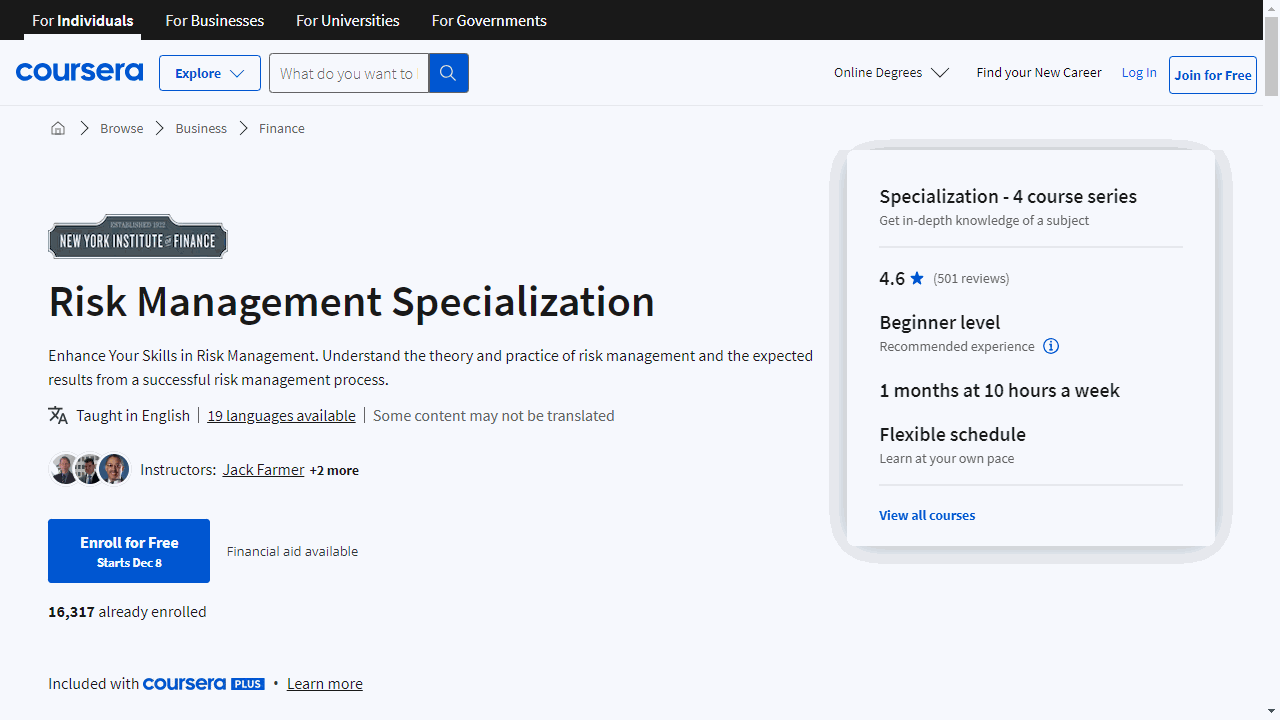

Risk Management Specialization

This specialization is offered by New York Institute of Finance.

It equips you to take control of investment risks with a clear understanding of risk governance, credit, market, and operational risk.

Kick off with “Introduction to Risk Management” to grasp the essentials of business and financial risks.

You’ll learn to differentiate, measure, and manage risks, setting you up to make informed decisions in your organization.

A basic understanding of statistics and familiarity with financial instruments will help you make the most of this course.

Move on to “Credit Risk Management: Frameworks and Strategies” where you’ll analyze companies and projects through business and industry analysis.

This course empowers you to conduct qualitative risk analysis and use financial metrics to evaluate a company’s financial health and risk exposure.

In “Market Risk Management: Frameworks & Strategies,” you’ll identify risks associated with financial instruments and learn techniques for estimating these risks.

The hands-on project involving a diversified equity portfolio will sharpen your skills in real-world scenarios, teaching you to calculate Value-at-Risk and Expected Shortfall.

Conclude with “Operational Risk Management: Frameworks & Strategies,” where you’ll delve into risk governance and the creation of an operational risk management program.

You’ll learn to report risk events, analyze trends, and assess risk appetite, culminating in the ability to design a risk assessment program.

Throughout these courses, you’ll gain proficiency in credit analysis, market risk management, and operational risk management.

You’ll also become familiar with critical concepts like Value-at-Risk and key risk indicators.

With a focus on practical application, these courses prepare you to confidently manage risk in any investment scenario.

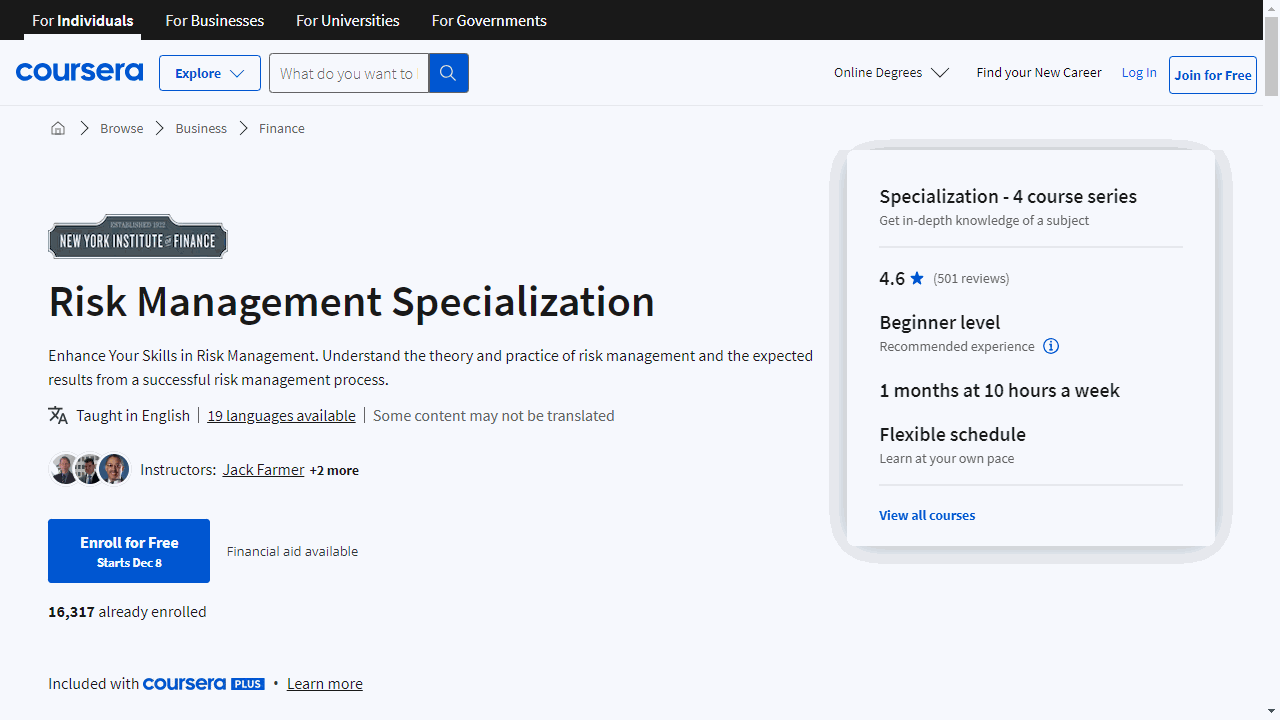

Financial Engineering and Risk Management Specialization

If you are interested in modeling financial derivatives, this specialization by Columbia University is a solid choice.

The specialization begins with the “Introduction to Financial Engineering and Risk Management” course.

This foundational course equips you with the mathematical tools necessary for financial analysis, covering probability, optimization, and the valuation of various financial instruments.

You’ll learn to calculate present value in an arbitrage-free environment and price options using models like Binomial and Black-Scholes.

It’s a solid starting point that prepares you for more advanced topics.

Moving on, “Term-Structure and Credit Derivatives” delves into the behavior of interest rates and the mechanics of credit markets.

You’ll explore how to model the evolution of interest rates and gain insights into instruments like credit default swaps and mortgage-backed securities.

The course also includes practical exercises, such as using Excel for model calibration, ensuring that you can apply your knowledge to real-world scenarios.

For those interested in asset management, “Optimization Methods in Asset Management” offers a deep dive into portfolio construction and risk assessment.

You’ll learn about the Capital Asset Pricing Model (CAPM) and other techniques to optimize investment portfolios, considering factors like transaction costs and market liquidity.

This course emphasizes the application of theory to practice, preparing you to handle the complexities of asset management.

“Advanced Topics in Derivative Pricing” is designed for those ready to tackle more sophisticated financial concepts.

You’ll get to grips with the Black-Scholes model, learn about the Greeks and their role in risk management, and explore the intricacies of volatility in the markets.

The course also examines the impact of credit derivatives on the financial system, providing a well-rounded understanding of derivative pricing.

Lastly, “Computational Methods in Pricing and Model Calibration” merges finance with computational techniques.

You’ll be introduced to various options and pricing methods, including the use of Fourier Transforms.

The course is hands-on, with Python coding exercises that allow you to practice pricing options and calibrating models, giving you a skill set that’s highly valued in the finance industry.

By the end of the specialization, you’ll have a diverse set of skills, from understanding derivatives and fixed income instruments to mastering computational methods in finance.

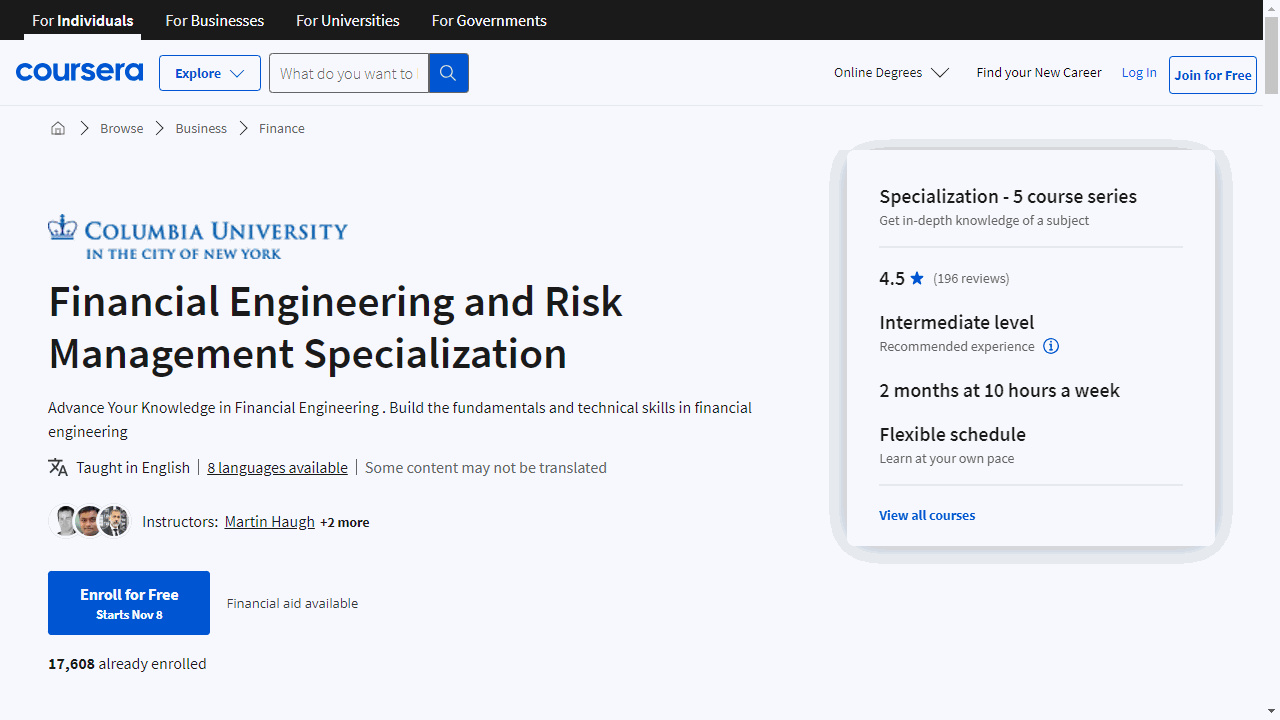

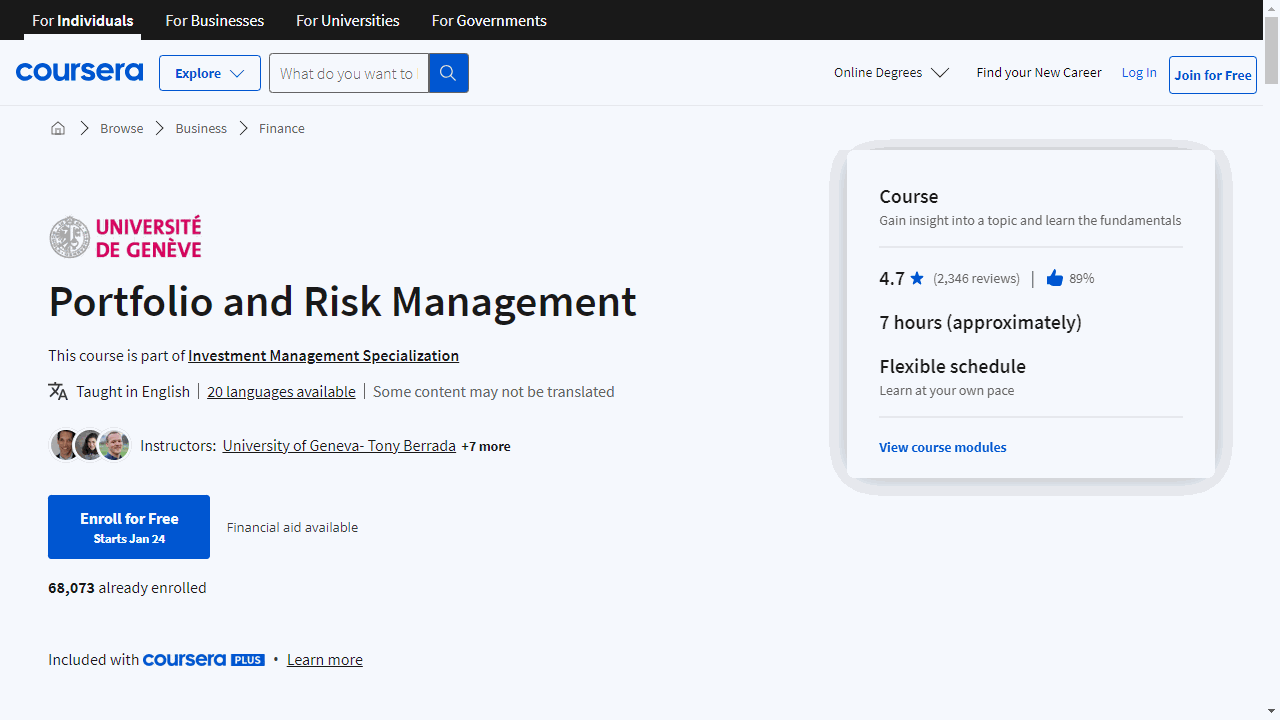

Portfolio and Risk Management

Provider: University of Geneva

Dive into the essentials of portfolio construction and learn to sidestep common pitfalls.

You’ll gain a clear understanding of risk through graphical and numerical analysis of returns.

With UBS experts as guest speakers, you’ll get insider perspectives on the risk-return trade-off and strategies to build a robust portfolio.

The course emphasizes the power of diversification, teaching you how to leverage correlation to your advantage and achieve the efficient frontier—the optimal balance of risk and return.

Explore the nuances of international diversification and the real-world tendencies of investors when it comes to global investment.

Modern Portfolio Theory (MPT) is dissected to reveal its limitations, and you’ll consider how personal factors like age and wealth shape investment decisions.

The role of robo-advisors in creating tailored investment strategies is also examined.

Practical application is a cornerstone of this course.

You’ll master strategic asset allocation, learning definitions and implementation techniques.

Discussions with UBS professionals will guide you through the intricacies of rebalancing and the impact of tactical asset allocation on market timing.

Risk management is thoroughly covered, with a focus on instruments like forwards and options.

You’ll delve into the significance of volatility and currency risk, and learn to quantify risk using Value-at-Risk and Expected Shortfall methods.

Regulatory frameworks, such as Basel recommendations, are explained, providing context for risk mitigation techniques like hedging against market downturns and currency fluctuations.

The course also addresses the value of liquidity in investment decisions.

FinTech Risk Management

Provider: The Hong Kong University of Science and Technology

This course equips you with the skills to tackle the unique challenges in the FinTech sector.

You’ll start by exploring the essentials of finance regulation and compliance, learning about their evolution and why they’re crucial in finance today.

You’ll understand the intricacies of financial compliance, the implications of dodging regulations, and the specifics of managing risks in cryptocurrency ventures.

As you progress, the course delves into FinTech-specific risks, providing you with strategies to manage these through corporate governance.

You’ll get hands-on with risk analysis and the risk management process, learning how to set up effective internal controls and sidestep fraud.

In the third week, the focus shifts to the development and maintenance of business applications, a cornerstone of FinTech.

You’ll identify the risks in application development and master the best practices for system maintenance and change management, ensuring you can handle updates and emergencies with finesse.

The final week is all about resilience, teaching you to create robust business continuity plans and disaster recovery strategies.

You’ll conduct business impact analyses and establish data backup and restoration policies to safeguard against unforeseen events.

Interactive elements like peer collaboration will enhance your learning experience, and a capstone project will allow you to apply your newfound knowledge practically.

Modeling Risk and Realities

Provider: University of Pennsylvania

This course equips you with the skills to build optimization models, manage investments, and make data-driven decisions under uncertainty.

You’ll start by learning to create an optimization model through the Hudson Readers Ad Campaign case study.

This hands-on experience will show you how to use Solver and handle various data inputs effectively.

As you progress, the course introduces you to the complexities of high uncertainty settings.

You’ll get familiar with probability distributions and the concept of risk reduction.

Understanding correlation values will also be a key part of your learning, helping you predict and manage potential risks in business operations.

In the second week, you’ll focus on optimizing in uncertain conditions.

You’ll learn to use scenarios and sensitivity analysis to identify the most efficient outcomes with the least risk—the Efficient Frontier.

Week three shifts your attention to data and visualization.

You’ll master choosing the right probability distributions and conduct hypothesis testing to ensure your data’s fit and relevance.

The final week brings everything together as you model uncertainty with continuous distributions.

You’ll connect random inputs to outputs using simulation, then analyze and interpret these results to evaluate different strategic options.

With PDFs of lecture slides and Excel files provided each week, you’ll have all the resources you need to practice and perfect your skills.

Portfolio Selection and Risk Management

Provider: Rice University

This course gives you a solid foundation in understanding investment risks and how to manage them effectively.

You’ll start by learning the essentials of risk and return, including how to measure returns using both geometric and arithmetic averages.

You’ll also tackle the concept of volatility and explore various risk measures to get a comprehensive view of investment uncertainties.

The course emphasizes practical application, using real stock examples and historical data to illustrate risk-return patterns.

With quizzes, solutions, and detailed lecture handouts, you’ll have all the resources you need to grasp these concepts thoroughly.

When it comes to managing a portfolio, understanding risk and return is just the beginning.

You’ll learn how to calculate expected returns for a portfolio and the importance of diversification in reducing risk.

The course provides clear examples with two, three, and international assets, demonstrating how diversification impacts your investment.

You’ll also have the opportunity to assess your risk tolerance, which is crucial for making informed investment choices.

The course covers utility functions and mean-variance preferences, helping you determine the level of risk you’re comfortable taking on for potential returns.

Advanced topics include the Capital Allocation Line and optimizing the mix of risky and risk-free investments.

You’ll get hands-on experience with Excel Solver and spreadsheets, which are integral tools for practicing these skills.

The course concludes with an exploration of asset pricing models, such as the Capital Asset Pricing Model and the Fama-French three-factor model.

These models are essential for understanding market risks and making educated investment decisions.

Financial Risk Management with R

Provider: Duke University

This course equips you with the skills to navigate the complexities of financial risk using R, a powerful statistical tool.

Starting with the basics, you’ll learn how to retrieve economic data from FRED and calculate both daily and longer-term returns.

This foundational knowledge is crucial for understanding market trends and investment behaviors.

You’ll then get hands-on experience with R and R Studio, ensuring you’re well-versed in these essential analytical tools.

After the first week, you’ll test your knowledge with a quiz, reinforcing what you’ve learned.

As the course progresses, you’ll delve into the core of risk management, studying the distribution of returns and learning to calculate Value-at-Risk (VaR) and Expected Shortfall (ES).

These concepts are key to assessing potential financial losses, and you’ll practice estimating them through simulation techniques.

By the second week, you’re ready to tackle more complex topics like non-normal distributions and the Student-t distribution, which address the irregularities often found in financial data.

You’ll also explore multi-day risk management with the rescaled t distribution model.

Week three introduces you to volatility clustering and the GARCH model, particularly GARCH(1,1), which helps predict investment risk over time.

You’ll gain proficiency in the rugarch package for model estimation and learn to conduct diagnostic tests to validate your risk assessments.

The course concludes with practical applications of the ugarchboot and ugarchroll functions, further enhancing your modeling skills.

A final quiz in week four allows you to demonstrate your newfound expertise.