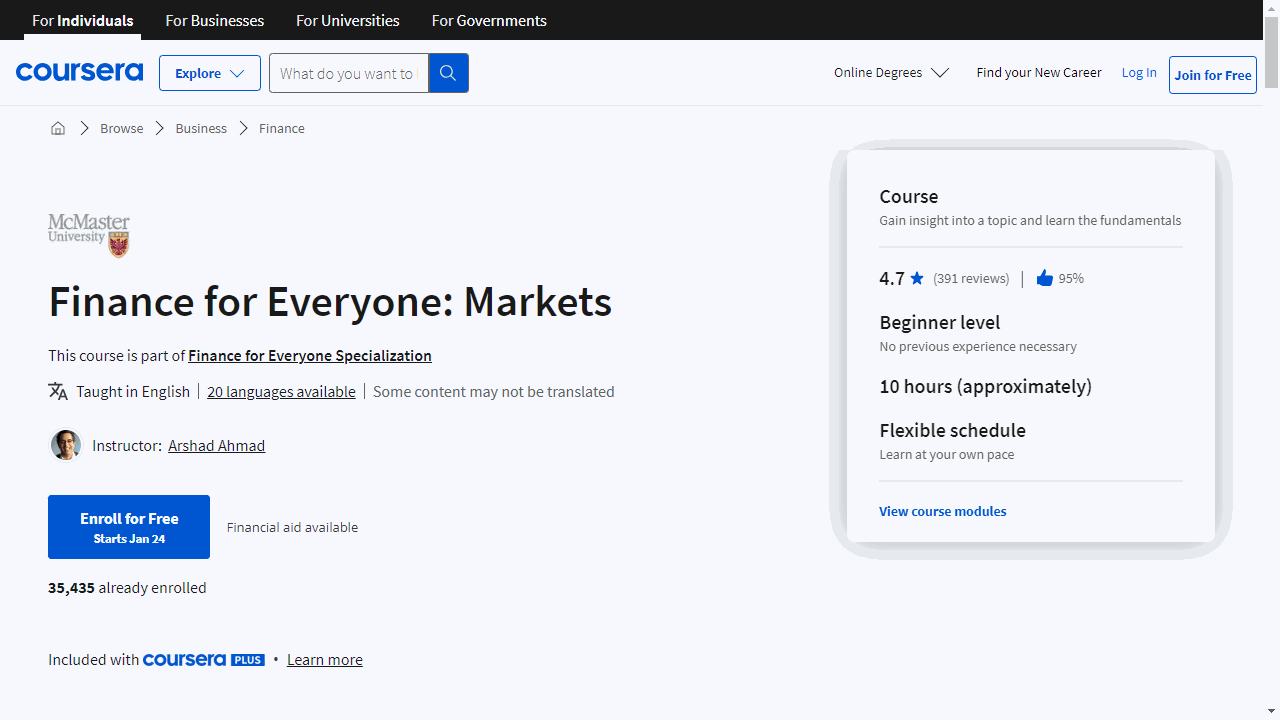

Finance for Everyone: Markets

Provider: McMaster University

The course begins with a deep dive into interest rates, covering the essentials and then moving into more complex territory.

This foundational knowledge is crucial, as interest rates affect everything from personal savings to global loans.

You’ll also join a community of learners, sharing your interests and gaining diverse perspectives.

The course encourages you to keep a learning portfolio, a practical way to track your progress and reflect on your insights.

LearnSmart, an optional study tool, can help you master the material, starting with Chapter 7 on interest rates and extending to bonds and stocks.

It’s designed to make your study time more efficient and effective.

Bonds are a major focus, with lessons on the basics, pricing strategies, and the impact of negative interest rates.

You’ll engage with real-world scenarios through MarketEx exercises, applying what you’ve learned to follow bond markets actively.

For those who want to delve deeper, additional content on bond valuation is available.

Stocks come next, with sessions on how they’re priced and what causes market turbulence.

After testing your knowledge with quizzes, you’ll participate in discussions that challenge you to ask insightful questions about the stock market.

The course also demystifies derivative securities through a three-part series, giving you a clear understanding of these advanced financial instruments.

A final presentation assignment allows you to apply your newfound knowledge, culminating in a tangible demonstration of your skills.

By the end of this course, you’ll have a comprehensive grasp of interest rates, bonds, stocks, and derivatives.

You’ll leave with a learning portfolio that showcases your journey through the complexities of financial markets.

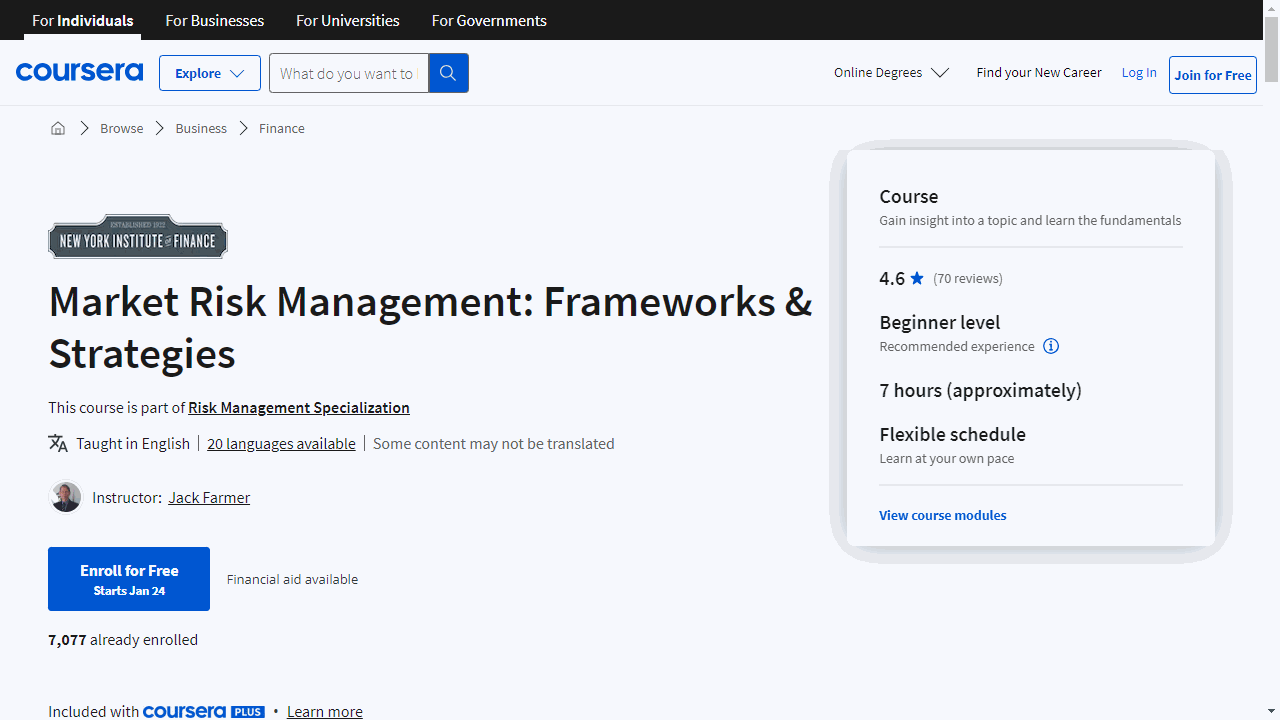

Market Risk Management: Frameworks & Strategies

Provider: New York Institute of Finance

Right from the start, you’ll be engaged with an introduction that helps you connect with peers and aligns the course with your specific interests.

The New York Institute of Finance sets the stage for a structured learning journey in risk management.

In the first module, you’ll tackle key financial instruments—bonds, equities, and derivatives.

These are the building blocks for understanding market risk, and you’ll test your grasp on these concepts with a quiz.

Moving on to the second module, you’ll delve into the nuts and bolts of market risk by measuring and analyzing the likelihood of losses and mastering statistical measures.

A quiz at the end ensures you’re on track.

The third module is where things get even more practical.

You’ll learn about market risk measurement systems, explore downside risk measures, and practice stress testing and scenario analysis.

This module’s quiz will challenge your new skills.

The course culminates with a three-part Market Risk Management Project, where you’ll apply your knowledge hands-on.

This isn’t just theory; you’ll be working with real spreadsheets, simulating the experience of managing risk in a professional setting.

By the time you reach the congratulatory note at the end, you’ll have a deep understanding of market risk management, endorsed by the prestigious New York Institute of Finance.

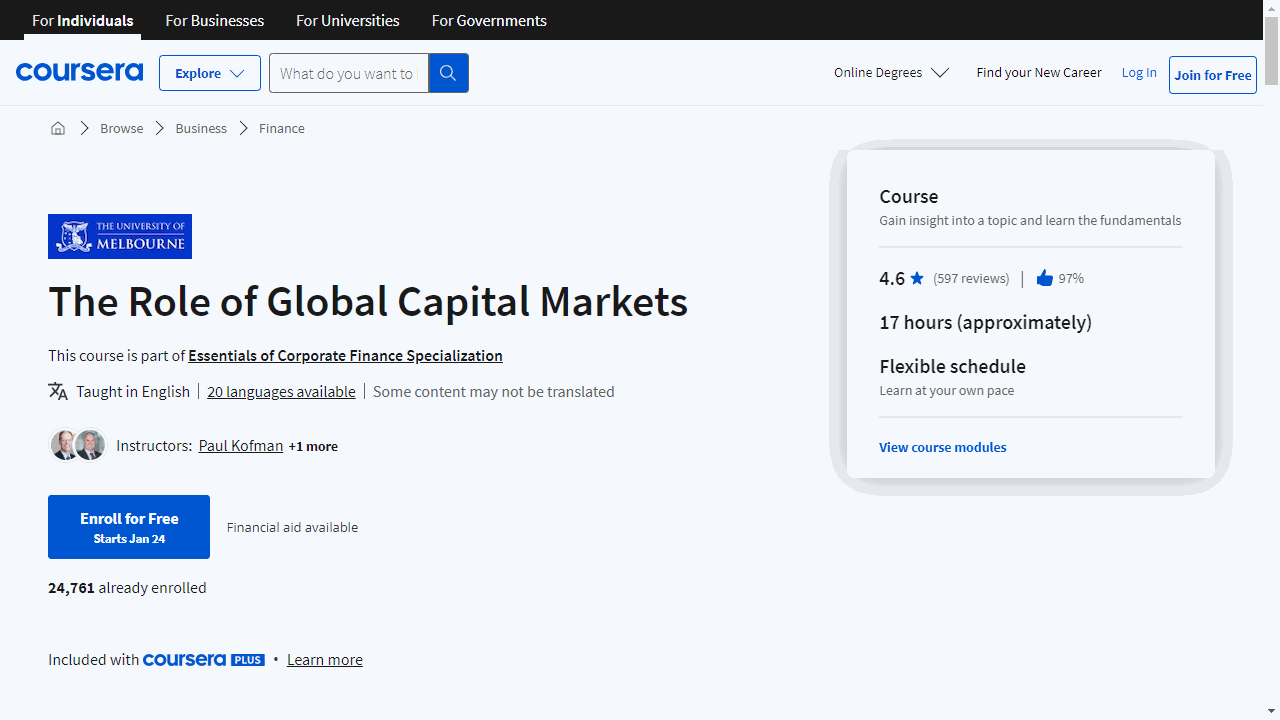

The Role of Global Capital Markets

Provider: The University of Melbourne

This course is packed with insights into the financial world, designed to equip you with a thorough grasp of how global markets function and their significance.

You’ll kick off with a clear introduction, diving into the equity market where shares are actively traded, and the debt market, the go-to place for company borrowing.

The foreign exchange market is next, revealing its importance for international business, followed by the commodity market, where tangible goods like metals and oil are exchanged.

The derivatives market rounds out your first week, showing you how companies manage risks.

In the second week, the course shifts focus to the value markets bring.

You’ll learn about the flow of funds, essential for company survival, and the process of price discovery, which ensures assets are fairly valued.

The competition for funds and the concept of portfolio diversification are also covered, teaching you risk management strategies.

Key market players are introduced, highlighting their roles in a successful market ecosystem.

Week three delves into the challenges of finance, such as liquidity crises and the critical need for integrity and transparency to maintain trust.

You’ll explore market discipline and the function of rating agencies in evaluating corporate health.

The course concludes by connecting global market dots.

You’ll understand market linkages, the impact of globalization on finance, and dissect the global financial crisis to determine the markets’ role.

Looking ahead, you’ll contemplate the future of financial markets.

With a blend of resources, expert insights from BNY Mellon, and practical study tools, this course doesn’t just teach—it’s an integral part of your academic progress, contributing 20% to your final grade.

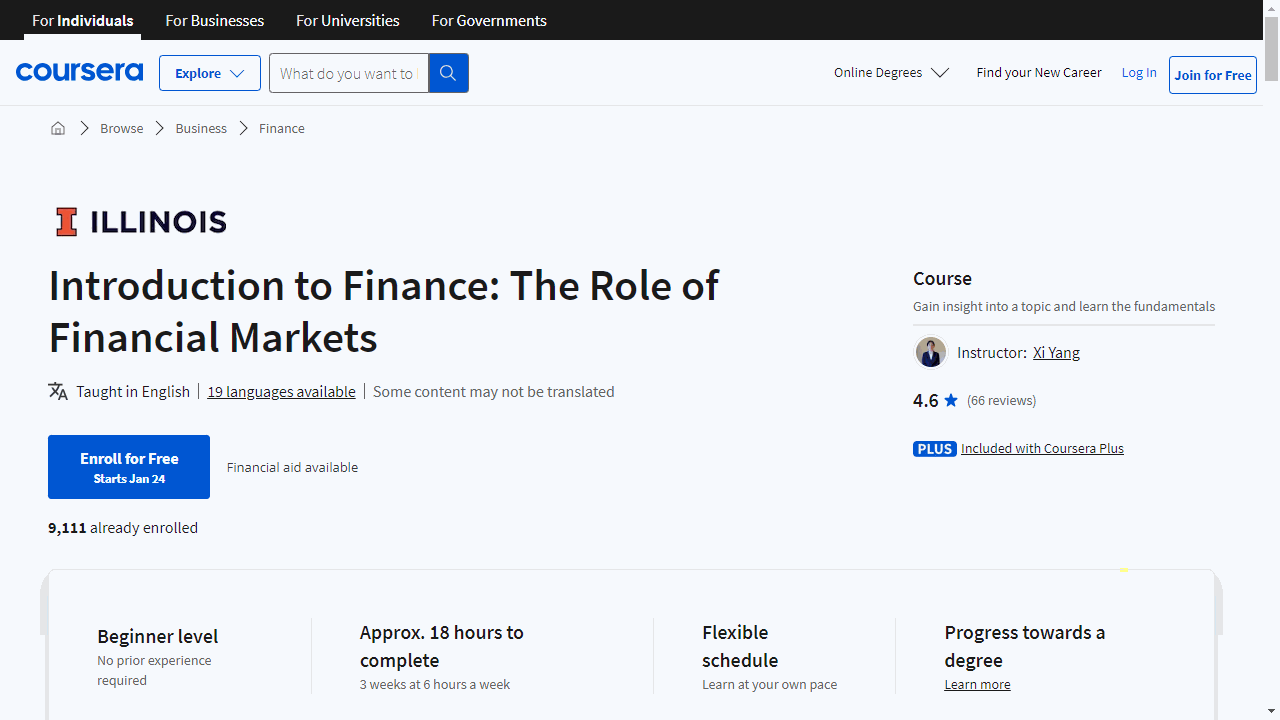

Introduction to Finance: The Role of Financial Markets

Provider: University of Illinois at Urbana-Champaign

This course, offered through the renowned Gies College of Business, is designed to give you a comprehensive understanding of finance in a way that’s both engaging and manageable.

You’ll start with the essentials, getting comfortable with the online learning environment and connecting with classmates.

The course provides resources like a glossary and formula sheet to support your learning journey right from the get-go.

Diving into Module 1, you’ll tackle bond fundamentals, learning how to evaluate bonds and the effects of interest rates.

You’ll also explore the variety of bonds available and the significance of bond ratings, equipping you with the knowledge to navigate this crucial segment of the financial markets.

Module 2 shifts the focus to stocks, starting with core concepts before advancing to valuation techniques.

You’ll discover how to estimate parameters, assess growth opportunities, and interpret the P/E ratio—all vital tools for savvy stock market participation.

In Module 3, the course zeroes in on the intricacies of finance, such as incremental cash flows, opportunity costs, sunk costs, and side effects.

These concepts are pivotal for making informed financial decisions.

A practical capital budgeting example will show you these principles in action, bridging theory and real-world application.

Module 4 rounds out your learning experience with an in-depth look at returns and risks.

You’ll differentiate between systematic and unsystematic risk and delve into the beta coefficient, understanding the risk-return tradeoff.

The module culminates with the Capital Asset Pricing Model, a cornerstone concept in finance.

Peer review assignments throughout the course provide opportunities to apply what you’ve learned, reinforcing your understanding and preparing you for real financial challenges.

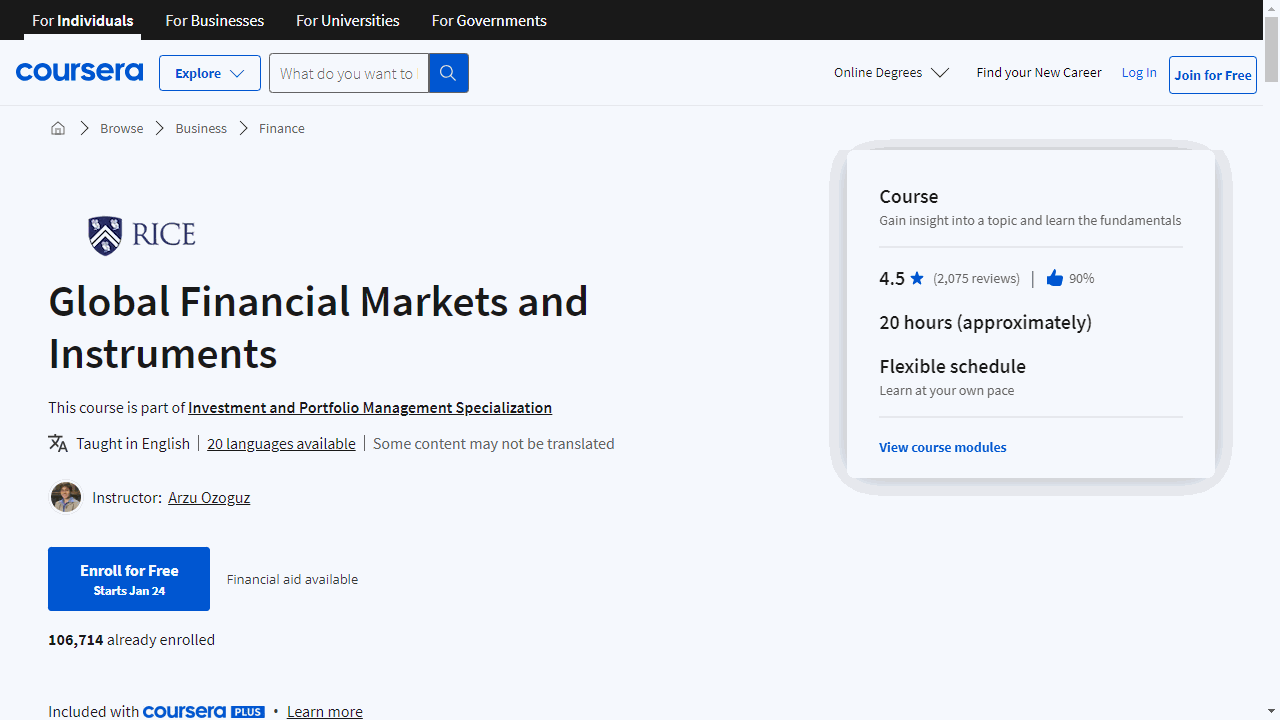

Global Financial Markets and Instruments

Provider: Rice University

Right from the start, you’ll get to know your professor, who will guide you through the essentials of the investment management process.

You’ll tackle the concept of the time value of money, a fundamental principle that helps you evaluate the worth of money over time.

The course breaks down complex topics like annuities, teaching you how they work in scenarios like retirement planning and loan payments.

You’ll also master the art of calculating various interest rates, including those that compound continuously, which is crucial for making informed investment decisions.

Quizzes and lecture handouts are part of the package, ensuring you grasp the material thoroughly.

Plus, you’ll gain insights from industry leaders like Vanguard CEO Bill McNabb through a special Bloomberg interview.

When it comes to investments, the course covers it all.

You’ll learn how to value bonds and delve into money market instruments and U.S. Treasury securities.

The world of equities and derivatives won’t be a mystery anymore, as you’ll explore equity valuation and the mechanics of options, futures, and forward contracts.

But it’s not just about individual investments.

You’ll also get a clear view of the market structure, understanding the roles of key players, the dynamics of primary and secondary markets, and the specifics of trading, including margin transactions and short sales.

Throughout the course, you’ll have access to resources and optional readings to deepen your knowledge.

Regular quizzes with solutions will keep you on track and reinforce your learning.

By the end of this course, you’ll have a comprehensive understanding of how global financial markets operate and the instruments used within them.

You’ll be equipped to make smarter investment choices, whether you’re planning for the long term or engaging in active trading.