Investment management is the art and science of making informed decisions about where to allocate money to achieve financial goals.

It involves understanding financial markets, assessing risk and return, and building and managing portfolios of assets.

Mastering investment management can empower you to make sound financial decisions, grow your wealth, and work in the finance industry.

Finding the right investment course on Coursera can feel overwhelming with so many options available.

You’re looking for a comprehensive program that’s taught by experts and provides practical skills, but also fits your learning style and goals.

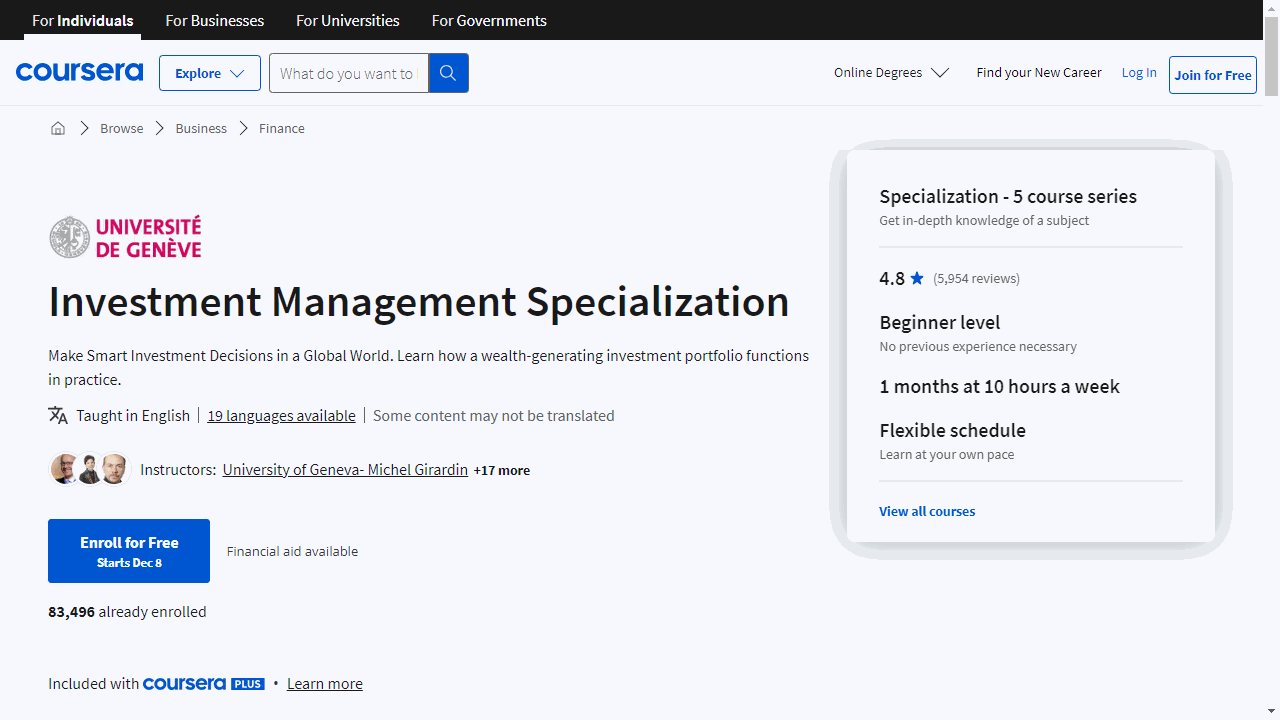

For the best investment course overall on Coursera, we recommend the Investment Management Specialization offered by the University of Geneva.

This specialization is a comprehensive five-course program that covers everything from the fundamentals of financial markets to advanced portfolio management techniques.

Taught by leading academics and professionals from UBS, the course provides real-world insights and practical applications, making it ideal for both aspiring investors and experienced professionals.

This is just one of many great investment courses available on Coursera.

Keep reading to explore our recommendations for different learning levels, areas of focus, and career goals.

Investment Management Specialization

This specialization offered by University of Geneva gives you a comprehensive understanding of the investment world.

Start with “Understanding Financial Markets” to grasp the essentials of financial markets and their connection to the economy.

You’ll learn how to calculate and interpret the movements of stock and bond prices, understand the concept of risk, and explore diverse markets like gold and real estate.

Real-world applications from UBS experts will show you how these concepts are used in a leading global bank, equipping you with practical skills in portfolio theories and risk management.

In “Meeting Investors’ Goals,” you’ll delve into the psychology behind investment decisions, uncovering how biases and emotions can influence market outcomes.

This course will also introduce you to various portfolio construction methods and investment styles, enhancing your knowledge in investment management and socially responsible investing.

“Portfolio and Risk Management” is where theory meets practice.

You’ll learn how to create optimal portfolios through strategic asset allocation and manage investment risks.

UBS professionals provide insights, ensuring you understand the practical aspects of bond markets and financial markets.

“Securing Investment Returns in the Long Run” demystifies the active versus passive investing debate and teaches you how to evaluate investment performance.

You’ll also discover the impact of sustainable finance, neurofinance, and fintech on the future of investment management.

The Capstone project, “Planning your Client’s Wealth over a 5-year Horizon,” is your chance to apply your learning.

You’ll design a wealth plan for a character, considering economic changes, emotional biases, portfolio optimization, and performance measurement.

By completing this specialization, you’ll gain valuable skills in portfolio construction, cognitive bias understanding, and investment style differentiation.

You’ll also become proficient in Microsoft Excel, a vital tool for financial analysis.

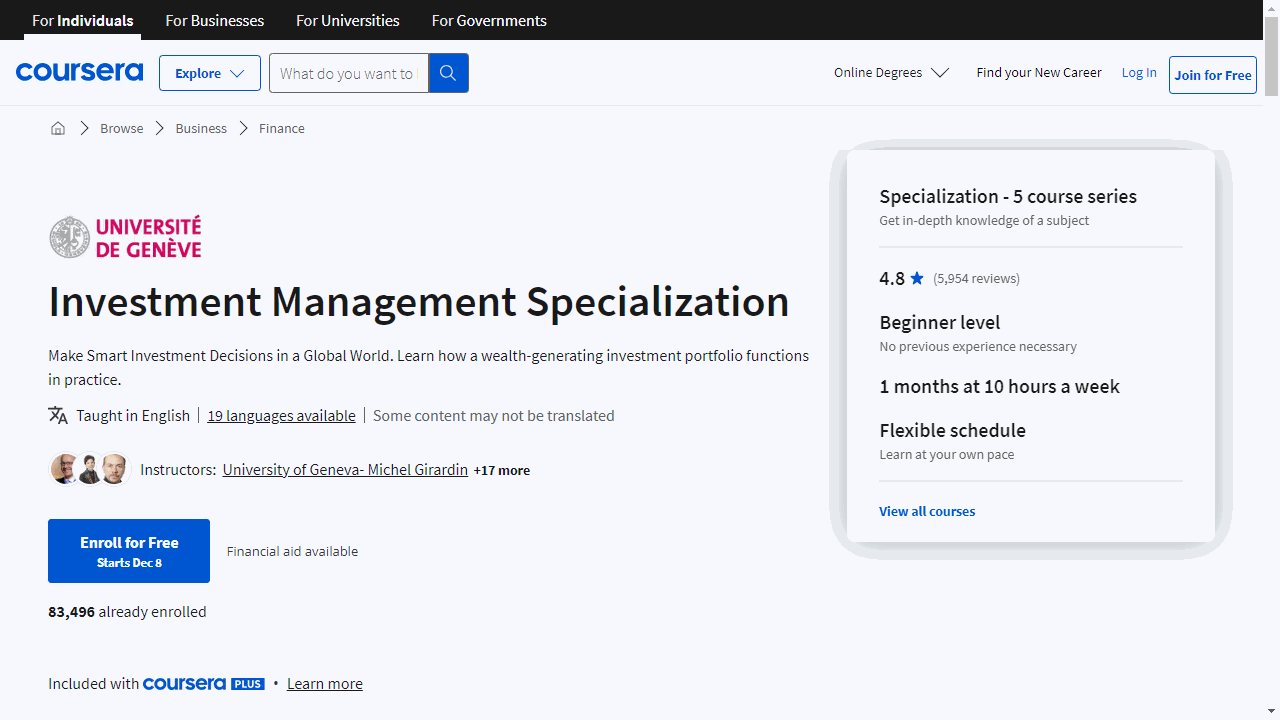

Investment and Portfolio Management Specialization

This comprehensive program offered by Rice University equips you with the tools to navigate financial markets with confidence.

Start with “Global Financial Markets and Instruments” to grasp the essentials of financial assets and markets.

You’ll learn about the roles of different financial instruments, delve into algorithmic trading, and understand market operations.

By the end, you’ll confidently list and compare various investment vehicles.

In “Portfolio Selection and Risk Management,” you’ll master the art of constructing an optimal portfolio and managing investment risks.

This course empowers you to analyze risk-return trade-offs and apply equilibrium asset pricing models, ensuring you make informed asset allocation decisions.

“Biases and Portfolio Selection” tackles the psychological side of investing.

You’ll uncover common behavioral biases and learn strategies to mitigate their impact on investment decisions.

This insight is crucial for maintaining a clear head in the often-irrational financial markets.

Move on to “Investment Strategies and Portfolio Analysis” to get up to speed with the latest investment strategies and performance evaluation techniques.

You’ll explore various approaches to investing and learn how to assess the effectiveness of different portfolio strategies.

The “Capstone: Build a Winning Investment Portfolio” is where theory meets practice.

You’ll manage a simulated investment portfolio and provide advice to virtual clients, using advanced analytical tools.

This real-world experience is a powerful way to demonstrate your investment acumen.

Throughout the specialization, you’ll engage with key concepts like bond valuation, modern portfolio theory, and risk management.

You’ll also become familiar with financial terms such as Treasury securities, derivative instruments, and mortgage-backed securities.

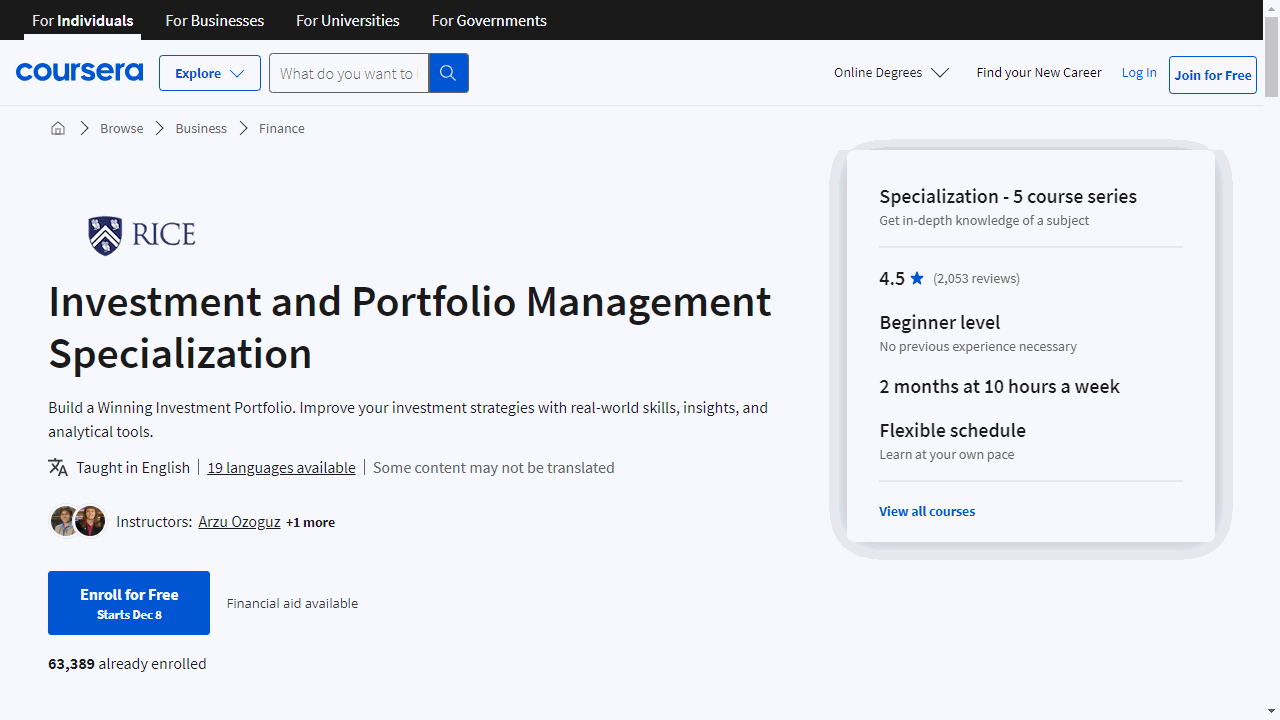

Investment Management with Python and Machine Learning Specialization

This specialization offered by EDHEC Business School equips you with the skills to apply Python and machine learning to investment management.

Start with “Introduction to Portfolio Construction and Analysis with Python,” where you’ll build a solid foundation in investment science.

You’ll learn to measure risk and return, and use Python to create diversified portfolios.

This course isn’t just about theory; it’s hands-on, ensuring you can apply what you learn to real-world scenarios.

Move on to “Advanced Portfolio Construction and Analysis with Python” to deepen your knowledge.

Here, you’ll tackle advanced topics like robust portfolio construction and the Black-Litterman approach.

You’ll come away with the ability to analyze and construct investment portfolios using sophisticated Python tools.

“Python and Machine Learning for Asset Management” bridges the gap between finance and technology.

You’ll start with machine learning fundamentals before applying them to asset management.

Expect to enhance factor models and risk management practices using the latest machine learning techniques.

Lastly, “Python and Machine-Learning for Asset Management with Alternative Data Sets” introduces you to the cutting-edge use of alternative data in finance.

You’ll analyze real-world data sets, explore current research, and develop skills in data analytics and visualization, all within the context of financial markets.

Each course combines lectures with practical coding exercises and quizzes to solidify your understanding.

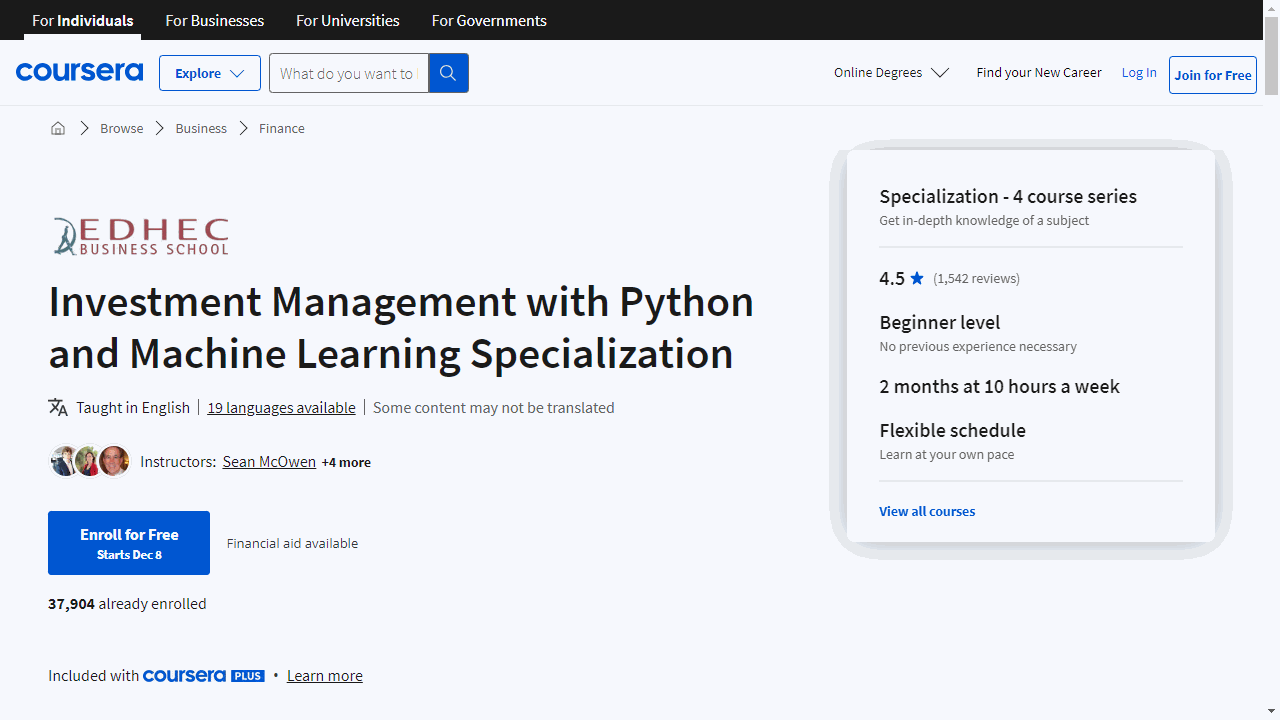

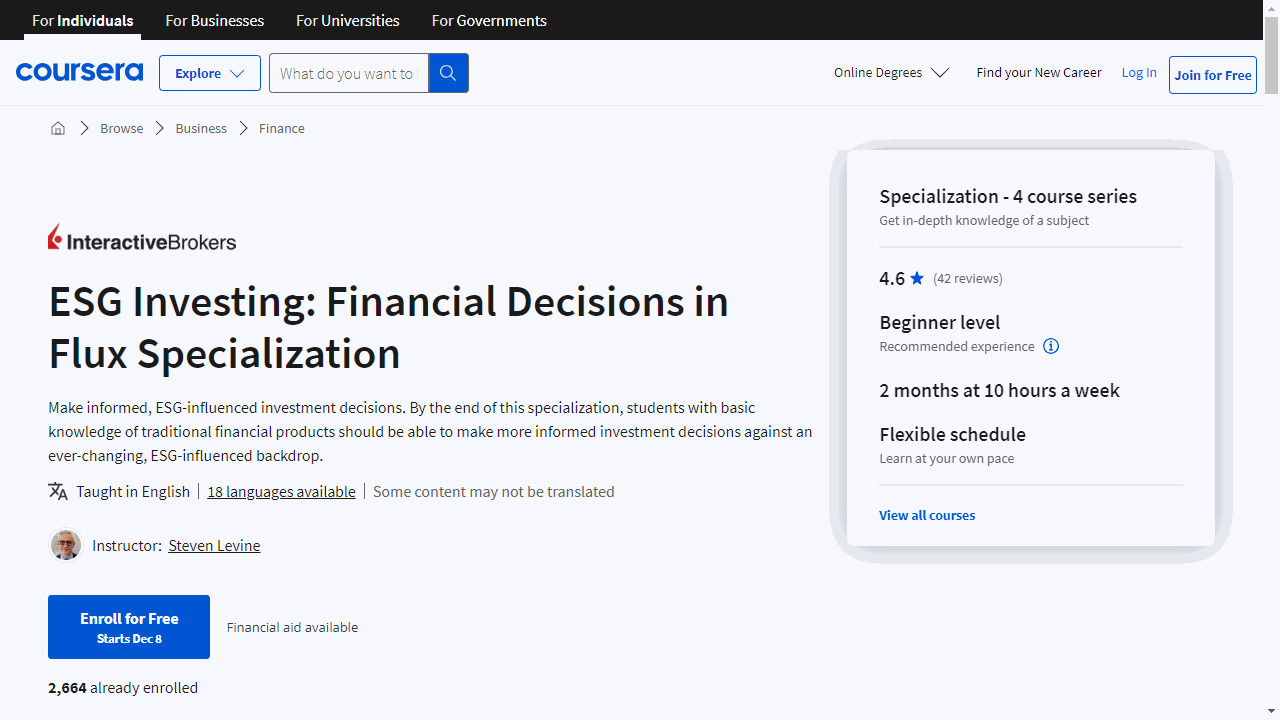

ESG Investing: Financial Decisions in Flux Specialization

This specialization is offered by Interactive Brokers.

Ideal for those eager to understand the impact of environmental, social, and governance (ESG) factors on investing.

Kick off with “ESG Investing: Setting Standards & Conducting Analysis” to grasp the essence of ESG.

You’ll uncover its origins, delve into the Sustainable Development Goals, and learn how to integrate ESG principles into investment strategies.

This course equips you with the ability to analyze investments beyond just profits, considering ethical and environmental dimensions.

Move on to “ESG Investing: Industry Impacts & Transformations” and witness how industries are adapting to ESG pressures.

Discover why companies like Borden and Dean Foods faced bankruptcy and how giants like BP and Exxon Mobil are navigating the energy transition.

You’ll gain the skills to assess ESG risks and their effects on a company’s financial health.

In “ESG-focused Financial Products,” you’ll explore the burgeoning world of green assets.

From green bonds to ESG-themed ETFs, learn about the instruments financing ESG initiatives and their growing market presence.

This course demystifies the complex landscape of ESG-related financial products, providing you with a comprehensive understanding of their performance and demand.

Lastly, “ESG Data & Accountability” empowers you with data-driven insights.

Learn to cut through deceptive marketing and understand how Big Data and AI are revolutionizing ESG accountability.

This course also highlights the influence of the millennial generation on the surge in ESG investing.

Each course is packed with practical knowledge, from ESG factor analysis to understanding green washing.

You’ll emerge with the ability to scrutinize investments through an ESG lens, ensuring your financial decisions align with ethical and sustainable practices.

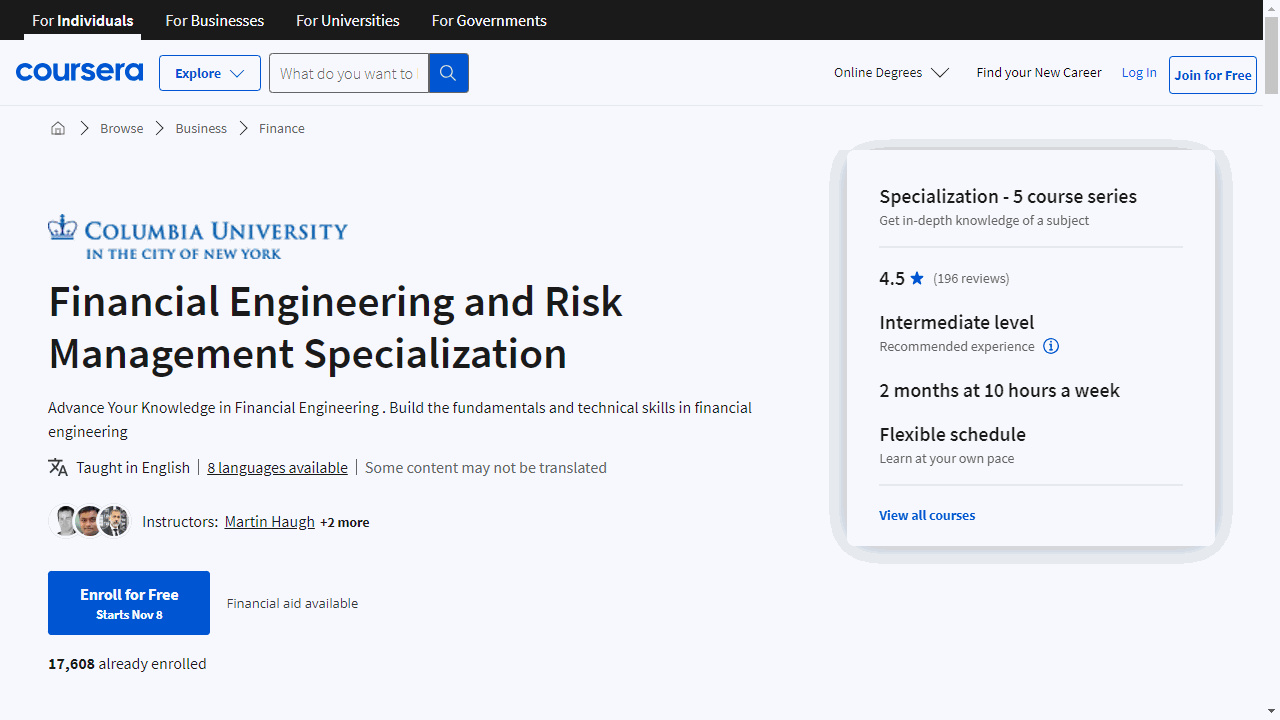

Financial Engineering and Risk Management Specialization

If you are interested in modeling financial derivatives, this specialization by Columbia University is a solid choice.

The specialization begins with the “Introduction to Financial Engineering and Risk Management” course.

This foundational course equips you with the mathematical tools necessary for financial analysis, covering probability, optimization, and the valuation of various financial instruments.

You’ll learn to calculate present value in an arbitrage-free environment and price options using models like Binomial and Black-Scholes.

It’s a solid starting point that prepares you for more advanced topics.

Moving on, “Term-Structure and Credit Derivatives” delves into the behavior of interest rates and the mechanics of credit markets.

You’ll explore how to model the evolution of interest rates and gain insights into instruments like credit default swaps and mortgage-backed securities.

The course also includes practical exercises, such as using Excel for model calibration, ensuring that you can apply your knowledge to real-world scenarios.

For those interested in asset management, “Optimization Methods in Asset Management” offers a deep dive into portfolio construction and risk assessment.

You’ll learn about the Capital Asset Pricing Model (CAPM) and other techniques to optimize investment portfolios, considering factors like transaction costs and market liquidity.

This course emphasizes the application of theory to practice, preparing you to handle the complexities of asset management.

“Advanced Topics in Derivative Pricing” is designed for those ready to tackle more sophisticated financial concepts.

You’ll get to grips with the Black-Scholes model, learn about the Greeks and their role in risk management, and explore the intricacies of volatility in the markets.

The course also examines the impact of credit derivatives on the financial system, providing a well-rounded understanding of derivative pricing.

Lastly, “Computational Methods in Pricing and Model Calibration” merges finance with computational techniques.

You’ll be introduced to various options and pricing methods, including the use of Fourier Transforms.

The course is hands-on, with Python coding exercises that allow you to practice pricing options and calibrating models, giving you a skill set that’s highly valued in the finance industry.

By the end of the specialization, you’ll have a diverse set of skills, from understanding derivatives and fixed income instruments to mastering computational methods in finance.

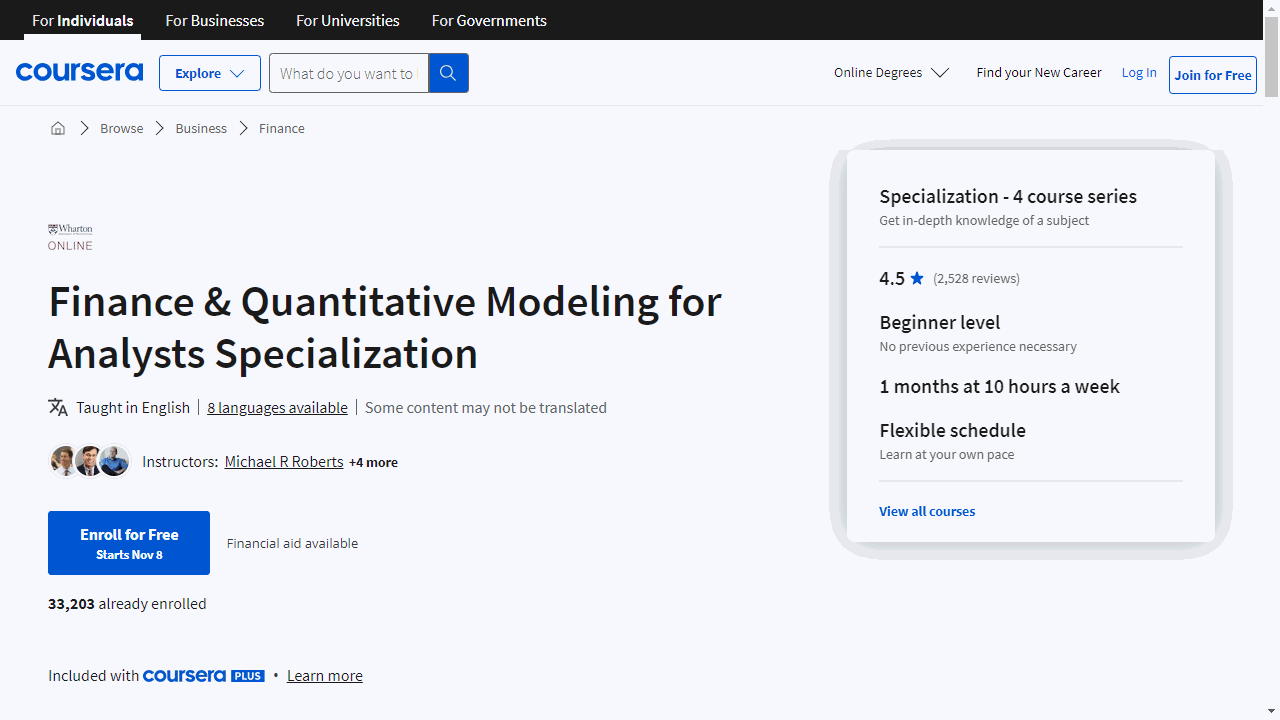

Finance & Quantitative Modeling for Analysts Specialization

This specialization offered by the Wharton School of the University of Pennsylvania.

The journey begins with “Fundamentals of Quantitative Modeling,” where you’ll learn to interpret and construct quantitative models.

This course isn’t just about crunching numbers; it’s about understanding the stories they tell about a business’s trajectory.

You’ll gain insight into the types of models used in the industry and acquire the foundational skills to build your own.

Moving on to “Introduction to Spreadsheets and Models,” you’ll discover the power of spreadsheets as a formidable tool for analysis.

This course equips you with the know-how to navigate Excel or Sheets, enabling you to transform raw data into actionable insights.

It’s a hands-on experience that prepares you to construct models that can inform your decision-making process.

For those less familiar with the financial world, “Financial Acumen for Non-Financial Managers” offers a clear view into how financial and non-financial data converge to influence a company’s performance.

You’ll delve into financial statements and learn to use data to predict and strategize for the future.

This course is designed to enhance your ability to make informed financial decisions without requiring a background in finance.

Lastly, “Introduction to Corporate Finance” provides a comprehensive overview of finance fundamentals.

You’ll explore concepts such as the time value of money and risk-return tradeoff, applying them to various scenarios from personal finance to corporate investments.

This course is about connecting theory with practice, ensuring you can apply concepts like discounted cash flow analysis to real-world situations.

Each course is infused with essential skills like regression analysis and cash flow analysis, ensuring that you’re not just learning theory but also acquiring practical expertise.

The specialization is designed to be accessible, avoiding jargon and focusing on clear, applicable knowledge.

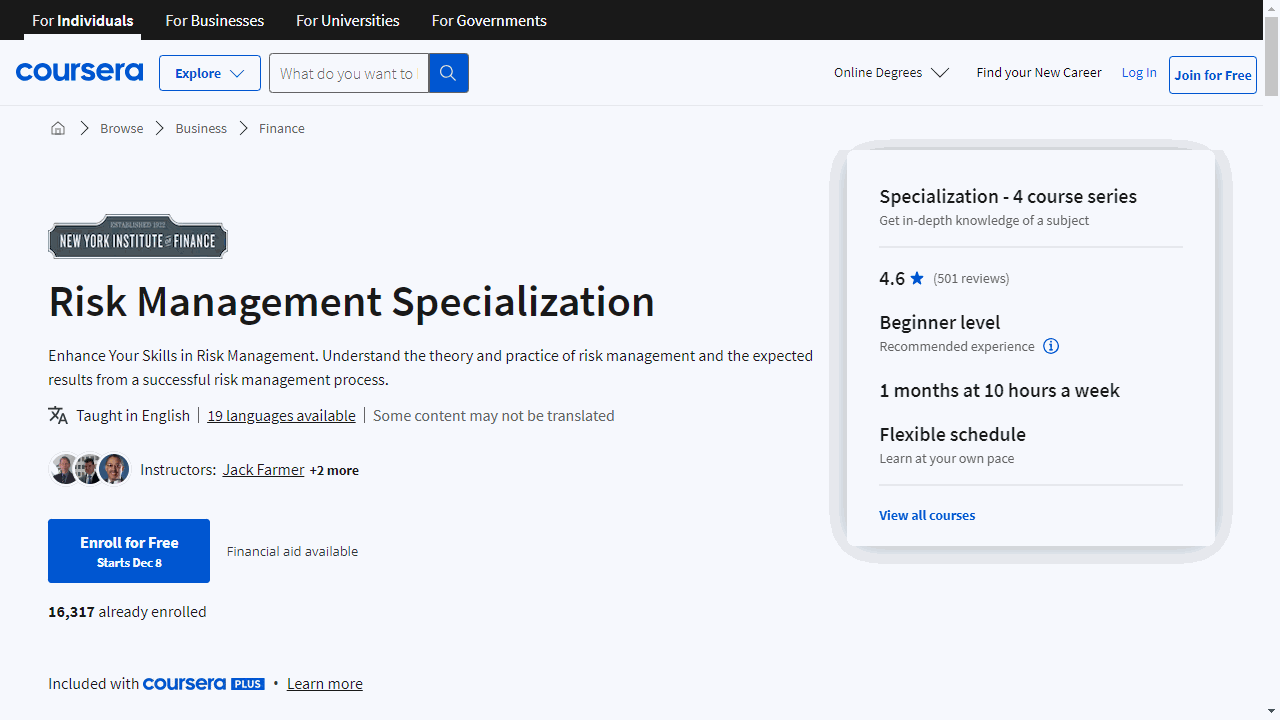

Risk Management Specialization

This specialization is offered by New York Institute of Finance.

It equips you to take control of investment risks with a clear understanding of risk governance, credit, market, and operational risk.

Kick off with “Introduction to Risk Management” to grasp the essentials of business and financial risks.

You’ll learn to differentiate, measure, and manage risks, setting you up to make informed decisions in your organization.

A basic understanding of statistics and familiarity with financial instruments will help you make the most of this course.

Move on to “Credit Risk Management: Frameworks and Strategies” where you’ll analyze companies and projects through business and industry analysis.

This course empowers you to conduct qualitative risk analysis and use financial metrics to evaluate a company’s financial health and risk exposure.

In “Market Risk Management: Frameworks & Strategies,” you’ll identify risks associated with financial instruments and learn techniques for estimating these risks.

The hands-on project involving a diversified equity portfolio will sharpen your skills in real-world scenarios, teaching you to calculate Value-at-Risk and Expected Shortfall.

Conclude with “Operational Risk Management: Frameworks & Strategies,” where you’ll delve into risk governance and the creation of an operational risk management program.

You’ll learn to report risk events, analyze trends, and assess risk appetite, culminating in the ability to design a risk assessment program.

Throughout these courses, you’ll gain proficiency in credit analysis, market risk management, and operational risk management.

You’ll also become familiar with critical concepts like Value-at-Risk and key risk indicators.

With a focus on practical application, these courses prepare you to confidently manage risk in any investment scenario.

Trading Strategies in Emerging Markets Specialization

This specialization is offered by Indian School of Business.

It offers a deep dive into the mechanics of trading, specifically designed for the dynamic emerging markets.

Kick off with “Trading Basics,” where you’ll get to grips with financial statements and the inner workings of the stock market.

This course empowers you to analyze company performance and craft trading strategies informed by academic research.

You’ll also tackle asset pricing theories to predict stock returns and understand the intricacies of asset markets, including order types, trading costs, and liquidity management.

Move on to “Trading Algorithms,” where you’ll focus on two powerful strategies: the Piotroski F-score and Post-Earnings-Announcement Drift (PEAD).

You’ll learn to navigate academic research and apply these strategies effectively, enhancing your trading acumen.

With “Advanced Trading Algorithms,” you’ll refine your strategy development with robust backtesting, avoiding common pitfalls like look-ahead and survival bias.

This course teaches you to incorporate transaction costs into your algorithms and evaluate strategy performance using measures like the Sharpe ratio, Treynor’s Ratio, and Jensen’s Alpha.

“Creating a Portfolio” brings your learning full circle by showing you how to assemble a portfolio of strategies fit for a hedge fund.

You’ll master risk and return assessment, optimal strategy weighting, and risk minimization techniques.

A bonus is the overview of hedge fund regulations and investor expectations.

The capstone, “Design your own trading strategy – Culminating Project,” is where you shine.

You’ll create and evaluate new trading strategies, integrate them into a portfolio, and draft a plan to start your hedge fund.

This specialization equips you with skills in financial analysis, algorithmic trading, and risk management.

Financial Markets (Yale University)

This course is a classic, taught by Nobel Prize-winning economist Robert Shiller. It will give you a thorough understanding of the financial world, from foundational concepts to advanced strategies.

You’ll start with the basics, learning about the dual nature of financial markets—the potential for both good and evil—and why understanding risk through tools like Value at Risk (VaR) is crucial.

The course then takes you through real-world examples, such as the S&P 500, to illustrate how these concepts play out in actual market scenarios.

Insurance is a key topic, and you’ll explore its fundamentals, its role in the financial system, and the nuances of health insurance and disaster management. The course emphasizes the importance of diversification, teaching you why concentrating all your resources in one place can be a risky move.

Risk management continues with sessions on the Capital Asset Pricing Model (CAPM), beta, and diversification. You’ll also tackle practical skills like short selling and portfolio optimization, which are essential for anyone looking to invest wisely.

The course also covers valuation models like the Gordon Growth Model, helping you understand how to assess a company’s future earnings potential. It doesn’t stop at theory; you’ll see how innovation and invention are integral to financial growth.

You’ll delve into the mechanics of inflation, real estate, and market forecasting, gaining insights into market efficiency and the psychological factors that can influence financial decisions. The course provides a comprehensive look at behavioral finance, shedding light on why people sometimes make irrational financial choices.

On the technical side, you’ll learn about compound interest, bonds, and the structure of corporate finance, including the dynamics of shares, dividends, and capital raising.

The course also covers the complexities of mortgages and the regulatory landscape post-financial crisis, helping you understand the safeguards in place to prevent future economic downturns.

Futures and options are demystified, and you’ll learn about the role of investment banks and the IPO process. The course also touches on the infrastructure of financial markets, including mutual funds, ETFs, and the technology-driven world of high-frequency trading.

Beyond the mechanics of finance, the course examines the broader impact of financial systems on society, discussing government debt, social insurance, and the intersection of finance with social issues like war and population growth.

Finally, the course connects theory to practice, offering interviews with finance professionals to provide real-world context and career insights.

Private Equity and Venture Capital

This course is offered by Università Bocconi.

It starts with the basics, explaining what PE and VC are and their crucial role in business growth.

You’ll learn about various financing stages, from seed funding to more complex strategies like vulture financing.

The course offers a detailed look at the landscape of private equity investors, with a focus on the structure and operation of closed-end funds in Europe.

You’ll compare these with US limited partnerships and UK funds, gaining a global perspective on investment structures and tax implications.

Innovative investment forms such as SPACs, private debt funds, and crowdfunding are also covered, equipping you with knowledge of the latest trends.

Plus, you’ll get hands-on with calculating investment returns, a skill essential for any aspiring investor.

The practical side continues as you delve into the managerial processes of equity funds, including fundraising and deal-making.

You’ll receive an Excel file to support your learning, ensuring you can apply your knowledge effectively.

Valuation is key in investment, and this course doesn’t skimp on the details.

You’ll master company valuation using the DCF method and adapt it for PE and VC scenarios.

The course also provides actionable advice for launching a startup, alongside expert insights into the intersections of PE with M&A and IPOs through interviews with industry leaders like Eugenio Morpurgo and Luca Peyrano.

By the end of this course, you’ll not only understand the mechanics of private equity and venture capital but also how to apply this knowledge in real-world scenarios.

Financing and Investing in Infrastructure

This course is offered by Università Bocconi.

It offers a deep dive into project finance, focusing on how to fund large infrastructure projects effectively.

You’ll start by understanding the essence of project finance, learning how it’s a unique approach to funding significant ventures.

You’ll explore the intricate web of contracts that bind shareholders, lenders, and industrial players together, using real-life examples like the Metro 5 project to bring these concepts to life.

The course then introduces you to syndicates, where banks join forces to finance big projects.

You’ll discover the roles they play, strategies for syndication, and the impact of financial crises on lending practices.

Risk management is crucial in investment, and you’ll tackle this head-on.

The course breaks down risks into pre- and post-completion categories, equipping you with a Risk Matrix tool to manage and monitor these potential pitfalls effectively.

When it comes to the financials, you’ll learn to craft budgets for both the construction and operational phases of a project.

Practical exercises will help you apply your newfound knowledge, ensuring you understand how to maintain a project’s profitability and financial health.

You’ll delve into the technicalities of loan repayment, studying various amortization methods and their implications for a project’s financial success.

The course also covers the security package and credit agreement covenants, teaching you how to use cover ratios to keep a close eye on a borrower’s financial status.

To cap it off, case studies like Bonollo Energia and Port De Paita will show you how all these elements come together in real-world scenarios, providing concrete examples of the course’s lessons in action.

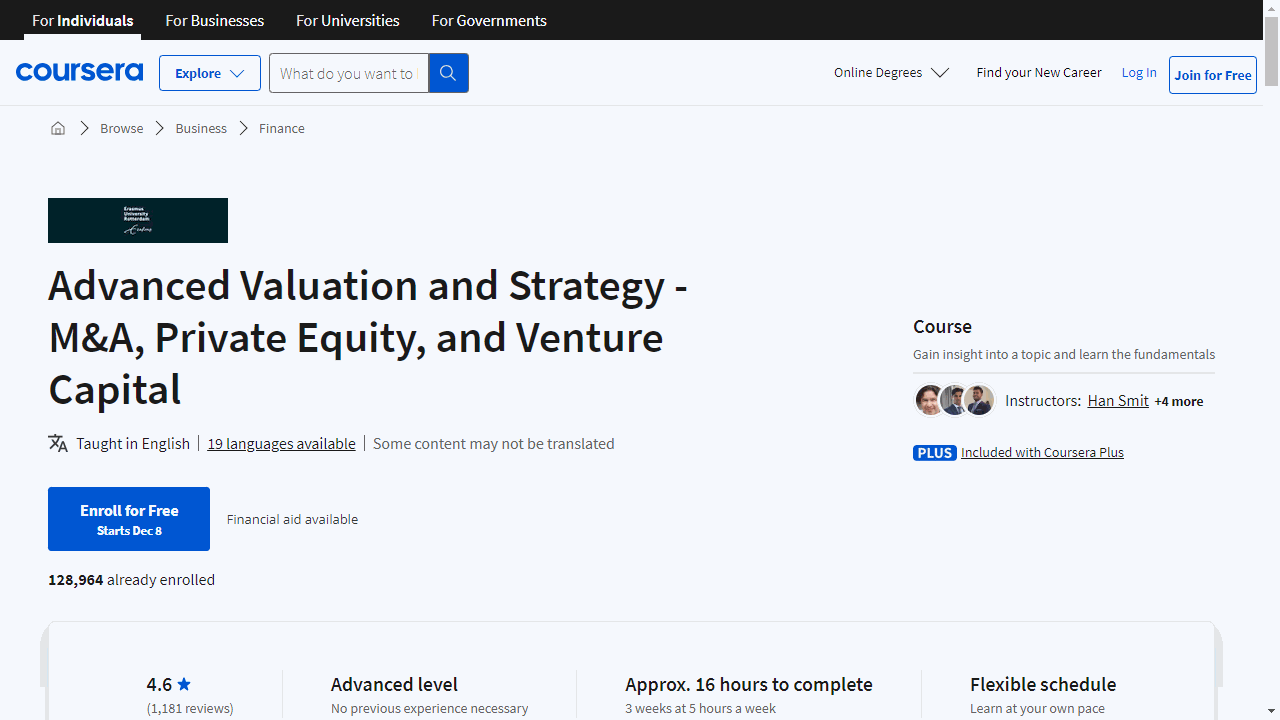

Advanced Valuation and Strategy - M&A, Private Equity, and Venture Capital

This course offered by Erasmus University Rotterdam goes into the essentials of corporate valuation and strategic decision-making, tailored for the dynamic fields of mergers and acquisitions, private equity, and venture capital.

You’ll start by understanding the core of investment decision-making, learning about the origins of value and the importance of flexibility in business.

The course breaks down real options, showing you how these strategic choices are present in everyday business scenarios and can significantly impact your investment approach.

The curriculum guides you through the practicalities of corporate valuation, teaching you to apply the Discounted Cash Flow (DCF) method and calculate free cash flows and terminal value.

You’ll become proficient in using the Weighted Average Cost of Capital (WACC) and multiples for accurate company valuation.

But it’s not all about the numbers.

You’ll learn to link valuation with corporate strategy, exploring how to assess the value of growth options and their influence on acquisition strategies.

The course brings theory to life with a case study on the RJ Reynolds Tobacco Company and Nabisco merger, providing real-world context to the valuation strategies you learn.

Real option theory is another highlight, equipping you with the skills to value R&D projects and understand options related to project timing, expansion, contraction, and abandonment.

These insights are crucial for navigating investment decisions in uncertain markets.

Game theory is also a key component of the course.

You’ll learn to solve various strategic games, including simultaneous and sequential games, and those with asymmetric information.

This knowledge is invaluable for understanding competitive dynamics and making informed strategic investments.

Throughout the course, checklists and practice quizzes reinforce your learning, ensuring you grasp key concepts like Internal Rate of Return (IRR) and Economic Value Added (EVA).

By the end, you’ll have a comprehensive toolkit for making strategic investment decisions, whether you’re aiming for a career in M&A, private equity, or venture capital, or simply looking to manage your investments more effectively.