Quantitative finance, also known as “quant finance,” leverages mathematical and statistical models to analyze and predict financial markets.

This field has become increasingly crucial in today’s data-driven world, enabling professionals to make informed investment decisions, manage risk more effectively, and develop sophisticated trading strategies.

By mastering quantitative finance, you can gain a competitive edge in the financial industry and open doors to exciting career opportunities in areas like portfolio management, risk analysis, and financial engineering.

Finding the right quantitative finance course on Coursera can be a challenge, with a wide range of programs available.

You’re looking for a course that’s both comprehensive and engaging, taught by experts in the field, and tailored to your learning style.

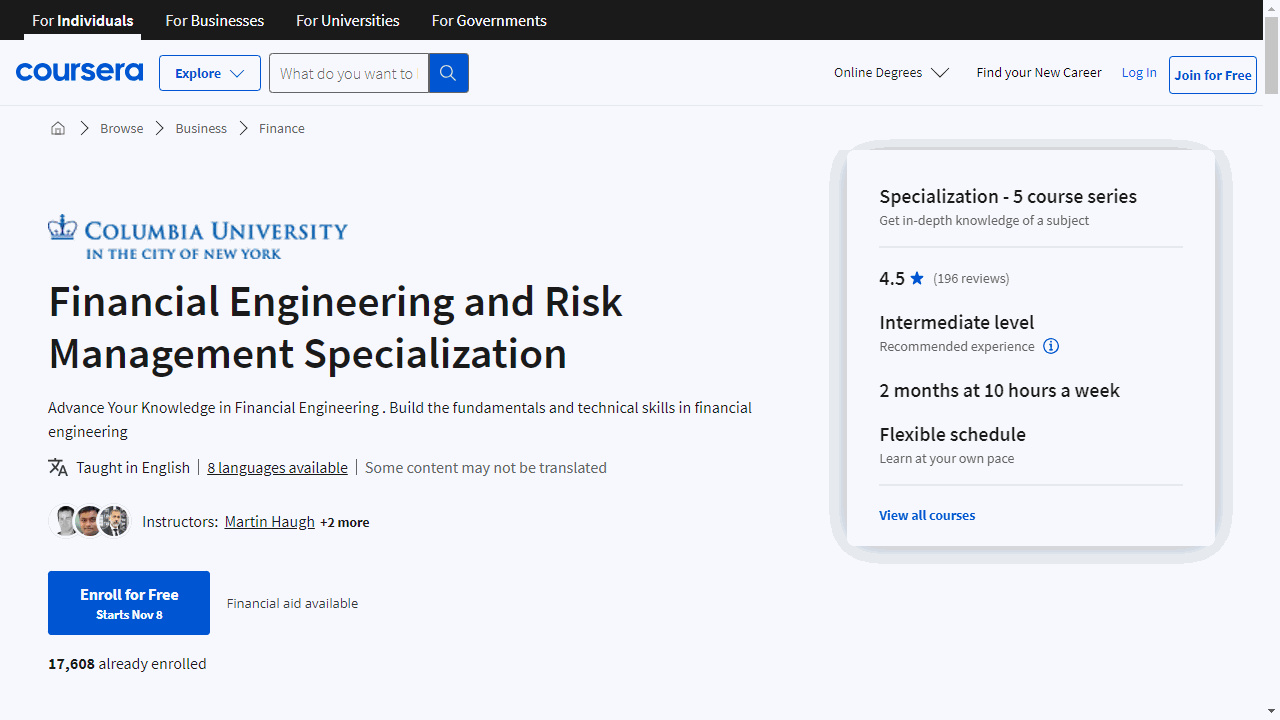

For the best quantitative finance course overall on Coursera, we recommend the "Investment Management with Python and Machine Learning Specialization" offered by EDHEC Business School.

This specialization stands out due to its focus on practical application.

You’ll learn to utilize Python and machine learning techniques to analyze and manage investment portfolios, which is highly relevant for those seeking to enter the world of quantitative finance.

The program provides hands-on experience with real-world data sets, preparing you to effectively utilize these tools in a professional setting.

While this program is our top pick, there are other great options available depending on your specific interests and goals.

Keep reading to discover more recommendations, including courses focusing on specific areas of quantitative finance like financial modeling, risk management, or asset pricing.

Investment Management with Python and Machine Learning Specialization

This specialization offered by EDHEC Business School equips you with the skills to apply Python and machine learning to investment management.

Start with “Introduction to Portfolio Construction and Analysis with Python,” where you’ll build a solid foundation in investment science.

You’ll learn to measure risk and return, and use Python to create diversified portfolios.

This course isn’t just about theory; it’s hands-on, ensuring you can apply what you learn to real-world scenarios.

Move on to “Advanced Portfolio Construction and Analysis with Python” to deepen your knowledge.

Here, you’ll tackle advanced topics like robust portfolio construction and the Black-Litterman approach.

You’ll come away with the ability to analyze and construct investment portfolios using sophisticated Python tools.

“Python and Machine Learning for Asset Management” bridges the gap between finance and technology.

You’ll start with machine learning fundamentals before applying them to asset management.

Expect to enhance factor models and risk management practices using the latest machine learning techniques.

Lastly, “Python and Machine-Learning for Asset Management with Alternative Data Sets” introduces you to the cutting-edge use of alternative data in finance.

You’ll analyze real-world data sets, explore current research, and develop skills in data analytics and visualization, all within the context of financial markets.

Each course combines lectures with practical coding exercises and quizzes to solidify your understanding.

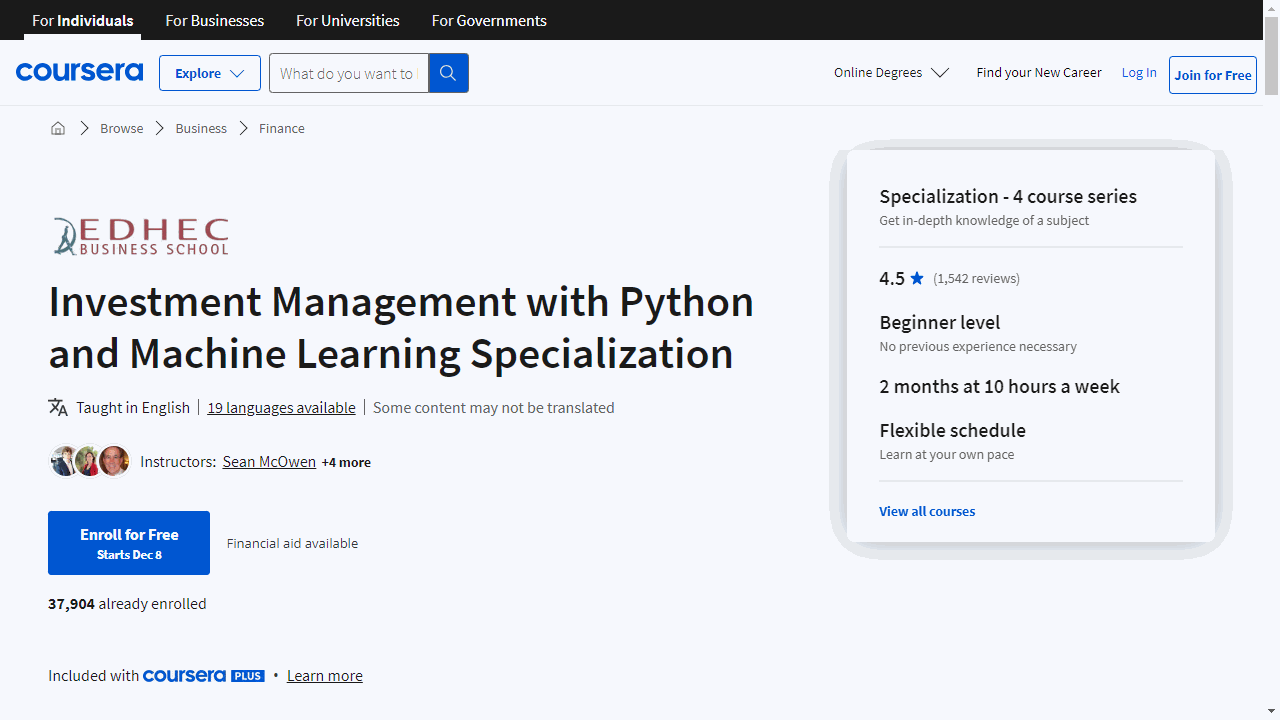

Finance & Quantitative Modeling for Analysts Specialization

This specialization offered by the Wharton School of the University of Pennsylvania.

The journey begins with “Fundamentals of Quantitative Modeling,” where you’ll learn to interpret and construct quantitative models.

This course isn’t just about crunching numbers; it’s about understanding the stories they tell about a business’s trajectory.

You’ll gain insight into the types of models used in the industry and acquire the foundational skills to build your own.

Moving on to “Introduction to Spreadsheets and Models,” you’ll discover the power of spreadsheets as a formidable tool for analysis.

This course equips you with the know-how to navigate Excel or Sheets, enabling you to transform raw data into actionable insights.

It’s a hands-on experience that prepares you to construct models that can inform your decision-making process.

For those less familiar with the financial world, “Financial Acumen for Non-Financial Managers” offers a clear view into how financial and non-financial data converge to influence a company’s performance.

You’ll delve into financial statements and learn to use data to predict and strategize for the future.

This course is designed to enhance your ability to make informed financial decisions without requiring a background in finance.

Lastly, “Introduction to Corporate Finance” provides a comprehensive overview of finance fundamentals.

You’ll explore concepts such as the time value of money and risk-return tradeoff, applying them to various scenarios from personal finance to corporate investments.

This course is about connecting theory with practice, ensuring you can apply concepts like discounted cash flow analysis to real-world situations.

Each course is infused with essential skills like regression analysis and cash flow analysis, ensuring that you’re not just learning theory but also acquiring practical expertise.

The specialization is designed to be accessible, avoiding jargon and focusing on clear, applicable knowledge.

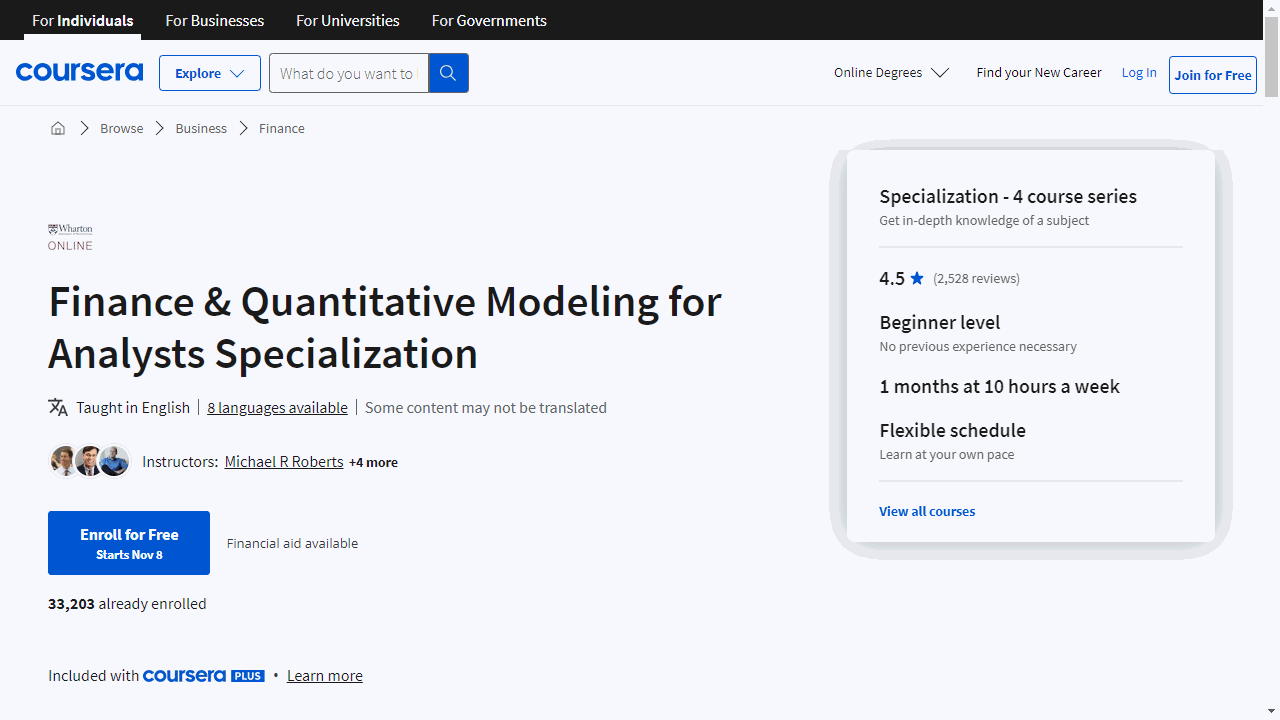

Investment and Portfolio Management Specialization

This comprehensive program offered by Rice University equips you with the tools to navigate financial markets with confidence.

Start with “Global Financial Markets and Instruments” to grasp the essentials of financial assets and markets.

You’ll learn about the roles of different financial instruments, delve into algorithmic trading, and understand market operations.

By the end, you’ll confidently list and compare various investment vehicles.

In “Portfolio Selection and Risk Management,” you’ll master the art of constructing an optimal portfolio and managing investment risks.

This course empowers you to analyze risk-return trade-offs and apply equilibrium asset pricing models, ensuring you make informed asset allocation decisions.

“Biases and Portfolio Selection” tackles the psychological side of investing.

You’ll uncover common behavioral biases and learn strategies to mitigate their impact on investment decisions.

This insight is crucial for maintaining a clear head in the often-irrational financial markets.

Move on to “Investment Strategies and Portfolio Analysis” to get up to speed with the latest investment strategies and performance evaluation techniques.

You’ll explore various approaches to investing and learn how to assess the effectiveness of different portfolio strategies.

The “Capstone: Build a Winning Investment Portfolio” is where theory meets practice.

You’ll manage a simulated investment portfolio and provide advice to virtual clients, using advanced analytical tools.

This real-world experience is a powerful way to demonstrate your investment acumen.

Throughout the specialization, you’ll engage with key concepts like bond valuation, modern portfolio theory, and risk management.

You’ll also become familiar with financial terms such as Treasury securities, derivative instruments, and mortgage-backed securities.

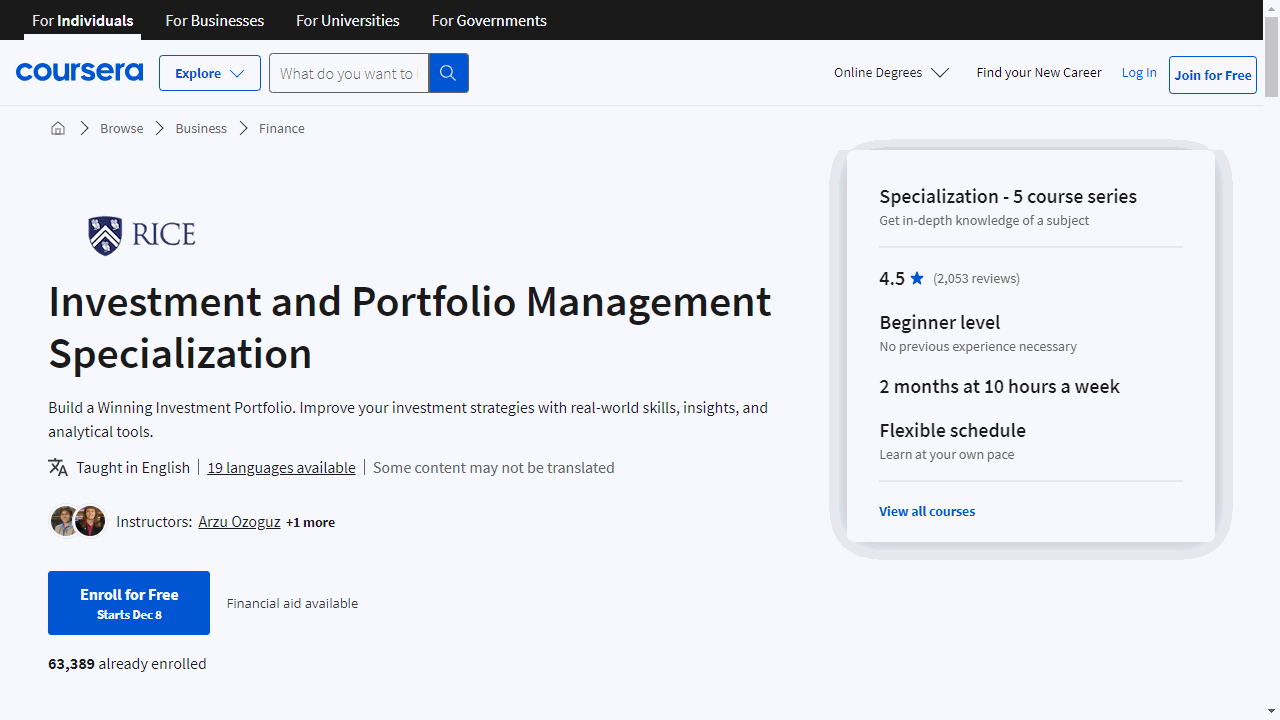

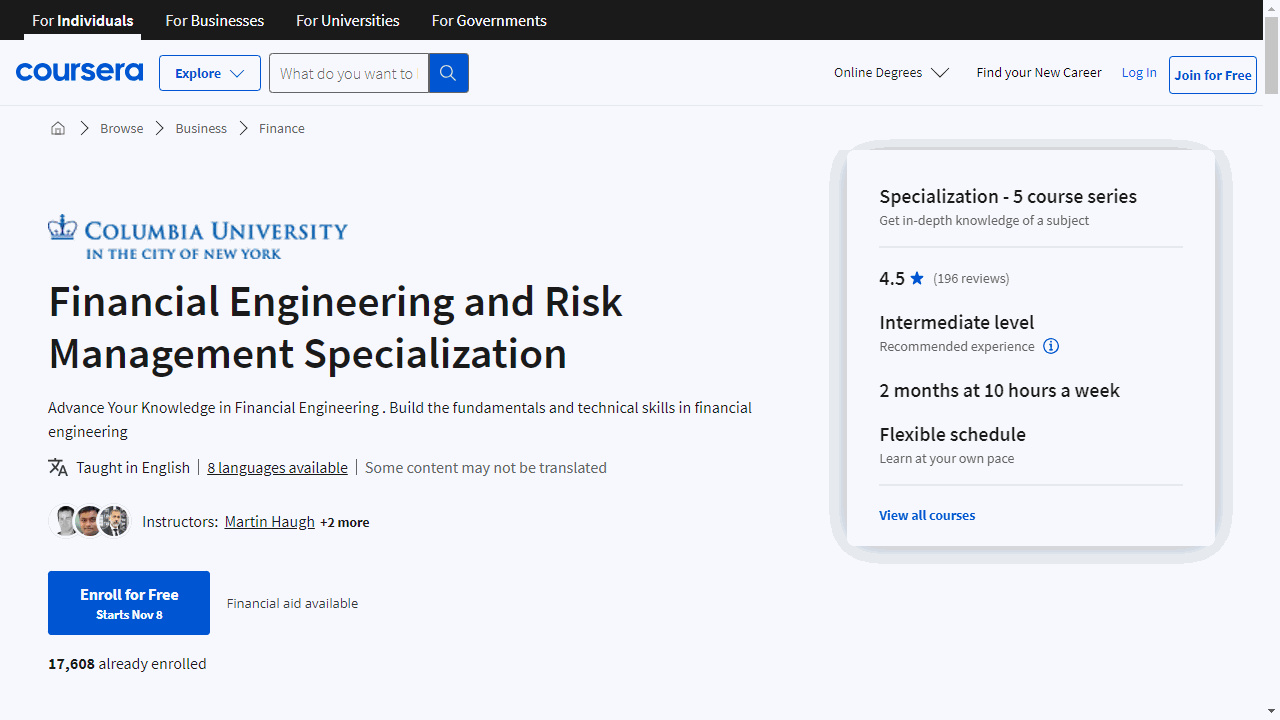

Financial Engineering and Risk Management Specialization

If you are interested in modeling financial derivatives, this specialization by Columbia University is a solid choice.

The specialization begins with the “Introduction to Financial Engineering and Risk Management” course.

This foundational course equips you with the mathematical tools necessary for financial analysis, covering probability, optimization, and the valuation of various financial instruments.

You’ll learn to calculate present value in an arbitrage-free environment and price options using models like Binomial and Black-Scholes.

It’s a solid starting point that prepares you for more advanced topics.

Moving on, “Term-Structure and Credit Derivatives” delves into the behavior of interest rates and the mechanics of credit markets.

You’ll explore how to model the evolution of interest rates and gain insights into instruments like credit default swaps and mortgage-backed securities.

The course also includes practical exercises, such as using Excel for model calibration, ensuring that you can apply your knowledge to real-world scenarios.

For those interested in asset management, “Optimization Methods in Asset Management” offers a deep dive into portfolio construction and risk assessment.

You’ll learn about the Capital Asset Pricing Model (CAPM) and other techniques to optimize investment portfolios, considering factors like transaction costs and market liquidity.

This course emphasizes the application of theory to practice, preparing you to handle the complexities of asset management.

“Advanced Topics in Derivative Pricing” is designed for those ready to tackle more sophisticated financial concepts.

You’ll get to grips with the Black-Scholes model, learn about the Greeks and their role in risk management, and explore the intricacies of volatility in the markets.

The course also examines the impact of credit derivatives on the financial system, providing a well-rounded understanding of derivative pricing.

Lastly, “Computational Methods in Pricing and Model Calibration” merges finance with computational techniques.

You’ll be introduced to various options and pricing methods, including the use of Fourier Transforms.

The course is hands-on, with Python coding exercises that allow you to practice pricing options and calibrating models, giving you a skill set that’s highly valued in the finance industry.

By the end of the specialization, you’ll have a diverse set of skills, from understanding derivatives and fixed income instruments to mastering computational methods in finance.

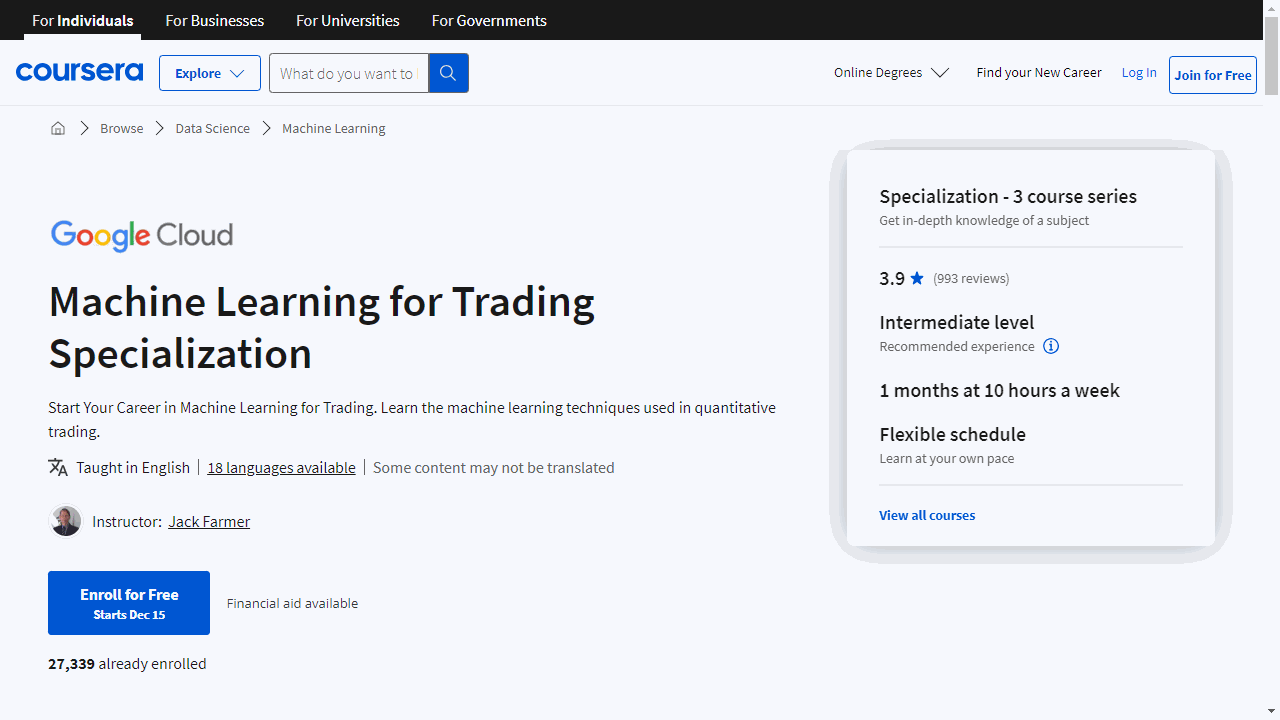

Machine Learning for Trading Specialization

Provider: New York Institute of Finance, Google Cloud

This set of courses is a practical deep dive into applying machine learning to the world of finance and trading.

Kick off with “Introduction to Trading, Machine Learning & GCP” to master trading basics like trends and volatility.

You’ll also learn to craft quantitative trading strategies and use machine learning to predict market movements.

The course leverages Google Cloud Platform and Jupyter Notebooks, giving you hands-on experience in building financial models.

You should come prepared with advanced Python knowledge and a solid foundation in statistics and financial markets.

Familiarity with machine learning libraries such as Scikit-Learn is also crucial.

The second course, “Using Machine Learning in Trading and Finance,” steps up the game.

It’s all about developing sophisticated trading strategies with machine learning.

You’ll get to grips with pairs trading and momentum trading, and use Keras and TensorFlow to create and test your own models.

The final course, “Reinforcement Learning for Trading Strategies,” introduces you to the cutting-edge world of reinforcement learning.

Discover how to integrate neural networks with reinforcement learning, apply LSTMs to time series data, and develop trading strategies that learn and adapt.

Each course builds on the last, ensuring you develop a robust understanding of both machine learning and trading.

By the end, you’ll be equipped to build, test, and optimize trading strategies using the latest AI techniques.

Also check our posts on: