Fintech, or financial technology, is revolutionizing the way we manage our money, invest, and borrow.

It encompasses a wide range of technologies, from mobile payments and blockchain to artificial intelligence and robo-advisors, all aimed at improving efficiency, accessibility, and security within the financial industry.

Learning about fintech can empower you to navigate the ever-changing landscape of personal finance, pursue exciting career opportunities in the growing fintech sector, and even contribute to shaping the future of finance.

Finding the right fintech course on Coursera can be a daunting task.

With so many options available, you’re looking for a program that’s comprehensive, engaging, and taught by experts, but also fits your learning style and goals.

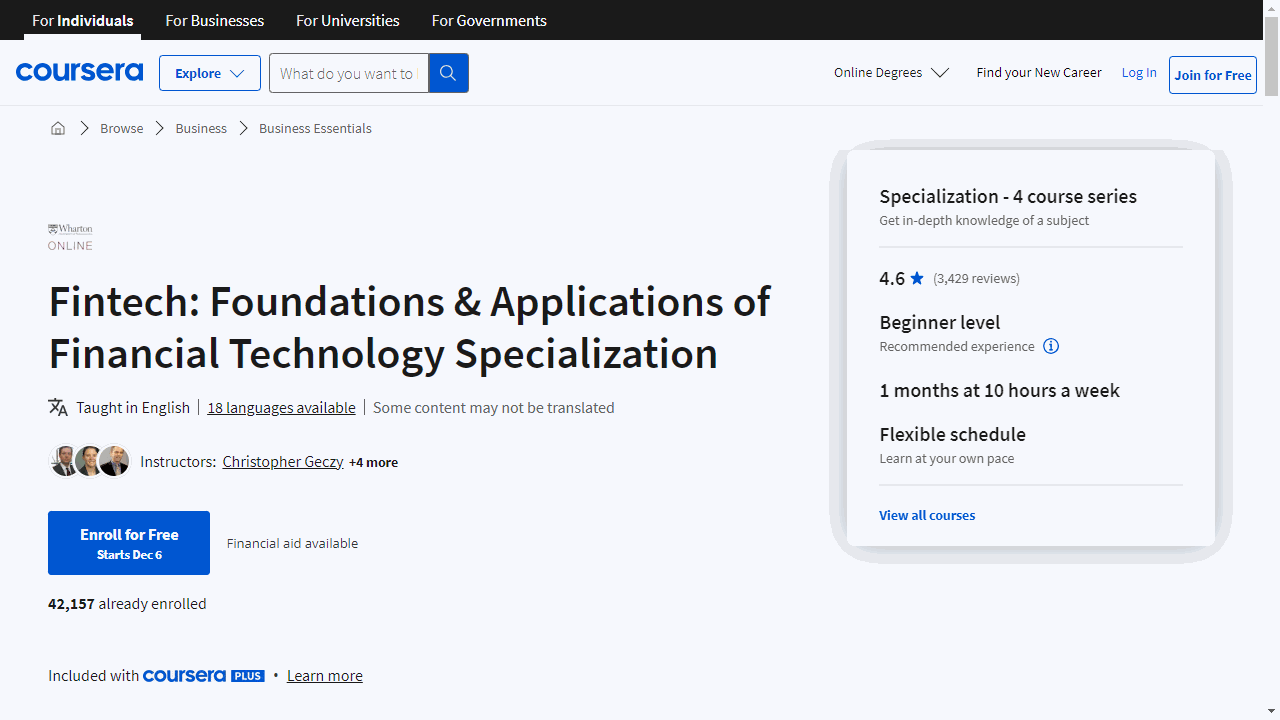

For the best fintech course overall on Coursera, we recommend the Fintech: Foundations & Applications of Financial Technology Specialization from the University of Pennsylvania.

This specialization offers a well-rounded introduction to fintech, covering topics like payment systems, cryptocurrency, lending, and the application of AI in finance.

It’s taught by leading academics and practitioners, providing a blend of theoretical knowledge and real-world insights.

While this program is our top pick, there are other excellent courses available on Coursera that delve deeper into specific areas of fintech or are tailored to different learning levels.

Keep reading for our full list of recommendations and find the perfect fintech course to jumpstart your journey.

Fintech: Foundations & Applications of Financial Technology Specialization

This specialization is offered by University of Pennsylvania.

Start with “FinTech: Foundations, Payments, and Regulations” to grasp investment strategies influenced by fintech.

Professors Natasha Sarin and Chris Geczy will guide you through payment systems and regulatory frameworks.

You’ll learn to identify fintech tools, navigate regulations, and develop strategies for personal or business use.

This course is accessible even if you’re new to the subject.

Then, “Cryptocurrency and Blockchain: An Introduction to Digital Currencies” demystifies digital currencies.

Professors Jessica Wachter and Sarah Hammer provide a framework for understanding cryptocurrencies and blockchain.

You’ll explore digital signatures, assess cryptocurrency risks, and consider their place in your investment portfolio.

Prior knowledge isn’t necessary, though familiarity with fintech foundations can be beneficial.

In “Lending, Crowdfunding, and Modern Investing,” Professor David Musto delves into modern investment avenues like robo-advising and crowdfunding.

You’ll apply theoretical frameworks to actual case studies, learning to evaluate risks and optimize investment returns.

This course stands alone but builds on the knowledge from previous courses.

Lastly, “Application of AI, InsurTech, and Real Estate Technology” reveals how AI and Machine Learning are reshaping insurance and real estate.

Professor Chris Geczy, along with insights from Vanguard’s Warren Pennington, will show you the impact of InsurTech and Real Estate Tech.

You’ll leave with an understanding of AI’s role in future financial landscapes.

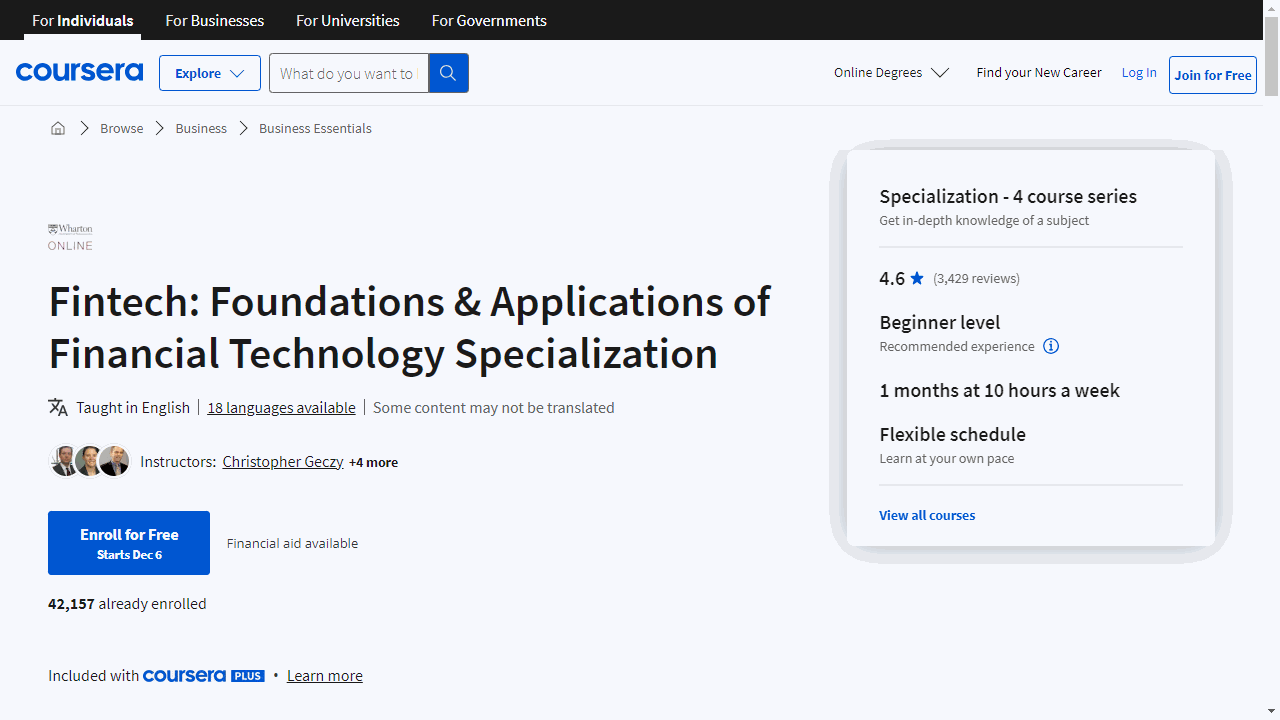

Financial Technology (Fintech) Innovations Specialization

This specialization is offered by University of Michigan.

In “The Future of Payment Technologies,” you’ll delve into the mechanics of modern payment methods, including digital wallets and mobile payments.

You’ll learn how payments function and the innovations that are streamlining transactions.

If you’re keen to understand payment processing and create value propositions for emerging technologies, this course is for you.

“Blockchain and Cryptocurrency Explained” demystifies the technology behind Bitcoin.

It breaks down blockchain’s technical aspects, such as decentralization and consensus algorithms, and evaluates cryptocurrency’s effectiveness as an asset and payment method.

If you aim to articulate blockchain’s applications and assess its business implications, this course provides the foundation.

For those interested in capital acquisition, “Raising Capital: Credit Tech, Coin Offerings, and Crowdfunding” examines how technology has revolutionized funding.

You’ll explore credit scoring, tokenization, and the nuances of crowdfunding.

If you want to navigate the landscape of modern capital-raising, including differentiating between crypto-based models, this course offers the necessary expertise.

Lastly, “Innovations in Investment Technology: Artificial Intelligence” covers the intersection of AI and investment.

You’ll compare traditional and AI-driven investment strategies, including the use of robo-advisors.

If you’re curious about AI’s role in portfolio management and trading decisions, this course will clarify these concepts.

Each course is designed to build your proficiency in fintech, from understanding payment systems to leveraging AI in investments.

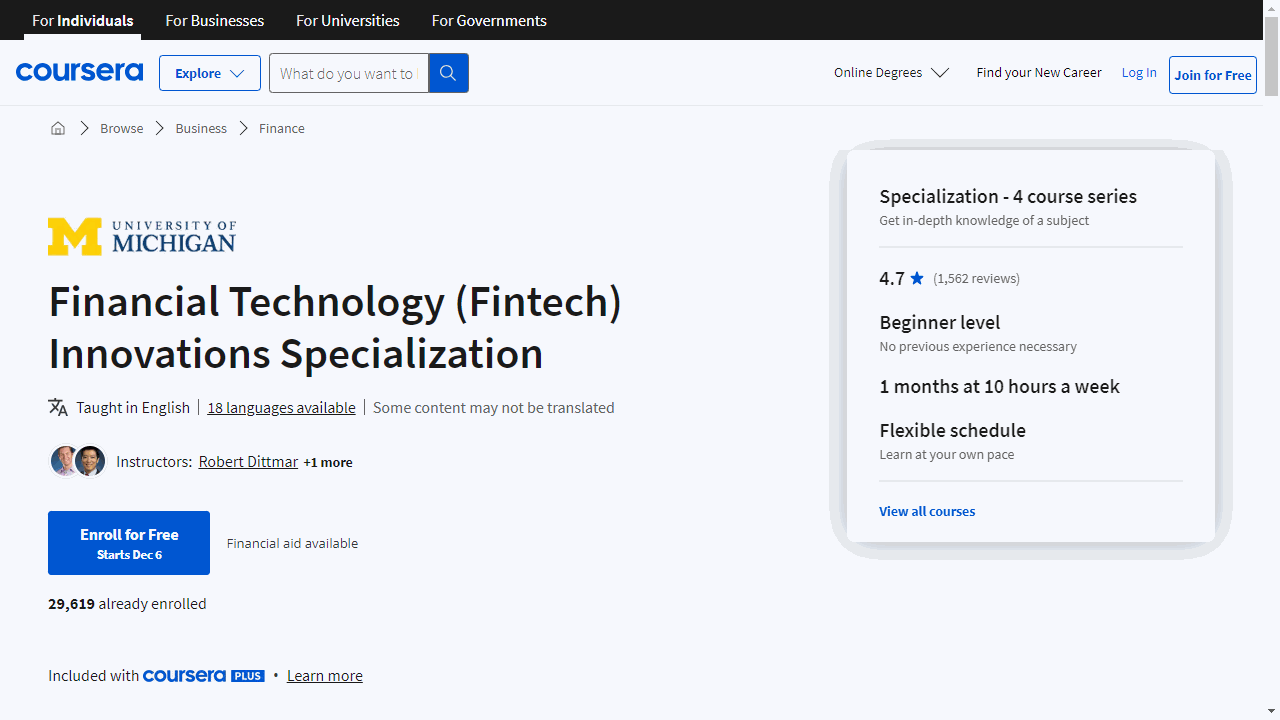

Digital Transformation in Financial Services Specialization

This specialization is offered by Copenhagen Business School.

It equips you with the skills needed to navigate the evolving landscape of financial technology.

The first course, “Digital Competition in Financial Services,” sets the stage by merging finance with digital innovation.

In just four weeks, you’ll understand the transformative forces reshaping the financial sector and get a glimpse into the strategies of leading financial companies.

You’ll also start preparing for the Capstone Project, where you’ll apply your newfound knowledge to devise a digital strategy for a financial firm.

Moving on, “FinTech and the Transformation in Financial Services” delves into the mechanics of modern financial services.

You’ll dissect payment infrastructures, explore various payment instruments, and grasp the significance of regulatory frameworks in fostering innovation.

This course is your roadmap to understanding the financial revolution brought about by technology.

In “Innovation Strategy: Developing Your Fintech Strategy,” you’ll connect innovation with business strategy within the fintech realm.

You’ll learn to craft effective fintech strategies using both internal and external innovation tools, drawing inspiration from industry giants like Google, Apple, and Amazon.

The specialization culminates with the “Digital Transformation of Financial Services - Capstone Project.”

Here, you’ll select a real-world company and create a digital transformation strategy, synthesizing insights from the entire program.

This hands-on project will challenge you to apply your skills in a practical setting, preparing you for real-world fintech challenges.

Decentralized Finance (DeFi): The Future of Finance Specialization

This series of courses, taught by Professor Campbell R. Harvey of Duke University, offers a deep dive into the rapidly evolving DeFi landscape.

The journey begins with “Decentralized Finance (DeFi) Infrastructure,” where you’ll trace the evolution of finance from bartering to blockchain.

This course doesn’t just recount history; it equips you with a solid understanding of the foundational elements of DeFi, such as smart contracts and cryptocurrencies.

You’ll learn about the inefficiencies and limitations of the current financial system and how DeFi addresses these issues.

Moving on to “Decentralized Finance (DeFi) Primitives,” you’ll delve into the mechanics of tokens, including the burgeoning world of NFTs.

The course demystifies the process of token creation and destruction and introduces you to the concept of decentralized exchanges.

By contrasting these with centralized counterparts, you’ll gain insight into the benefits and workings of platforms and participants, like Automated Market Makers (AMMs) and liquidity providers.

The third course, “Decentralized Finance (DeFi) Deep Dive,” is where theory meets practice.

Here, you’ll examine leading DeFi protocols, understanding their mechanisms and applications.

From credit and lending platforms like Aave and Compound to decentralized exchanges such as Uniswap, this course offers practical examples, including executing arbitrage transactions, to solidify your learning.

Finally, “Decentralized Finance (DeFi) Opportunities and Risks” rounds out the specialization by addressing the potential pitfalls of this nascent technology.

You’ll explore various risks, including smart contract vulnerabilities and regulatory challenges.

This course provides a balanced perspective, ensuring you’re well-informed about the complexities of DeFi.

This specialization is more than just a set of courses; it’s an investment in your financial literacy in a domain that’s poised to play a significant role in the future of finance.

Whether you’re a finance professional looking to stay ahead of the curve or a curious learner eager to understand the next wave of financial innovation, these courses offer valuable insights and hands-on knowledge.

Entrepreneurial Finance: Strategy and Innovation Specialization

This specialization is offered by Duke University.

It equips you with essential financial knowledge tailored for the startup environment and the evolving landscape of financial technology.

Prior knowledge of R is recommended to fully benefit.

In “Startup Valuation Methods,” you’ll master the art of determining a startup’s worth through practical Excel exercises, focusing on discounted cash flow analysis.

This course demystifies the valuation process and introduces you to various investment securities, preparing you to make informed decisions about potential deals.

“Financing for Startup Businesses” guides you through creating capitalization tables in Excel, a crucial tool for visualizing your startup’s financing options.

You’ll explore innovative digital financing methods, including crowdfunding and web-based credit scoring.

The course concludes with insights into fintech’s impact on traditional credit evaluation.

“Blockchain Business Models” offers a comprehensive look at blockchain technology beyond cryptocurrencies.

You’ll discover its applications in diverse areas such as supply chain management and secure voting, learning to identify opportunities for blockchain integration and assess associated risks.

Lastly, “Financial Risk Management with R” sharpens your ability to quantify and manage investment risks.

Utilizing R programming, you’ll calculate portfolio returns and employ techniques like Value-at-Risk and Expected Shortfall.

Blockchain Revolution in Financial Services Specialization

This comprehensive program from INSEAD demystifies the technology and positions you to lead in the evolving digital economy.

The journey begins with “Introduction to Blockchain for Financial Services,” where you’ll dissect the internet’s limitations and blockchain’s innovative solutions.

You’ll grasp essential concepts like mining and public key cryptography, and understand blockchain’s seven design principles.

This foundational knowledge sets the stage for practical application in the financial sector.

“Blockchain, Cryptoassets, and Decentralized Finance” propels you into the world of digital assets, smart contracts, and the promise of a more equitable financial landscape.

You’ll explore the inefficiencies of current systems and how blockchain’s transparency and efficiency are poised to transform them.

By demystifying terms like “tokenization” and “distributed ledgers,” you’ll gain a clear view of the technology’s potential.

In “Blockchain Transformations of Financial Services,” you’ll analyze blockchain’s disruptive power across eight financial functions.

The course reveals how blockchain can streamline global payments and reshape the roles of financial managers, offering a forward-looking perspective on the industry’s trajectory.

The capstone, “Blockchain in Financial Services: Strategic Action Plan,” is where theory meets practice.

You’ll develop a Strategic Action Plan to address a real challenge in financial services, leveraging blockchain as a solution.

This hands-on project, supported by insights from industry practitioners and a rich collection of case studies, culminates in a peer-reviewed strategy ready for real-world implementation.

FinTech: Finance Industry Transformation and Regulation Specialization

Offered by the Hong Kong University of Science and Technology (HKUST).

Exploring the world of finance through the lens of technology has never been more accessible.

This series of courses is designed to equip you with a comprehensive understanding of the rapidly evolving FinTech landscape.

The specialization kicks off with “FinTech Foundations and Overview,” which serves as a solid introduction to the field.

This course isn’t just about learning the basics; it’s about building the confidence to discuss and analyze FinTech trends critically.

With insights from HKUST, a leading institution renowned for its finance programs, you’ll gain a unique perspective on the advancements in Asia, a region at the forefront of FinTech innovation.

Moving on to “FinTech Security and Regulation (RegTech),” you’ll delve into the complexities of keeping financial technology secure and compliant.

This course demystifies the regulatory environment surrounding emerging technologies like cryptocurrencies.

You’ll explore the challenges of data protection and risk management, and understand how different countries are navigating the intersection of technology and finance.

In “FinTech Risk Management,” the focus shifts to the strategic side of managing financial risks in the age of disruption.

You’ll learn about the importance of compliance and the strategies for analyzing and mitigating FinTech risks.

The course also touches on the increasing role of technology firms in the financial sector, highlighting the need for robust IT compliance and assurance.

Lastly, “FinTech Disruptive Innovation: Implications for Society” broadens the scope to consider the societal impact of FinTech.

This course encourages you to think about how disruptive technologies create opportunities and challenges within the finance industry and beyond.

You’ll examine the potential effects on various stakeholders and learn how to position yourself for success in a FinTech-driven future.

Supply Chain Finance and Blockchain Technology Specialization

Offered by the New York Institute of Finance.

The specialization begins with “Introduction to Supply Chain Finance & Blockchain Technology,” where you’ll unravel the fundamentals of supply chain finance and discover blockchain’s role in reshaping the industry.

You’ll learn to assess and enhance working capital, and understand the dynamics of implementing supply chain finance solutions.

Moving on to “Key Success Factors in Supply Chain Finance,” the course hones in on the practical aspects of creating successful financing programs.

It covers customer identification, program pricing, and supplier engagement strategies, ensuring you can conduct thorough pre-sales and supplier analyses.

“Supply Chain Finance Market and Fintech Ecosystem” expands your perspective, providing insights into market size, growth, and the key players.

This course prepares you to navigate the market with an understanding of the various funding sources and trends that could impact the future of supply chain finance.

Lastly, “Future Development in Supply Chain Finance and Blockchain Technology” propels you into the technological advancements shaping the industry’s future.

You’ll explore the implications of AI, APIs, and Distributed Ledger Technology, gaining foresight into how these innovations can be applied within supply chain finance.

Throughout the specialization, you’ll acquire targeted skills such as risk management, blockchain implementation, and financial innovation.

This curated learning path not only deepens your understanding of supply chain finance but also positions you to leverage blockchain technology effectively.

Fintech Startups in Emerging Markets Specialization

This specialization is offered by University of Cape Town.

Start by diving into “Financial Regulation in Emerging Markets and the Rise of Fintech Companies” to grasp how fintech is reshaping finance globally.

You’ll explore the impact of financial regulations post-crisis and how technologies like AI and blockchain are creating opportunities for innovation.

With case studies from China and South Africa, you’ll see firsthand how fintech is thriving in different regulatory and socio-economic landscapes, focusing on peer-to-peer lending and remittances.

In “How Entrepreneurs in Emerging Markets can master the Blockchain Technology,” you’ll unravel the complexities of blockchain and its applications beyond finance.

This course demystifies how blockchain secures data and empowers users to control their personal information, challenging the dominance of tech giants.

You’ll also delve into artificial intelligence, learning about various AI algorithms and assessing when blockchain is an appropriate solution for your business challenges.

“Building Fintech Startups in Emerging Markets” is tailored for aspiring entrepreneurs.

It introduces design thinking and the business model canvas, tools that prioritize user needs in product development.

You’ll gain insights from entrepreneurs who are actively navigating the fintech space, learning that the right time to start is now, with the right idea in hand.

The “Capstone Course: Start Up Your Fintech Future” is the culmination of the specialization, where you apply your learning to develop a business model canvas and pitch for your startup.

You’ll identify market needs, navigate regulatory frameworks, and select suitable technologies to propose a viable business solution.

Crafting a compelling pitch will be your final step in this hands-on project.