Time series analysis is a powerful technique used to analyze data that changes over time, allowing us to identify patterns, trends, and seasonality within data.

This ability is essential for forecasting events, understanding historical trends, and making informed decisions in various fields, such as finance, marketing, and economics.

By mastering time series analysis, you can gain valuable insights from data, predict future outcomes, and create more effective strategies for your business or research.

Finding a high-quality time series analysis course on Coursera can be a daunting task, with so many options available.

You’re likely looking for a program that’s comprehensive, engaging, and taught by experts, but also fits your learning style and goals.

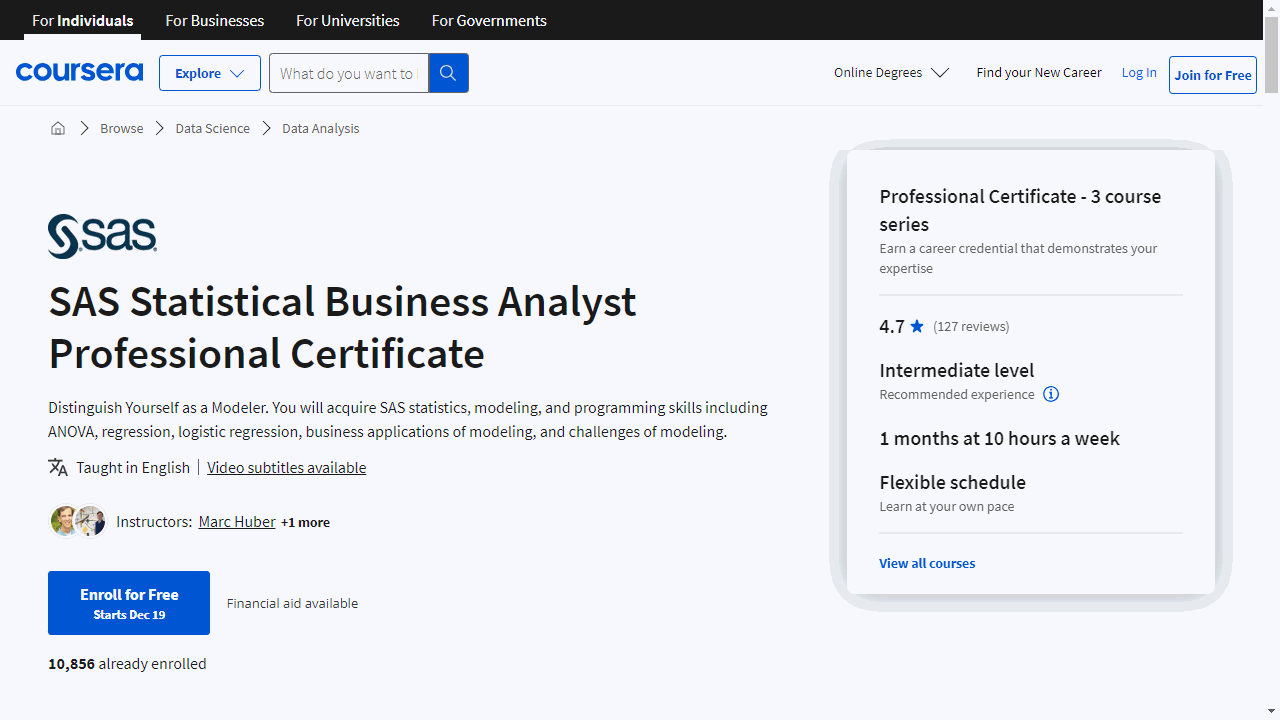

For the best time series course overall on Coursera, we recommend the SAS Statistical Business Analyst Professional Certificate.

This suite of courses provides a robust foundation in time series analysis, with a strong emphasis on practical skills and software tools.

You’ll gain hands-on experience with SAS software, an industry-standard for statistical analysis, and learn how to apply various forecasting techniques to real-world scenarios.

While this is our top pick, there are other great options available.

Keep reading to explore more recommendations, covering different levels of experience and specific areas of focus within time series analysis, so you can find the perfect course to meet your needs.

SAS Statistical Business Analyst Professional Certificate

Provider: SAS

If you’re eager to unlock the patterns hidden within data and forecast future trends accurately, this professional certificate is your key.

This is a suite of courses that build your statistical analysis skills, with a strong emphasis on time series analysis—a key tool for deciphering trends over time.

Start with “Introduction to Statistical Analysis: Hypothesis Testing” to master the essentials.

You’ll tackle t tests, ANOVA, and linear regression, and get a taste of logistic regression.

This course equips you with the know-how to analyze multiple variables simultaneously, setting the stage for more complex predictive modeling.

Move on to “Regression Modeling Fundamentals” to deepen your understanding.

Here, you’ll enhance your time series analysis capabilities, sharpening your ability to forecast and identify patterns.

It’s all about honing your skills in predicting outcomes and exploring the dynamics between different variables.

The course “Predictive Modeling with Logistic Regression using SAS” is where your skills solidify.

Learn to predict individual behaviors with logistic regression, create impactful visualizations, and navigate through missing data challenges.

You’ll also learn to evaluate your model’s performance and understand how to manage multicollinearity among predictors.

Throughout these courses, you’ll become proficient with SAS software, an industry-standard for statistical analysis.

You’ll gain practical experience in managing missing data, interpreting odds ratios, and addressing oversampling.

By the end, your expertise in multivariate analysis and predictive modeling will be robust.

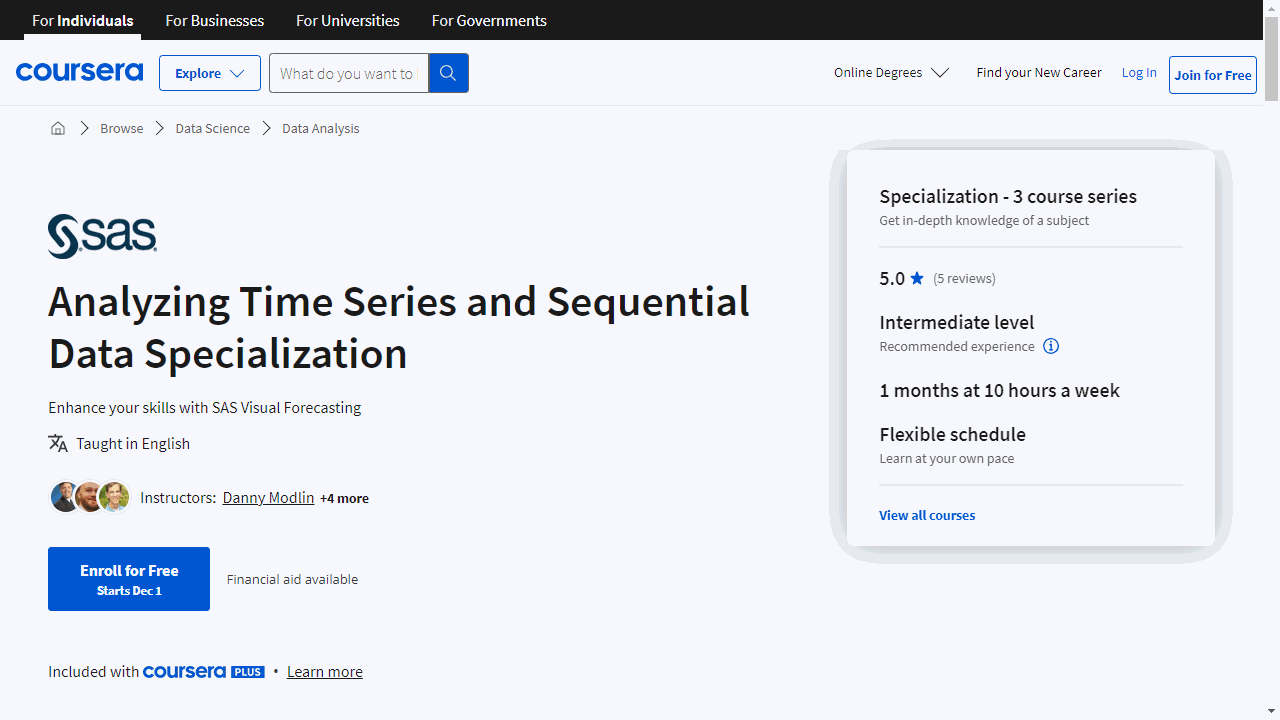

Analyzing Time Series and Sequential Data Specialization

Provider: SAS

This specialization is great if you are looking to deepen your understanding of time series analysis and forecasting, and it’s packed with practical, real-world applications.

The first course, “Creating Features for Time Series Data,” equips you with the tools to expertly navigate data exploration.

You’ll learn to identify and extract meaningful features from time sequences using advanced techniques such as binning and smoothing.

The course also delves into spectral and singular spectrum analysis, teaching you to uncover hidden patterns in your data.

A basic grasp of statistics and some familiarity with matrices will set you up for success in this course.

Moving on, “Building a Large-Scale, Automated Forecasting System” is designed for those ready to tackle big data challenges.

You’ll get hands-on experience with SAS Visual Forecasting tools, learning to craft and refine forecasting models.

This course is ideal if you’re keen on enhancing your machine learning expertise and have some coding background.

It’s a practical dive into managing and interpreting large-scale data sets.

Lastly, “Modeling Time Series and Sequential Data” offers a comprehensive look at various modeling techniques.

From the Box-Jenkins method to Bayesian frameworks and machine learning algorithms, this course covers a broad spectrum of strategies.

You’ll learn to build models that can handle complex, nonlinear relationships and improve forecasting accuracy by combining different approaches into ensemble and hybrid models.

While prior knowledge of SAS software and machine learning is beneficial, it’s not mandatory.

Overall, this specialization provides a robust foundation in econometrics, with a strong emphasis on practical skills and software tools.

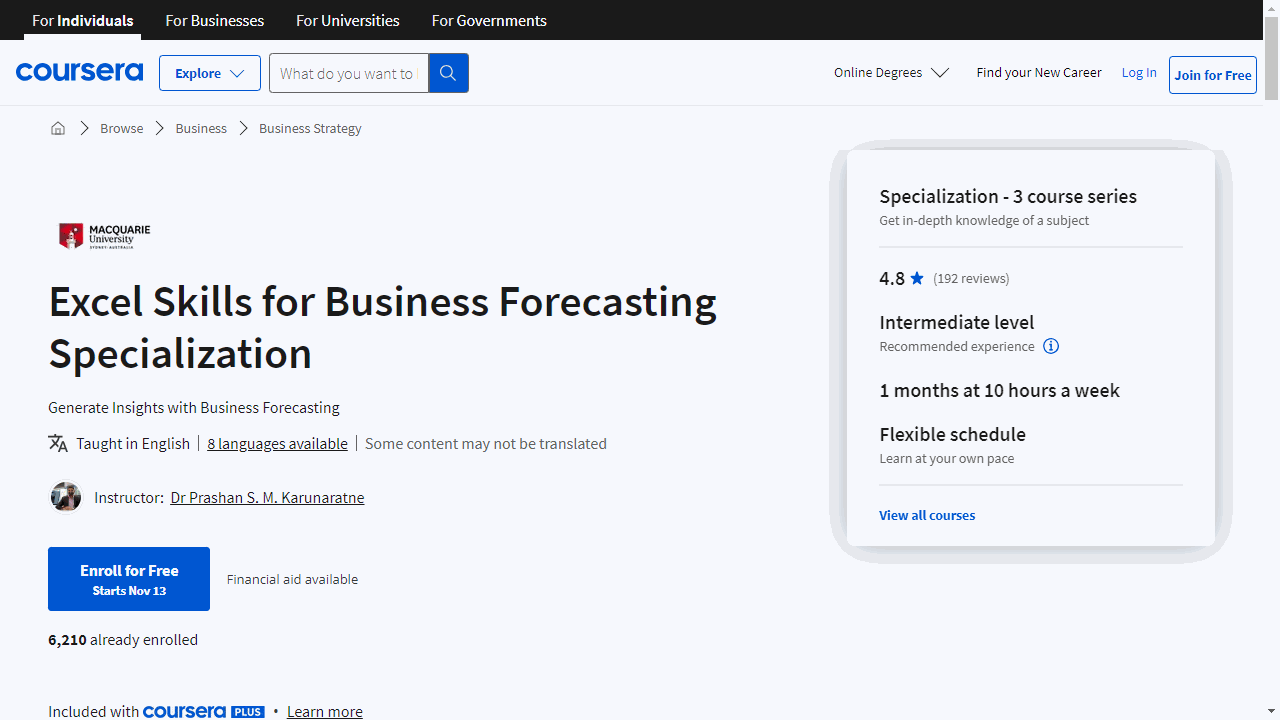

Excel Skills for Business Forecasting Specialization

Provider: Macquarie University

This specialization equips you with the tools and techniques necessary to analyze and predict business trends effectively with Excel.

The specialization begins with “Excel Time Series Models for Business Forecasting,” where you delve into various forecasting methods tailored to different data behaviors.

You’ll learn to interpret and manipulate time series data, applying theoretical concepts directly within Excel.

The course emphasizes practical application, teaching you to build models, graphically represent data, and refine forecasts for accuracy.

You’ll leave with the ability to discern which model best aligns with your business objectives.

Moving forward, “Excel Regression Models for Business Forecasting” introduces you to the causal relationships within your business data.

This course expands your analytical toolkit, covering a range of regression models from simple to multiple, and even autoregressions.

You’ll explore how to identify influential variables and use these insights for forward planning.

The course is designed to help you understand the nuances of each model and apply them to generate actionable business intelligence.

Lastly, “Judgmental Business Forecasting in Excel” complements quantitative techniques with a qualitative approach.

This course acknowledges the limitations of numerical data and guides you through judgmental forecasting methods.

You’ll learn to incorporate business indicators and subjective assessments into your forecasts, using Excel to visualize outcomes.

The course also addresses the impact of biases, ensuring you maintain objectivity in your predictions.

You’ll gain not just a set of Excel skills, but also a strategic approach to business forecasting.

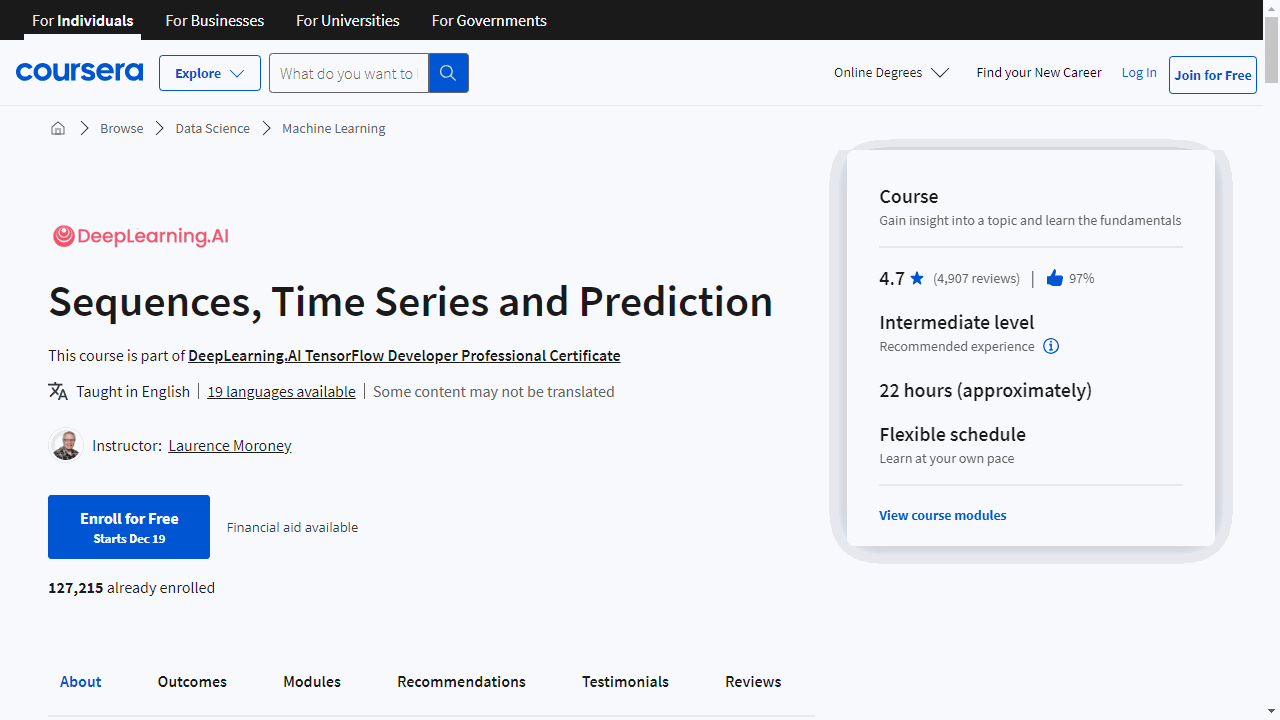

Sequences, Time Series and Prediction

Provider: DeepLearning.AI

Guided by machine learning expert Andrew Ng, you’ll explore the fascinating world of time series data, which tracks changes over regular time intervals – think stock market trends or weather forecasts.

You’ll start by learning how to organize your data into training, validation, and test sets, ensuring your model learns effectively without peeking at the answers.

You’ll also master evaluation metrics to gauge the accuracy of your predictions.

The course then takes you through forecasting techniques, including moving averages and window functions, to help you identify underlying patterns in time series data.

You’ll apply these concepts in practical labs, reinforcing your learning.

As you progress, you’ll delve into neural networks, starting with single-layer networks and advancing to deep neural networks.

These powerful tools enable your models to uncover complex relationships within the data.

In the third week, you’ll tackle Recurrent Neural Networks (RNNs) and Long Short-Term Memory networks (LSTMs), which excel at processing sequential data for even more accurate predictions.

The final week combines convolutions with bidirectional LSTMs, culminating in a real-world project analyzing sunspot data.

This hands-on experience cements your skills and prepares you to apply them to various time series challenges.

Throughout the course, interactive labs and notebooks provide practical experience, and a supportive community is available for troubleshooting and idea exchange.

By the end of this course, you’ll have a robust toolkit for making and improving predictions using machine learning techniques like CNNs and LSTMs in TensorFlow.

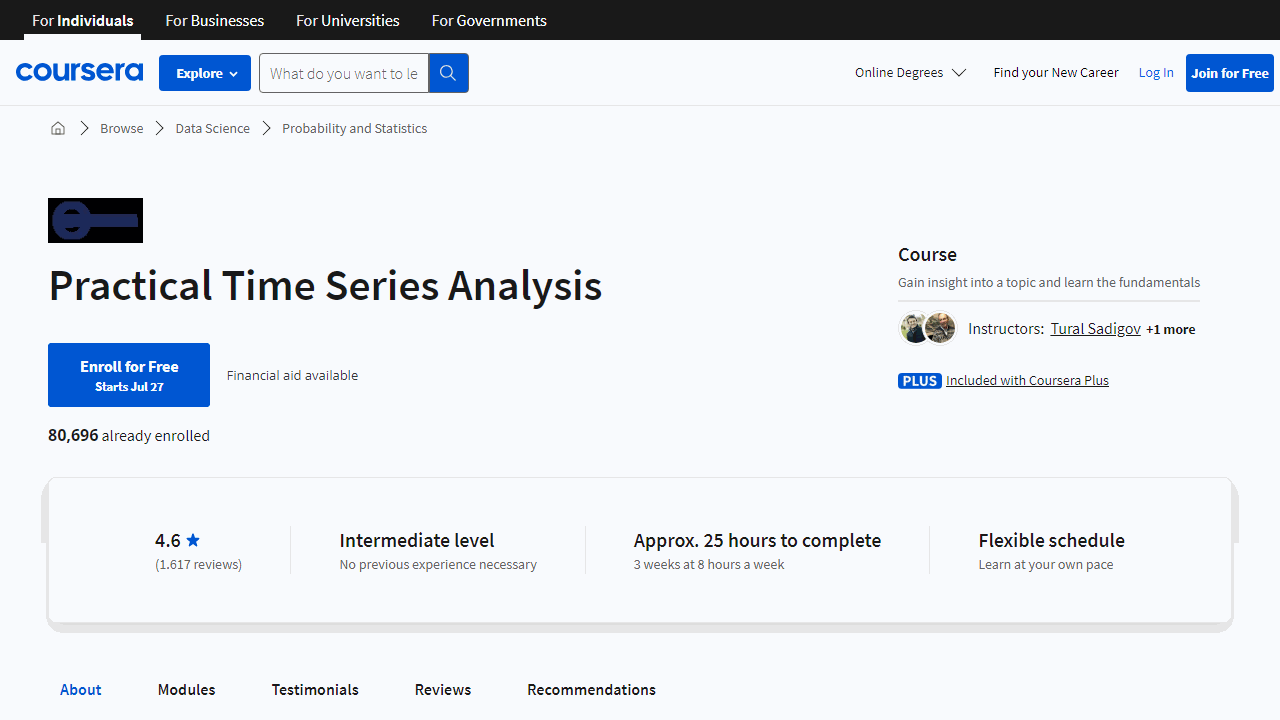

Practical Time Series Analysis

Provider: State University of New York

This course offers a comprehensive introduction to time series analysis, starting from the basics and gradually moving to more advanced topics.

This means that even if you’re new to the subject, you’ll be able to follow along and gain a solid understanding.

One of the strengths of this course is its balance between theory and practice.

You’ll find many examples throughout the course that will help you better understand the material.

Plus, there are practical exercises and quizzes that allow you to apply what you’ve learned, which is crucial for truly mastering the subject.

The course covers a wide range of models, including ARIMA, SARIMA, and exponential smoothing.

This means you’ll gain a broad understanding of the different tools and techniques used in time series analysis.

The course uses R for its programming exercises, which I don’t find ideal, but it’s not the end of the world.

Another advantage of this course is that it provides a good refresher on basic statistics.

So, even if it’s been a while since you’ve taken a stats class, you’ll be able to catch up quickly.

The course also offers a detailed look at other tools used for analyzing time-series data, such as autocorrelation and partial-autocorrelation.

Despite some criticisms, several students found the course to be one of the best they’ve taken on Coursera, praising its practicality and thoroughness.

So, if you’re looking for a course that provides a practical understanding of time series analysis, this could be the one for you.

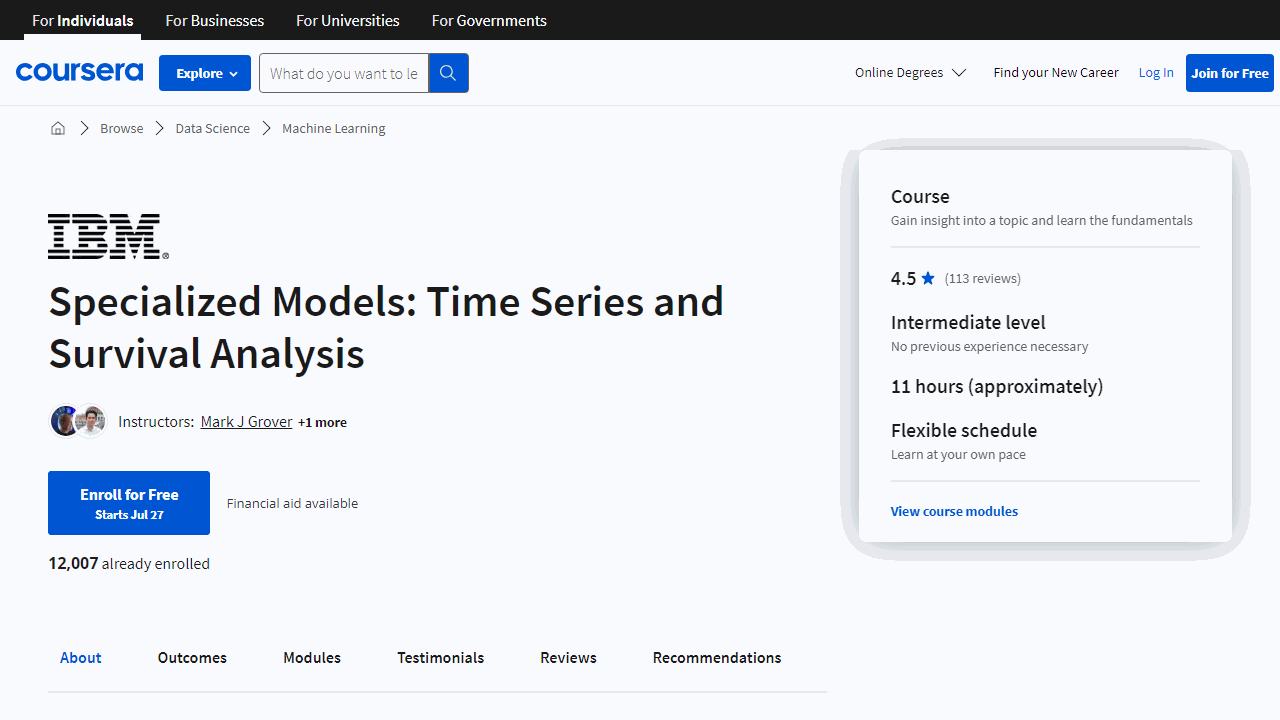

Time Series And Survival Analysis

Provider: IBM

It covers a wide range of time series analysis topics with a special focus on survival analysis, giving you a broad understanding of the field.

One of the standout features of this course is its practicality.

The Python code templates provided are not just theoretical exercises, but useful tools you can apply to real-life problems.

The course material is particularly useful if you’re a data analyst or machine learning practitioner.

It provides a comprehensive overview of the topic, covering a large area of time series analysis.

This includes both classical statistical learning algorithms and deep learning techniques, giving you a well-rounded understanding of the field.

The survival analysis part of the course is particularly interesting and provides a unique perspective on the subject matter.

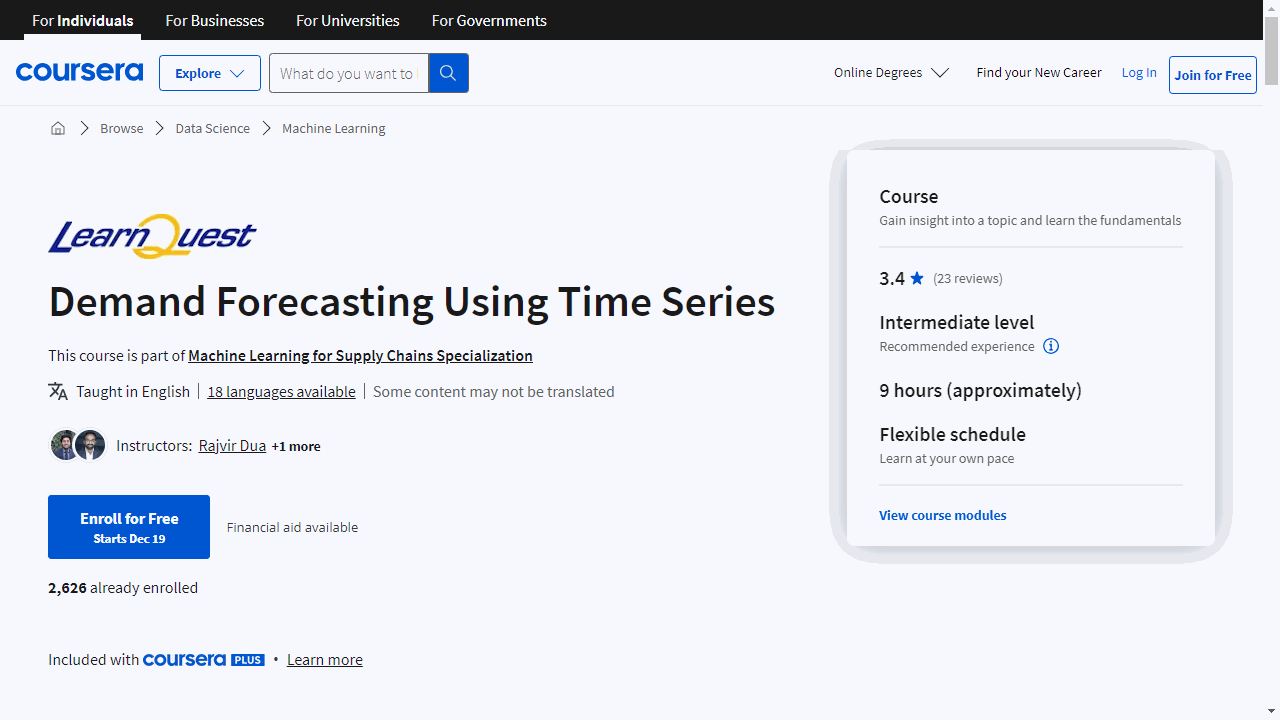

Demand Forecasting Using Time Series

Provider: LearnQuest

This course equips you with the skills to analyze and predict data trends effectively, which is crucial for supply chain management and business forecasting.

Starting with the basics, you’ll learn how to work with datetime objects in Python, a critical skill for managing time-sensitive data.

You’ll also become proficient in using Pandas for data visualization, making complex data sets accessible and interpretable.

As you progress, the course introduces you to machine learning applications within the supply chain, demonstrating how predictive models can optimize inventory levels and reduce costs.

You’ll explore key concepts such as correlation and autoregression, learning how past data can inform future predictions.

A deep dive into ARIMA models will provide you with a powerful forecasting tool, enabling you to make more accurate predictions.

These models are essential for anyone looking to understand time series data in greater depth.

Hands-on programming assignments and a comprehensive course project will allow you to apply your new knowledge to real-world scenarios.

This practical approach ensures that you’re not just learning theory but also gaining valuable experience that can be directly applied to your work or studies.

By the end of the course, you’ll have a strong foundation in time series analysis, backed by the ability to use Python and machine learning techniques to forecast demand.

Bayesian Statistics: Time Series Analysis

Provider: University of California, Santa Cruz

This course gives you a thorough understanding of time series concepts and the practical skills to apply Bayesian methods to real-world data.

You’ll start with the basics of stationarity and work your way through autocorrelation (ACF) and partial autocorrelation functions (PACF), essential for recognizing data patterns.

The course emphasizes hands-on learning, and you’ll use R—a statistical programming language—to simulate time series processes, such as the AR(1) model, and perform Bayesian inference.

As you progress, the course introduces more complex models like AR(p) and ARIMA, teaching you how to select the right model complexity for your data.

You’ll also delve into non-linear dynamic linear models (NDLMs), learning to manage trends and regression effectively.

Practical application is a key component of this course.

You’ll analyze EEG datasets and Google trends, applying filtering, smoothing, and forecasting techniques using R. This direct experience prepares you to tackle similar challenges in your career or research.

By the end of the course, you’ll have a solid foundation in Bayesian statistics and be equipped to handle various time series analysis tasks.

The Econometrics of Time Series Data

Provider: Queen Mary University of London

This course equips you with the essential skills to analyze and forecast economic data over time.

You’ll start by mastering the basics of time series observations, including how to effectively detrend data to uncover underlying trends.

Key concepts like memory and autocorrelation are central to the course, helping you understand the relationships within your data.

Practical application is a cornerstone of this course, with extensive use of R software to bring theory to life.

You’ll learn to generate and analyze time series data, estimate autocorrelation functions, and detrend data—all within R. This hands-on approach ensures you’ll gain skills that are directly applicable to real-world scenarios.

The course also delves into the importance of historical data, teaching you how past events can influence current trends.

You’ll tackle the challenges of detrending and learn to avoid common pitfalls that can skew your analysis.

Forecasting is a major focus, with lessons on using econometrics to predict future trends and assess the impact of unexpected shocks.

You’ll practice creating forecasts in R and learn methods to verify their accuracy.

When dealing with non-stationary time series, which can lead to spurious results, the course introduces the Dickey and Fuller test to determine stationarity.

This is crucial for accurate data analysis.

Volatility modeling is another highlight, with in-depth coverage of ARCH and GARCH models.

These models are vital for understanding fluctuations in financial markets, and you’ll gain experience estimating them using R, allowing you to determine the best fit for your data.

By the end of the course, you’ll have a deep understanding of cointegration and its role in revealing long-term relationships in economic data.

Introduction to Vertex Forecasting and Time Series in Practice

Provider: Google Cloud

This course is a blend of theory and hands-on experience, designed to equip you with the skills to analyze and predict time-based data effectively.

Starting with the essentials, you’ll grasp sequence models and time series patterns, laying the groundwork for more complex concepts.

You’ll become familiar with forecasting notations, essential for identifying data trends and seasonal shifts.

The course then introduces you to forecasting tools like BigQuery ML and Vertex AI, where you’ll actively engage in building a demand forecasting model.

This practical approach ensures you not only learn the concepts but also apply them.

Data handling is crucial in forecasting, and you’ll cover the entire spectrum—from uploading and converting data to feature engineering.

You’ll adopt best practices in data preparation, setting the stage for accurate forecasting models.

Training your model is a critical step, and you’ll learn to determine the right context window and forecast horizon.

The course also covers optimization objectives, guiding you to refine your model for peak performance.

Evaluating and improving your model is next, with training on data splits, backtesting, and evaluation metrics.

You’ll gain the know-how to enhance your model’s accuracy and reliability.

As you progress, the course delves into MLOps with Vertex AI Pipelines, teaching you to streamline the prediction process.

You’ll gain efficiency in making and using predictions, a skill highly valued in the industry.

The capstone of the course is the creation of a forecasting pipeline using Vertex AI Python SDKs.

You’ll tackle real-world challenges like model drift and retraining, and learn to automate your forecasting pipeline.

Your final project involves developing a comprehensive forecasting solution for a retail scenario.

This hands-on lab cements your learning, as you apply the course concepts to a practical use case, including a pilot study.

By the end of this course, you’ll have a robust understanding of time series and forecasting, backed by the practical experience of using Google Cloud’s powerful tools.

Also check our posts on: