Investing in the stock market is a great way to grow your wealth, but it can be a daunting process if you don’t know where to start.

Learning how to manage a portfolio is a valuable skill that can help you achieve your financial goals.

By understanding investment principles, portfolio diversification, and risk management, you can make informed decisions and maximize returns over time.

Finding a good course on portfolio management can be challenging, especially with so many online options available.

Many courses are either too basic, too advanced, or don’t provide enough practical application.

For the best overall portfolio management course on Coursera, we highly recommend the Investment and Portfolio Management Specialization offered by Rice University.

This comprehensive program covers key concepts like bond valuation, modern portfolio theory, and risk management, and equips you with the tools to build a winning investment portfolio.

It’s highly rated for its engaging format, expert instructors, and real-world case studies.

But if this specialization doesn’t meet your needs, don’t worry!

We’ve got you covered.

Keep reading for more recommendations, including other Coursera courses, and explore alternative platforms and specialized programs that fit your learning style and goals.

Investment and Portfolio Management Specialization

This comprehensive program offered by Rice University equips you with the tools to navigate financial markets with confidence.

Start with “Global Financial Markets and Instruments” to grasp the essentials of financial assets and markets.

You’ll learn about the roles of different financial instruments, delve into algorithmic trading, and understand market operations.

By the end, you’ll confidently list and compare various investment vehicles.

In “Portfolio Selection and Risk Management,” you’ll master the art of constructing an optimal portfolio and managing investment risks.

This course empowers you to analyze risk-return trade-offs and apply equilibrium asset pricing models, ensuring you make informed asset allocation decisions.

“Biases and Portfolio Selection” tackles the psychological side of investing.

You’ll uncover common behavioral biases and learn strategies to mitigate their impact on investment decisions.

This insight is crucial for maintaining a clear head in the often-irrational financial markets.

Move on to “Investment Strategies and Portfolio Analysis” to get up to speed with the latest investment strategies and performance evaluation techniques.

You’ll explore various approaches to investing and learn how to assess the effectiveness of different portfolio strategies.

The “Capstone: Build a Winning Investment Portfolio” is where theory meets practice.

You’ll manage a simulated investment portfolio and provide advice to virtual clients, using advanced analytical tools.

This real-world experience is a powerful way to demonstrate your investment acumen.

Throughout the specialization, you’ll engage with key concepts like bond valuation, modern portfolio theory, and risk management.

You’ll also become familiar with financial terms such as Treasury securities, derivative instruments, and mortgage-backed securities.

Investment Management Specialization

This specialization offered by University of Geneva gives you a comprehensive understanding of the investment world.

Start with “Understanding Financial Markets” to grasp the essentials of financial markets and their connection to the economy.

You’ll learn how to calculate and interpret the movements of stock and bond prices, understand the concept of risk, and explore diverse markets like gold and real estate.

Real-world applications from UBS experts will show you how these concepts are used in a leading global bank, equipping you with practical skills in portfolio theories and risk management.

In “Meeting Investors’ Goals,” you’ll delve into the psychology behind investment decisions, uncovering how biases and emotions can influence market outcomes.

This course will also introduce you to various portfolio construction methods and investment styles, enhancing your knowledge in investment management and socially responsible investing.

“Portfolio and Risk Management” is where theory meets practice.

You’ll learn how to create optimal portfolios through strategic asset allocation and manage investment risks.

UBS professionals provide insights, ensuring you understand the practical aspects of bond markets and financial markets.

“Securing Investment Returns in the Long Run” demystifies the active versus passive investing debate and teaches you how to evaluate investment performance.

You’ll also discover the impact of sustainable finance, neurofinance, and fintech on the future of investment management.

The Capstone project, “Planning your Client’s Wealth over a 5-year Horizon,” is your chance to apply your learning.

You’ll design a wealth plan for a character, considering economic changes, emotional biases, portfolio optimization, and performance measurement.

By completing this specialization, you’ll gain valuable skills in portfolio construction, cognitive bias understanding, and investment style differentiation.

You’ll also become proficient in Microsoft Excel, a vital tool for financial analysis.

Investment Management with Python and Machine Learning Specialization

This specialization offered by EDHEC Business School equips you with the skills to apply Python and machine learning to investment management.

Start with “Introduction to Portfolio Construction and Analysis with Python,” where you’ll build a solid foundation in investment science.

You’ll learn to measure risk and return, and use Python to create diversified portfolios.

This course isn’t just about theory; it’s hands-on, ensuring you can apply what you learn to real-world scenarios.

Move on to “Advanced Portfolio Construction and Analysis with Python” to deepen your knowledge.

Here, you’ll tackle advanced topics like robust portfolio construction and the Black-Litterman approach.

You’ll come away with the ability to analyze and construct investment portfolios using sophisticated Python tools.

“Python and Machine Learning for Asset Management” bridges the gap between finance and technology.

You’ll start with machine learning fundamentals before applying them to asset management.

Expect to enhance factor models and risk management practices using the latest machine learning techniques.

Lastly, “Python and Machine-Learning for Asset Management with Alternative Data Sets” introduces you to the cutting-edge use of alternative data in finance.

You’ll analyze real-world data sets, explore current research, and develop skills in data analytics and visualization, all within the context of financial markets.

Each course combines lectures with practical coding exercises and quizzes to solidify your understanding.

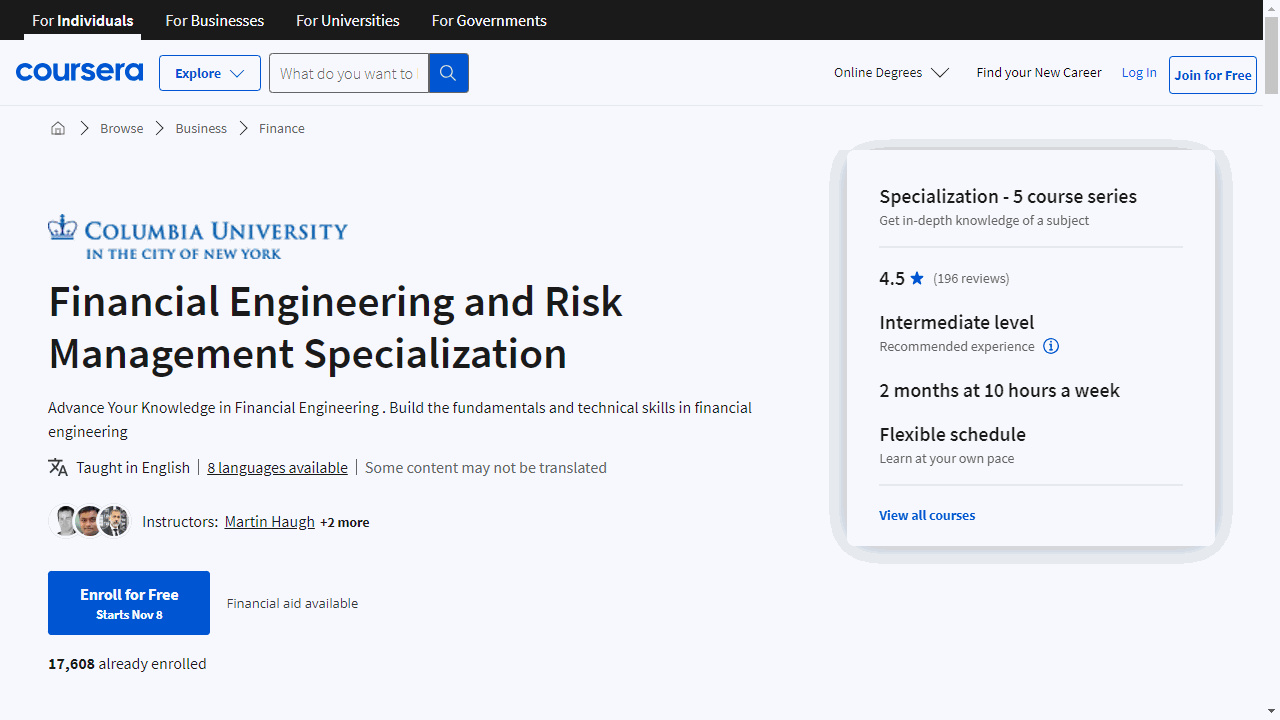

Financial Engineering and Risk Management Specialization

If you are interested in modeling financial derivatives, this specialization by Columbia University is a solid choice.

The specialization begins with the “Introduction to Financial Engineering and Risk Management” course.

This foundational course equips you with the mathematical tools necessary for financial analysis, covering probability, optimization, and the valuation of various financial instruments.

You’ll learn to calculate present value in an arbitrage-free environment and price options using models like Binomial and Black-Scholes.

It’s a solid starting point that prepares you for more advanced topics.

Moving on, “Term-Structure and Credit Derivatives” delves into the behavior of interest rates and the mechanics of credit markets.

You’ll explore how to model the evolution of interest rates and gain insights into instruments like credit default swaps and mortgage-backed securities.

The course also includes practical exercises, such as using Excel for model calibration, ensuring that you can apply your knowledge to real-world scenarios.

For those interested in asset management, “Optimization Methods in Asset Management” offers a deep dive into portfolio construction and risk assessment.

You’ll learn about the Capital Asset Pricing Model (CAPM) and other techniques to optimize investment portfolios, considering factors like transaction costs and market liquidity.

This course emphasizes the application of theory to practice, preparing you to handle the complexities of asset management.

“Advanced Topics in Derivative Pricing” is designed for those ready to tackle more sophisticated financial concepts.

You’ll get to grips with the Black-Scholes model, learn about the Greeks and their role in risk management, and explore the intricacies of volatility in the markets.

The course also examines the impact of credit derivatives on the financial system, providing a well-rounded understanding of derivative pricing.

Lastly, “Computational Methods in Pricing and Model Calibration” merges finance with computational techniques.

You’ll be introduced to various options and pricing methods, including the use of Fourier Transforms.

The course is hands-on, with Python coding exercises that allow you to practice pricing options and calibrating models, giving you a skill set that’s highly valued in the finance industry.

By the end of the specialization, you’ll have a diverse set of skills, from understanding derivatives and fixed income instruments to mastering computational methods in finance.

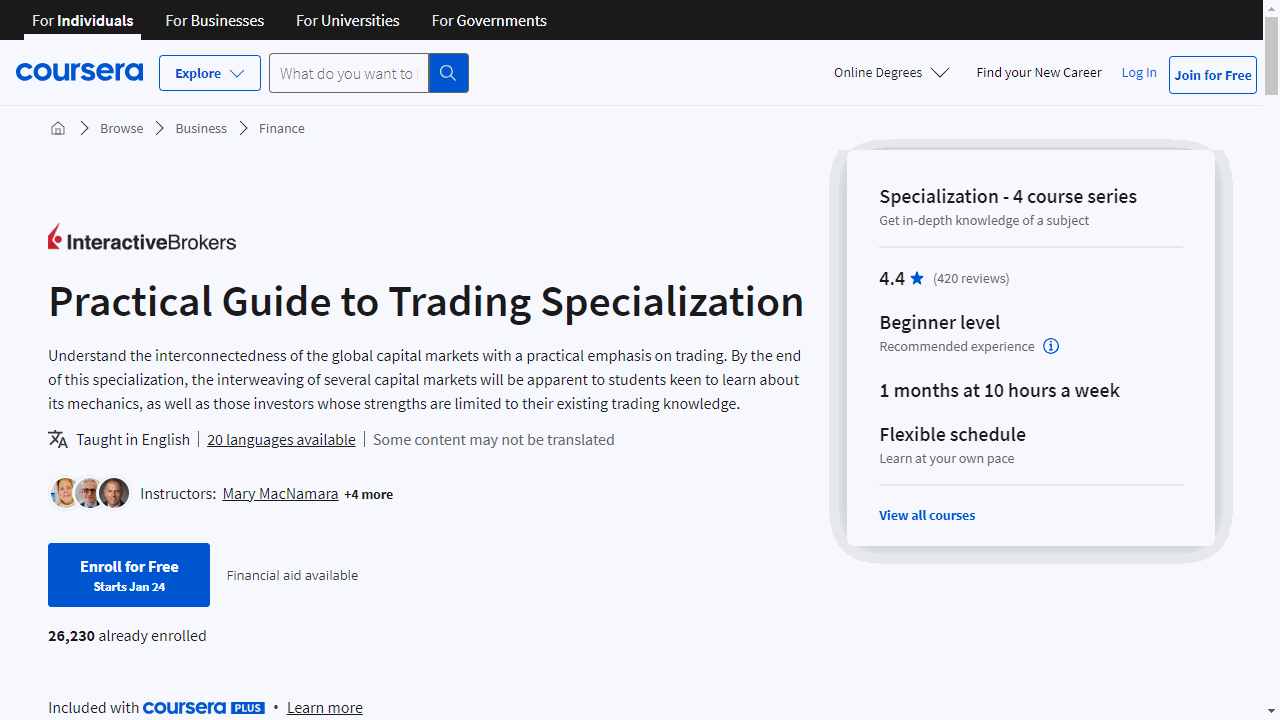

Practical Guide to Trading Specialization

Provider: Interactive Brokers

This is a comprehensive program that covers the essentials of trading across various asset classes.

In “Fundamentals of Equities,” you’ll dive into the stock market, learning to analyze industries, economic sectors, and fundamental values.

You’ll become adept at interpreting balance sheets, cash flows, and income statements.

This course also introduces you to mutual funds and ETFs, providing a broader investment perspective.

“Forex - Trading Around the World” offers a thorough understanding of the foreign exchange market (FOREX).

You’ll explore the roles of its participants, the intricacies of currency pairs, and the use of margin accounts.

Practical skills in executing trades on an online trading platform are a key takeaway, setting you up for real-world currency trading.

For a solid grasp of the fixed income space, “U.S. Bond Investing Basics” is your go-to.

You’ll differentiate between corporate and municipal bonds, understand the mechanics of the bond market, and identify investment risks.

The course equips you with the know-how to navigate an online trading platform for bond transactions.

Lastly, “Derivatives - Options & Futures” demystifies complex financial instruments.

You’ll learn the language of stock options, the mechanics of the futures market, and strategies for trading options.

The course emphasizes practical demonstrations, helping you to comprehend and apply options and futures concepts.

Each course is designed with practical examples, quizzes, and projects, ensuring you not only learn but also apply your knowledge.

For hands-on practice, you can use a demo trading account to simulate trading in a risk-free environment.

By completing this specialization, you’ll acquire the skills to analyze and trade in equities, FOREX, bonds, and derivatives with confidence.

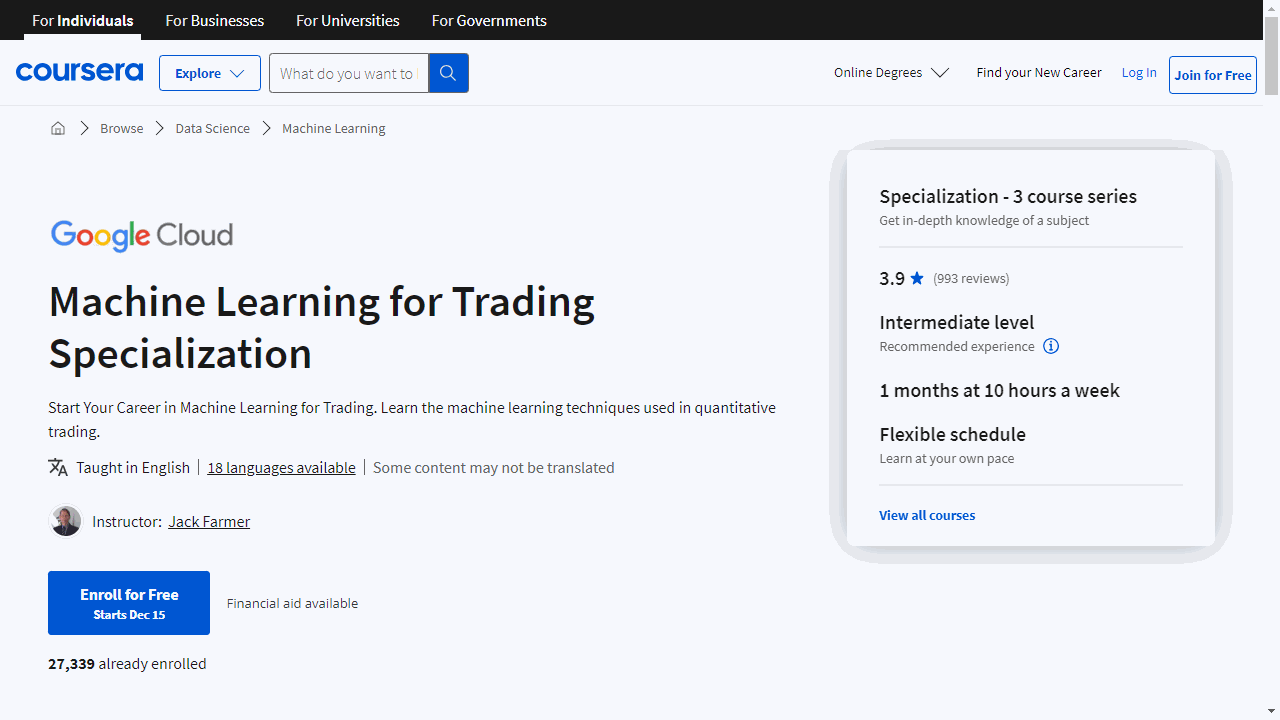

Machine Learning for Trading Specialization

Provider: New York Institute of Finance, Google Cloud

This set of courses is a practical deep dive into applying machine learning to the world of finance and trading.

Kick off with “Introduction to Trading, Machine Learning & GCP” to master trading basics like trends and volatility.

You’ll also learn to craft quantitative trading strategies and use machine learning to predict market movements.

The course leverages Google Cloud Platform and Jupyter Notebooks, giving you hands-on experience in building financial models.

You should come prepared with advanced Python knowledge and a solid foundation in statistics and financial markets.

Familiarity with machine learning libraries such as Scikit-Learn is also crucial.

The second course, “Using Machine Learning in Trading and Finance,” steps up the game.

It’s all about developing sophisticated trading strategies with machine learning.

You’ll get to grips with pairs trading and momentum trading, and use Keras and TensorFlow to create and test your own models.

The final course, “Reinforcement Learning for Trading Strategies,” introduces you to the cutting-edge world of reinforcement learning.

Discover how to integrate neural networks with reinforcement learning, apply LSTMs to time series data, and develop trading strategies that learn and adapt.

Each course builds on the last, ensuring you develop a robust understanding of both machine learning and trading.

By the end, you’ll be equipped to build, test, and optimize trading strategies using the latest AI techniques.