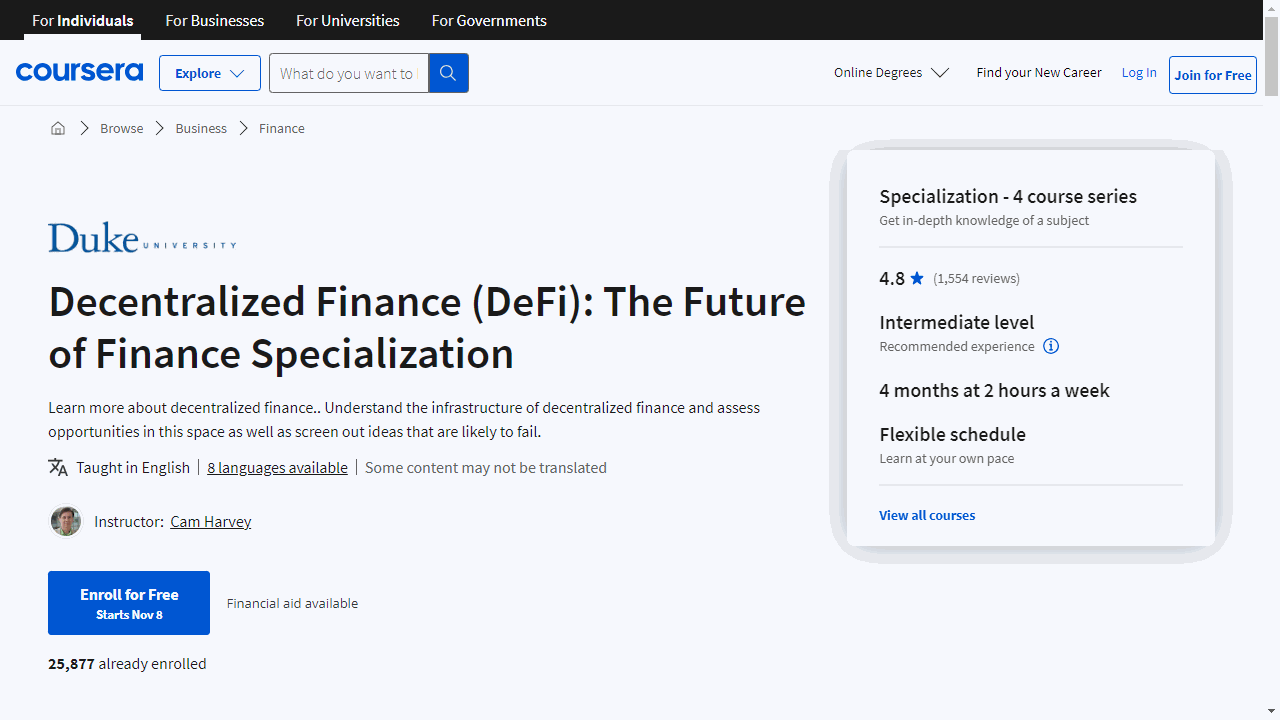

Decentralized Finance (DeFi): The Future of Finance Specialization

This series of courses, taught by Professor Campbell R. Harvey of Duke University, offers a deep dive into the rapidly evolving DeFi landscape.

The journey begins with “Decentralized Finance (DeFi) Infrastructure,” where you’ll trace the evolution of finance from bartering to blockchain.

This course doesn’t just recount history; it equips you with a solid understanding of the foundational elements of DeFi, such as smart contracts and cryptocurrencies.

You’ll learn about the inefficiencies and limitations of the current financial system and how DeFi addresses these issues.

Moving on to “Decentralized Finance (DeFi) Primitives,” you’ll delve into the mechanics of tokens, including the burgeoning world of NFTs.

The course demystifies the process of token creation and destruction and introduces you to the concept of decentralized exchanges.

By contrasting these with centralized counterparts, you’ll gain insight into the benefits and workings of platforms and participants, like Automated Market Makers (AMMs) and liquidity providers.

The third course, “Decentralized Finance (DeFi) Deep Dive,” is where theory meets practice.

Here, you’ll examine leading DeFi protocols, understanding their mechanisms and applications.

From credit and lending platforms like Aave and Compound to decentralized exchanges such as Uniswap, this course offers practical examples, including executing arbitrage transactions, to solidify your learning.

Finally, “Decentralized Finance (DeFi) Opportunities and Risks” rounds out the specialization by addressing the potential pitfalls of this nascent technology.

You’ll explore various risks, including smart contract vulnerabilities and regulatory challenges.

This course provides a balanced perspective, ensuring you’re well-informed about the complexities of DeFi.

This specialization is more than just a set of courses; it’s an investment in your financial literacy in a domain that’s poised to play a significant role in the future of finance.

Whether you’re a finance professional looking to stay ahead of the curve or a curious learner eager to understand the next wave of financial innovation, these courses offer valuable insights and hands-on knowledge.

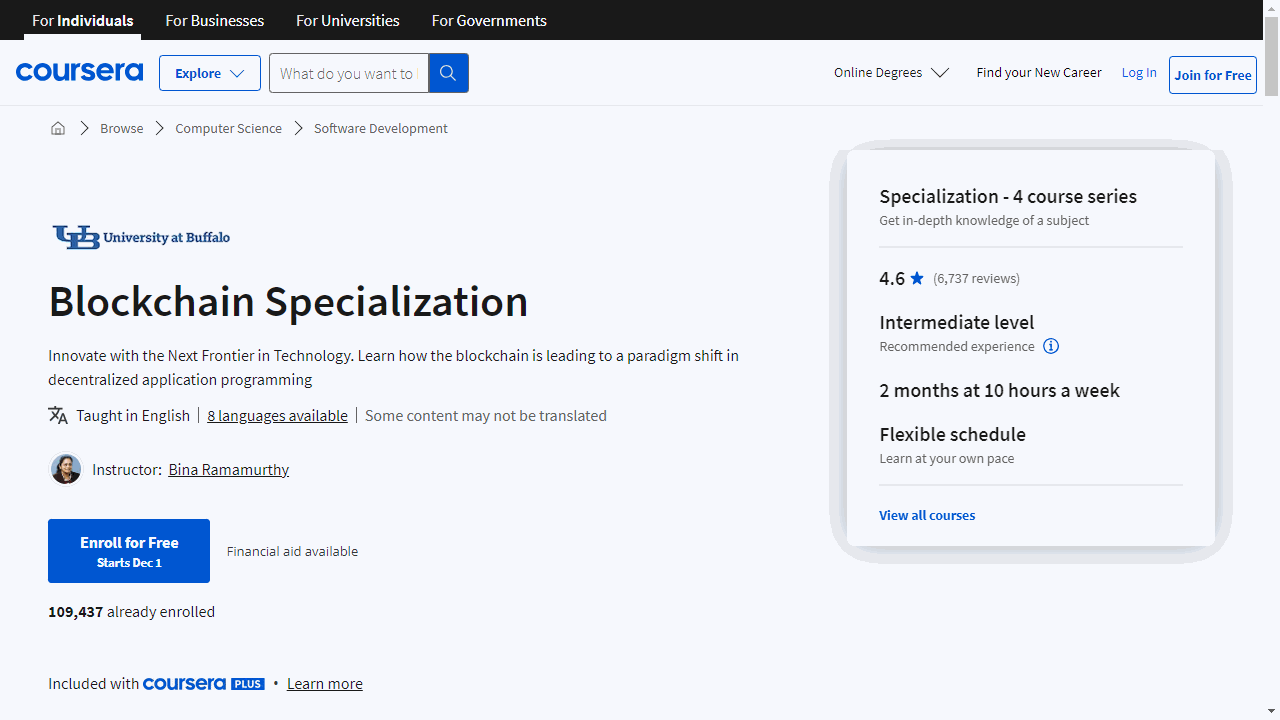

Blockchain Specialization

This specialization is offered by the University at Buffalo and professor Bina Ramamurthy.

Starting with “Blockchain Basics,” you’ll unravel the complexities of Bitcoin and Ethereum protocols.

This course isn’t just theoretical; you’ll actively engage in setting up an Ethereum blockchain, managing transactions, and understanding the mechanics of mining.

Key concepts like decentralized networks and immutable ledgers are broken down into digestible pieces, ensuring you grasp the foundational elements of blockchain technology.

“Smart Contracts” takes your learning a notch higher.

Here, you’ll delve into the Solidity language, crafting smart contracts that can automate and enforce agreements without intermediaries.

Using the Remix IDE, you’ll design, test, and deploy these contracts, gaining hands-on experience that’s crucial for anyone looking to innovate in the blockchain space.

In “Decentralized Applications (Dapps),” you’ll apply your knowledge to build applications on the blockchain.

Through practical exercises with Truffle IDE, you’ll learn the architecture of Dapps and develop skills to create applications that are both functional and secure.

This course is about turning concepts into real-world solutions.

The final course, “Blockchain Platforms,” broadens your perspective to include various blockchain ecosystems.

You’ll explore platforms like Hyperledger and Microsoft Azure, confronting challenges such as privacy and scalability.

This course is designed to round out your knowledge, preparing you to engage with the blockchain industry at a strategic level.

Each course is enriched with interactive content, from videos to hands-on exercises, ensuring that your learning experience is both engaging and effective.

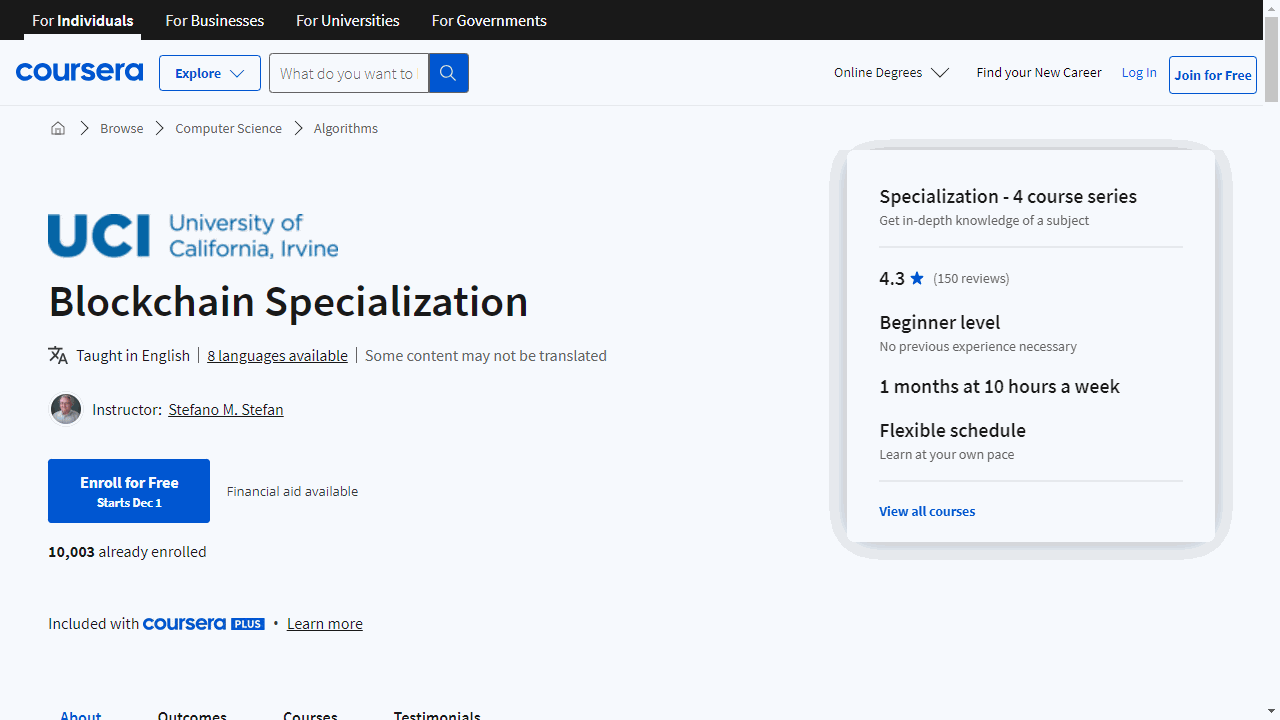

UCI Blockchain Specialization

The first course, “The Blockchain,” lays the foundation, introducing you to the essential concepts and real-world applications, particularly in cryptofinance.

It’s hands-on, with exercises designed to solidify your learning, and it sets the stage for what’s to come.

You’ll need two key texts: “Blockchain Basics: A Non-Technical Introduction in 25 Steps” and “The Internet of Money, Volume Two.”

These books are not just for reading; they’re tools that will guide you through assignments and deepen your understanding.

As you progress to “Cryptography and Hashing Overview,” the focus shifts to the mechanisms that ensure transaction security.

This course demystifies the technology that keeps blockchain trustworthy, a must-know if you’re serious about the field.

In “The Merkle Tree and Cryptocurrencies,” you’ll apply your knowledge to understand how new transactions are added securely to the blockchain.

The course also introduces you to consensus mechanisms like proof of work and proof of stake, which are critical for blockchain’s reliability.

The final course, “The Blockchain System,” ties everything together.

It shows you how transactions are authenticated and how the blockchain maintains a consistent state across all nodes.

You’ll also explore practical applications of blockchain in business, preparing you to apply your knowledge in the real world.

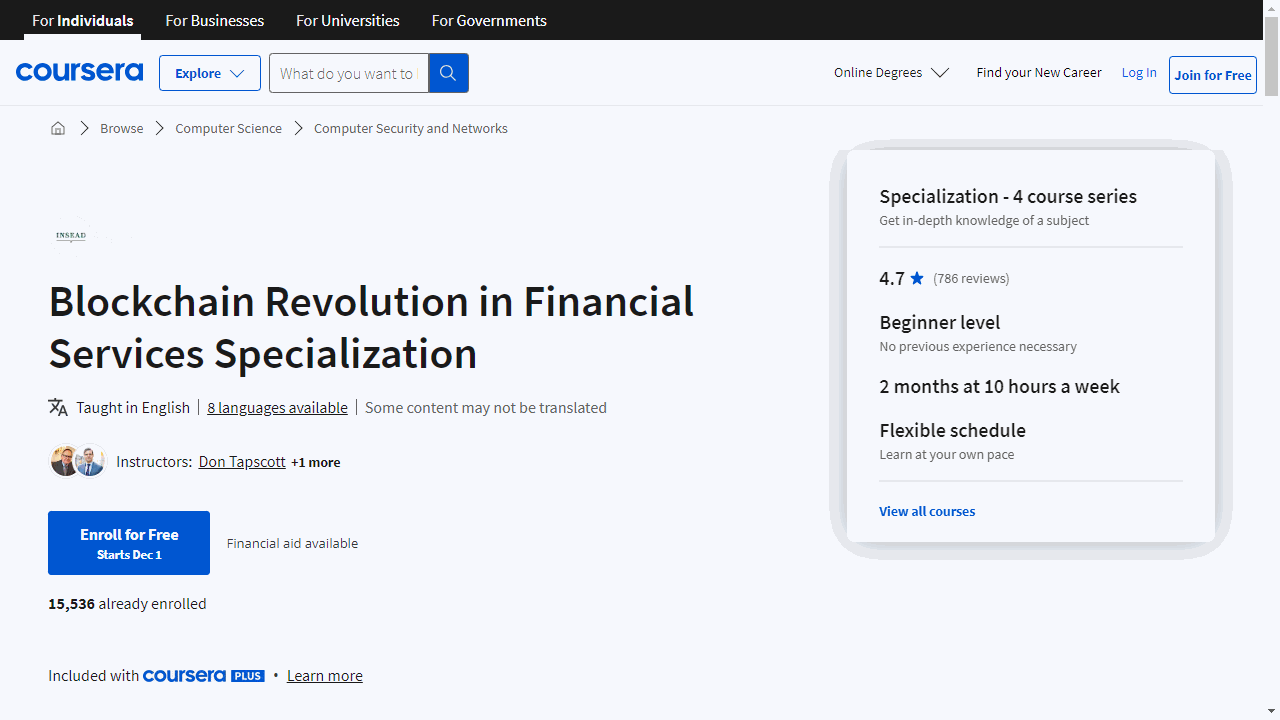

Blockchain Revolution in Financial Services Specialization

This comprehensive program from INSEAD demystifies the technology and positions you to lead in the evolving digital economy.

The journey begins with “Introduction to Blockchain for Financial Services,” where you’ll dissect the internet’s limitations and blockchain’s innovative solutions.

You’ll grasp essential concepts like mining and public key cryptography, and understand blockchain’s seven design principles.

This foundational knowledge sets the stage for practical application in the financial sector.

“Blockchain, Cryptoassets, and Decentralized Finance” propels you into the world of digital assets, smart contracts, and the promise of a more equitable financial landscape.

You’ll explore the inefficiencies of current systems and how blockchain’s transparency and efficiency are poised to transform them.

By demystifying terms like “tokenization” and “distributed ledgers,” you’ll gain a clear view of the technology’s potential.

In “Blockchain Transformations of Financial Services,” you’ll analyze blockchain’s disruptive power across eight financial functions.

The course reveals how blockchain can streamline global payments and reshape the roles of financial managers, offering a forward-looking perspective on the industry’s trajectory.

The capstone, “Blockchain in Financial Services: Strategic Action Plan,” is where theory meets practice.

You’ll develop a Strategic Action Plan to address a real challenge in financial services, leveraging blockchain as a solution.

This hands-on project, supported by insights from industry practitioners and a rich collection of case studies, culminates in a peer-reviewed strategy ready for real-world implementation.

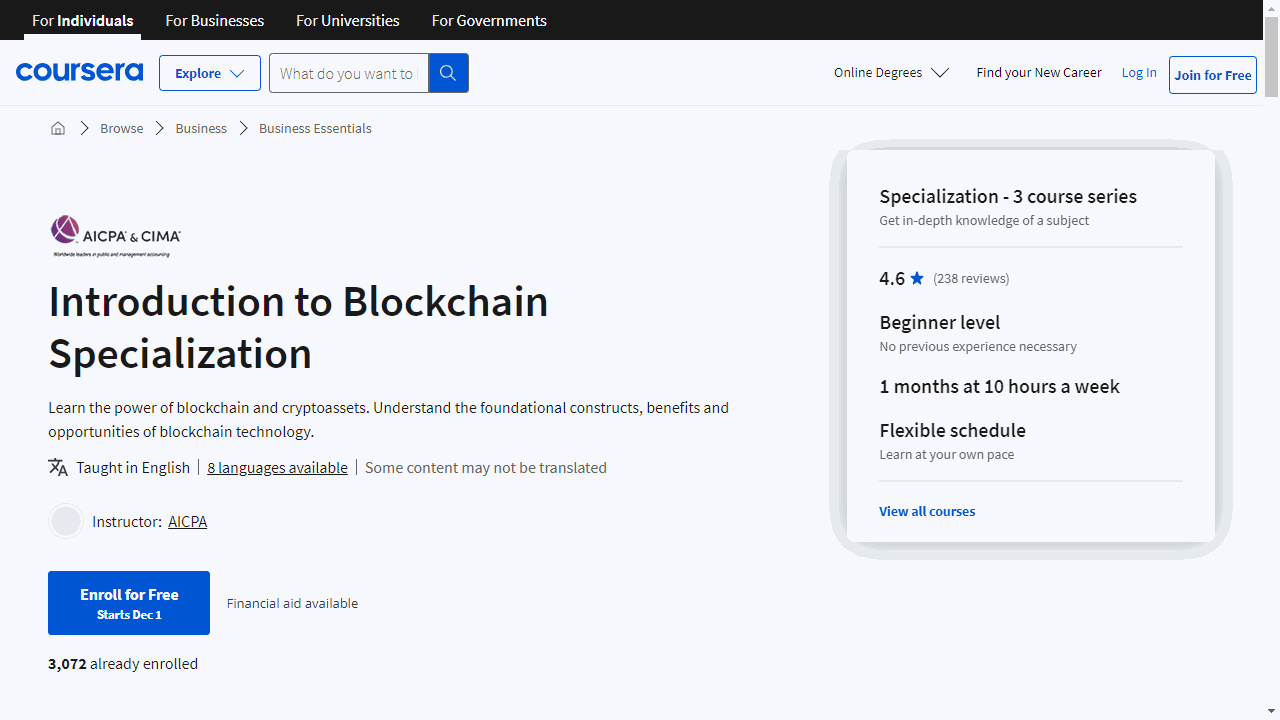

Introduction to Blockchain Specialization

The specialization starts with a dive into “Blockchain Evolution and Technology Concepts” to grasp the transformative journey of blockchain technology.

This course breaks away from the mundane with dynamic animated videos that enhance learning and retention.

You’ll gain a clear understanding of blockchain’s past, present, and potential future.

Then, broaden your perspective with “Blockchain Opportunities Beyond Crypto Assets.”

This course reveals blockchain’s impact beyond digital currencies, highlighting its potential to revolutionize various industries.

Discover how blockchain can innovate fields like finance and logistics, proving its versatility beyond just cryptocurrency.

Lastly, “Understanding, Using, and Securing Crypto and Digital Assets” equips you with the knowledge to confidently navigate the world of digital assets.

Learn the ins and outs of cryptocurrency usage and the best practices for securing your digital assets against threats.

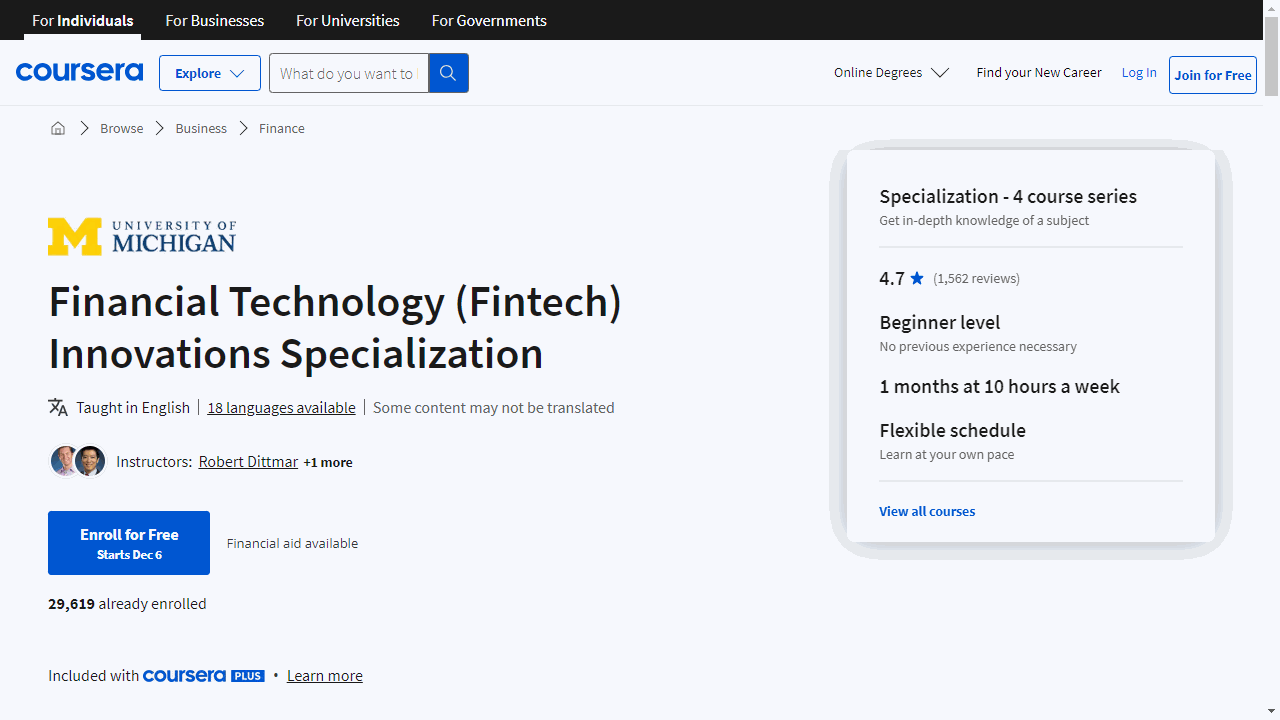

Financial Technology (Fintech) Innovations Specialization

This specialization is offered by University of Michigan.

In “The Future of Payment Technologies,” you’ll delve into the mechanics of modern payment methods, including digital wallets and mobile payments.

You’ll learn how payments function and the innovations that are streamlining transactions.

If you’re keen to understand payment processing and create value propositions for emerging technologies, this course is for you.

“Blockchain and Cryptocurrency Explained” demystifies the technology behind Bitcoin.

It breaks down blockchain’s technical aspects, such as decentralization and consensus algorithms, and evaluates cryptocurrency’s effectiveness as an asset and payment method.

If you aim to articulate blockchain’s applications and assess its business implications, this course provides the foundation.

For those interested in capital acquisition, “Raising Capital: Credit Tech, Coin Offerings, and Crowdfunding” examines how technology has revolutionized funding.

You’ll explore credit scoring, tokenization, and the nuances of crowdfunding.

If you want to navigate the landscape of modern capital-raising, including differentiating between crypto-based models, this course offers the necessary expertise.

Lastly, “Innovations in Investment Technology: Artificial Intelligence” covers the intersection of AI and investment.

You’ll compare traditional and AI-driven investment strategies, including the use of robo-advisors.

If you’re curious about AI’s role in portfolio management and trading decisions, this course will clarify these concepts.

Each course is designed to build your proficiency in fintech, from understanding payment systems to leveraging AI in investments.

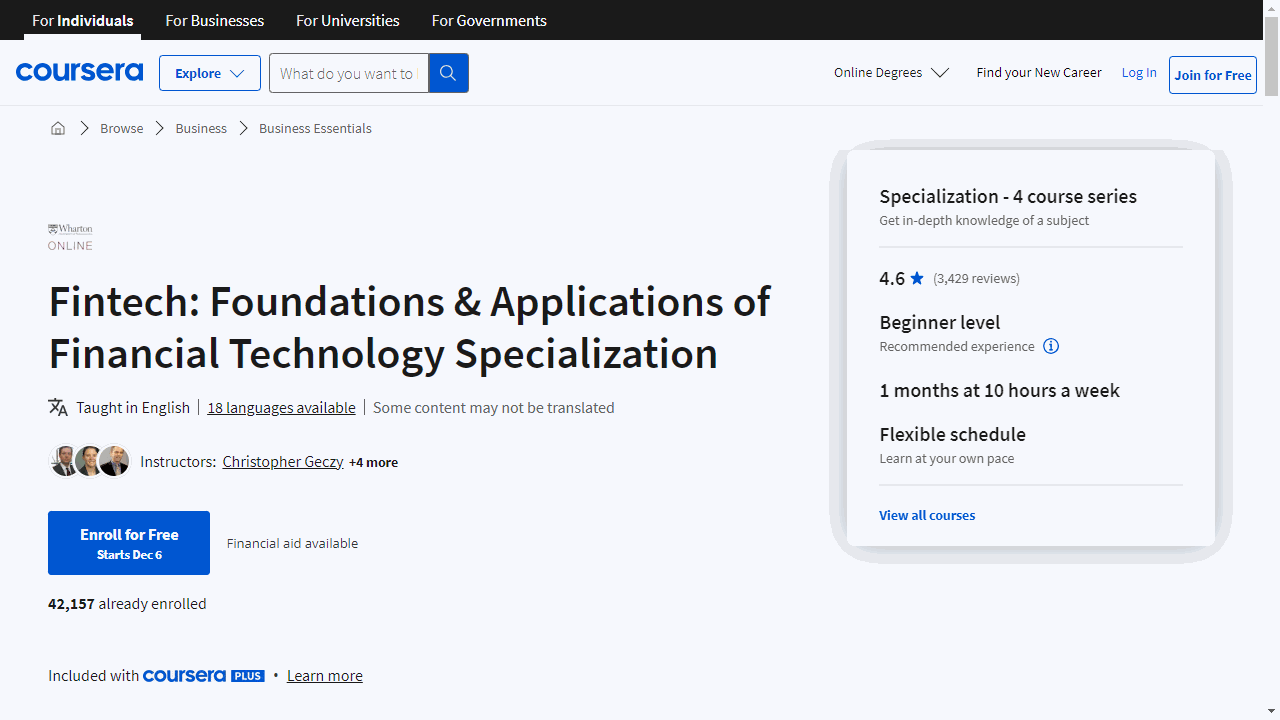

Fintech: Foundations & Applications of Financial Technology Specialization

This specialization is offered by University of Pennsylvania.

Start with “FinTech: Foundations, Payments, and Regulations” to grasp investment strategies influenced by fintech.

Professors Natasha Sarin and Chris Geczy will guide you through payment systems and regulatory frameworks.

You’ll learn to identify fintech tools, navigate regulations, and develop strategies for personal or business use.

This course is accessible even if you’re new to the subject.

Then, “Cryptocurrency and Blockchain: An Introduction to Digital Currencies” demystifies digital currencies.

Professors Jessica Wachter and Sarah Hammer provide a framework for understanding cryptocurrencies and blockchain.

You’ll explore digital signatures, assess cryptocurrency risks, and consider their place in your investment portfolio.

Prior knowledge isn’t necessary, though familiarity with fintech foundations can be beneficial.

In “Lending, Crowdfunding, and Modern Investing,” Professor David Musto delves into modern investment avenues like robo-advising and crowdfunding.

You’ll apply theoretical frameworks to actual case studies, learning to evaluate risks and optimize investment returns.

This course stands alone but builds on the knowledge from previous courses.

Lastly, “Application of AI, InsurTech, and Real Estate Technology” reveals how AI and Machine Learning are reshaping insurance and real estate.

Professor Chris Geczy, along with insights from Vanguard’s Warren Pennington, will show you the impact of InsurTech and Real Estate Tech.

You’ll leave with an understanding of AI’s role in future financial landscapes.

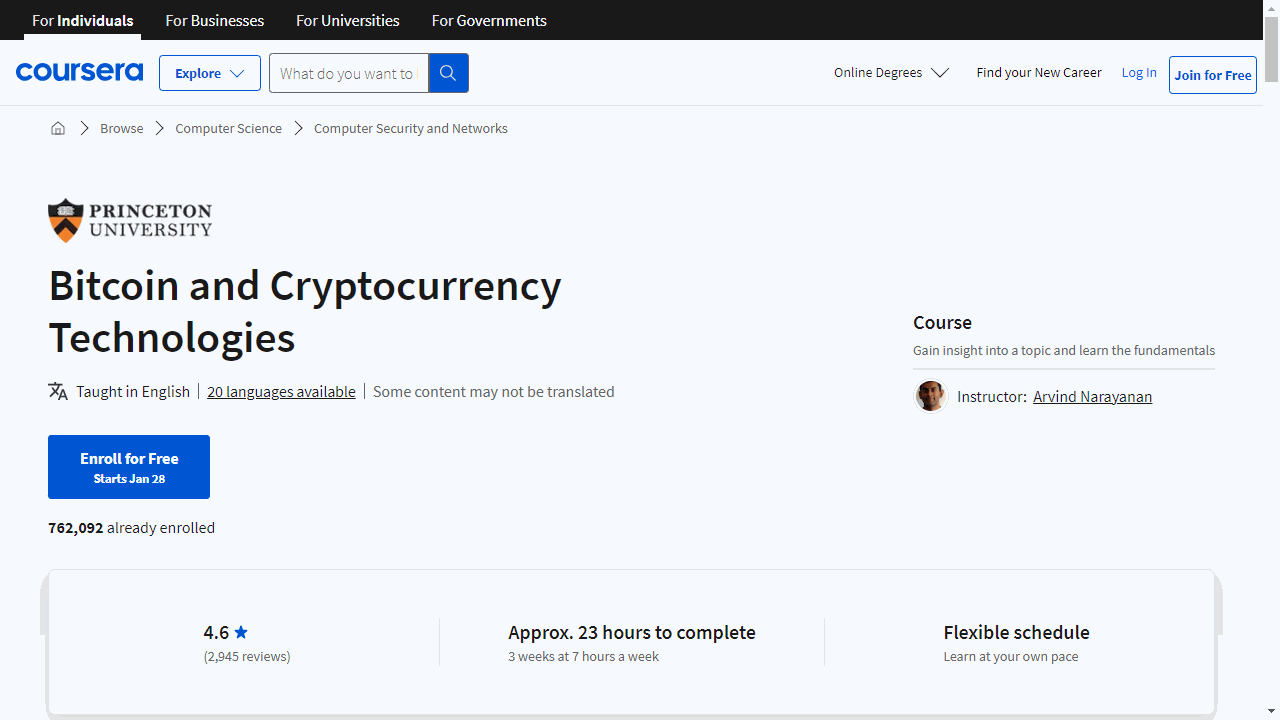

Bitcoin and Cryptocurrency Technologies

Provider: Princeton University

This course covers the essentials and dives deep into the complexities of cryptocurrencies, ensuring a comprehensive understanding.

Starting with the basics, you’ll learn about cryptographic hash functions and digital signatures, essential for blockchain integrity.

The course then introduces public keys as identities, setting the stage for a deeper exploration of Bitcoin and other cryptocurrencies.

A unique aspect of this course is its practical approach to Bitcoin.

You’ll delve into Bitcoin transactions, scripts, and the process of block creation.

This hands-on knowledge is crucial for understanding blockchain’s real-world applications and its transformative potential.

The course also addresses critical debates such as centralization versus decentralization, introducing concepts like distributed consensus and proof of work.

These discussions highlight the innovative solutions that maintain network security and functionality.

Practical advice on using and storing Bitcoins safely is another valuable component.

You’ll navigate the nuances of hot and cold storage, online wallets, and exchanges.

The course also demystifies the economics of Bitcoin, including transaction fees and currency exchange markets.

Mining plays a pivotal role in Bitcoin’s ecosystem, and this course covers it extensively.

You’ll learn about the miners’ tasks, the hardware they use, and the environmental implications of mining.

Discussions on mining pools, incentives, and strategies offer a well-rounded view of Bitcoin’s operational backbone.

Privacy and anonymity are addressed thoroughly, teaching you about anonymity basics, the challenges of de-anonymizing Bitcoin, and privacy-enhancing technologies like Tor and Zerocoin.

Beyond Bitcoin, the course explores the broader cryptocurrency ecosystem, including altcoins, side chains, and blockchain’s potential beyond currencies.

Topics like smart property, secure lotteries, and blockchain as a source of randomness showcase the technology’s versatility.

Regulatory and ethical considerations are not overlooked.

You’ll gain insights into government regulations, anti-money laundering efforts, and the ethical debates surrounding Bitcoin’s use.