Blockchain technology is revolutionizing the way we interact with data and each other.

By creating decentralized, secure, and transparent systems, blockchain is opening up new possibilities in finance, supply chain management, and beyond.

Learning blockchain can equip you with in-demand skills and give you a competitive edge in a rapidly growing field.

Finding a high-quality blockchain course can be overwhelming with so many options available.

You want a course that’s engaging, comprehensive, and taught by experts, but you also need to make sure it aligns with your learning style and goals.

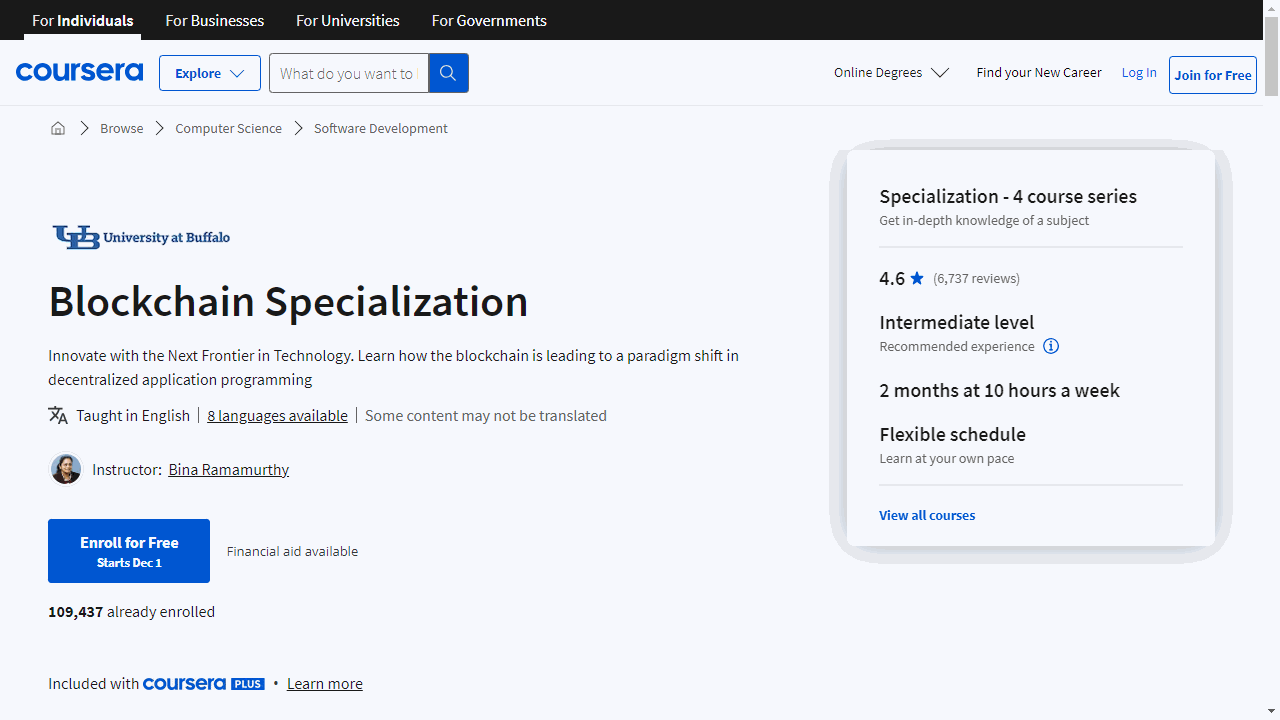

For the best blockchain course overall on Coursera, we recommend the Blockchain Specialization offered by the University at Buffalo and professor Bina Ramamurthy.

This course stands out for its hands-on approach, taking you from the fundamentals of blockchain to practical application with smart contracts and decentralized applications (Dapps).

You’ll learn to set up and manage a blockchain, design and deploy smart contracts, and build real-world applications on the blockchain, all while gaining a deep understanding of the underlying technology.

This is just one of the many excellent blockchain courses available on Coursera.

Whether you’re a beginner or an experienced developer, there’s a course out there to help you master blockchain technology.

Keep reading for more recommendations tailored to different skill levels and interests.

Blockchain Specialization

This specialization is offered by the University at Buffalo and professor Bina Ramamurthy.

Starting with “Blockchain Basics,” you’ll unravel the complexities of Bitcoin and Ethereum protocols.

This course isn’t just theoretical; you’ll actively engage in setting up an Ethereum blockchain, managing transactions, and understanding the mechanics of mining.

Key concepts like decentralized networks and immutable ledgers are broken down into digestible pieces, ensuring you grasp the foundational elements of blockchain technology.

“Smart Contracts” takes your learning a notch higher.

Here, you’ll delve into the Solidity language, crafting smart contracts that can automate and enforce agreements without intermediaries.

Using the Remix IDE, you’ll design, test, and deploy these contracts, gaining hands-on experience that’s crucial for anyone looking to innovate in the blockchain space.

In “Decentralized Applications (Dapps),” you’ll apply your knowledge to build applications on the blockchain.

Through practical exercises with Truffle IDE, you’ll learn the architecture of Dapps and develop skills to create applications that are both functional and secure.

This course is about turning concepts into real-world solutions.

The final course, “Blockchain Platforms,” broadens your perspective to include various blockchain ecosystems.

You’ll explore platforms like Hyperledger and Microsoft Azure, confronting challenges such as privacy and scalability.

This course is designed to round out your knowledge, preparing you to engage with the blockchain industry at a strategic level.

Each course is enriched with interactive content, from videos to hands-on exercises, ensuring that your learning experience is both engaging and effective.

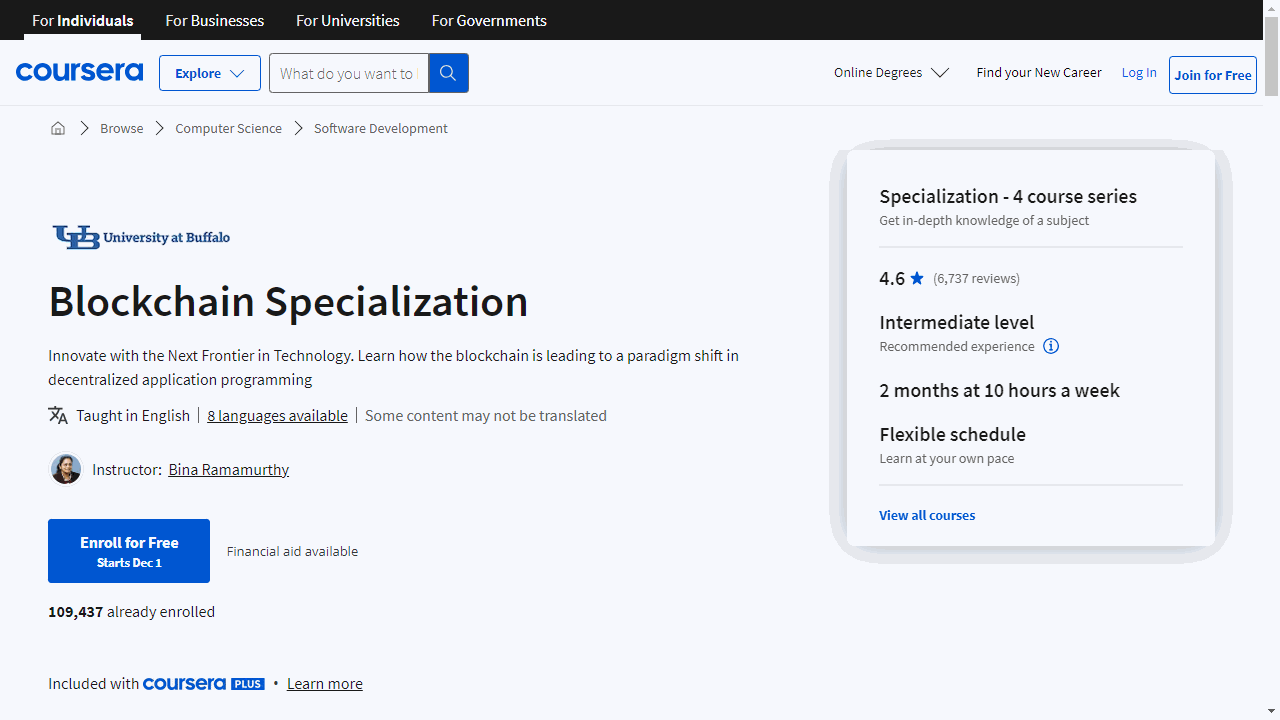

Blockchain Revolution Specialization

The journey begins with “Introduction to Blockchain Technologies,” where you’ll unravel the limitations of the current internet for businesses and grasp the fundamentals of blockchain.

You’ll decode concepts like mining and public key cryptography, and understand the design principles that make blockchain revolutionary.

Moving on to “Transacting on the Blockchain,” you’ll discover how blockchain is reshaping the financial landscape by eliminating intermediaries.

Learn about cryptoassets, smart contracts, and how blockchain can democratize the economy, making transactions faster and more equitable.

In “Blockchain and Business,” the focus shifts to the impact of blockchain on corporate structures.

You’ll explore new business models, understand how blockchain can safeguard intellectual property, and consider the technology’s influence on executive roles.

The final course, “Blockchain Opportunity Analysis,” is where theory meets practice.

You’ll identify a blockchain application within your industry and develop a project, using tools and insights from blockchain practitioners.

This capstone course culminates in a peer-reviewed analysis, ready to present to stakeholders or investors.

This specialization equips you with not just knowledge, but actionable skills.

It’s an investment in your understanding of blockchain that could pay dividends in your career or entrepreneurial ventures.

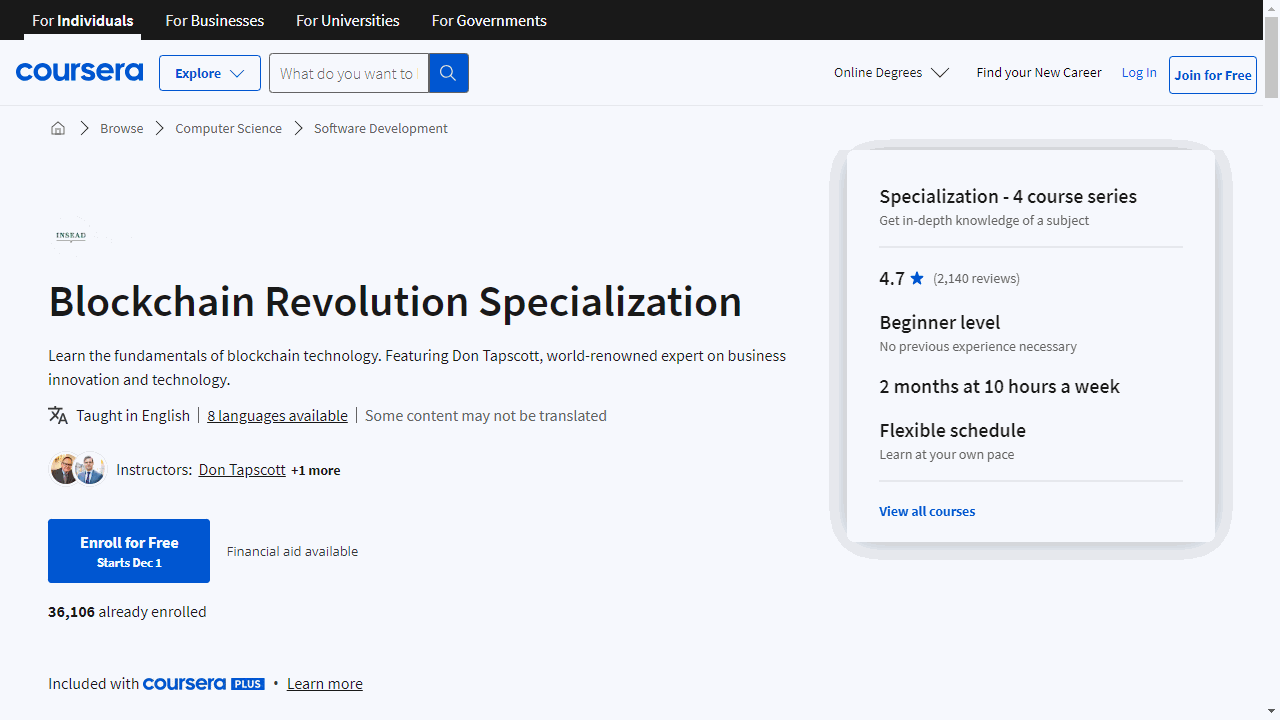

Blockchain Revolution in Financial Services Specialization

This comprehensive program demystifies the technology and positions you to lead in the evolving digital economy.

The journey begins with “Introduction to Blockchain for Financial Services,” where you’ll dissect the internet’s limitations and blockchain’s innovative solutions.

You’ll grasp essential concepts like mining and public key cryptography, and understand blockchain’s seven design principles.

This foundational knowledge sets the stage for practical application in the financial sector.

“Blockchain, Cryptoassets, and Decentralized Finance” propels you into the world of digital assets, smart contracts, and the promise of a more equitable financial landscape.

You’ll explore the inefficiencies of current systems and how blockchain’s transparency and efficiency are poised to transform them.

By demystifying terms like “tokenization” and “distributed ledgers,” you’ll gain a clear view of the technology’s potential.

In “Blockchain Transformations of Financial Services,” you’ll analyze blockchain’s disruptive power across eight financial functions.

The course reveals how blockchain can streamline global payments and reshape the roles of financial managers, offering a forward-looking perspective on the industry’s trajectory.

The capstone, “Blockchain in Financial Services: Strategic Action Plan,” is where theory meets practice.

You’ll develop a Strategic Action Plan to address a real challenge in financial services, leveraging blockchain as a solution.

This hands-on project, supported by insights from industry practitioners and a rich collection of case studies, culminates in a peer-reviewed strategy ready for real-world implementation.

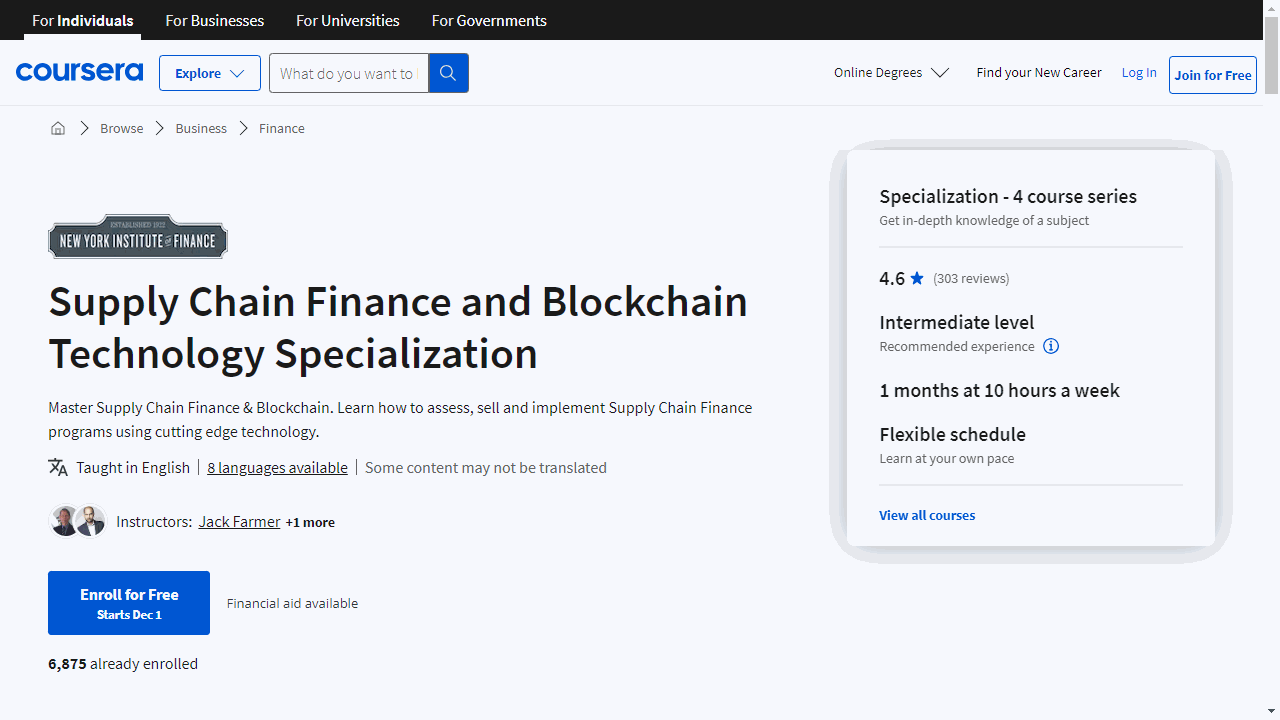

Supply Chain Finance and Blockchain Technology Specialization

The specialization begins with “Introduction to Supply Chain Finance & Blockchain Technology,” where you’ll unravel the fundamentals of supply chain finance and discover blockchain’s role in reshaping the industry.

You’ll learn to assess and enhance working capital, and understand the dynamics of implementing supply chain finance solutions.

Moving on to “Key Success Factors in Supply Chain Finance,” the course hones in on the practical aspects of creating successful financing programs.

It covers customer identification, program pricing, and supplier engagement strategies, ensuring you can conduct thorough pre-sales and supplier analyses.

“Supply Chain Finance Market and Fintech Ecosystem” expands your perspective, providing insights into market size, growth, and the key players.

This course prepares you to navigate the market with an understanding of the various funding sources and trends that could impact the future of supply chain finance.

Lastly, “Future Development in Supply Chain Finance and Blockchain Technology” propels you into the technological advancements shaping the industry’s future.

You’ll explore the implications of AI, APIs, and Distributed Ledger Technology, gaining foresight into how these innovations can be applied within supply chain finance.

Throughout the specialization, you’ll acquire targeted skills such as risk management, blockchain implementation, and financial innovation.

This curated learning path not only deepens your understanding of supply chain finance but also positions you to leverage blockchain technology effectively.

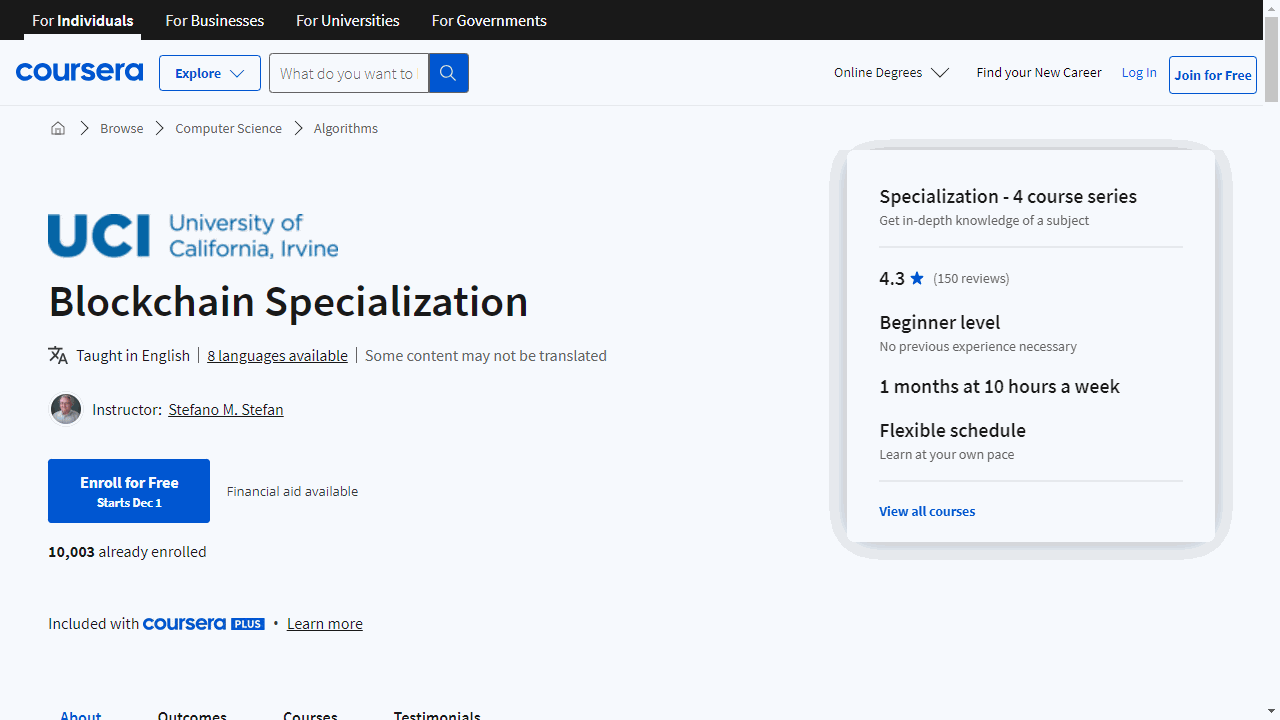

Blockchain Specialization

The first course, “The Blockchain,” lays the foundation, introducing you to the essential concepts and real-world applications, particularly in cryptofinance.

It’s hands-on, with exercises designed to solidify your learning, and it sets the stage for what’s to come.

You’ll need two key texts: “Blockchain Basics: A Non-Technical Introduction in 25 Steps” and “The Internet of Money, Volume Two.”

These books are not just for reading; they’re tools that will guide you through assignments and deepen your understanding.

As you progress to “Cryptography and Hashing Overview,” the focus shifts to the mechanisms that ensure transaction security.

This course demystifies the technology that keeps blockchain trustworthy, a must-know if you’re serious about the field.

In “The Merkle Tree and Cryptocurrencies,” you’ll apply your knowledge to understand how new transactions are added securely to the blockchain.

The course also introduces you to consensus mechanisms like proof of work and proof of stake, which are critical for blockchain’s reliability.

The final course, “The Blockchain System,” ties everything together.

It shows you how transactions are authenticated and how the blockchain maintains a consistent state across all nodes.

You’ll also explore practical applications of blockchain in business, preparing you to apply your knowledge in the real world.

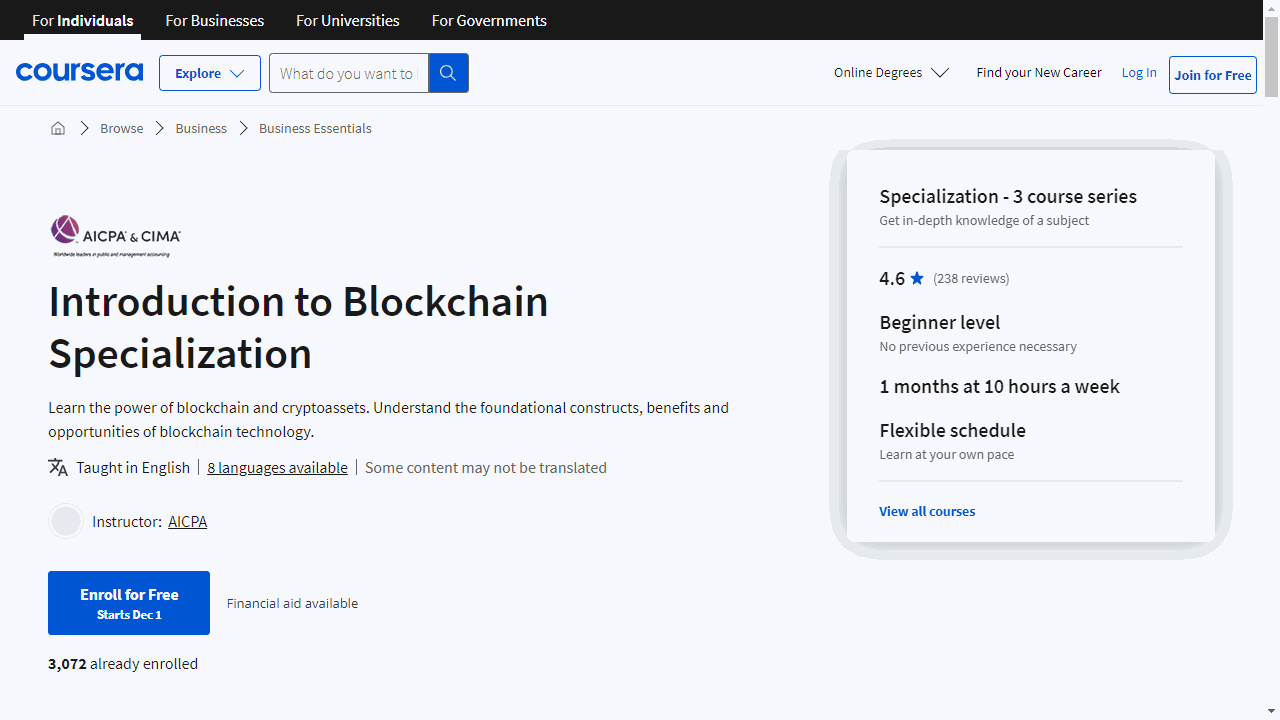

Introduction to Blockchain Specialization

The specialization starts with a dive into “Blockchain Evolution and Technology Concepts” to grasp the transformative journey of blockchain technology.

This course breaks away from the mundane with dynamic animated videos that enhance learning and retention.

You’ll gain a clear understanding of blockchain’s past, present, and potential future.

Then, broaden your perspective with “Blockchain Opportunities Beyond Crypto Assets.”

This course reveals blockchain’s impact beyond digital currencies, highlighting its potential to revolutionize various industries.

Discover how blockchain can innovate fields like finance and logistics, proving its versatility beyond just cryptocurrency.

Lastly, “Understanding, Using, and Securing Crypto and Digital Assets” equips you with the knowledge to confidently navigate the world of digital assets.

Learn the ins and outs of cryptocurrency usage and the best practices for securing your digital assets against threats.

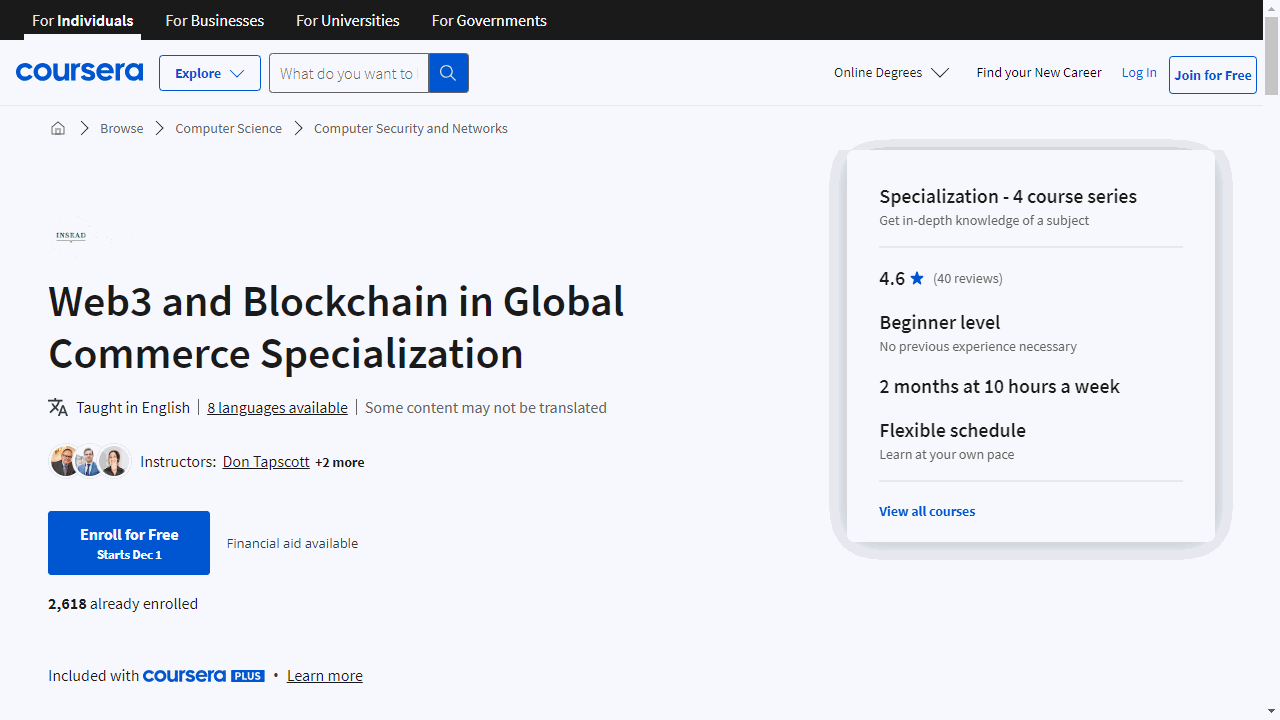

Web3 and Blockchain in Global Commerce Specialization

The specialization kicks off with “Introduction to Blockchain for Global Commerce,” where you’ll demystify the core concepts of blockchain.

This course lays a solid foundation, explaining the mechanics of trust, the intricacies of digital assets like cryptocurrencies and NFTs, and the principles that underpin blockchain’s potential to reshape commerce.

The second course, “Web3 and Blockchain Transformations in Global Supply Chains,” zooms in on the practical applications of blockchain in streamlining global trade.

You’ll learn how blockchain can enhance transparency, reduce fraud, and simplify transactions.

Real-world insights from FedEx’s Dale Chrystie ensure that the lessons are grounded in industry practices, offering a lens into the technology’s tangible benefits for supply chains.

Leadership within the blockchain space is the focus of “Web3 and Blockchain Leadership for Transformation.”

Here, you’ll delve into the dynamics of the blockchain ecosystem, exploring how different stakeholders can drive innovation.

The course addresses the complexities of collaboration and standardization, preparing you to navigate and lead blockchain initiatives effectively.

The final course, “Blockchain Opportunity Analysis for Global Commerce,” is where theory meets practice.

You’ll identify a commerce challenge and design a blockchain-based solution, using tools and methodologies employed by entrepreneurs.

This capstone project is an opportunity to synthesize your learning and produce a compelling analysis that could influence decision-makers or attract investment.

Throughout the specialization, you’ll engage with a blend of theoretical knowledge and practical insights.

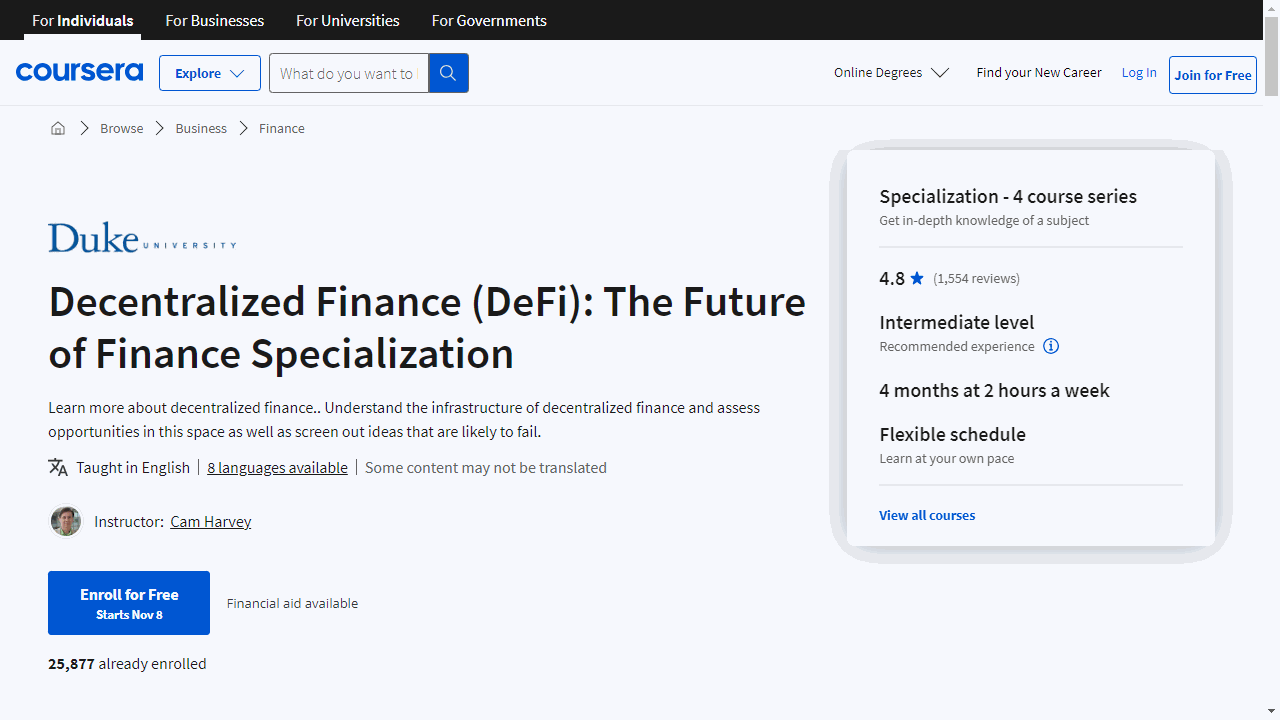

Decentralized Finance (DeFi): The Future of Finance Specialization

This series of courses, taught by Professor Campbell R. Harvey of Duke University, offers a deep dive into the rapidly evolving DeFi landscape.

The journey begins with “Decentralized Finance (DeFi) Infrastructure,” where you’ll trace the evolution of finance from bartering to blockchain.

This course doesn’t just recount history; it equips you with a solid understanding of the foundational elements of DeFi, such as smart contracts and cryptocurrencies.

You’ll learn about the inefficiencies and limitations of the current financial system and how DeFi addresses these issues.

Moving on to “Decentralized Finance (DeFi) Primitives,” you’ll delve into the mechanics of tokens, including the burgeoning world of NFTs.

The course demystifies the process of token creation and destruction and introduces you to the concept of decentralized exchanges.

By contrasting these with centralized counterparts, you’ll gain insight into the benefits and workings of platforms and participants, like Automated Market Makers (AMMs) and liquidity providers.

The third course, “Decentralized Finance (DeFi) Deep Dive,” is where theory meets practice.

Here, you’ll examine leading DeFi protocols, understanding their mechanisms and applications.

From credit and lending platforms like Aave and Compound to decentralized exchanges such as Uniswap, this course offers practical examples, including executing arbitrage transactions, to solidify your learning.

Finally, “Decentralized Finance (DeFi) Opportunities and Risks” rounds out the specialization by addressing the potential pitfalls of this nascent technology.

You’ll explore various risks, including smart contract vulnerabilities and regulatory challenges.

This course provides a balanced perspective, ensuring you’re well-informed about the complexities of DeFi.

This specialization is more than just a set of courses; it’s an investment in your financial literacy in a domain that’s poised to play a significant role in the future of finance.

Whether you’re a finance professional looking to stay ahead of the curve or a curious learner eager to understand the next wave of financial innovation, these courses offer valuable insights and hands-on knowledge.