Financial modeling is a critical skill in the world of finance, allowing you to analyze and predict a company’s financial performance.

By understanding financial modeling, you can assess investment opportunities, make informed business decisions, and even create your own forecasts for potential scenarios.

This knowledge is highly sought after by various financial institutions and organizations, making it an excellent asset in your career journey.

Finding the right financial modeling course on Coursera can be a challenging task, with numerous options vying for your attention.

You’re seeking a course that goes beyond theoretical concepts and provides practical applications and hands-on experience, ideally taught by industry experts.

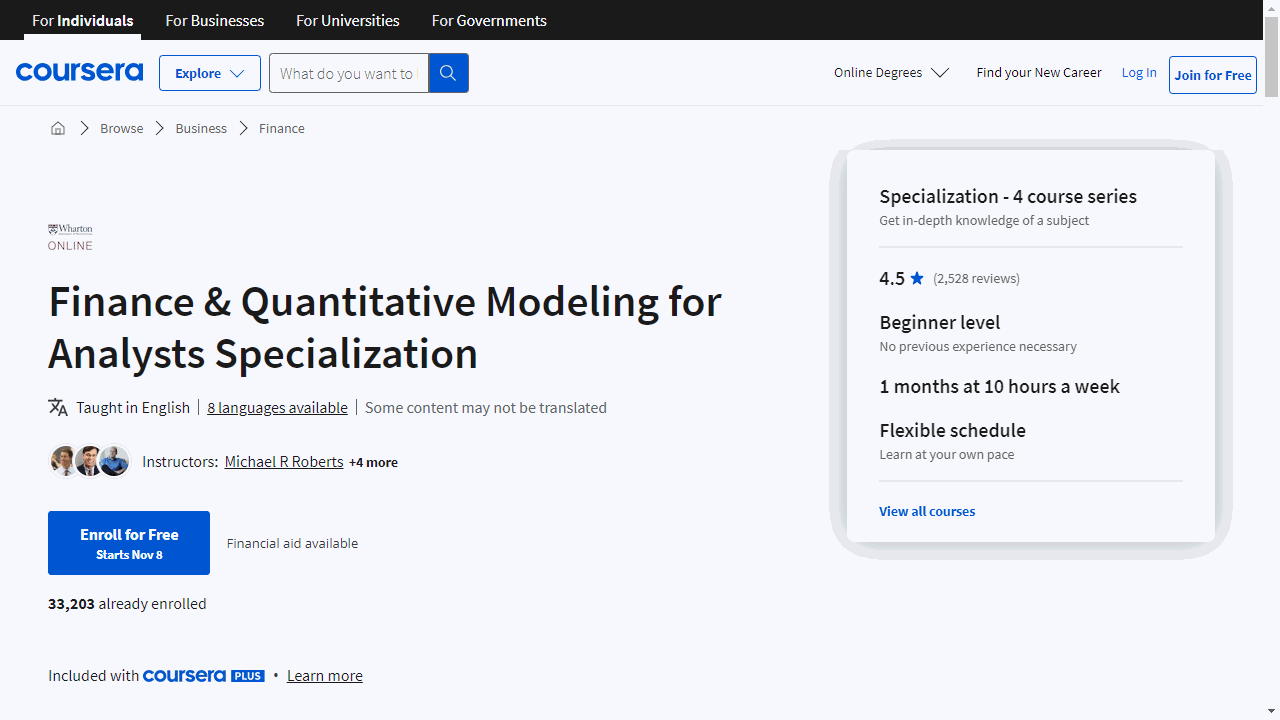

For the best financial modeling course overall on Coursera, we recommend "Finance & Quantitative Modeling for Analysts Specialization" offered by the Wharton School of the University of Pennsylvania.

This program provides a comprehensive, practical approach to financial modeling, starting with the fundamentals and culminating in hands-on application exercises.

The instructors are seasoned professionals with extensive knowledge and experience in the field, ensuring you gain valuable insights and practical skills.

While this is our top recommendation, there are other excellent courses available on Coursera that cater to specific areas of financial modeling.

Keep reading to discover more options, explore different learning styles, and find the perfect course to help you master this critical skill.

Quick Picks

| Course | Skills |

|---|---|

| Finance & Quantitative Modeling for Analysts Specialization | • Build quantitative models • Analyze financial data • Apply financial concepts |

| Business and Financial Modeling Specialization | • Build financial models • Analyze business data • Make informed decisions |

| Analysing: Numeric and digital literacies Specialization | • Analyze financial statements • Interpret financial ratios • Apply accounting techniques |

| Mergers and Acquisitions Specialization | • M&A valuation • Deal structuring • Financial analysis |

| Financial Engineering and Risk Management Specialization | • Price financial instruments • Model interest rates • Calibrate financial models |

| Private Equity and Venture Capital | • Analyze VC investments • Calculate investment returns • Master DCF valuation |

Finance & Quantitative Modeling for Analysts Specialization

This specialization offered by the Wharton School of the University of Pennsylvania.

The journey begins with “Fundamentals of Quantitative Modeling,” where you’ll learn to interpret and construct quantitative models.

This course isn’t just about crunching numbers; it’s about understanding the stories they tell about a business’s trajectory.

You’ll gain insight into the types of models used in the industry and acquire the foundational skills to build your own.

Moving on to “Introduction to Spreadsheets and Models,” you’ll discover the power of spreadsheets as a formidable tool for analysis.

This course equips you with the know-how to navigate Excel or Sheets, enabling you to transform raw data into actionable insights.

It’s a hands-on experience that prepares you to construct models that can inform your decision-making process.

For those less familiar with the financial world, “Financial Acumen for Non-Financial Managers” offers a clear view into how financial and non-financial data converge to influence a company’s performance.

You’ll delve into financial statements and learn to use data to predict and strategize for the future.

This course is designed to enhance your ability to make informed financial decisions without requiring a background in finance.

Lastly, “Introduction to Corporate Finance” provides a comprehensive overview of finance fundamentals.

You’ll explore concepts such as the time value of money and risk-return tradeoff, applying them to various scenarios from personal finance to corporate investments.

This course is about connecting theory with practice, ensuring you can apply concepts like discounted cash flow analysis to real-world situations.

Each course is infused with essential skills like regression analysis and cash flow analysis, ensuring that you’re not just learning theory but also acquiring practical expertise.

The specialization is designed to be accessible, avoiding jargon and focusing on clear, applicable knowledge.

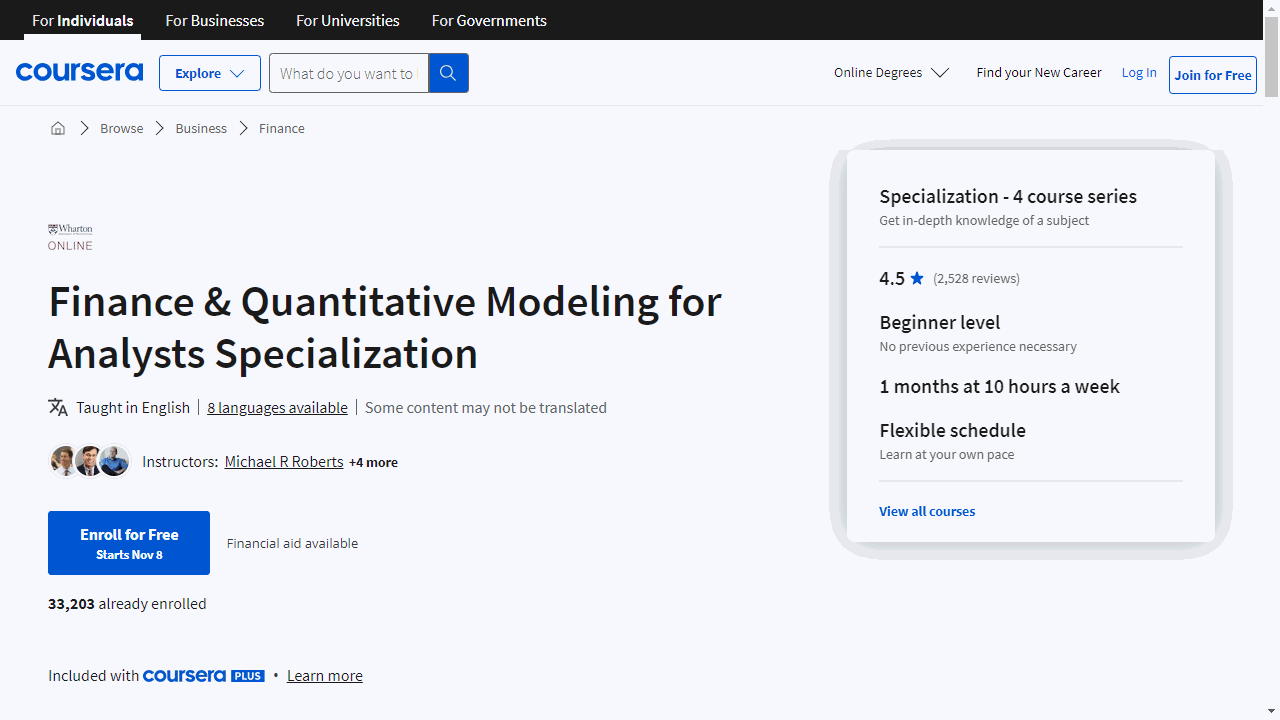

Business and Financial Modeling Specialization

This specialization begins with “Fundamentals of Quantitative Modeling,” where you’ll grasp the essentials of using data to analyze business activities and forecast future trends.

This course lays the groundwork for creating models that can be applied to your own business challenges.

Next, “Introduction to Spreadsheets and Models” demystifies the spreadsheet, a ubiquitous tool in financial analysis.

You’ll learn practical spreadsheet functions and formulas that are crucial for organizing and projecting your business’s financial data.

In “Modeling Risk and Realities,” the focus shifts to the unpredictable nature of business.

Here, you’ll learn to build models that incorporate elements of risk and uncertainty, equipping you with the foresight to navigate complex decision-making landscapes.

“Decision-Making and Scenarios” further refines your ability to use quantitative models for business decisions.

This course teaches you to structure decision-making processes effectively, enhancing your capability to weigh alternatives and outcomes.

In the “Wharton Business and Financial Modeling Capstone,” you’ll develop a business strategy based on a data model you’ve constructed, using real-world data from Wharton Research Data Services.

This hands-on experience culminates in a professional presentation, showcasing your ability to synthesize data and analysis into actionable business insights.

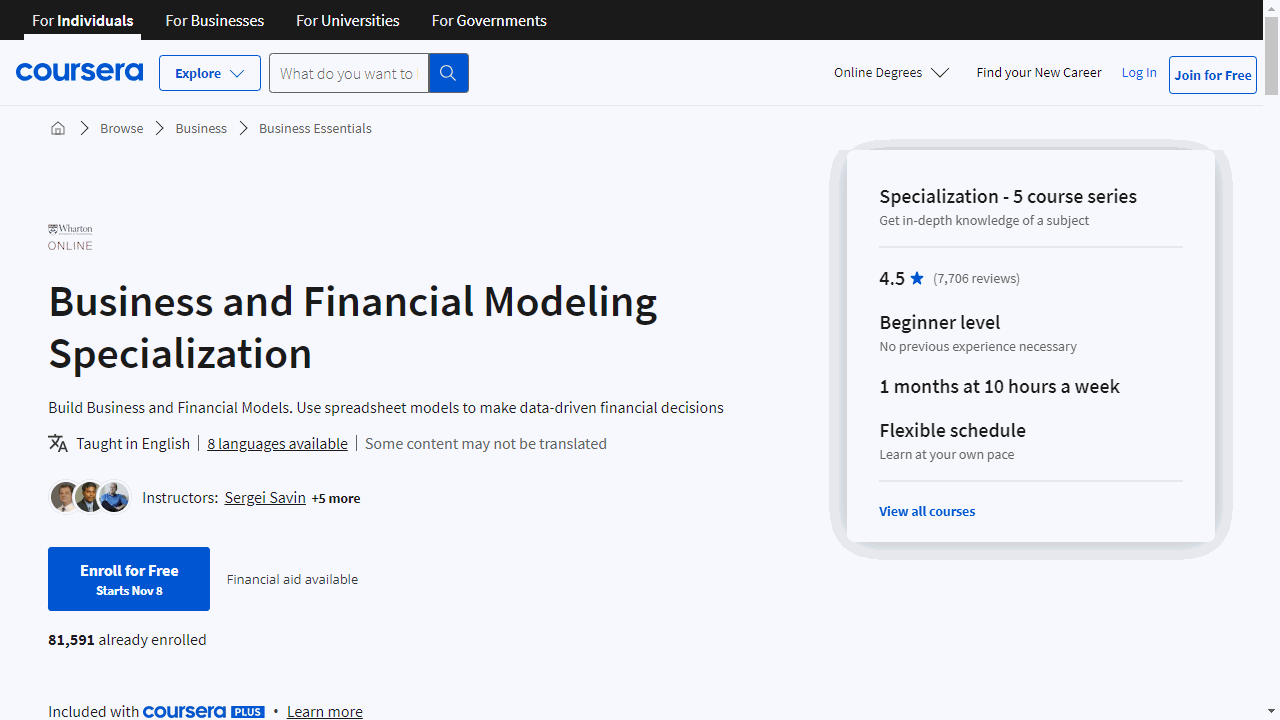

Analysing: Numeric and digital literacies Specialization

Provider: Macquarie University

This specialization enhances your financial and digital skills, crucial for success in any business environment.

Dive into “Management and financial accounting: Know your numbers 1” to build a solid foundation in financial and management accounting.

You’ll learn to create and interpret financial statements, use financial ratios to gauge business health, and apply accounting techniques for better decision-making.

This course empowers you to communicate financial information effectively and improve your organization’s processes.

Next, “Corporate finance: Know your numbers 2” deepens your financial management understanding.

It’s all about assessing your organization’s financial health, planning for the future, and making informed financing and investment decisions.

You’ll master financial analysis and modeling tools, essential for responsible leadership and sustainable business growth.

With “Business intelligence and data analytics: Generate insights,” you’ll tackle the ‘megatrends’ shaping our world.

This course equips you with analytical tools to understand and evaluate these trends, fostering sustainability-oriented innovation.

You’ll explore systems thinking and multidisciplinary methods to future-proof your skills, ensuring you’re prepared for the challenges ahead.

Finally, “Marketing analytics: Know your customers” centers on understanding customer value.

Learn to measure and analyze customer data, both traditional and digital, to deliver targeted marketing strategies.

This course teaches you to integrate customer insights, enhancing the effectiveness of your marketing efforts across various touchpoints.

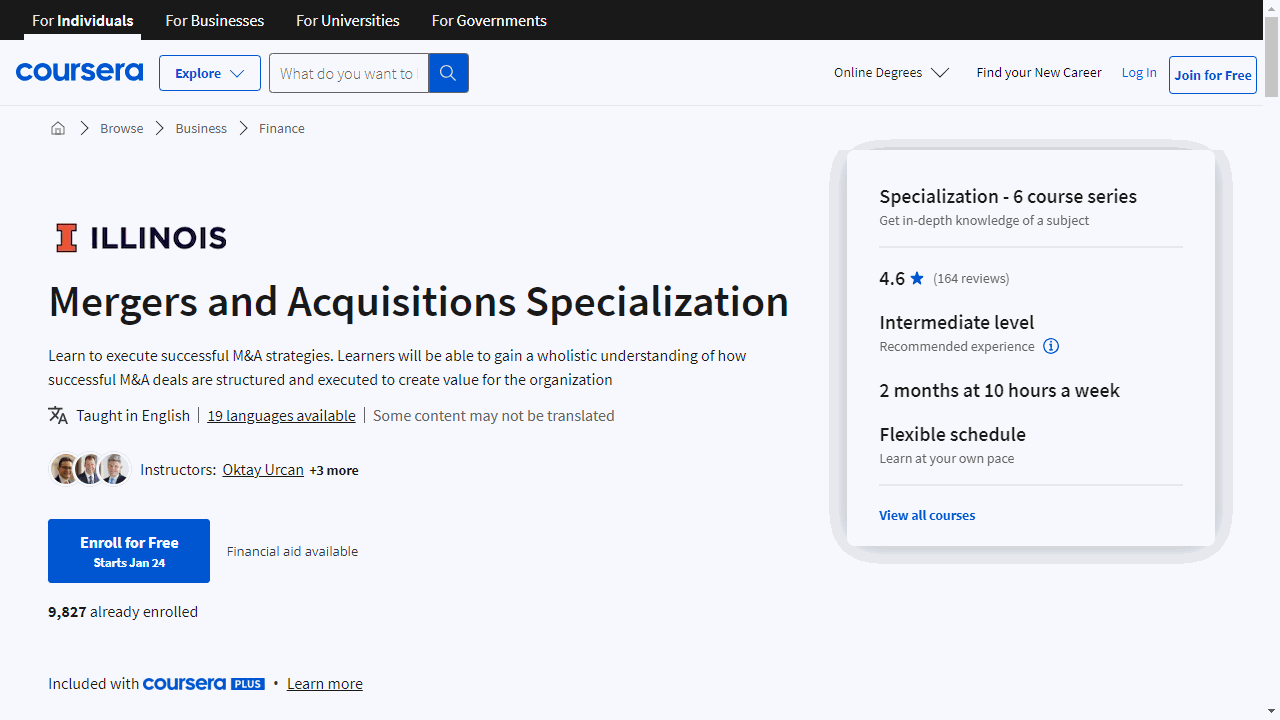

Mergers and Acquisitions Specialization

Provider: University of Illinois at Urbana-Champaign

This specialization equips you with the expertise to navigate the complex world of M&A, whether you’re eyeing a career in investment banking or aiming to master corporate finance.

Dive into “Finance of Mergers and Acquisitions: Valuation and Pricing” to master the art of determining the value and price of M&A deals.

You’ll explore various deal types, including strategic M&A and private equity LBOs, while gaining proficiency in accounting, financial statements, and tax implications.

Progress to “Finance of Mergers and Acquisitions: Designing an M&A Deal” to understand the strategic elements of deal-making.

This course sharpens your skills in financial modeling and capital structure, ensuring you can craft deals that make financial sense.

With “Accounting for Mergers and Acquisitions: Foundations,” you’ll learn to interpret financial accounting information for different types of corporate investments.

It’s essential for unraveling the complexities of organizational structures through financial data.

“Accounting for Mergers and Acquisitions: Advanced Topics” takes you further into the realm of spinoffs, buyouts, and tax considerations.

This course is crucial for analyzing financial statements when companies are interconnected through investments.

“Investment Banking: Financial Analysis and Valuation” is your gateway to the essentials of investment banking.

It focuses on financial statement analysis and valuation techniques, preparing you for real-world application in corporate finance roles.

Lastly, “Investment Banking: M&A and Initial Public Offerings” reveals the mechanics behind leveraged buyouts, acquisitions, and IPOs.

This course is a deep dive into the strategies used by private equity firms and public companies during these high-stakes transactions.

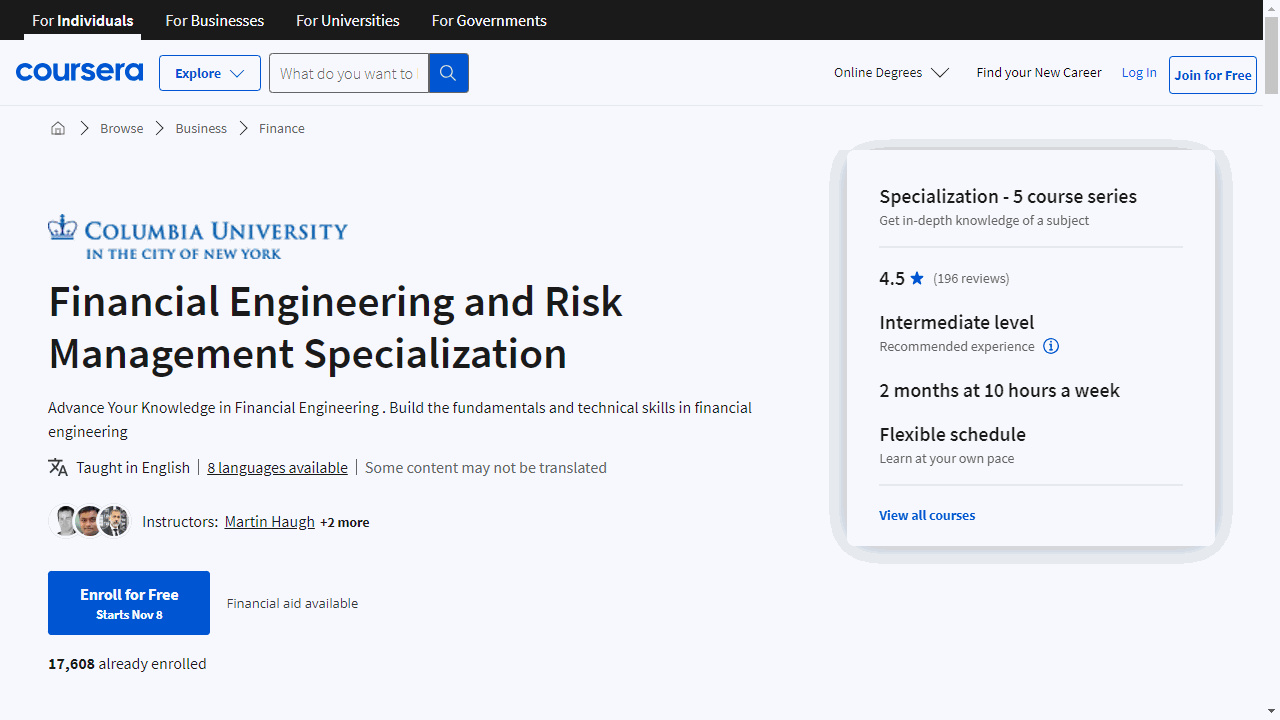

Financial Engineering and Risk Management Specialization

If you are interested in modeling financial derivatives, this specialization by Columbia University is a solid choice.

The specialization begins with the “Introduction to Financial Engineering and Risk Management” course.

This foundational course equips you with the mathematical tools necessary for financial analysis, covering probability, optimization, and the valuation of various financial instruments.

You’ll learn to calculate present value in an arbitrage-free environment and price options using models like Binomial and Black-Scholes.

It’s a solid starting point that prepares you for more advanced topics.

Moving on, “Term-Structure and Credit Derivatives” delves into the behavior of interest rates and the mechanics of credit markets.

You’ll explore how to model the evolution of interest rates and gain insights into instruments like credit default swaps and mortgage-backed securities.

The course also includes practical exercises, such as using Excel for model calibration, ensuring that you can apply your knowledge to real-world scenarios.

For those interested in asset management, “Optimization Methods in Asset Management” offers a deep dive into portfolio construction and risk assessment.

You’ll learn about the Capital Asset Pricing Model (CAPM) and other techniques to optimize investment portfolios, considering factors like transaction costs and market liquidity.

This course emphasizes the application of theory to practice, preparing you to handle the complexities of asset management.

“Advanced Topics in Derivative Pricing” is designed for those ready to tackle more sophisticated financial concepts.

You’ll get to grips with the Black-Scholes model, learn about the Greeks and their role in risk management, and explore the intricacies of volatility in the markets.

The course also examines the impact of credit derivatives on the financial system, providing a well-rounded understanding of derivative pricing.

Lastly, “Computational Methods in Pricing and Model Calibration” merges finance with computational techniques.

You’ll be introduced to various options and pricing methods, including the use of Fourier Transforms.

The course is hands-on, with Python coding exercises that allow you to practice pricing options and calibrating models, giving you a skill set that’s highly valued in the finance industry.

By the end of the specialization, you’ll have a diverse set of skills, from understanding derivatives and fixed income instruments to mastering computational methods in finance.

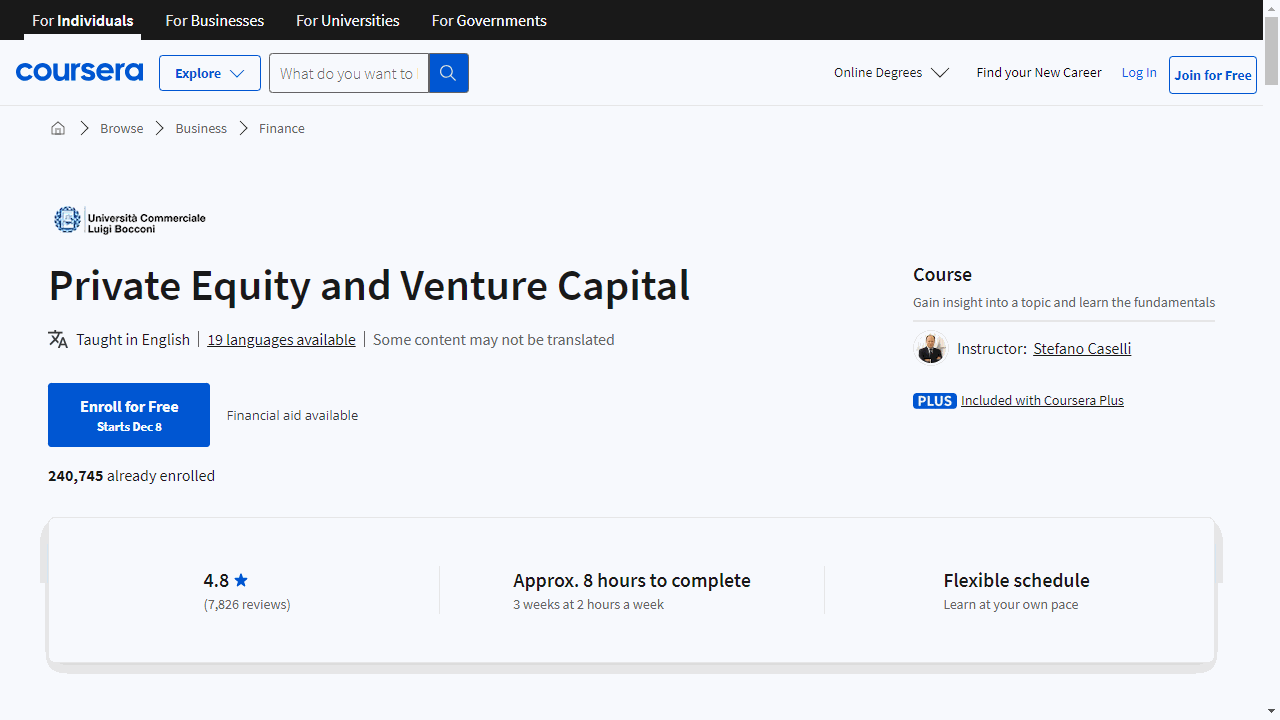

Private Equity and Venture Capital

This course is offered by Università Bocconi.

It starts with the basics, explaining what PE and VC are and their crucial role in business growth.

You’ll learn about various financing stages, from seed funding to more complex strategies like vulture financing.

The course offers a detailed look at the landscape of private equity investors, with a focus on the structure and operation of closed-end funds in Europe.

You’ll compare these with US limited partnerships and UK funds, gaining a global perspective on investment structures and tax implications.

Innovative investment forms such as SPACs, private debt funds, and crowdfunding are also covered, equipping you with knowledge of the latest trends.

Plus, you’ll get hands-on with calculating investment returns, a skill essential for any aspiring investor.

The practical side continues as you delve into the managerial processes of equity funds, including fundraising and deal-making.

You’ll receive an Excel file to support your learning, ensuring you can apply your knowledge effectively.

Valuation is key in investment, and this course doesn’t skimp on the details.

You’ll master company valuation using the DCF method and adapt it for PE and VC scenarios.

The course also provides actionable advice for launching a startup, alongside expert insights into the intersections of PE with M&A and IPOs through interviews with industry leaders like Eugenio Morpurgo and Luca Peyrano.

By the end of this course, you’ll not only understand the mechanics of private equity and venture capital but also how to apply this knowledge in real-world scenarios.

Frequently Asked Questions

What is Financial Modeling and why is it important?

Financial modeling is the process of creating a mathematical representation of a company’s financial performance.

It involves using historical data, assumptions, and projections to build a model that can be used to forecast future financial performance, assess the impact of different business decisions, and evaluate potential investments or acquisitions.

Financial modeling is essential for businesses to make informed decisions, attract investors, and manage their finances effectively.

What are the different types of Financial Modeling?

There are several types of financial models, each serving a specific purpose. Some common types include:

-

Three-statement models: These models integrate a company’s income statement, balance sheet, and cash flow statement to provide a comprehensive view of its financial performance.

-

Discounted cash flow (DCF) models: DCF models are used to estimate the intrinsic value of a company by projecting its future cash flows and discounting them back to the present value.

-

Merger and acquisition (M&A) models: These models are used to evaluate the potential benefits and costs of a merger or acquisition, including synergies, financing options, and post-deal performance.

-

Leveraged buyout (LBO) models: LBO models are used to assess the feasibility and potential returns of acquiring a company using a significant amount of debt financing.

What skills do you need to be good at Financial Modeling?

To excel in financial modeling, you should possess a combination of technical and analytical skills. These include:

- Strong understanding of accounting principles and financial statements

- Proficiency in Microsoft Excel, including advanced functions and formulas

- Knowledge of valuation techniques and financial theory

- Attention to detail and ability to spot errors or inconsistencies

- Analytical thinking and problem-solving skills

- Ability to communicate complex financial concepts effectively

What common tools should Financial Modeling beginners learn?

The most essential tool for financial modeling is Microsoft Excel.

Beginners should focus on mastering Excel functions, such as IF statements, VLOOKUP, INDEX/MATCH, and financial functions like NPV, IRR, and XIRR.

Additionally, learning data visualization tools like Excel charts and graphs can help present financial information more effectively.

Some professionals also use specialized visualization software, such as Tableau or Alteryx, but these are more advanced tools that beginners can explore later in their careers.

What jobs can you get with Financial Modeling skills?

Financial modeling skills are highly sought-after in various finance-related roles, including:

- Financial analyst

- Investment banker

- Equity research analyst

- Corporate development manager

- Private equity associate

- Financial consultant

- Business development manager

What should I look for in a Financial Modeling course for beginners?

When choosing a financial modeling course for beginners, consider the following factors:

- Comprehensive coverage of Excel functions and formulas relevant to financial modeling

- Practical, hands-on exercises and real-world case studies

- Instruction on various types of financial models, such as three-statement models and DCF models

- Guidance on best practices for model structure, formatting, and error-checking

- Taught by experienced professionals with industry expertise

- Offers a certificate of completion to showcase your skills to potential employers

What are the common uses of Financial Modeling across various industries?

Financial modeling is used across a wide range of industries for various purposes, such as:

- Corporate finance: Companies use financial models to create budgets, forecast financial performance, and make investment decisions.

- Investment banking: Bankers use financial models to value companies, assess M&A opportunities, and pitch deals to clients.

- Private equity and venture capital: Investors use models to evaluate potential investments, monitor portfolio companies, and plan exit strategies.

- Real estate: Real estate professionals use financial models to analyze property investments, calculate returns, and assess financing options.

- Consulting: Consultants use financial models to help clients solve complex business problems, such as optimizing capital structure or evaluating strategic initiatives.